Part 1

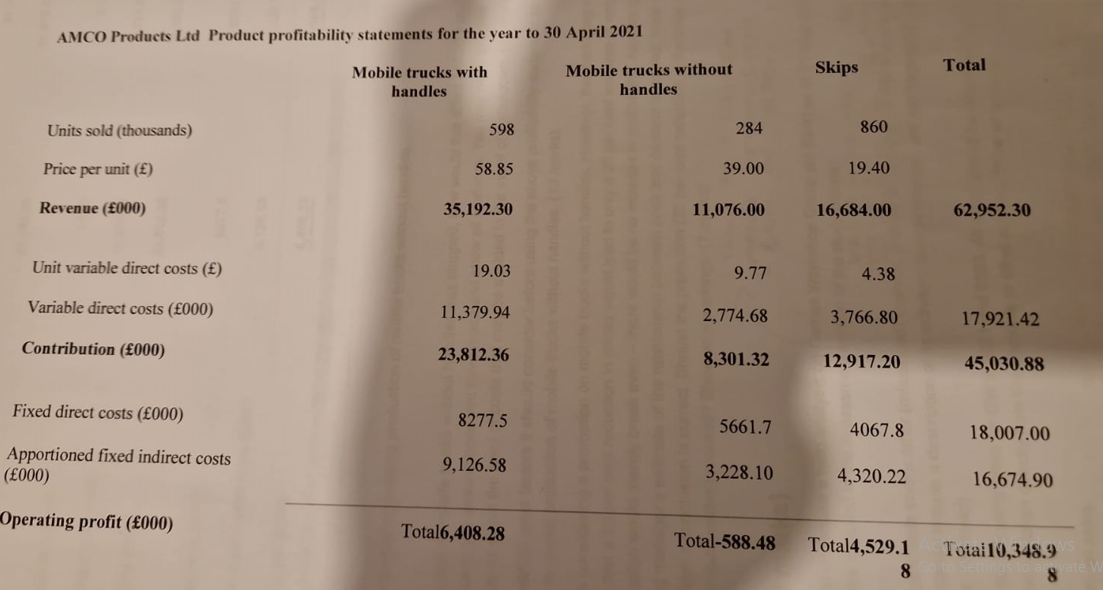

AMCO products Ltd their profitability statements for the year 2021. In this profitability statement, calculate the operating profit margin of the mobile trucks with handles and mobile trucks without handles.

If the production stopped in the mobile trucks without handles then no impact on the AMCO products because their “operating profit margin” has a negative on the business that’s why no impact to stop the mobile trucks without handles production (Abolfathi and Taebi, 2020). Their revenue is only £11076 and their variable costs are £2774.68 and find their contribution cost is only £8301.32, this amount getting by sales minus variable costs and finding the contribution cost. Mobile trucks without handling negative “operating profit” means that the business making less money from the sales. As a result, it creates a low sales price or a high cost and both. If the business’s total sales fail to increase the profit that affects their income statement and it will go down. Mobile trucks without handling negative “operating profits margin” was £-588.48 in the year 2021 (Aksan et al. 2019). Mobile trucks without handling fixed only £5661.7. This all the reasons directly affects the market and most important for the business to take a decision in the future regarding this situation. And also impacts the business's financial position this year and the unprofitable operation is to create “unsustainable” profitability. So if AMCO product stopped the production of the mobile trucks without handling that not affect the business profitability statements in 2021.

Figure 1: Factors that affect the profit

Figure 2: AMCO product Ltd profitability statements

- Before using the profitability statement for the year 2021, first AMCO should be considered the production number of mobile trucks without handles and increase their sales units and variable expenses because helps to increase the “operating profit” (Almansoori et al. 2021). And not affect their financial position if the business increases its sales units and does not impact their external factors. If the business completes its production target in the market of mobile trucks without handling this target helps in the sales.

| Mobile trucks without handles | |

| Units sold (thousands) | 284 |

| Price per unit £ | 39 |

| Revenue(£000) | 11076 |

| 20% Increase in revenue | 13291.2 |

| Unit variable direct costs | 9.77 |

| variable direct costs (£000) | 2774.68 |

| Contribution (£000) | 10516.52 |

| Fixed direct costs (£000) | 5661.7 |

| Apportioned fixed indirect costs (£000) | 3228.1 |

| Operating profit (£000) | 1626.72 |

Table 1: Profit of Mobile trucks without handles

The above table demonstrates the “operating profit” of the Mobile trucks without handles of the AMCO product ltd. Here the increase of 20% in the sales value of the Mobile trucks without handles then the change in the amount of “operating profit margin” then getting the positive value of the profit (El‐Haj et al. 2019). And in case, not stopped the production of the Mobile trucks without handles of the AMCO product ltd. Then not create a low sales price and the business try to maintain its financial position in 2021.

