Financial Decision Making - BM414 Case Study

Financial Decision Making - BM414 Case Study By Native Expert.

Ph.D. Experts For Best Assistance

Plagiarism Free Content

AI Free Content

Financial Decision Making - BM414

Are you in search of the best assignment help in the UK? Look no further than Native Assignment Help. We understand the challenges you may encounter during your academic journey, which is why we're here to alleviate your burdens. Our website is user-friendly, and our customer support team is available around the clock to assist students. Let Native Assignment Help provide quality services and relieve your academic stress today! Additionally, explore our AI-free case study for a comprehensive understanding of our work.

Task 1: Critical evaluation of managerial aspects of SKANSKA plc

Importance of accounting and finance functions

Financial decision-making aspects

Accounting and Finance functions within the organization's performance help to improvise its internal factors. These factors positively affected the company’s financial performance on a long-run and short-run basis. Involvement of the accounting and Finance functionalities going to help the financial analyst and the manager of the business to increase the potential of the existing financial condition of the company (De Villiers et al. 2019). Financial decision-making is important for organizations regarding meeting the business requirement and filling the organization's target. This proportional situation refers to the financial decision-making aspect being an important part of improving the current business performance situation. It has been also provided to create a new business strategy for future Business expansion aspects. This segmentation and situation refer to the accounting and Finance functions of SKANSKA plc that are going to help improve the current financial and managerial situation. As it creates Strategies for finding out the current financial gas and way out to recover those (Hopwood, 2019). This financial decision is going to help the company to build and implement new Strategies for the business development aspects.

Meeting legal requirements

Accounting and Finance functionalities provide the business to follow the accounting guidelines, specifically rules, and regulations for maintaining the proper accounting practices. Ethical accounting practices lead towards having the proper avoidance of financial errors within the business. Involvement of the proper accounting practices going to help SKANSKA plc regarding maintaining error-free financial data segmentation. There are specific options regarding the avoidance of legal disruption for the accounting maintenance aspect (Kokina and Blanchette, 2019). It has been indicated that the company is required to involve various rules and regulations for the better maintenance of internal accounting transactions. These rules and regulations are also going to help the company in developing the financing transaction. Maintaining the legal implications of the accounting and financing aspects has been referred to as following up the accounting basics and creating better financing reporting at the end of the accounting period.

Financial strategy

Having the accounting and financial better implications in the business proportional aspect helps the company to create a financial strategy. These financial strategies are going to help the company regarding resolving the current lack of positioning by involving various strategic implications. Accounting and financing functionalities help the manager and financial analyst to note down the financial gaps of the organization based on the current financial reporting aspect. Based on those identified financial gaps, financial analysts can easily suggest business improvement strategies for future aspects (Hill, 2020). Those strategies are mostly focused on controlling the financial debt proportion along with the excess cost evaluation aspects. Hence this financial strategy has been going to help SKANSKA plc regarding recovering the financial implications for future aspects. These financial strategies not only help the company regarding improvement of the financial position it has also positively impacted the business operational condition (Wahlen et al. 2022). If the financial analysis proportion indicates that the company has repeatedly failed to meet the net profit proportion, the manager is going to suggest implementing a cost control strategy or going to suggest a proper budget based on the current situation of the company. This determination has been going to help the company in overcoming the financial gap and leads towards positively meeting the business proportional aspects.

Figure 1: Benefits of financing and accounting functionalities

Record tracking

Accounting functionalities required proper tracking down situations for maintaining the accounting and financing transactions. Financial transaction tracking provides the company with financial implication accuracy as it has been going to help the company for mitigating all financial gaps and errors (Fridson and Alvarez, 2022). Tracking the transactional record of the business helps to create a link between inflows and outflows of the company at the end of the accounting year. Hence based on this, record tracking functionalities company is going to successfully create the financial reporting aspects. It has been demonstrated that maintenance of financial accuracy is important for taking into consideration any kind of investment decision or Business expansion decision for future aspects. Based on the current business position analysis, investors are going to invest in the business, along with the owner going to take any kind of expansion decision for the business functionalities development aspects (Prayoga and Afrizal, 2021). In this reference, it has been noted that accounting transaction tracking down for SKANSKA plc, going to improvise to find out financial errors from the primary preparation of financial reporting. However, implementation of accounting and financial determination can be improvised by the transaction checking proportional aspects for future better references. This transaction cross-checking also helps the company to avoid the financial risk situation and it has helped to point out the future situation regarding higher debt situations. As this record tracking is also being used by finding all the financial disruption from the financial statement proportional aspects and it has been provided the way out to mitigate all the financial gaps.

