- Task 1: Discussion on the Nature and Financing of a Limited Entity

- Discussion on the nature and financing of a limited entity

- Task 2: Procedures to Explain the Identified Misunderstanding to the Owner

- Procedures to explain the identified misunderstanding to the owner

- Task 3: Identification of the primary users of accounting for a university

- Significance and role of accounting information for different user groups

- Difference between accounting information for business and university

- Task 4: Explanation and Critical Discussion on Expenses and Depreciation

- A) Explanation of the provided statement and critical estimation of future implications with an example

- B) Critical discussion on the provided statement

Task 1: Discussion on the Nature and Financing of a Limited Entity

Discussion on the nature and financing of a limited entity

An entity that has registered under the company’s act of a specific country has been identified as a limited entity or firm. A public limited company has a separate legal entity, which has created limited liability and the personal property of the shareholders or owners of a firm has not liable to clear off the firm’s debt. As per the reference of Bilan et al. (2019), the legal entity has created assurance to shareholders to acknowledge that the firm and shareholders are two separate legal bodies. The nature and financing of a limited firm has discussed with reference to relevant peppers. An entity that has effectively registered under the company’s act has a “separate legal entity”, common seal and “perpetual succession”. It has been identified as a voluntary association in which a minimum of seven and a maximum of unlimited people have contributed their money to provide financial support to a firm and take participation in the affairs and agenda of business meetings.

We offer a reliable assignment help UK-oriented, with a free case study. At Native Assignment Help, you have found what you were looking for. To guarantee that every task is done perfectly well, the team of specialists will give you individualized support tailored to your academic requirements.

Nature of the limited entity

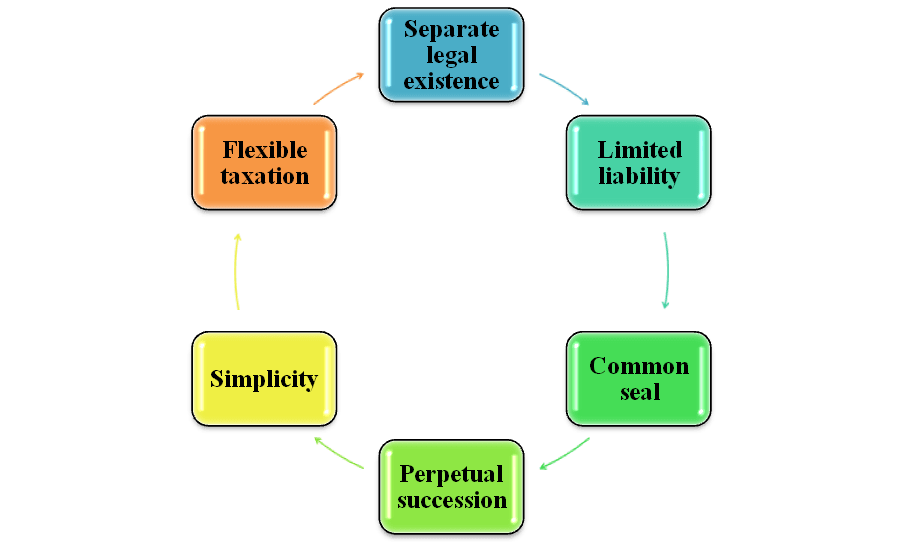

A limited company has six specific identities by which observer or stakeholders have recognised that the specific firm is limited and registered under a legal “company act”. These are “separate legal existence”, “limited liability”, common seal, “perpetual succession”, simplicity and flexible taxation (Van Niekerk, 2021). The existence of these six characteristics has justified the nature of a “limited company”.

Figure 1: Nature of Limited company

The above figure has outlined that six specific features of a firm have reflected the nature of a firm as a limited company. The feature of “separate legal existence” has provided transparency in providing a guarantee to shareholders or other stakeholders that their personal property will not undertake by a financial institution to clear off the debt of an entity. However, limited liability has depicted that member of the limited company has provided a limit to take an external loan to meet financial requirement to protect the entity from getting insolvent. As per the opinion of Alsaadi (2020), flexible taxation has provided the facility for a firm to pay tax as per the flexibility in the corporate tax imposed by legal authority. A limited company has continuously filed its IT file towards the government to avoid issues in a tax obligation.

