Cost Management On Zero-Based Budgeting In Private Sector Organisations

The UK’s top-notch assignment writing service, Native Assignment Help, specialises in providing unparalleled quality and outstanding customer satisfaction through our human-written case study. Our dedicated team can readily assist you with challenging essays or intricate research papers. Choose Native Assignment Help today and experience firsthand what a reliable and committed partner can achieve for you.

1.0 Introduction: Cost Management On Zero-Based Budgeting In Private Sector Organisations

Zero Based Budgeting, is implicated in achieving the top-level strategic goals for the process of budget, it is implicated in a specific functional area in a specific organization. It is used in the measurement of the previous results of the first group cost and current expectations. Through the zero-based budgeting, the lower cost management, and strategic execution of the operations of revenue generation could be focused on for budget growth over the time period of any organization.

2.0 Discussion

2.1 Answer: 1

Budgeting is a financial planning of the revenues and expenses to keep economies active. There are both public and private sectors that have been managing budgets and creating a financial planning for the effective establishment within the economy (Couldry, (2019). Private and non-governmental organizations have already established various financial departments, that are responsible for the creating and drawing action plans for every Financial period. Through the financial roadmap, set by the governments around the world, could process the budgetary activities. In this perspective of the budgetary process, the private sector has emerged better than the public sector for assessing governing principles.

In an exact manner, The governments around the world have been creating effective budgetary decisions through their budgetary decisions. There are budgetary processes that have been clearing the budget for the updated business performance. There are some traditional practices that need for the reporting of the business activities. There is the making of financial planning, forecasting of the budgets, and management of risks that could simply streamline the process. According to the financial professionals, there is severe pressure that has been bettering the performance accuracy and controlling the auditability of the organization (Changalima, 2021). Through the assessment, the more clearer and enhanced insights regarding cost, resources and performance should be able to counter challenges.

In the assessment of the public sector, there are various challenges from the perspective of effective budgeting and manual limitations. Faster analysis and effective levels of data availability are significantly lower. These limitations would be

- Financial budgeting does not links with the traditional budgeting. Through the effective budgeting and an understanding and the analysis of the return on investment should be applicated to any initiatives. In comparison of the with private and public ownership the profit distribution is one of the key differences and also a limitation, as in the private sector, the ratio that the owner has set, the segregation of the profit is distributed on that ratio. The public sector enterprises shares the profit according to the government allocated tender.

- Changes in the market are inevitable, which causes the market in hospitality and instability. There are changes in strategies, levels of resources, and budgetary constraints that should be flexible according to the scenario types The organization is impacted by effective business and marketing processes, that needed to be implicated for the business evaluation. In the concept of strategy making the private company makes a strategy according to the current market situation and according to the suggestions of the accountants and board leadership, For the private sector, the decision making is completely on the policies of the governements.

- In the public sector, strategic budgets and effective financial planning and strategies should be on the different financial attributes (De Villiers, 2020). There are cases of deviations. There are processes that the changes in the creation of budgetary decisions and adjust the restoration levels and decision-making. In strategy making, for Private sector, is more flexible in fast decision making could be observed and for the public organization the allocation and the approval of the government is needed to create a strategy and to approve all market approach

- The processing of inaccurate data could be a major issue in the analysis of the cost pattern that would be a herculean task for the carry of the certain accurate and inaccurate data.

- There is the process of creating static budgets for the financial years, which have been dependent on the financial target constants for the adjustment of markets. In the creating of budget, the private sector is much more flexible, as it is under sole ownership or under partnership basis. The allocation of the funds is much more faster than the government processes. In the public organizations, the creation of a budget is a lengthy process, the limitation is of the delaying of various endeavors which delaying the economic development.

2.2 Answer: 2

The potential of the economic planning would be in the respect of the particular period. There are control, coordination, planning, and management for the achievement of the organizational goals (Furman, 2019). Zero-based budgeting would be is an approach through which no cost would be factored on the premises of the plans. There are budgetary activities that have been according to the previous periods.

