- Introduction: Analysis Of Beyond Budgeting Model And Learning Curve

- 1. Q1. Discuss the particular difficulties encountered when budgeting in public sector organisations compared with budgeting in private sector organisations, drawing comparisons between the two types of organisations.

- Q2. Discuss the view that ‘there is no longer a place for incremental budgeting in any organization, particularly public sector ones,’ highlighting any drawbacks of zero-based budgeting that need to be considered.

- 3.0 Discussion of Benefits of Beyond Budgeting Model in an Organization

- 4.0 Discussion of limitations of the Learning curve model

Introduction: Analysis Of Beyond Budgeting Model And Learning Curve

If you want to be successful in your assignments and improve your grades, use our free questions and Answers at Native Assignment Help. Our team of proficient assignment help UK is knowledgeable and experienced enough to produce outstanding papers that meet academic standards. Thus, come together with us at Native Assignment Help for sure success in everything.

1. Q1. Discuss the particular difficulties encountered when budgeting in public sector organisations compared with budgeting in private sector organisations, drawing comparisons between the two types of organisations.

Answer 1: Budgeting is an important process for public and private sector in organizations, aimed at allocating resources in the most efficient and effective manner to achieve organisational objectives. However, public sector organizations face unique challenges when it comes to budgeting, which sets them apart from their private sector counterparts. Some experts have argued that zero-based budgeting is more suitable for public sector organizations than incremental budgeting, given the need to control costs and maintain efficiency. Followingly, it will be discussed these difficulties by drawing comparisons between the two types of organizations.

One significant difficulty in public sector budgeting is the need to satisfy diverse stakeholders. Public sector organizations have to deal with multiple stakeholders, including elected officials, government agencies, and the general public, who all have diverse interests and expectations. This complexity makes the budgeting process more challenging and time-consuming compared to the private sector, where decision-making is more streamlined, and the budgeting process is more straightforward (Ibrahim, Ramli, & Nor, 2019). Another difficulty in public sector budgeting is the lack of flexibility in budget allocation. Public sector organizations are often bound by regulations, policies, and laws that restrict their ability to allocate resources flexibly. This rigidity can lead to inefficiencies in the use of resources, which can affect the ability of public sector organizations to achieve their objectives effectively. Opposed to, private sector organizations have more flexibility in allocating resources, which enables them to adapt quickly to changing market conditions and customer needs (Ibrahim, Ramli, & Nor, 2019). Additionally, public sector organizations also face the challenge of budgetary restrictions. Public sector budgets are commonly limited by political decisions, economic conditions, and other external factors beyond the control of the organization. These, can limit the ability of public sector organizations to invest in long-term projects, which can impact their ability to achieve their strategic objectives. Private sector organizations, on the other hand, can raise capital through equity and debt financing, enabling them to invest in long-term projects and achieve their strategic objectives (McCarthy & Lane, 2012).

Although some experts argue that zero-based budgeting is more suitable for public sector organizations, it also has its challenges. Zero-based budgeting requires a detailed analysis of all activities and programs, which can be time-consuming and resource-intensive. It also requires a significant change in organizational culture and mindset, which can be difficult to achieve in public sector organizations that are often resistant to change (McCarthy & Lane, 2012).. Thus, budgeting in public sector organizations is more complex than in private sector organizations, given the diverse stakeholders, lack of flexibility, and budgetary constraints. While zero-based budgeting may be more suitable for public sector organizations, it also has its challenges, such as the need for a detailed analysis and a significant change in organizational culture. Public sector organizations should, therefore, adopt budgeting practices that are tailored to their specific needs and challenges, taking into account the unique circumstances they face. There are different variations of the techniques and the traditional budgeting is different from the individuals and the familes. The Zero based budgeting allows the budgeting process of strategic goals should be specific to the functioning area. The rolling process of the detail oriented should be properly reviewed and researched. The decrease and the increase in the budget period should be helping in the reduction of the costs. In the management of the justified expenses the cost optimization is crutial for the creation of revenue in private sectors. The implication of the Zero based budgeting the prevention of mis allocation could be regulated and could grow increasingly for greater business operations.

Q2. Discuss the view that ‘there is no longer a place for incremental budgeting in any organization, particularly public sector ones,’ highlighting any drawbacks of zero-based budgeting that need to be considered.

Answer 2: Deloitte (2017) has noted that while zero-based budgeting (ZBB) can potentially lead to significant cost control and efficiency improvements in public sector organizations, there are also several drawbacks that need to be taken into account before its implementation as a budgeting approach. One significant concern is the resources and time required to develop and maintain a ZBB system. As per the report, the process of analyzing and justifying each expense in the budget can be labor-intensive and time-consuming, and may require additional training for staff. In this regard, it can be inferred that a lack of adequate resources or expertise could result in ZBB being an ineffective approach to budgeting in public sector organizations.

