Impact Of Direct And Indirect Taxes On Saudi Public Joint Stock Companies

Looking for top-notch assignment help services in the UK? Look no further than Native Assignment Help. With our dedicated team of experts, we offer comprehensive assistance tailored to your academic needs, ensuring excellence in every assignment.

Primary qualitative

Interview with the Bank of Saudi Arabia

This interview was conducted by a researcher with the branch manager of the largest known bank in Dubai, the NBD and here is the result of the conversation that was held.

Researcher: Good morning

Branch manager: Morning, please be seated

Researcher: We will ask you various questions regarding the impact of direct and indirect tax on Saudi Arabia's public joint-sector companies.

Branch manager: Sure, ask anything regarding the topic, we are comfortable answering them.

Researcher: Okay, so the first question we have been going to ask you is, what do you think about Saudi Arabia's public joint stock company's taxations that have been provided to the government?

Branch manager: According to the question you asked, it can be said that the public joint stock companies of Saudi Arabia have been paying taxes to the government very well and there are various types of impacts that were faced with the introduction of direct and indirect taxation policy. Various joint stock companies have their business accounts with our banks. It can rather be seen that the taxes were being charged from the revenue of the company directly or indirectly.

Researcher: Coming up with the next question, what do you think about how these companies are getting affected by the policy of indirect tax?

Branch manager: Indirect tax refers to a tax that is to be paid by every single e person around the globe by way of purchasing any products or services in the world. Every individual pays taxes and most of them have been paying indirect taxes. The indirect tax is levied on the goods and services that are produced and the price of that product or service contains the amount of tax along with other charges. The joint stock companies face various issues in the payment of these taxes as the main indirect tax is the import duty. Every time the company imports any kind of goods from the factory, the company has to mandatorily pay tax to the government. This tax has to be paid by the owner of the company and it gets directly to the government. This results in the degradation of the performance of the company as the owner rather than the capital of the firm getting decreased in paying the taxes.

Researcher: What is your opinion on the impact of the direct tax on the performance of the public joint stock companies of Saudi Arabia?

Branch manager: So as I said the company has been facing various issues in the performance for paying taxes to the government, now with the help of direct taxes, the rate is been high in the market and there are various restrictions in the payment of the tax to the government, the companies pay off the taxes with the help of making sales and profit from the company and it impacts on the performance of the company adversely as the company has to pay more tax than which impacts the profitability of the company.

Experimentation:

It refers to the examination of various kinds of data from many sources and identifying them with specific targets in order to get to the actual outcome of the performance of the company. Here in this article, the results were derived from the articles that had been taken from various sources. Various articles were taken from Google Scholar, Google Books and business journals which derived the performance of the company.

Data analysis

Secondary analysis

Various data were analyzed about the performance of the company. The data includes graphs and charts of the performance of public joint stock companies of Saudi Arabia and those are discussed below.

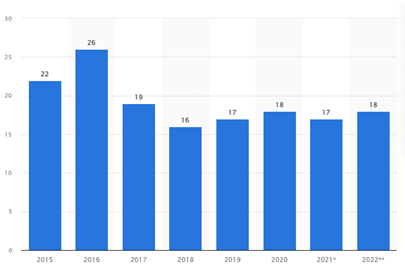

Figure 1: the amount of tax collected by the government of Saudi Arabia

The above chart shows the amount of tax collected by the government from the year 2015-2022, and it can be seen that the amount of tax collected by the government has fluctuated from the time to time. It can be seen that the tax collected in the year 2016 was at its peak and it was around 26 billion Saudi Arabian Riyal compared to the previous year at 22 billion Saudi Arabian Riyal. It can also be seen that in the year 2022, the total amount of tax collected by the government of Dubai amounts about to 18 billion Saudi Arabian Riyals which is comparatively more. The graphs show a minor fluctuation in the value of the tax collected compared to the actual value of taxes collected in the year 2015 to 2016. The amount of tax collected in the year 2018 was very low and this has helped many joint stock companies in Saudi Arabia to grow the value of their business in the market. It has a very low impact on the performance of the companies. In the year 2015, the amount of tax collected by the income tax was 22 billion Saudi Arabian Riyal, after one year in the year 2016 the tax collected by the income tax officer was 26 billion Saudi Arabian Riyal. In the year 2017 tax collected amount by the income tax officer was 19 billion Saudi Arabian Riyal. It was a low collected amount by comparing in between the previous two years’collected amount. In the year 2018, the collecting tax amount value was 16 billion Saudi Arabian Riyals. In the years 2019 and 2020, the tax amount collected by the income tax was respectively 17 and 18 billion Riyals.