The limited company has implicated precise and simple operation and formation activities to manage financial and non-financial affairs in an entity. A limited company has focused on highlighting the simplicity in forming terms and operating affairs of a firm. The common seal has been the most effective nature of a firm that has limited liability. The “common seal” has provided “originality and existence” to a firm and provides a specific seal to a firm after registration as its signature. “Perpetual succession or existence” has depicted that the company has been unaffected by the death or retirement of any “shareholders or stakeholders” engaged with a firm. These aforementioned features have depicted the nature of a limited firm.

“Financing of a limited company”

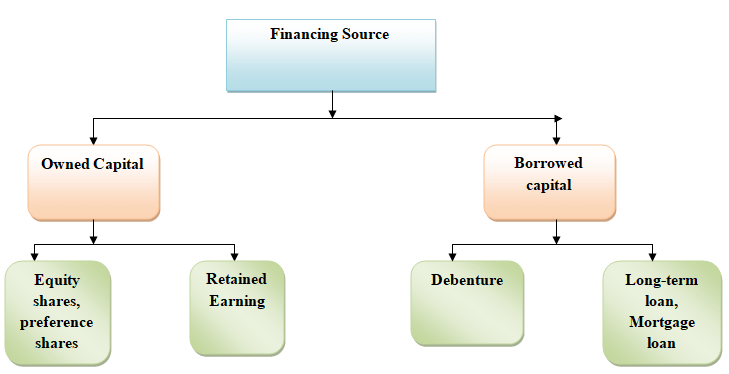

Limited companies are of two types “private and public limited firms”, these “company has financed its firm from two specific sources these are owned source and borrowed sources. The main source of “owned capital” is “equity capital”, apart from this internal capital is “retained earning” has been used by the limited company to finance the firm (Widnyana et al. 2021). The other type of financing is borrowed capital, debenture and long-term loan used by the limited firm to finance the company.

Figure 2: Financing sources

The “private limited company” has introduced capital or fund in a firm by “issuing capital” or taking an external loan in the financial market. However, in a public limited entity, at least 51% of the shares issued by an entity have held by the government of the specific country (Al Amosh and Khatib, 2022). The remaining 49% of owned capital has been introduced by both the “internal and external stakeholders” of a firm. Public Ltd firm has implemented advertisement techniques to get recognised by the stakeholders and acquired the entity shares from a "large number of investors". The “private limited company” has introduced funds to meet the requirement of “working capital” privately without any official advertisement or announcement. On the other hand, “public ltd company” has focused on attracting “potential stakeholders” and investors through effective advertisement.

A limited company has legal rights to buy or sell the “shares and debentures” to introduce and invest finance of a firm. A limited company has also introduced funds in a firm by taking “loans and advances” from financial institutions for both “long and short-term”. In addition to these limited firm has introduced funds from personal investment, venture capital and subsidies. Furthermore, venture capital has been introduced in an entity by partnering with another firm to expand the operation of a firm to accomplish its “profit-maximising” objective. The limited firm has excessively relied on equity financing to avoid the risk of bankruptcy or excessive liability burden. The limited company has focused on controlling the liability incurred in an entity to avoid the risk of dissolution.

Task 2: Procedures to Explain the Identified Misunderstanding to the Owner

Procedures to explain the identified misunderstanding to the owner

The argument of the owner is totally null and void. As per the GAAP, equity is one of the liabilities of the business; the business and the owner are both separate entities. It means the business and the entrepreneur are different. Equity of the business is the liability of the business therefore the equity is shown in the liability side of the balance sheet. Therefore the equity is not shown on the asset side of the balance sheet, as per the owner the equity is the major asset for the entrepreneur but it is not for a business (Cioca, 2020). Therefore the statement of the financial position prepared by the accountant is correct and complies the all the compliances at the time of preparation of the financial statement. Business raise fund by issuing equity share, therefore, the equity are the liability for the business, as a result, the business show equity on the liability side of the balance sheet at the time of organization is not a company. When the organization is a company then the equity is shown next to the liability. Therefore the argument of the owner is null and void.