Another drawback of ZBB highlighted by Deloitte (2017) is the potential for bias in decision-making. The comprehensive assessment of all expenditures that ZBB requires could result in particular departments or programs being disproportionately cut or eliminated. In this regard, there is a risk that certain areas of the organization may receive less funding than necessary. Furthermore, the report highlights that ZBB may not be suitable for all public sector organizations, especially those that have stable funding sources or political influence.

Deloitte (2017) also cautions that ZBB is not a universal solution, and public sector organizations must carefully evaluate their unique needs and circumstances before deciding to adopt it as a budgeting approach. Therefore, it is important to take into account the organization's financial situation, goals, and resources, as well as the potential impact on employees and stakeholders. In some cases, incremental budgeting may still be a more appropriate approach, depending on the organization's specific needs and circumstances.

It is important to note that the Deloitte report (2017) acknowledges the potential benefits of ZBB in terms of cost control and efficiency. However, the drawbacks must be taken into account before making any decision to implement ZBB. In some cases, organizations may need to consider other budgeting approaches that align better with their unique circumstances.

Overall, while ZBB can potentially lead to cost control and efficiency improvements in public sector organizations, it is crucial to carefully evaluate its potential drawbacks before implementing it as a budgeting approach. As per Deloitte (2017), the potential for bias, the suitability of ZBB for different types of public sector organizations, and the need for careful evaluation must all be taken into account. Furthermore, organizations must ensure that they have adequate resources and expertise to implement and maintain a ZBB system. It is also important to consider other budgeting approaches that may better align with the organization's specific needs and circumstances. In the drawbacks of the implication of ZBB system, the short term thinking is shifted towards the area of the revenue generation, the budgeting period of a company could possibly be hurt because the long term budgets and the competitiveness is increasing. There are manipulation of the savvy managers , that have been decreasing the spirit of budgeting. The resource intensive process the modification and the justify position are reviewed in the critic of the time cost. There is need of modification of the exsiting budgetary framework, according to the budgetary benefit of the resources.

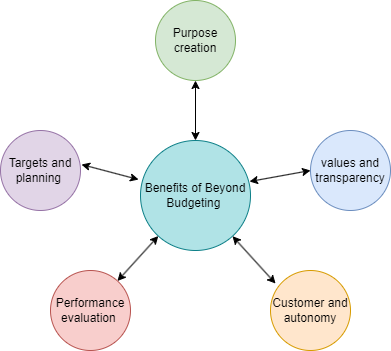

3.0 Discussion of Benefits of Beyond Budgeting Model in an Organization

Answer 3.1 Introduction of Beyond Budgeting

Beyond Budgeting is a system of management control that has evolved in the late 1990s. The advantages are observed in the competitive sector. There are a few practicing approaches in the organizations which are based on the modern institutions. In this decentralized system, the annual budget and the improvement of the activity of management. The research organization and the principles of beyond budgeting are on the principles of encouragement of shareholders to motivate to achieve the goal of the organization. The valuation of the employees is on the freedom of responsibility to believe in the judgement of common sense. Through the beyond-budgeting process, the transparency of the information of the employees. Through beyond budgeting the planning and forecasting of the target and the evaluation of the performance could be developed.

3.2 Benefits of Beyond Budgeting in an Organization

There are leadership benefits and management benefits and through these benefitting factors, the prevention of confusion could be transmitted through the implication of Beyond Budgeting. In the leadership benefits,

Purpose

The determination of involvement in organizational success is derived by sharing common goals and engaging in the financial monitoring and short-term individual goals (Saille, (2020). Through the proper monitoring of the financial goals the purpose is fulfilled

Values & Transparency

In the process of the encouragement of the organizational values of the employees, the simulation of the greater sense of responsibility is factored according to the organizational performance (Chai,2021). The self-regulation, innovation, and regulation of opportunities could create a positive image of transparency in the functioning of organizational activities. By creating value for the employees, the understanding of the market trends and the identification of the issues could be assessed.

Customers and autonomy

In the structure of the organizational hierarchy, the decentralization of the self-regulated units is created for the fluent management of the authority. The influence in the decision-making is more flexible and cheaper in the self-regulated units. In this activity, the prevention of the conflict of interests of customer value could be regulated. Through the focus, on the number of sales, the short-term focus should be approached (Dabsha, 2022). The faster response to the customer needs, the clear strategic management could be created for continuous improvement and innovation.