Part 2

a. Overview of Games Workshop Group Plc

- Background: The business of Games workshop group Plc is the biggest, as well as most developing in fantasy miniature, sculptures, stories, games, and artwork. It is a manufacturing business, and this business is based in “Nottingham” in the UK. Their best and most popular products are “Warhammer Age of Sigmar”. This business was established in the year 1975 by “Steve Jackson” and two people (Gataullin and Gataullin, 2019). When this business was established then it was the manufacturing the wooden boards for games. They expanded their business in the year 1990s and it expanded their business in European countries, the “US”, “Canada”, and “Australia”.

- Strategies and objectives: This business is to make better fantasy miniatures around the globe, inspire their customers, and sell their products in the world at a profit. They are focused on long-term development, not on short-term profit. Here discuss the business strategies step by step. Firstly, businesses make the best quality miniatures (Gregova et al. 2020). They understand what they make may not be to everyone, so retain band recruit the consumers that the business is focused on making its best models in the globe. They sell their miniatures for a price that they believe represents the investment in their best quality.

The second strategy of the business is to make fantasy miniature that is based on their endless, and imaginary global. This provides them control over the style and imagery they use and the ownership of the “intellectual property”. Besides their core business, they are looking to develop their licensing revenue from the opportunities to use their “intellectual property” in other markets in the world. The third strategy of the business, they are focused on its consumers. They aim to communicate in a fun way (Jiang et al. 2019). Businesses reached their consumers with the use of important tools like digital content and the use of retail chains. Their “digital has never been richer” and in retail, they offer a customer experience. The fourth strategy of the business is focused on cash. Through delivering good cash returns each and every year that they can continually innovate, and delight their existing consumers and new consumers with great goods. They measure their long-term development and success through high returns on investments. In the period of short term, they measure their success on their capability to develop sales and maintain their core business “operating profit margin” at the current position. These all strategies of the business os help to the development in the future and increase the more customers. - Business model and structure: They design all their goods at their headquarters in “Nottingham”. This business has almost 263 employees, and the studio of design is to create all, the “intellectual property” as well as associate miniatures, games, and artwork that are sold in the world's market. Their employees and their staffs produce hundreds of new sculptures, stories, illustrations, and so on, enabling them to deliver new goods each and every week and they continue to keep their consumers engaged (Karzaeva and Karzaeva, 2019). In the year, 2020 and 2021 they invested £12.8 million in the design studio as well as included the cost of the software with £4.5 million spent on the tools for new miniatures of plastics. Businesses invest in these areas with the right approach each and every year. All of their plastics miniature that is branded miniatures, a mart with a matchless reputation for the best quality. Their “resin miniatures”, are designed for their consumer's experienced, “resin miniatures” are branded in the world and they are very less available than their “plastics counterparts”. So many consumers love their miniatures and their “citadel” color pain, and color brushes and go with a system of printing that is designed with the help of everyone from the more experienced painters around the globe so that the business achieves better results (Kou et al. 2019). They are continuously growing new kinds of paint and this process of using them. When their consumers are not interacting with their miniatures so many consumers enjoy reading stories that are set in their immersive global (Lewis and Young, 2019). Their goods were distributed in their warehouse at the “Nottingham” and their new rented warehouse, the new warehouse approx. 20 minutes far in the “Nottingham”.