For example, ABC ltd. raises funds by the issue of equity shares to operate the business. Issued equity shares are a liability for the company because the company needs to pay back the money at the time of winding up the company. As per the principle of “separate entities” both businesses and the shareholder or owners are different. Money received by the issue of equity shares needs to be returned to the shareholder, therefore, the equity shares are a liability for the company and these are shown in the liability side of the balance sheet.

Liability is the amount of money that the business needs to pay or payable in the future. The business needs to pay back the shareholder at the time of the winding up of the business, therefore, the equity is the liability for the business. Payment to the equity shareholder at the winding up of the business is not mandatory, it means at the time of winding up if the business has sufficient fund to repay the equity shareholder then the business pay otherwise not.

Task 3: Identification of the primary users of accounting for a university

The primary university accounting users are external and internal users that can help give the data. The internal users of the university are denoted as the teachers, students, staff and employees that have the use for accounting. On the other hand, the investors, shareholders, the public and the government are denoted as the external users for the accounting at the university. This can be stated that the level of use of accounting in the university is based on a different basis and also the requirement is different. The identification has been conducted on the basis of the level of requirement of each of the users in the university where the students and the employees use it primarily.

Significance and role of accounting information for different user groups

There has been the identification of two types of primary users of accounting information in the university where significance and role are on the basis of the level of usage. The goals of the accounting information of the internal users are for the sustenance and the positive growth of the cash inflow as well as control over the risk.

Internal users

The first internal users of the university are students where the accounting information can provide a huge arrangement of options for future employability like tax and auditing. There is also the scope for cost management and other accounting that can help in the future recruitment process. In the case of the teachers the management, collection and process of the information or data that has been collected where the relevant information can be used. The primary objective for the use of this information for the teachers is for the financial report where the accurate economic decision can be conducted. The employees or the staff in the University can use this to record all the financial transactions and operations to analyse the financial performance. Furthermore, financial health, fees, salary and other types of opportunities are also tracked with the help of this information.

External Users

The significance of external users where the shareholders can utilise them for the best possible way to manage the investment and other projects of a university The overall performance of the university where the necessary decision is taken whether to increase or decrease or any requirement that can help in the positive growth. The investors use the accounting information to help determine the best possibilities of the university based on the performance for the future and analyse the investment decision process. Accounting information can help with the analysis of past information with future information. The role of accounting information for the Government is to help accumulate information for tax purposes and also for regulation purposes. The importance of the general public in accounting information can help in the reliability of all financial activities.

Difference between accounting information for business and university

The implementation of accounting information in a business and university is different where the internal users are the primary difference. This is also based on the development of the new economy where the impact on the accounting information for business is based on the economic activities which are the main concern. On the other hand, economic activities do not have an important impact on university accounting information (Barth et al. 2023). There is also a difference between the processes of preparation where the business is used only for the purpose of the sale whereas in the university this is used for tracking the funds used. Moreover, there is also the impact of the social or political changes that have an influence on the business whereas there is no such impact on the university.

Task 4: Explanation and Critical Discussion on Expenses and Depreciation

A) Explanation of the provided statement and critical estimation of future implications with an example

Expenses are the amount of money that the organization spent to generate an additional amount of revenue. Expenses help the business to generate income, for example, if the business spent $100 to purchase an article, the spent of $100 is the expenses. However, when the business sells such articles the business must earn a certain amount of revenue and the business must be sold an article above $100 to generate revenue. Therefore it can be said that the expenses refer to the amount of money that the company spent to generate the additional amount of revenue.