Financial planning creation

The functionalities of the accounting and financing proportion impacted positively on the financial planning creation proportion aspect. As if the manager found that there are requirements to create a budget plan for control over the current higher cost situation, it has been possible to create the proper finning planning regarding budgetary proportion implementation within the accounting and financing situation (Drábková and Pech, 2019). The plan creation is mostly going to involve the transactional details of the company and it has been focused on the highlighted financial gaps. Creation of the financial planning is going to improvise the current business condition as it has been going to positively impact not only the financial statement but also increase the market position of the company. Hence, it has been addressed that if SKANSKA plc is going to involve financial planning for the business development aspect, it is going to be affected by giving positive results and higher expectations regarding business expansion scope. It has been also helped by meeting the highest net earnings proportion and the end of every accounting period on a long-run basis.

Roles and duties of accounting and finance aspects within SKANSKA plc

The accounting and financing proportion has the main duties and responsibility for monitoring the financial transactions and available financial business data. It has created a comparable discussion for the organization to understand the current state of the company as per the effect of the market condition and compared to the previous year (Malmendier et al. 2022). This accounting and financial proportion also has to provide the business with pointing out the financial stability, weak points, and earning capacity. Financial data tracking down can be segregated by preparing monthly, quarterly, and annual financial statements for the business. Maintenance of fair accounting practices is also an important responsibility for organizing the available financing data and creating supporting report determination. Within the duties and responsibilities of maintaining accounting and financial practices, budget preparation for the entire business and department-wise segmentation have been going to help the company for segregating the entire cost and other functionalities for future reference.

Figure 2: Role of financing

The preparation of the budget creates a compatible discussion with the current situation of the company and it provides a statement regarding adverse or favorable business situations for the future aspects (Boivie et al. 2021). As responsibility indicates forecasting the conditions regarding higher cost proportion and counting expected lost situation or profit situation from the allocated revenue determination of the company. Internal audit has been also involved within the accounting practices duties and responsibilities of a business. As this internal audit helps the company to refer to the financial transaction accuracy and it has also guided the organization for preparing a compact financial statement determination for future reference.

Roles and duties of accounting and financing practices have been going to improvise the current financial state of SKANSKA PLC. These determination has been referred that if roles of fair accounting practices going to increase the potentiality of the business condition of the company. It has been the duty to follow the accounting guidelines and specific rules and regulations for preparing financial statements. Those common guidelines related to financial statement preparation are going to help the company to maintain and track all the financial factors and transactions effectively (Morshed, 2020). These guidelines regarding roles and duties for maintaining proper accounting practices also improvised the managerial performances of the organization. Hence accounting and financing determination is required to be followed up in a proper and structured manner for future reference. These roles and duties are related to the accounting and financial transactions going to help the company address the financial gaps. Proper maintenance of the financing factors of SKANSKA plc is going to improve the financial condition and it is going to impact positively on the company's business expansion aspects. A better financial condition indicates having better managerial aspects along with better internal and external relationships with the stakeholders of the company.

Task 2: Financial performance discussion and recommendation

Financial ratio analysis of SKANSKA PLC

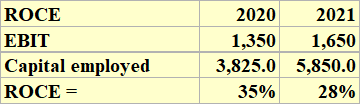

Return on capital employed

The return on capital employed determination has been referred to by taking the capital employed valuation along with the earning before taxation determination. In this aspect, it has been mentioned as SKANSKA PLC's return on capital employed proportion indicated as 35% and 28% for the financial years 2020 and 2021. This situation has been referred to as the company’s capital employed valuation increasing from 3825000 pounds to 5850000 pounds in 2021. On the other hand, the earning valuation declined from the valuation of 1350000 pounds to 1650000 pounds from 2020 to 2021. In this aspect, it has been mentioned that the return on capital employed valuation declined in 2021 from the previous year of 2020. As per the industry averages, it has been mentioned that a higher ROCE valuation is better for the company (Islami and Rio, 2019). The higher ROCE indicated having better earnings for the company and it referred to shareholders going to have better profit segmentation in future aspects. In this determination, SKANSKA plc has lowered ROCE valuation and it stated that the company’s profit proportion of shareholders is being lowered in 2021 rather than 2020.