Zero-based budgeting was introduced in the 1960s, which is one of the main drivers of budgetary models and the preparation of business operations. There are objectives and purposes of the organization, that needed to be flexible in nature. Zero-based budgeting questions should be on the assumption of proper reviewing, drawing, and reprioritizing of the long-term actions to align the organizational objectives. In the successful and effective involvement with the executive managers, the present level of the service provision and increment level could be evaluated.

Through this effective budgeting, the encouragement of the business environment could be promoted. The incrementing budget method is set up for the evaluation of the present period of budgeting or the real performance (Giudicianni,2020). The increment amounts are added for the fresh budget period. The adjustment in the sales price and cost and adjusting those attributes, according to the inflation could effectively reallocate the resources. Performance goals are being targeted on the past performance goals, which would be a needed for the scrutinization and justification of the organizational contribution. Since the organizational management information process may not be accessible for the proper analysis, there are objectives.

- To determine the difficulties in the Zero based process.

- To determine the decision makers that would affect the process of budget making.

- To find out the process of the implication of the zero budgeting and to achieve benefits to be absorbed.

- To determine the cost benefits and effectiveness of Zero Based budgeting.

Through incremental budgeting, the division of the departments, and the adjustment of the legislative requirements, the development of wage inflation and service price anticipation would be adjusted for current budgetary allowances.

According to CIPFA, using of this model of incremental budgeting could be an approach of negotiation and compromisation settlement of the fundamental decision-making (Kwon,2019). The breakdown of agreements and negotiating settlements is for the rational approach to the incremental process. Through the implication of this budgetary model, Qatar has grown its business from 7 percent to 8.8 percent. As per the strategy of the government, the instigation of these Zero based principles in the hydrocarbon sector, the country has increased its production of oil from 900000 barrels to 1 million barrels, with an estimated reserve of 14 billion barrels of oil reserves. As in the public sector Zero budgeting is different from traditional budgeting, the planning and preparation is based on the previous year budget. In the sector the financial budgeting is dependant on the expenditure of financial ministry.

In Zero Budget, the carried forward balance is zero, so the identification of the tasks is regardless whether the budget is higher and lower in the previous year. For public sectors, the expenses are the budget beginning which calls a a traditional increase. In the regulation of the expenses, the government schemes could be carried forward to spend money to get bigger gains in future.

2.3 Answer: 3

There are various challenges that are emerging in the budgeting process of both the public and private sectors. There are revolutionary ideas, that have been increasing in the pressure of competitiveness (Nersisyan,2019). Through the increase in demand, and flexibility in the responsive events. The idea of Beyond Budgeting is to critically modify the traditional budgeting process through the control of the management in organizations. Through the adaptation of the highly decentralized aim could be seen as the adaptive set of processes of management.

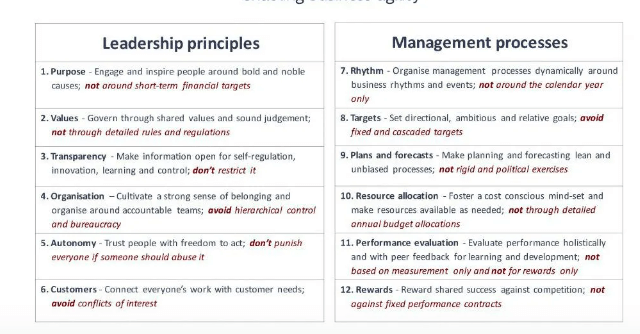

In the process of traditional budgeting, the carry of the crucial flaws could be observed. In the modification of the process of the traditional budgeting process, the improvement in the control of management. In the framework of Beyond Budgeting, there are Six management principles and leadership principles that have been followed. Through the beyond budgeting, the reduction of flaws in the traditional process of budgeting could be reduced (Palley,2019). There are several flaws that could be resolved, these are

Through the development of a budget, the consumption of the time and cost-effectiveness could be assessed. Through the focus on the strategy of the company, the negative impacts on the business operation could be resolved.