The expenses are recorded by the business on the debit side of the income statement. The expenses help the business to generate an additional amount of revenue. As per the principle of the “matching concept,” the business needs to record all the expenses and income as per the ‘mercantile basis of accounting” (Barker et al. 2020). It means all the revenue must be recorded when the income has been generated whether received or not and the expenses must be recorded when the expenses are incurred whether paid or not.

For example, PMC ltd. sales of 1000 units of goods to PRM ltd. and successfully perform the sales Mr. Ramos charge 10% as sales commission to PMC ltd. The sales are complete on 10th December and as per the agreement PMC ltd needs to pay a sales commission to Mr. Ramos. The PMC ltd records the sales commission on the 10th of December as per the matching concept whether the sales commission was paid or not. Therefore it can be said that PMC ltd needs to record the sales commission on the 10th of December when the expenses are incurred not when the expenses are paid.

B) Critical discussion on the provided statement

Depreciation is denoted in the accounting system where the primary purpose is the distribution of tangible capital assets on the basis of the anticipated lifespan. The statement "Depreciation is a process and not valuation" denotes the estimated useful life of the equipment or machinery in a structured format. This can be stated that the salvage value is deducted from the capital value in the accounting system which is a process and not a valuation. In the balance sheet, the depreciated assets are a part of the initial cost which has not to be distributed where this is stated to be part of the periodic expenses (Quesada, 2019). The allocation of the cost of any structure or equipment that is conducted during the time periods for the evaluation process is a process where the "straight-line method" is implied.

Depreciation is stated to be an element in the process of the calculation for the fixed assets cost where the cost cannot be retrieved as the asset is used. The estimated benefits are from the asset itself which can help in the assessment of the profit from the depreciation. Furthermore, this is not used for the assessment of the overall value of the asset but can help with the ascertainment of the cost of the asset for a specific period of time. This can be denoted that the balance sheet contains a part of the depreciated value that has not to be distributed at the time of assessment of the income statement.

The process of allocation can be denoted in the term of accounting as the differentiation of the outcome on the basis of time and classifications. The calculation of the expenses that have been allocated should be equivalent to the value of the revenue in each period. There is no detection of the decrease in the physical aspects where the market value for the assets is ascertained for the specific period of time. The concept of valuation denotes the decline in the valuation of the asset for a specific period of time. There is also the concept of the assets valuation process in two aspects where one is the estimation of the decrease in the value and the difference between the initial and end value of the asset.

References

Al Amosh, H. and Khatib, S.F., 2022. Ownership structure and environmental, social and governance performance disclosure: the moderating role of the board independence. Journal of Business and Socio-Economic Development, 2(1), pp.49-66.

Alsaadi, A., 2020. Financial-tax reporting conformity, tax avoidance and corporate social responsibility. Journal of Financial Reporting and Accounting, 18(3), pp.639-659.

Barker, R., Penman, S., Linsmeier, T.J. and Cooper, S., 2020. Moving the conceptual framework forward: Accounting for uncertainty. Contemporary Accounting Research, 37(1), pp.322-357.

Barth, M.E., Li, K. and McClure, C.G., 2023. Evolution in value relevance of accounting information. The Accounting Review, 98(1), pp.1-28.

Bilan, Y., Rubanov, P., Vasylieva, T.A. and Lyeonov, S., 2019. The influence of industry 4.0 on financial services: Determinants of alternative finance development. Polish Journal of Management Studies.

Cioca, I.C., 2020. The Importance Of Financial Statements In The Decision-Making Process. Annales Universitatis Apulensis Series Oeconomica, 1(22), pp.73-83.

Quesada, H.J., 2019. Analysis of financial statements using ratios.

Van Niekerk, J.J., 2021. The development and reform of the rules regulating authority to contract on behalf of companies in South African and English Law.

Widnyana, I.W., Wiksuana, I.G.B., Artini, L.G.S. and Sedana, I.B.P., 2021. Influence of financial architecture, intangible assets on financial performance and corporate value in the Indonesian capital market. International Journal of Productivity and Performance Management, 70(7), pp.1837-1864.