Three Theories Of Banking And The Conclusive Evidence By Richard

Banking Theories: A Comprehensive Analysis by Richard A. Werner

Ph.D. Experts For Best Assistance

Plagiarism Free Content

AI Free Content

Three Theories Of Banking And The Conclusive Evidence By Richard A. Werner

Academic tasks can be challenging, but Native Assignment Help provides practical support and expert guidance to help students achieve well-structured and high-quality assignments.

Purpose and objectives of the article

The critical review of financial analysis has considered the article "A lost century in economics: Three theories of banking and the conclusive evidence" by "Richard A. Werner" has considered sustainable development and finance, the centre for banking in the UK. Based on analyzing the purpose the major prospect of the article is to evaluate the money supply to operate banks for analyzing "Fractional reserve theory". Along with that, the financial intermediaries of banks have focused to create credit at the time of granting a loan as the theories differ for the accounting treatment (Werner, 2016). As per the analysis of non-banking financial intermediaries, the policy implication has evaluated the policymakers to consider bank capital adequacy.

Dealing with the reserve theories of banks the empirical system considers the monetary system to evaluate the current bank-free academic census. After that, to incorporate the banking system based on economic theories central dispute focuses on concerned the implication finance research has considered the effectiveness of "Credit creation theory". The monetary system considers the purpose of analyzing the factors of modern banking to focus on simulation situations based on tests of booking a bank loan (Castellano and Dubovec, 2018).

Objectives

- To deal with the three theories of banking for credit creation and the banking system approach

- To evaluate the banking system operates in the money supply process

- To consider the financial and non-financial intermediaries' role in creating money

- To focus on accounting treatment and policy implications for granting a bank loan

Arguments in Article

The implication of different theories to analyze the credit creation banking process

The article has faced different arguments based on the implication of theories supporting the fractional reserve by Samuelson based on the banking system the analysis of funds in bank loans has intended (Patalano and Roulet, 2020). As to deal with the analysis of arguments the banking system cretes money has focused on the example of small banks. however, a 20% reserve is required to consider the balance sheet in the accounts of the bank based on the evaluation of new cash deposits. Dealing with the deposit of $1000, Samuelson asked the banking activity to expand its loan or investments by $4000 to consider the change in its balance sheet.

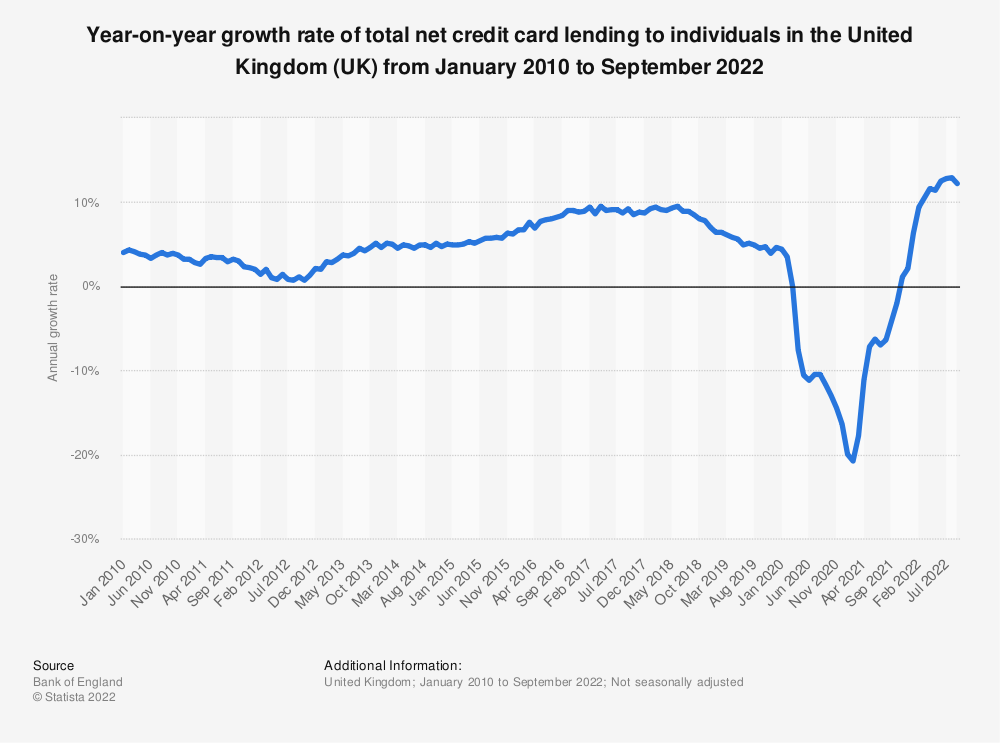

Figure 1: Growth rate of total net credit card lending to individuals in the UK

As per the comparison of total assets and liabilities the cash reserve is 20% based on the total deposit. hence the promissory note has focused on spending money for the payment of banks (Statista.com, 2022). In contrast to this Samuelson as a loan extension to loan out the money has evaluated the after-loan extension to bring a new deposit of $1000. In contrast to this, the credit creation process in the banking system has evaluated the legal reserves based on individual bank cretes money (Thakor, 2020). Along with that, to grant loans Mises argued for the function of banks as the general theory states the investment or savings to consider "Keynesian growth models" to evaluate the justification for the influence of economic policy.