In the management benefit factor of beyond budgeting,

Targets & planning

There is the valuation of targets for the guidance of employees, and the dynamics of the development should be targeted. The planning of objectivity and the different targets should be ambitious for the achievement of goals and through the proper planning of a more realistic and accurate job could be followed (Hoiem, 2021). By proper planning of Beyond Budgeting, the cost of operation and the entitlement of the budget could be reduced.

Performance Evaluation and rewards

In this approach of the beyond budgeting demands, the performance evaluation is important for the improved results and development of the learning process. The attention on the results should be on the feedback of the marketing development of customers. Allocation of effective reward, the relative performance is increased for surviving the competition. Under this Beyond Budgeting approach, the incentives should be promoted in acquiring of the fixed targets.

Figure1: Benefits of Beyond Budgeting

4.0 Discussion of limitations of the Learning curve model

A4 :4.1 Introduction of learning curves

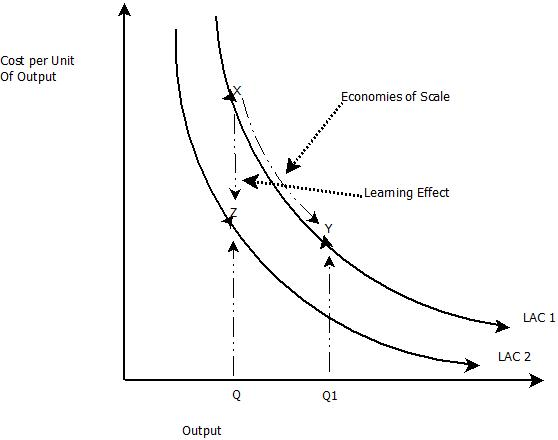

Learning curves are mathematical concepts, which are depicted through graphs. In this process, the improvement in learning proficiency could be performed. A learning curve identifies the rate of improvement. There are an efficiency curve, a productive curve, and a cost curve. Through the learning curve, the visual representation of the acquired skill and knowledge could be observed. Through the slopes of learning curves, the rate of cost savings of the company could be assessed. In a learning curve, the identification of the improvement rate could be seen. The steeper slope, a higher cost per unit of output could be observed.

4.2 Limitation of the learning curve model

There are various limitations to the assessment of the usage of learning curves, these limitations are,

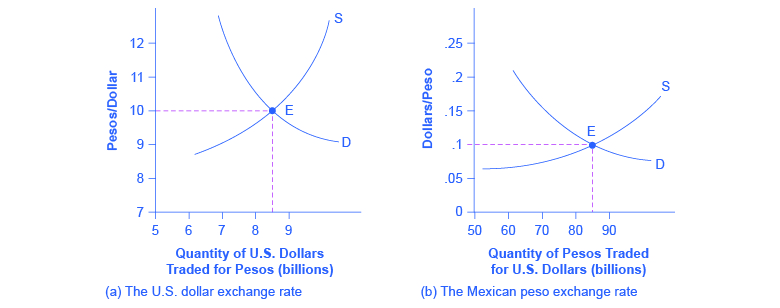

- The model of the learning curve does not continue forever, as there are factors that could diminish. There are different market trends according to the financial market situations which could define the learning curves,

As there is an example of dollar rates, the value of the dollar diminishes over time as per the hour pass. There are fluctuations in the market valuation

- There are bits of knowledge that are gained in the analysis of the of learning curve of one product that might not be shared with the experiences of other products, as the other products share different valuations and product costs are different (Musaji,2020). There are different elements that could not be extendable in gaining the learning curve knowledge.

- In the learning curve, the data on cost may not be readily available, there are other costs like the overhead cost, and labor costs which could create obstacles regarding accounting codes in a sufficient work package (Pan,2020). There is also an identification of the elements which could be demonstrated experience effects.

- The quantity of the discounts could distort the costs of operations and could reduce the benefits of the learning curves for the business evaluation. By providing discounts on the quantity, the learning curve could be on the basis of the production. There is an increase in the quantity could be observed in the process of providing a discounting cost.