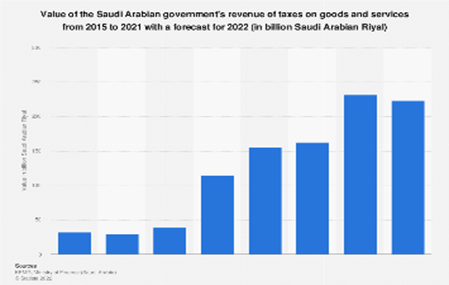

Figure 2: Revenue of tax collected by the government

From the above table, it can be seen that the government has been collecting various taxes in the form of revenue from the companies of KSA and hence this figure mentioned above shows the amounts of tax collected by the government from the year 2015 to 2021 along with a forecast made for the year 2022. It can be seen that the amount of tax collected in the year 2021 was at its peak compared to the taxes collected in other years. The tax rate has been seen gradually increasing year by year and has severely increased by the year 2021. The tax revenue received by the government in the year 2015 was very low compared to the revenue incurred in the year 2021. The tax revenue to be received by the government has been forecasted in a low term compared to the revenue incurred in the year 2021. The government charges a high rate of tax on the companies the tax collectors are the direct tax of the government and this impacts the joint stock company of Saudi Arabia which makes the performance of the company decline in the market (Havrlantet al. 2021). In the year 2015, the revenue values that are collected by the government were7 percent.

Impact of Indirect taxes on Saudi public joint stock company

In recent years the economic growth of the country Saudi Arabia is upgrading. To introduce the revenue of the tax of the country Saudi Arabia the financial experts are increasing the "Value-Added tax" values as the percentage of 5 percent to 15 percent. The stock market always gives a transparent picture of how thecountry’seconomy is going. “Tadawul All shares Index” is lead the index of the Saudi Arabian Stock market (Abdulrahman, 2021). In Saudi Arab countriesfirst the “Tadawul All shares Index” are described the relationship between the stock index and the stock market of the Saudi Arab country. Indirect taxes makea huge impact on the Saudi public joint stock company.

Impact of Direct taxes on Saudi public joint stock company

In the country of Saudi Arabia, the tax rate range income for the purpose of “oil and hydrocarbon” is increasing from 50 per cent to the range of 85 per cent. The rate on corporate income is 20 per cent on the basis of the standard rate (Khan,2020). The tax rate percentage on the Branch rate it is 20 per cent along with the additional charge of 5 per cent as per branch remittance tax. In the country of Saudi Arabia, the tax gains rate is 20 per cent.

Primary issues that have an effect on Saudi Arabia country’s lack of a tax system

The Saudi Arabia country’s tax payment system is quite unfair. In that country, many peoples earn a high-income amount but in terms of tax payments, they are not paying enough amount of tax to the government (Mogielnicki, 2019). Saudi Arabian country is a member of “The Gulf Cooperation Council”, to a member of this “Gulf Cooperation Council” the people of Saudi Arabian country are effectively working the reliance how lower the decreases of energy income.

Research findings and result

Discussion on Qualitative Research

From the qualitative research computed from the above report, it can be seen that the interview conducted with the banks of the KSA has shown certain restrictions and information regarding the problems faced by the joint stock companies in their performance in the market (Alkhodreet al. 2019). From the interview, it is derived that many companies in Saudi Arabia have been having problems in paying taxes to the government and grants loans from the banks to bear the burden of various direct and indirect taxes that were levied on them by the government.

It can also be seen that the information derived from the qualitative research shows that the companies require public investment funds where the companies can ask for the money and can invest it in purchasing or importing the goods from the foreign country resulting in a decrease in the impact of the performance of the company in the market. It can be helpful for the public joint stock companies of KSA to invest more by importing goods from foreign companies and working more efficiently in the market and can also pay tax to the government. The government also required to decrease the value of the indirect taxes that are been charged on the imports of goods in the domestic country (Althumiriet al. 2020). The qualitative research shows how the tax rates and the performance of the joint stock company get impacted based on the schemes of taxes made by the government. The tax levied by the government seems to be increasing every year at a high rate.