Macroeconomic determinants of bank profitability

On the other hand, "Gurley and Shaw" argues based on banks and non-banking financial institution function as intermediaries in bak argues for influential work. As per the analysis of commercial banks and financial intermediate operations, the theory of fractional reserve has to consider the arguments to disagree with the former theory (Yu et al. 2022). The macroeconomic role of the non-banking financial institution has focused on the prospects of financial intermediaries to support deposit creation (Warjiyo and Juhro, 2019). As the argument on the banking system for creating money brings the argument of Crick. the financial intermediary system for creating money evaluates the theory of banking's role as the ability of banks to create credit has to be focused on reassuring the public.

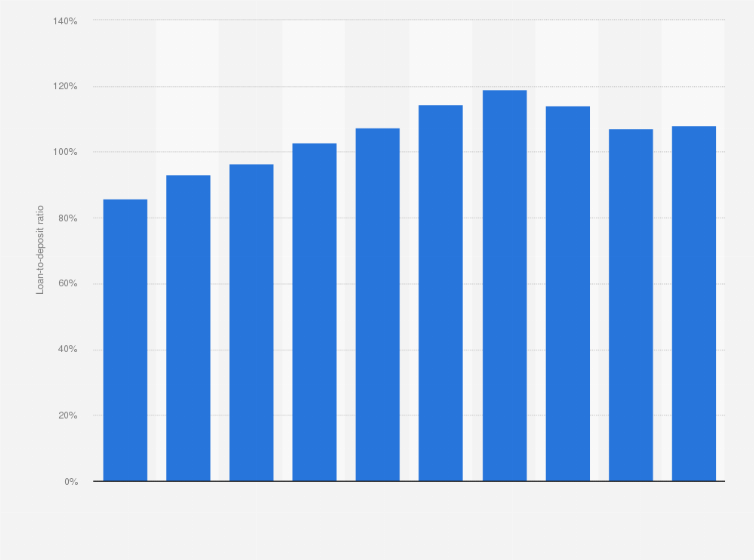

Figure 2: Loan-to-deposit ratio in the United Kingdom

In contrast to that, the money creation process technically defuses the direct consequences for economic model builders based on the argument of 10% reserve and 90% lend amount. The analysis of the banking system deposit creation process helps to evaluate Keynes's arguing judgement (Statista.com, 2021). Instant deposit deals with bank transfer and the credit creation process the authorization of claiming a deposit focuses on cash transfer. However, the credit creation activities for expanding the supply of loanable funds analyze the financial expenditure (Werner, 2016). The Smith argument for distinct inaction of financial intermediate with non-financial one has based on multiple credit creation processes.

Loan borrowings of non-financial intermediaries

The evaluation of Samuelson's argument against the false explanation of wide circulation has considered the ordinary bank's supportive arguments based on banking creates money. In contrast, this statement focuses on the loan extension process for implementing the plans of a banker (Ozili 2022). Dealing with the Schumpeter arguments the alternative theory of banking profoundly the bank credit in existing finds through analyzing the situation of the bank credit model. The analysis of Keynes's prominent supporter analyzes the credit creation theory's importance as the revolutionary improvement brings into focus the bank intermediaries to consider the argument of Moore.