Table 1: ROCE

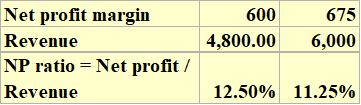

Net profit margin

The net margin proportion has been calculated by taking the net profit valuation and revenue portion of the company. In this aspect, it has been referred to that the net profit valuation of SKANSKA plc mentioned as 12.50% in 2020 declined in 2021 by 11%.25%. In this aspect, it has been mentioned that the company's net profit valuation increased by 600000 pounds to 675000 pounds in 2021. On the other hand, revenue valuation also increased by 4800000 pounds to 6000000 pounds from 2020 to 2021. It has been noted that lowered net margin valuation ratio indicated having a better profit segmentation allocation in the financial situation of the company. Hence, it has been mentioned that SKANSKA plc’s revenue and net profit valuation increased from 2020 to 2021 that affect positively on the company’s profitability earning capacity proportion. Based on this determination, it has been stated that the financial strength of SKANSKA plc is in a better situation in 2021 than in 2020. This situation addressed that the company is capable of overcoming any financial gap in the future aspects (Prawirodipoero et al. 2019). It has been also mentioned that the company has successfully controlled the excess expenses proportion that help to achieve a higher net earnings proportion from 2020 to 2021.

Table 2: Net margin ratio

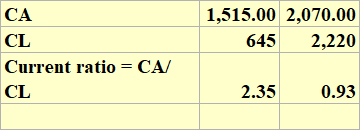

Current ratio

The evaluation of the company's current ratio determination has been demonstrated by taking into consideration the criteria regarding 1:1. If a company has the highest current ratio proportion then describe the area it addresses the company’s debt proportion higher than its previous year's situation. Hence it has been mentioned that the company's liquidity situation is critical and it has also been mentioned that there are chances of meeting a bankrupt situation in the future. Controlling over the debt situation is required for the company to meet the criteria regarding 1:1 that addresses optimum capital structure proportion. This criterion also indicated that the company’s financial stability is in a good position. SKANSKA plc’s current ratio is mentioned as 2.35 for 2020 and 0.93 for 2021. This situation has indicated the company’s liquidity proportion is critical in both fiscal years 2020 and 2021. Based on this evaluation, it mentioned that SKANSKA plc’s current assets valuation increased in 2021 by 1515000 pounds to 2070000 pounds. In this aspect, it has been also noticed that the company's current liabilities valuation increased from 645000 pounds to 2220000 pounds in 2021. This increased proportional situation has been affected negatively on the company’s financial stability situation. As it has been mentioned that SKANSA plc’s financial stability is in a critical situation and the higher short-term debt situation might create financial risk for the company in the future (Widagdo et al. 2020). This segmentation has been referred to as SKANSKA plc’s liquidity proportion availability being lower.

Table 3: Current ratio

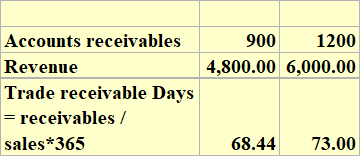

Accounts receivable ratio

The debtors' collection days have been evaluated by taking the debtor acquisition valuation along with the revenue evaluation proportion of the company. SKANSKA plc’s accounts receivable valuation increased from 2020 to 2021 by amounting to 900000 pounds to 1200000 pounds. On the other hand, it has been noted that the company's revenue valuation increased in the same period. The overall discussion has been noticed that SKANSA plc’s trade receivable ratio is 68 days for 2020 and 73 days for 2021. Shorter debtors' days' valuation is preferable as it indicates a higher liquidity determination situation. In this aspect, SKANSKA plc’s debtor collection period has been higher than 60 days for both years. It has been mentioned that the company’s liquidity situation is critical which has been also found from the liquidity distribution analysis of the company for the financial year 2020 and 2021.