- Calculate the ratios for the group Plc in 2021 and 2020

| 30-May-21 | 31-May-20 | ||

| £m | £m | ||

| Return on sales | Operating profit / net sales *100 | -34 | -40 |

| Assets utilization ratio | Net revenue/total assets | 1.3 | 1.3 |

| ROCE | EBIT/total assets-total liabilities | 1.8 | 1.2 |

| Gearing | EBIT/ Total equity | 0.8 | 0.7 |

| payables days | Account payables/ COGS * 365 | 134.2 | 124.1 |

| Receivables days | Account receivable/ sales * 365 | 31.6 | 26.5 |

| Inventory days | Inventory / COGS *365 | -104.2 | -84.8 |

| Interest cover | EBIT / Interest expense | -151 | -128 |

Table 1: Ratio analysis of the Games Workshop group Plc

The above table reflected the ratio analysis of the Games Workshop group Plc. Here calculate the essential ratio for identifying the business position and performance for 2020 and 2021. The essential ratios are “Return on sales”, “Assets utilization ratio”, “ROCE”, “Gearing”, “payables days”, “Receivables days”, “Inventory days” and “Interest cover”.

Figure 3: Ratio analysis

Here is the “Return on sales” ratio -34 and -40 for 2021 and 2020, this ratio is negative which means the business has trouble in its financial position (Mousa et al. 2022). The good ratio of the “Assets utilization ratio” is 2: 1 but here the ratio is 1: 1 which means this ratio is not considered in the business. It allows businesses to measure the efficiency of the business assets band to generate revenue. ROCE is to measure the business profitability. The good ratio of this ratio is 20% which is usually good for the business and the business in a good position financially. The good ratio of the “gearing’ is 25% to 50% but here the business gearing ratio is 80% and 70% when there are convert the ratio in the percentage then get this percentage in 2021 and 2020. This percentage is considered risk low by lenders and investors. The high ratio indicates that a business's financial position is more susceptible to the economy. Here are the “payable days” for 2021, 134 days, and 2020, 124days the good days of “payable days” is 20 days but here these days are more according to the good days that means business takes to pay their bills to their trade creditors and this means a business has extra cash that is used in the investments in the short term. The main reason for the negative inventory is if the business does not sell a great amount of inventory then their “turnover” create the negative and also the business does not convert their “inventory” into cash.

Part 3

A "cash flow statement" is a statement of financial that summarizes the amount of money flowing in and out of a business over a specific period of time. This statement usually covers the operating activities of a business, investing activities, and financing activities. The statement of cash flows is an essential part of financial reporting as it allows a company to track the cash they have available to use (Rogulenko et al. 2021). The "cash flow statement" is important to a business because it provides a clear overview of the company's overall financial health. It can be used to assess liquidity, and measure the ability to generate cash and it can help to identify cash flow problems. The "cash flow statement" also highlights any areas of the business where money is either being misused or wasted. The "cash flow statement" can also be used to identify any potential cash flow problems that could arise, such as a decrease in cash flow from operations or an increase in accounts receivable. This can help the business to take corrective action before a cash flow crisis occurs. Additionally, the "cash flow statement" can help to determine the company's overall financial position (Saura et al. 2019). It can help to identify any potential areas of financial weakness, such as a lack of liquidity or poor cash flow management. The statement can also be used to compare the cash flow of one business to another, allowing for an apples-to-apples comparison. In short, the "cash flow statement" can provide important insight into a company's overall financial health and can be used to identify potential problems, measure the ability to generate cash, and compare the cash flow of one business to another.

Figure 4: Cash flow statements analysis

An essential statement of financial that gives a summary of the company's cash sources and uses is the "cash flow statement". It is used to evaluate a company's liquidity, solvency, and financial flexibility as well as its capacity to create cash. Even if the company's cash position is improving year over year, it is still crucial to evaluate the "cash flow statement" in addition to another statement of financial to fully grasp the company's financial situation. An organization's cash flow from current operations, investments, and financing activities is disclosed in a "cash flow statement". This data might help you decide whether your business is making enough money to pay its bills and fund new initiatives. It can also show if the company is relying too heavily on debt or equity financing, which can be a sign of financial instability. The "cash flow statement" is particularly important for companies with positive cash balances that are increasing annually. This is because, while the company may have a positive cash balance, it could still be operating at a loss or using up its cash reserves. A "cash flow statement" can help to identify potential problems in the company’s operations and indicate any changes that need to be made to improve the company’s financial position (Ravula, 2021). The "cash flow statement" can also be used to identify areas where the company could be more efficient. For example, if a company is generating a large amount of cash from operations but is using that cash to pay for non-essential items such as corporate jet trips, this could be an indication that the company is not using its cash wisely. The "cash flow statement" can help to identify areas where the company could be more efficient and use its cash more effectively. In addition to the cash statement of cash flows, the balance sheet and income statement are other statements of financials that may be used to evaluate the company's financial health. While the income statement displays the company's revenues and outlays, the balance sheet provides a general summary of the company's assets, liabilities, and equity (Ungureanu et al. 2019). Together, these statements of financials paint a fuller picture of the company's financial situation, including its capacity for cash flow and debt servicing. In conclusion, even for businesses with positive cash on hand that are growing year over year, it is crucial to study the "cash flow statement" in addition to other financial accounts. An organization's operating, investing, and financing operations' cash flows are detailed in a "cash flow statement". The “balance sheet” and “income statement” can also be used to assess the company’s overall financial position and help to identify areas where the company could be more efficient.