Discussion on Quantitative Research

The revenue incurred by the government is getting more and more in the upcoming years as forecasted. From the mentioned table, it can be seen that the tax collected by the government is been rising at a very high rate which is affecting the performance of the company of KSA to a declining stage (Alkahteebet al. 2020). It can be seen that the revenue earned by the government in the year 2021 has been more than compared to the tax collected in the year 2015. The forecasted tax that can be collected by the government in the year 2022 was more than the 2015 but it seems to be less than that of the tax collected in the year 2021. It can also be seen that the amount of tax collected overall by the government was more in the year 2016 and has been now in a low fluctuation rate (Alsukaitet al. 2020). The tax incurred by the government is been high in the KSA and it severely affects the joint stock companies owned by the single investors to pay off the amount of tax to the government every year at a high rate. It can be seen that the rate of tax gets increased every year due to various reasons and the rate of GDP also increases resulting in a high tax burden on the performance of the joint stock companies of the KSA.

Research limitations

There are various kinds of limitations that were been seen while projecting this article. There is a lack of sufficient data on the internet which led to a time-consuming process while the calculations and analysis of the data were made. A lack of ideas was in the journals and books that were been selected for the analysis of the data in this report.

Conclusion

From the above-mentioned report, it can be seen that the tax has been high in the KSA resulting in an impact on the performance of the joint stock companies. It has been seen that the companies are gradually decreasing their value in the market as the government is been charging a high amount of taxes from the companies. The rate of the taxes gets increased every year resulting in the fall in the value of the company. The tax rates are at their peak which results in a decrease in the market position of the joint stock companies and affects their performance also. With the increase in the tax rate, the growth of the country is gradually increasing as the government has been increasing the tax rate but in the case of joint stock companies having a single owner, it becomes difficult for them to pay taxes to the government.

Thus it can be concluded that the tax is to be paid as much as required by the government for the betterment of the companies facing the burdens of the tax and has been declining performance in the market.

Recommendation

From the above-mentioned report, it can be seen that the companies are been facing a high tax burden and failing to pay the tax to the government resulting in the winding up of the company from the market. The performance of the company is highly affected by the failure in the payment of tax. The tax is charged directly or indirectly by the companies and the burden increases rapidly.

Thus it is to be suggested to both the government and the joint stock companies of the KSA to make various kinds of taxation policies for the betterment of the country. The government has suggested decreasing the rate of tax to make the companies more efficient in doing business. The joint stock companies are been suggested and recommended to take financial loans from the banks to pay off the high taxes levied by the government. Thus it can be said that the government charges a high rate of taxes in both the taxation system and incurs a high amount of tax from the companies which affects the performance of the companies to work efficiently and decreases the goal of the company in terms of earning a high profit in the competitive market. Various companies with the help of certain legal measures somehow manage to pay tax at a minimal rate and thus it affects the government in the collection of the actual amount of tax from the joint stock companies.

Reference

Abdulrahman, B.M.A., 2021. Oil and non-oil exports and its impact on economic performance in Saudi Arabia. 670216917.

Alkahteeb, T.T., 2021. Role of oil price in fiscal cyclicality in Saudi Arabia. 670216917.

Alkhodre, A., Ali, T., Salman, J., Alsaawy, Y., Khusro, S. and Yasar, M., 2019. A blockchain-based value-added tax (VAT) system: Saudi Arabia as a use-case. International Journal of Advanced Computer Science and Applications, 10(5).

Alsukait, R., Bleich, S., Wilde, P., Singh, G. and Folta, S., 2020. Sugary drink excise tax policy process and implementation: A case study from Saudi Arabia. Food Policy, 90, p.101789.

Alsukait, R., Wilde, P., Bleich, S.N., Singh, G. and Folta, S.C., 2020. Evaluating Saudi Arabia’s 50% carbonated drink excise tax: Changes in prices and volume sales. Econ Hum Biol, 38(100868), pp.10-1016.

Altawyan, A., 2020. The tax and zakat appeal system in the Kingdom of Saudi Arabia: An overview. Journal Sharia & Law-(COL).

Althumiri, N.A., Basyouni, M.H., AlMousa, N., AlJuwaysim, M.F., Almubark, R.A., BinDhim, N.F., Alkhamaali, Z. and Alqahtani, S.A., 2021, March. Obesity in Saudi Arabia in 2020: prevalence, distribution, and its current association with various health conditions. In Healthcare (Vol. 9, No. 3, p. 311). MDPI.