Table 4: Debtors ratio

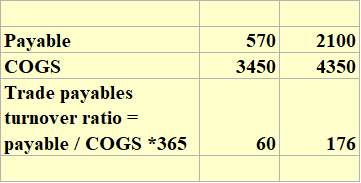

Accounts payable ratio

The accounts payable collection period has been determined by using creditors along with the COGS valuation of the company. This evaluation of the creditor collection period of SKANSKA plc is mentioned as 60 days and 176 days for 2020 and 2021. In these references, it has been mentioned that a good creditors collection period should be within 30-60 days (Alkhyeli et al. 2021). Based on that, it has been indicated that SKANSKA plc’s collection period was better in 2020, but due to the higher cost of goods sold valuation determination in 2021, the creditor collection period was affected negatively. This entire situation that accounts for the payable proportion of SKANSKA plc has been mentioned as 570000 pounds in 2020 which increased by 2100000 pounds in 2021. On the other hand, the cost of goods sold valuation increased by 3450000 pounds to 4350000 pounds in 2021. This overall situation has been mentioned that the company's debt payable proportion increased due to having higher debt. It has been also indicated that the company faced a financial crisis due to having lower liquidity capability along with a higher debt situation.

Table 5: Creditors ratio

Discussion regarding financial performances

SKANSKA plc Is a UK-based construction company that has been planning for expanding its business operations in other countries within Europe. The company has created this business expansion plan for the next 10 years. Financial ratio analysis provides the determination of aspects of the company's financial condition, in respect of 2020 and 2021. It has been mentioned that the company’s income valuation increased due to having indeed revenue determination. It has been noticed that the company’s cost of goods sold increased in 2021 rather than 2020. On the other hand capital employee evaluation of the company will also be increased in the financial year 2021 than in 2020. Hence, all over the financial determination of SKANSKA plc has been mentioned that the company has a better profit generation capacity for the future aspects. It has been evaluated that SKANSKA plc faced a higher debt valuation situation. This situation has affected negatively the company’s accounts payable collection determination along with the debtors' collection days’ proportion.

Higher debt valuation indicated towards has a critical situation in terms of the solvency aspects, as the company’s future net earnings capacity has been declining. On the other hand, higher debt valuation refers to a company having higher financial risk in the future. The higher debt valuation can also be impacted negatively on the asset allocation of the company. It has been indicated that SKANSKA plc's financial stability and health are not in a better situation, but it has the capacity regarding acquiring better profit segmentation in the future. Better profit allocation can be achieved by having a better revenue valuation along with a controlled cost situation. In this aspect, it has been noticed that SKANSKA plc’s cost proportion increased but due to having better revenue acquisition, the company's net profit margin was not affected negatively.

Recommendation

The overall discussion indicated that the company’s financial strength is in a critical situation due to having a higher debt proportion. In this aspect, it has been mentioned that SKANSKA plc is required to take into consideration a debt control strategy, as this strategy is going to help the company in controlling the debt proportion. This strategy is going to help the company’s debt reduction aspects and it has been helping to improvise the liquidity proportion in future situations. This financial discussion mentions that if an investor is going to invest in SKANSKA plc, amounting to 1 million pounds, it is going to achieve profit segmentation in the future. This recommendation refers to the company having improvised its earnings base from the financial year 2020 to 2021. However, it has been also noticed that the company's debt proportion is higher and there are chances of facing financial risk in the future. This overall situation mentions that the company is going to consider the cost control and debt control strategy within the business operating system. Financial disrupted situations can be easily improvised in future aspects and it has been going to provide the investor a better return from that investment aspect.

References

Alkhyeli, S., Abdulla, F., Alshehhi, A., Aldhaheri, N., Alhosani, M., Alsereidi, A., Al Breiki, M. and Nobanee, H., 2021. Financial Analysis and Performance Evaluation of Pfizer.Available at SSRN 3896385.

Boivie, S., Withers, M.C., Graffin, S.D. and Corley, K.G., 2021. Corporate directors' implicit theories of the roles and duties of boards.Strategic Management Journal,42(9), pp.1662-1695.

De Villiers, C., Dumay, J. and Maroun, W., 2019. Qualitative accounting research: dispelling myths and developing a new research agenda.Accounting & Finance,59(3), pp.1459-1487.

Drábková, Z. and Pech, M., 2019. Financial statements risk: Case study of a small accounting unit.Scientific papers of the University of Pardubice. Series D, Faculty of Economics and Administration. 45/2019.