In the Simulation of creating values, the changes in the obstacles could be centralized in the increase in budget for the organizational performance evaluation.

The Beyond budgeting process would be an agile business structure, which is a relatively new model for the framework development (Tangcharoensathien, 2019). The idea of the agile techniques could be primarily associated with the counter of change in goals and to fulfill the requirements to survive in the competitive market environment. There are industries that have been implementing the agile techniques, which are following the trends of mobility, globalization, and digitization.

Through the adaptation of the framework of the adaptive management process and decentralized leadership model, the performance evaluation of the budgeting process could be evaluated.

Figure 1: The leadership principles and Management processes

There are some effective techniques that is existing in the process of the Beyond Budgeting framework. These techniques are proven for the specific application of the organisations. These are:

- Firstly: The rolling forecast should be created on a monthly, quarterly, and annual basis.

- Secondly: The targets of the companies should be based on the Key Performance Indicators(KPI)

- Thirdly: The external benchmarks of the past performance should be evaluated on the basis of the managerial performance of the organization.

- Fourthly: The dynamic changes in the business environment could impact the operational managers to react to the changes in the empowerment of the business.

2.4 Answer: 4

In the understanding of the learning curve theory, the initial period of investment in learners should be a greater return (Yang,2019). The learning curve would be defined as the correlation between the learner’s performance and the time required for the complete activity. There are four types of learning curves, they are:

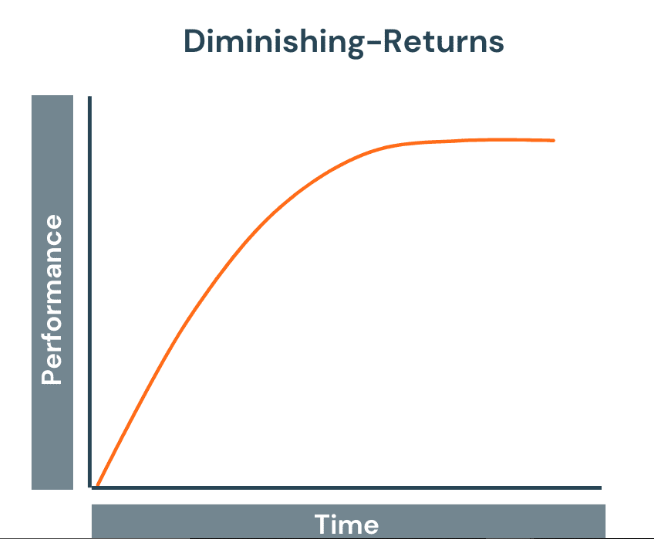

Diminishing Curve

In this curve, the rate of rapid progression , could be dependent on the learning and decreases over the time period (Rizvi, (2020). This graph describes the situation of the fast and rapid progression activities which follows a diminishing returns over the change of times. It is needed to the cost down to the initial plateau.

In the limitation of diminishing curve, this curve cannot predict the future accurately and cannot also recognizes that misleading data that has been influenced by time, quality, previous experiences and quality of training.

Figure 2: Diminishing Curve

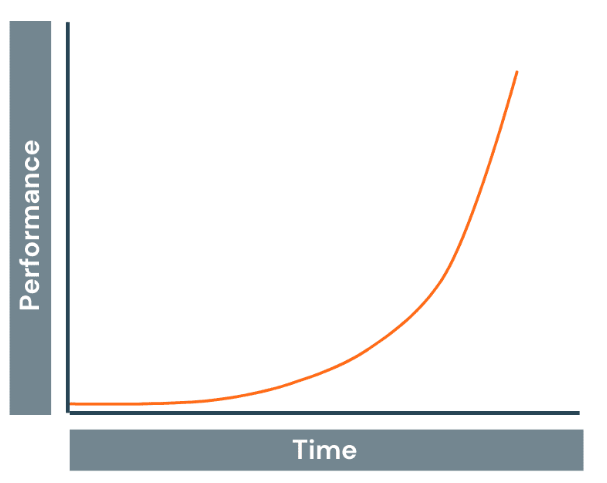

Increasing Returns

In this increasing returns curve, a gradually slow progression could be observed. The rise of teh full proficiency could be achieved. Through this graph a prolonged late learning rate in terms of effective decision-making, with high efficiency of the modified in indications.