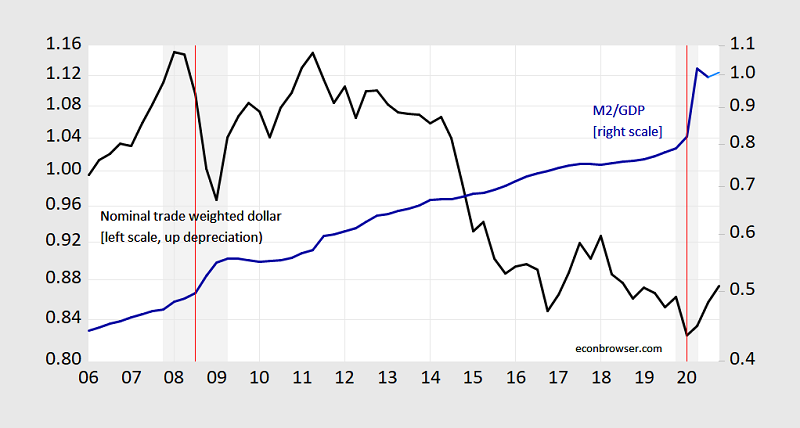

- Inflation is one of the key factors for the neutralization of the learning curve, The gain realization could not be experienced in the increasing rate of inflation of the money valuation concept. The effective decrease in the prices of services and goods is parallel in the future assessment of the assumptions of the market.

For example, the valuation of the inflation of the dollar has been significantly observed due to the time value of money (Porpiglia,2020). The debt instrument was the factor in increasing the valuation of the dollar.

- Learning curves are useful for the external influence of the limitation of government regulations, patents, and even materials. These factors are limiting the experience of annual constant production. There are also long-term horizons and short-term horizons which are limiting the results of the benefits of learning curves.

4.3 Evidence with relevant examples

Figure 2: The learning curve of the Dollar Rate in market valuation

The quantity of U.S. dollars learning curve is increasing regarding the comparison of the Mexican Pesos, The valuation is 9.55 for the valuation of the Mexican peso is between 0.1 to 80.5.

Figure 3: The learning curve of overhead cost and labor cost

The overhead cost and labor cost are increasing the cost per unit of output which is an accounting obstacle for the identification of the limiting elements (Balios, (2021) . On the Economic scale, the learning effect is neutral.

Figure 4: The learning curve of inflation and debt of dollar

This learning curve of the inflation rate of the dollar, is being on the debt actualization of the time value of the dollar rate. According to the example of increasing debt to the average American is significantly increasing and the depreciation rate is increasing.

_661922c418e45.png)

Figure 5: The learning curve of Patent and government regulation

In this learning curve, there is a massive growth that has been seen in the 1990s, the growth period, of this market, has been seen in the 2005 (Corporatefinanceinstitute.com (2023). As the economic growth of the globe is increasing, the influence of the external factors could be seen, and also the increase in patients and government regulations could be observed.

Reference List

Book

Saille, (2020) Responsibility beyond Growth Available at www.degruyter.com/document/doi/10.56687/9781529208351/html [Accessed on 15.4.2023]

Journals

Chai, Y.J., Chae, S., Oh, M.Y., Kwon, H. and Park, W.S., 2021. Transoral endoscopic thyroidectomy vestibular approach (TOETVA): Surgical outcomes and learning curve.Journal of Clinical Medicine,10(4), p.863.

Dabsha, A., Khairallah, S., Elkharbotly, I.A., Hossam, E., Hanafy, A., Kamel, M., Amin, A., Mohamed, A. and Rahouma, M., 2022. Learning curve and volume outcome relationship of endoscopic trans-oral versus trans-axillary thyroidectomy; A systematic review and meta-analysis.International Journal of Surgery, p.106739.

Hoiem, D., Gupta, T., Li, Z. and Shlapentokh-Rothman, M., 2021, July. Learning curves for analysis of deep networks. InInternational conference on machine learning(pp. 4287-4296). PMLR.

Musaji, S., Schulze, W.S. and De Castro, J.O., 2020. How long does it take to get to the learning curve?.Academy of Management Journal,63(1), pp.205-223.

Pan, M., Huang, W., Li, Y., Zhou, X., Liu, Z., Song, R., Lu, H., Tian, Z. and Luo, J., 2020. DHPA: Dynamic human preference analytics framework: A case study on taxi drivers’ learning curve analysis.ACM Transactions on Intelligent Systems and Technology (TIST),11(1), pp.1-19.

Porpiglia, F., Checcucci, E., Amparore, D., Verri, P., Campi, R., Claps, F., Esperto, F., Fiori, C., Carrieri, G., Ficarra, V. and Scarpa, R.M., 2020. Slowdown of urology residents’ learning curve during the COVID-19 emergency.BJU int,125(6), pp.E15-E17.

Balios, (2021) the Impact of Big Data on Accounting and Auditing Available at www.igi-global.com/article/the-impact-of-big-data-on-accounting-and-auditing/270934 [Accessed on 15.4.2023]