Fridson, M.S. and Alvarez, F., 2022.Financial statement analysis: a practitioner's guide. John Wiley & Sons.

Hill, A., 2020.Manufacturing Operations Strategy: Texts and Cases. Bloomsbury Publishing.

Hopwood, A.G., 2019. Accounting and organisation change. InManagement Control Theory(pp. 357-368). Routledge.

Islami, I.N. and Rio, W., 2019. Financial ratio analysis to predict financial distress on property and real estate company listed in indonesia stock exchange.JAAF (Journal of Applied Accounting and Finance),2(2), pp.125-137.

Kokina, J. and Blanchette, S., 2019. Early evidence of digital labor in accounting: Innovation with Robotic Process Automation.International Journal of Accounting Information Systems,35, p.100431.

Malmendier, U., Pezone, V. and Zheng, H., 2022. Managerial duties and managerial biases.Management Science.

Morshed, A., 2020. Role of working capital management in profitability considering the connection between accounting and finance.Asian Journal of Accounting Research,5(2), pp.257-267.

Prawirodipoero, G.M., Rahadi, R.A. and Hidayat, A., 2019. The Influence of Financial Ratios Analysis on the Financial Performance of Micro Small Medium Enterprises in Indonesia.Review of Integrative Business and Economics Research,8, pp.393-400.

Prayoga, I. and Afrizal, T., 2021. Perceptions of Educators, Accounting Students and Accountants Public Accountant against Ethics of Financial Statement Preparation (Studies at University and KAP in Semarang).Budapest International Research and Critics Institute-Journal (BIRCI-Journal),4(1), pp.89-101.

Wahlen, J.M., Baginski, S.P. and Bradshaw, M., 2022.Financial reporting, financial statement analysis and valuation. Cengage learning.

Widagdo, B., Jihadi, M., Bachitar, Y., Safitri, O.E. and Singh, S.K., 2020. Financial Ratio, Macro Economy, and Investment Risk on Sharia Stock Return.The Journal of Asian Finance, Economics and Business,7(12), pp.919-926.

Go Through the Best and FREE Case Studies Written by Our Academic Experts!

Native Assignment Help. (2026). Retrieved from:

https://www.nativeassignmenthelp.co.uk/financial-decision-making-bm414-case-study-23398

Native Assignment Help, (2026),

https://www.nativeassignmenthelp.co.uk/financial-decision-making-bm414-case-study-23398

Native Assignment Help (2026) [Online]. Retrieved from:

https://www.nativeassignmenthelp.co.uk/financial-decision-making-bm414-case-study-23398

Native Assignment Help. (Native Assignment Help, 2026)

https://www.nativeassignmenthelp.co.uk/financial-decision-making-bm414-case-study-23398

- FreeDownload - 976 TimesManagerial Economics and Market Expansion in Unilever Case Study

Managerial Economics and Market Expansion in Unilever Click to see how our...View or download

- FreeDownload - 623 TimesMitchells & Butlers Marketing Mix: Strategies for Hospitality Success Case Study

How M&B Combines Innovation and Marketing in the Hospitality...View or download

- FreeDownload - 1870 TimesUnit 24: Understanding and Leading Change Case Study

Unit 24: Understanding and Leading Change Introduction: Unit 24:...View or download

- FreeDownload - 1005 TimesHSCN4102Y Health Determinant and Bio-Psyco Socio Case Study

Introduction The purpose of this essay is to discuss the determinants of...View or download

- FreeDownload - 920 TimesTUI Group Case Study: Internal, Micro & Macro Environment Analysis

Introduction: Business Environment The case study develops a deep...View or download

- FreeDownload - 1042 TimesCase Study on Vulnerability Scanning and Security Reporting

Vulnerability Scanning and Reporting Second part: Vulnerability Scanning...View or download

-

100% Confidential

Your personal details and order information are kept completely private with our strict confidentiality policy.

-

On-Time Delivery

Receive your assignment exactly within the promised deadline—no delays, ever.

-

Native British Writers

Get your work crafted by highly-skilled native UK writers with strong academic expertise.

-

A+ Quality Assignments

We deliver top-notch, well-researched, and perfectly structured assignments to help you secure the highest grades.