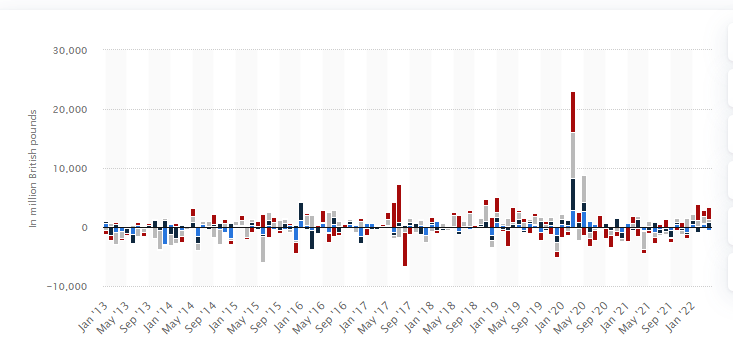

Figure 3: Borrowing by non-financial industries in the United Kingdom

In comparison to the fractional reserve theory, the supportive arguments bring the economic growth of FPC members as the direct finance recommended by the "Bank of England". On the other hand, the crisis of market-based finance evaluates the financial intermediation and fractional reserve theory to evaluate the bank's forecasting model (Statista.com, 2022). The financial intermediary theory argues regarding the regulation of interest rates, and capital requirements the major focus is on fractional reserve analysis of the accounting system. However, the necessary investments and savings have focused on economic growth and the fundamental support of producing the argument of Werner (Sarmiento, 2022). As to deal with the application of political view the deductive methodology focuses on the research paper.

Conclusion

The research paper concludes that the influence of economic policy leads to creating a major role in the interpretation of developing countries considering the international bank's effectiveness. Based on the evaluation of missing savings for domestic purposes, the policy examines the bank credit creation system. Along with that, the mechanical process evaluates the different economic theories to focus on different assumptions to deal with the approach of banks creating money. After that, the "Journal of Political Economy" article considered the influential economist to point out the ambiguity of the "Bank of England”. As per the analysis of preconceived ideas, the framework justifies the suitable assumption and option for analyzing the bank regulation.

The financial intermediaries analysis has considered the theory of fractional reserves, credit creation, and financial intermediaries for analyzing the regulation of financial crisis. Dealing with bank credit derivatives the bank regulation focuses on the GDP growth rate for analyzing the financial transaction. Based on that, the different author's agreements have critically evaluated representing the control of bank credit as the central bank guidance evaluates the non-inflationary growth to stimulate the currency debt un domestic banks. Along with that, the taxpayer's burden for central banking as the progress of economic theories stimulates the flow of funds for maintaining rescued and better settlement process. As per the analysis of the bookkeeping economic system, the result of interdisciplinary research allows banks to create money.

Reflection on Article

The article evaluates the empirical bank reality by analyzing the different theories and textbooks it has found by me at the interdisciplinary research agenda has analyzed the role of banks, especially the central bank. As per the evaluation, I considered that the monetary system has focused on the interdisciplinarity approach of accounting, management, information technology, and operation. Dealing with the prospect of ensuring the supplementary data ignoring the empirical reality has considered the financial intermediaries' function (Grose et al. 2021). I also analysed that, the case of credit and money creation by banks has reflected the accounting process through aligning with the fractional reserve theories.

In my opinion, the bank accounting process for cooperative movement evaluates the reflection of commerce to deal with the understanding of eminent economist committee meetings. Along with that, I evaluate the opportunities to consider omitted transactions as autonomous transactions and design the bank customers' standard procedures to evaluate the standard loan process by contract. Based on the unrealistic assumptions the loan amount has shown on the liability side however the borrower account has been credited thus this misleading conception creates different arguments between authors (Miao et al. 2021). The exposition of incorrect sensation in bank procedures has evaluated the impact of fractional reserve theory as the restricted amount of loan context based on the credit creation process.

Dealing with the prospects of different banking process bank deposits has also been analyzed as a liability thus the interbank market has focused on mutual claims to emphasise the higher capital requirement. The loan contract system has also been considered by me as the empirical reality of interdisciplinary research focusing on the monetary system to bring the empirical reality of banks. Based on the evaluation of bank regulation the process helps to focus on the critics of credit creation theory as the different arguments of authors based on the banking system help to analyse the effective measure of economic activity (Lo et al. 2022). The three theories help to evaluate the quantity and quality of bank credit and financial transactions. Thus, the GDP growth has focused on the interest rate tested by the central bank to control the influence of supporters.

The measures that evaluated the central bank goals gas consider the misleading conception of credit creation theory in order to deal with the arguments the influencer political views have analyzed. In my opinion, the research has presented the implication of economic theories to consider the accounting realities in the banking system. Based on the central settlement bureau the bookkeeping centre has focused on the financial intermediaries' function (Jakab and Kumhof, 2018). Along with that, I found that the fractional reserve theory supports the lending money process to evaluate the unrealistic aspects of imposed regulation.

References

Castellano, G.G. and Dubovec, M., 2018. Credit creation: Reconciling legal and regulatory incentives. Law & Contemp. Probs., 81, p.63.

Grose, C., Kanella, A., Kargidis, T., Mocanu, M. and Spyridis, Τ., 2021. Determinants of Bank Profitability in UK on the Eve of the Brexit. In The Changing Financial Landscape (pp. 187-203). Springer, Cham.

Jakab, Z. and Kumhof, M., 2018. Banks are not intermediaries of loanable funds—facts, theory and evidence.