In the limitations of the Increasing returns, if the size of production unit is large, the management of efficiency is not possible, then the area of law increasing return will not operate, then the instruments and will return to the law of diminishing returns.

Figure 3: Increasing Returns

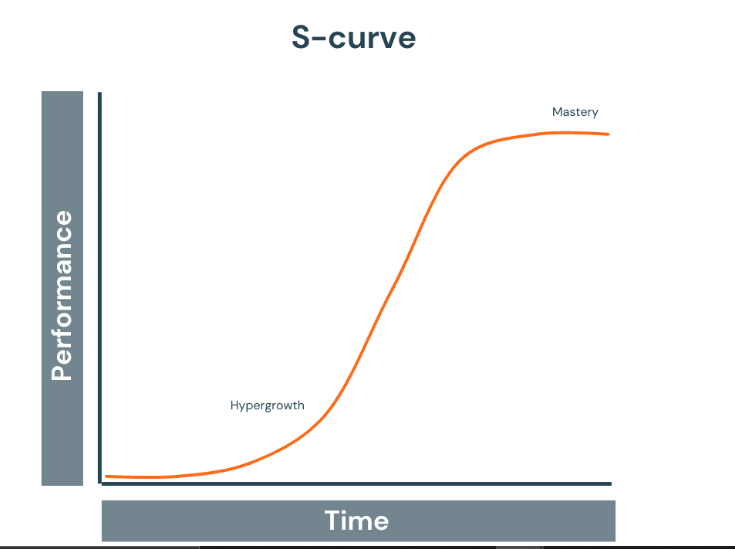

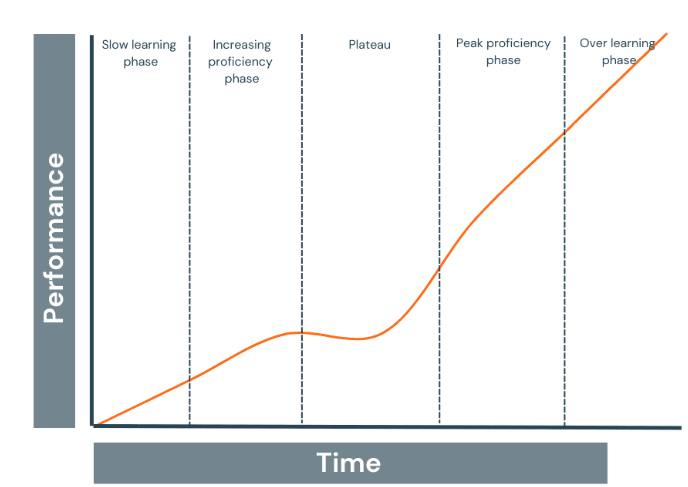

S-Curve

In the model of increasing and decreasing return learning curve model, is considered an S-Curve. The indicators of this curve indicate that a slower learning could take time in the mastery of a skill (Agicap.com (2022). The learning benefit and the proficient performance levels could be countered as productivity tools. The plateau is closer to the X- axis and is being represented by the highly effective performance and cost-effectiveness of the ongoing performance. In the assessment of the limitation of S-curve, this model cannot inferred the gains of new technologies. S curves simply point out the cost of relation with the time. Through this curve the physical progress of the anticipated time could not be assessed.

Figure 4: S curve

Complex Curve

In the pattern of the complex curves, the reflection of the extensive tracking could be measured. Through this curve, a certain amount of learning and practice could be measured. There is a slow initial learning process. In the increased indication of proficiency in skills should be adequate in the mastering of the skill. Through the representation of the improvement of skills could automatically be instigated in the learner’s muscle memory. Through these models, a better understanding of the employee's progression in the learning of a particular task is adjusted. Through this learning curve, strategic planning could be improved for the employees’ output. Effective decision-making is also identified as viable for the business evaluation of an organization.