By analyzing all of these “statements of financials”, a company can get a better understanding of its overall financial position and make more informed decisions about its future.

Reference list

Journals

Abolfathi, E. and Taebi, P., 2020. Modern Analysis of Financial Statements: Pharmaceutical companies in Iran. Journal of management and accounting studies, 8(2), pp.19-23.

Aksan, I., Setiawan, D. and Gantyowati, E., 2019. Research development related to implementation of financial accounting standards in Indonesia. International Journal of Economics, Business and Accounting Research (IJEBAR), 3(04).

Almansoori, M.S., Almansoori, M.H., Almansoori, M.M., Almansoori, A.R., Alhammadi, A.A., Alnuaimi, S.M. and Nobanee, H., 2021. Financial analysis of Adnoc. Available at SSRN 3895246.

El‐Haj, M., Rayson, P., Walker, M., Young, S. and Simaki, V., 2019. In search of meaning: Lessons, resources and next steps for computational analysis of financial discourse. Journal of Business Finance & Accounting, 46(3-4), pp.265-306.

Gataullin, T. and Gataullin, S., 2019, October. Management of financial flows on transport. In 2019 Twelfth International Conference" Management of large-scale system development"(MLSD) (pp. 1-4). IEEE.

Gregova, E., Valaskova, K., Adamko, P., Tumpach, M. and Jaros, J., 2020. Predicting financial distress of slovak enterprises: Comparison of selected traditional and learning algorithms methods. Sustainability, 12(10), p.3954.

Jiang, Z.Q., Xie, W.J., Zhou, W.X. and Sornette, D., 2019. Multifractal analysis of financial markets: a review. Reports on Progress in Physics, 82(12), p.125901.

Karzaeva, N.N. and Karzaeva, E.A., 2019. Methods for assessing solvency in the financial diagnostics system of an economic entity. International Transaction Journal of Engineering, Management, and Applied Sciences and Technologies, 10(19).

Kou, G., Chao, X., Peng, Y., Alsaadi, F.E. and Herrera-Viedma, E., 2019. Machine learning methods for systemic risk analysis in financial sectors. Technological and Economic Development of Economy, 25(5), pp.716-742.

Lewis, C. and Young, S., 2019. Fad or future? Automated analysis of financial text and its implications for corporate reporting. Accounting and Business Research, 49(5), pp.587-615.

Mousa, G.A., Elamir, E.A. and Hussainey, K., 2022. Using machine learning methods to predict financial performance: Does disclosure tone matter?. International Journal of Disclosure and Governance, 19(1), pp.93-112.

Ravula, S., 2021. Text analysis in financial disclosures. arXiv preprint arXiv:2101.04480.

Rogulenko, T., Orlov, E.V., Smolyakov, O.A., Bodiako, A.V. and Ponomareva, S.V., 2021. Analytical methods to assess financial capacity in face of innovation projects risks. Risks, 9(9), p.171.

Saura, J.R., Herráez, B.R. and Reyes-Menendez, A., 2019. Comparing a traditional approach for financial Brand Communication Analysis with a Big Data Analytics technique. IEEE Access, 7, pp.37100-37108.

Ungureanu, S., Topa, V. and Cziker, A.C., 2021. Analysis for Non-Residential Short-Term Load Forecasting Using Machine Learning and Statistical Methods with Financial Impact on the Power Market. Energies, 14(21), p.6966.