Lo, D., McCord, M., Davis, P.T., McCord, J. and Haran, M.E., 2022. Causal relationships between the price-to-rent ratio and macroeconomic factors: a UK perspective. Journal of Property Investment & Finance.

Miao, M., Saide, S. and Muwardi, D., 2021. Positioning the Knowledge Creation and Business Strategy on Banking Industry in a Developing Country. IEEE Transactions on Engineering Management.

Ozili, P.K., 2022. Determinants of bank income smoothing using loan loss provisions in the United Kingdom. Journal of Economic and Administrative Sciences.

Patalano, R. and Roulet, C., 2020. Structural developments in global financial intermediation: The rise of debt and non-bank credit intermediation.

Sarmiento, M., 2022. Sudden yield reversals and financial intermediation in emerging markets. Journal of Financial Stability, p.101050.

Statista.com (2021). Loan-to-deposit ratio of the Virgin Money Group in the United Kingdom (UK) from 2011 to 2021. Available from:https://www.statista.com/statistics/509617/virgin-money-group-s-loan-to-deposit-ratio-uk/. Accessed on: 14.12.2022

Statista.com (2022). Headline flow of borrowing by non-financial industries in the United Kingdom (UK) from January 2013 to June 2022, by key sector. Available from:https://www.statista.com/statistics/1117100/headline-flow-in-lending-to-businesses-in-the-united-kingdom-by-key-sector/. Accessed on: 14.12.2022

Statista.com (2022). Year-on-year growth rate of total net credit card lending to individuals in the United Kingdom (UK) from January 2010 to September 2022. Available from:https://www.statista.com/statistics/1116134/uk-lending-net-credit-card-lending-in-the-united-kingdom/. Accessed on: 14.12.2022

Thakor, A.V., 2020. Fintech and banking: What do we know?. Journal of Financial Intermediation, 41, p.100833.

Warjiyo, P. and Juhro, S.M., 2019. Central bank policy: Theory and practice. Emerald Group Publishing.

Werner, R.A., 2016. A lost century in economics: Three theories of banking and the conclusive evidence. International Review of Financial Analysis, 46, pp.361-379.

Yu, M., Feng, Z. and Wang, Y., 2022. The business cycles driven by loan defaults via credit creation: An agent-based perspective. Finance Research Letters, 48, p.102846.

Go Through the Best and FREE Case Studies Written by Our Academic Experts!

Native Assignment Help. (2026). Retrieved from:

https://www.nativeassignmenthelp.co.uk/three-theories-of-banking-and-the-conclusive-evidence-by-richard-20608

Native Assignment Help, (2026),

https://www.nativeassignmenthelp.co.uk/three-theories-of-banking-and-the-conclusive-evidence-by-richard-20608

Native Assignment Help (2026) [Online]. Retrieved from:

https://www.nativeassignmenthelp.co.uk/three-theories-of-banking-and-the-conclusive-evidence-by-richard-20608

Native Assignment Help. (Native Assignment Help, 2026)

https://www.nativeassignmenthelp.co.uk/three-theories-of-banking-and-the-conclusive-evidence-by-richard-20608

- FreeDownload - 1681 TimesAnalyzing the Supply Chain Management Of Zara Case Study

Introduction: Analysis Of The Supply Chain Of Zara Strategies and...View or download

- FreeDownload - 2230 TimesM&S Change Management Strategy: Digital Transformation and Future Growth Case Study

Exploring Key Factors Behind M&S Retail Evolution During COVID-19...View or download

- FreeDownload - 865 TimesAnalysis of Unilever Business Strategy Assignment Sample

Introduction: Unilever's Strategy Analysis Assignment Research Background and...View or download

- FreeDownload - 812 TimesMitchells and Butlers: Business Analysis of the UK Hospitality Leader Case Study

Examining the Growth, Ethics, and Strategy of Mitchells and Butlers Company...View or download

- FreeDownload - 1166 TimesExploring the Development of Workplace Critical Thinking: A Case Study of Amazon

Developing Workplace Critical Thinking Amazon Case...View or download

- FreeDownload - 410 TimesGeotechnical ULS Failure Case Study Analysis

Geotechnical ULS Failure Case Study Analysis Introduction: Geotechnical...View or download

-

100% Confidential

Your personal details and order information are kept completely private with our strict confidentiality policy.

-

On-Time Delivery

Receive your assignment exactly within the promised deadline—no delays, ever.

-

Native British Writers

Get your work crafted by highly-skilled native UK writers with strong academic expertise.

-

A+ Quality Assignments

We deliver top-notch, well-researched, and perfectly structured assignments to help you secure the highest grades.