In the limitation of the complex learning curve, it is not able to recognize the current skill and cannot predict the future according to the current basis of the data. The misleading data could not be corrected.

Figure 5: Complex curve

Conclusion

In the analysis of the cost management of the Zero-based business model for the private and public sectors, there are some variances in the management of an organization that should be diversified in different attributes and understanding of the market trends. There are applications of zero-based management, through which the cost-effectiveness of the business operations and various learning process could be implicated for business evaluation.

Reference List

Book

Couldry, (2019) The Costs of Connection How Data Is Colonizing Human Life and Appropriating It for Capitalism Available at www.degruyter.com/document/doi/10.1515/9781503609754/html [Accessed on: 7.4.2023]

Journals

Changalima, I.A., Mushi, G.O. and Mwaiseje, S.S., 2021. Procurement planning as a strategic tool for public procurement effectiveness: experience from selected public procuring entities in Dodoma city, Tanzania.Journal of Public Procurement,21(1), pp.37-52.

De Villiers, C., Cerbone, D. and Van Zijl, W., 2020. The South African government's response to COVID-19.Journal of Public Budgeting, Accounting & Financial Management,32(5), pp.797-811.

Furman, J. and Summers, L.H., 2019. Who’s afraid of budget deficits?.Foreign Affairs,98(2), pp.82-95.

Giudicianni, C., Herrera, M., di Nardo, A., Carravetta, A., Ramos, H.M. and Adeyeye, K., 2020. Zero-net energy management for the monitoring and control of dynamically-partitioned smart water systems.Journal of Cleaner Production,252, p.119745.

Kwon, H. and Kang, C.W., 2019. Improving project budget estimation accuracy and precision by analyzing reserves for both identified and unidentified risks.Project Management Journal,50(1), pp.86-100.

Nersisyan, Y. and Wray, L.R., 2019. How to pay for the Green New Deal.Levy Economics Institute, Working Papers Series,931.

Palley, T.I., 2019.What's wrong with Modern Money Theory (MMT): a critical primer(No. 44). FMM Working paper.

Tangcharoensathien, V., Patcharanarumol, W., Kulthanmanusorn, A., Saengruang, N. and Kosiyaporn, H., 2019. The political economy of UHC reform in Thailand: lessons for low-and middle-income countries.Health Systems & Reform,5(3), pp.195-208.

Yang, X., Li, Y., Wang, H., Wu, D., Tan, Q., Xu, J. and Gai, K., 2019, July. Bid optimization by multivariable control in display advertising. InProceedings of the 25th ACM SIGKDD international conference on knowledge discovery & data mining(pp. 1966-1974).

Jariya, A.M.I. and Haleem, A., 2021. MANAGEMENT ACCOUNTING PRACTICES'ADOPTION AMONG LISTED MANUFACTURING COMPANIES IN SRI LANKA.Academy of Entrepreneurship Journal,27(6), pp.1-15.

Fapohunda, R.T., 2020.The usage of cost control measures to improve organisational performance of small and medium-sized enterprises in Western Cape, South Africa(Doctoral dissertation, Cape Peninsula University of Technology).

Nikodijević, M., Novićević, B. and Rogan, M., 2020. Empirical Study of the Implementation of Certain Budgeting Concepts in Manufacturing Companies in Serbia.Economic Themes,59(1), pp.61-76.

Pratolo, S., Sofyani, H. and Anwar, M., 2020. Performance-based budgeting implementation in higher education institutions: Determinants and impact on quality.Cogent Business & Management,7(1), p.1786315.

Article

Rizvi, (2020) Fair budget constrained workflow scheduling approach for heterogeneous clouds Available at link.springer.com/article/10.1007/s10586-020-03079-1 [Accessed on: 7.4.2023]