- Analytical Study Of Risk Management In Course Of Black Swan Events

- Chapter 1: Introduction: Analytical Study Of Risk Management In Course Of Black Swan Events

- 1.1 Purpose of the study

- 1.2 Aim of the study

- 1.3 Objectives of the study

- 1.4 Research problem and Questions

- 1.5 Structure of the study

- Chapter 2: Literature Review

- 2.1 Introduction

- 2.2 Background of the study

- 2.3 Case study 1: Wal-Mart

- 2.4 Case study 2: Cirque du Soleil

- 2.5 The key factors that contribute to the success of organizations in managing black swan events

- 2.6 The existing risk assessment methodologies used for managing Black Swan events

- 2.7 The challenges that organisations face in managing risks

- 2.8 The risk management strategies used by organisations

- 2.9 The alternative risk management strategies organisations can use

- 2.10 The implications of the research findings for risk management practices in the context of black swan events

- 2.11 Recommendation for an effective risk management approach

- 2.12 Summary of the Literature review

- Chapter 3: Research Methodology

- 3.1 Introduction

- 3.2 Types of research

- 3.6 Details of how, when, where, and what of the research that was conducted

- 3.7 Data analysis strategies employed

- Saunders Onion Ring Approach h5

- 3.8 Limitations of the Research

- 3.9 Justification of research approach and research methodology

- 3.10 Conclusion

- Chapter 4: Data Analysis

- Chapter 5: Research Findings

- 5.1 Findings of the Research

- 5.2 Critical analysis

- 5.3 Key Patterns and Theories

- 5.4 Insights into the factors for managing Black swan events

- 5.5 Evaluation of risk assessment methodologies

- Chapter 6: Discussion

Analytical Study Of Risk Management In Course Of Black Swan Events

Are you in need of online assignment help in the UK with AI-free case study? Look no further than Native Assignment Help. We have a dedicated team of professionals who are committed to delivering customised support for your academic needs and ensuring that you get excellent marks on all your assignments.

Chapter 1: Introduction: Analytical Study Of Risk Management In Course Of Black Swan Events

An extremely unlikely, disastrous event known as a "black swan" can have a constant negative impact on the economy, businesses, and society. (Boyle et al., 2021, p.797). These occurrences are unanticipated, and the results are frequently outside the purview of conventional risk management techniques. So it is essential to have a strong risk management plan that can lessen the effects of "black swan" incidents. Black swan events are typically unanticipated and have a significant impact on business, the economy, and society as a whole. Due to the unpredictable or challenging-to-manage consequences of these catastrophes, it is imperative to have a strong risk management strategy in place. An effective risk management plan includes identifying potential black swan events, assessing their likelihood and significance, and developing processes to limit their effects. This strategy demands a proactive approach to risk management, in which hazards are identified and addressed before they materialise. This can decrease the impact of an event in a specific industry or region and support the performance of the overall portfolio. Another method for lowering risk in the event of a black swan incidence is to have a strong crisis management plan in place. This plan should include clear decision-making processes, backup plans, and communication strategies. There is less uncertainty and concern about how the event will affect the company when there is a plan in place.

Another alternative for risk management techniques is to use insurance to transfer some of the risk to insurers. Insurance can help businesses avoid the financial damages that can result from black swan catastrophes. Depending on their specific needs and potential risks, businesses should consider a variety of insurance choices, including property and casualty, cyber liability, and business interruption. Companies may also consider using cutting-edge technology and data analytics to monitor potential black swan events and identify fresh threats. These technologies can help businesses keep ahead of emerging risks and aid in smarter risk management choices. Last but not least, a solid risk management strategy is necessary to reduce the impact of black swan incidents. Spreading risk, creating a strong crisis management plan, utilising insurance, and depending on technology and data analytics to identify and address new threats are all necessary components. Through proactive risk management, organisations can decrease the impact of these unanticipated and catastrophic events.

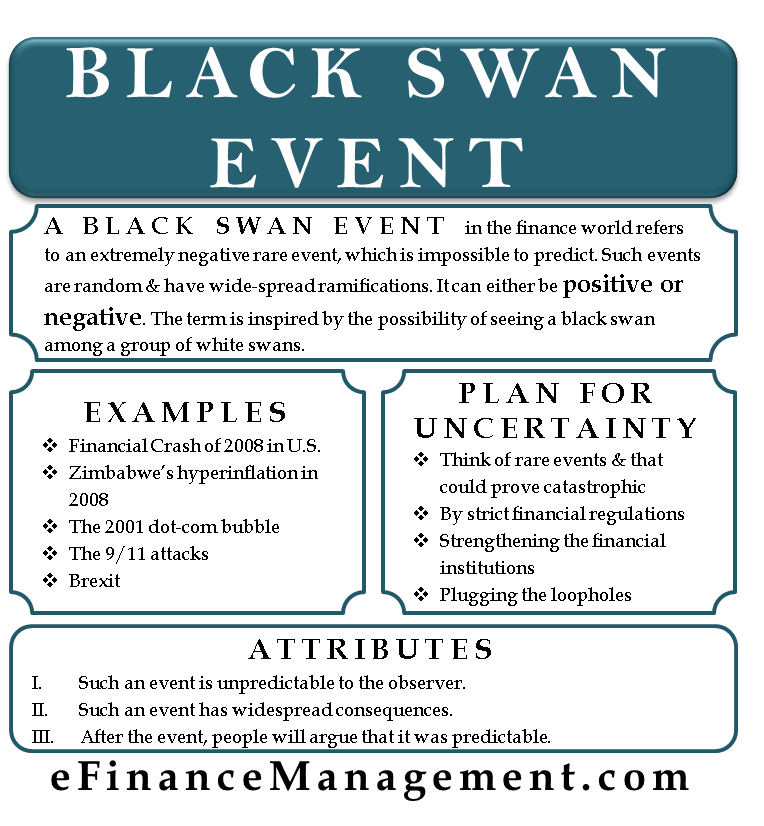

Figure 1: Black Swan Event – What It Is, Examples and More

1.1 Purpose of the study

The goal of doing a thorough analysis of risk management during black swan events is to pinpoint various strategies for reducing the hazards involved with these exceptional occurrences. The goal of this study is to look at readily available risk management techniques and pinpoint any weaknesses in the existing approaches that must be filled in order to successfully manage risks. This study also seeks to examine the efficacy of various risk management strategies and their applicability to handling black swan situations. The current business environment, where black swan occurrences are happening more frequently and with more impact, makes this research topic particularly pertinent. As an illustration, the COVID-19 pandemic has significantly disrupted the global economy and underlined the significance of appropriate risk management techniques. In order to help businesses and organisations better plan for such catastrophes, our research can offer useful insights into managing the risks associated with black swan events.

1.2 Aim of the study

The goal of the research dissertation "Analytical Study of Risk Management in Course of Black Swan Events" is to examine how black swan occurrences are thought of and how they affect risk management practices in diverse industries. (Gray & Alles, 2021,p.195). The goal of the dissertation is to establish best practices for risk management in such situations and to shed light on the difficulties that organizations encounter when attempting to control the risks connected with "black swan" incidents.

1.3 Objectives of the study

The key objectives of this research dissertation may include:

- To identify the characteristics of Black Swan events and their impact on organizations.

- To evaluate the existing risk assessment methodologies and techniques used for managing Black Swan events.

- To analyze the risk management strategies used by organizations to cope with Black Swan events.

- To recommend an effective risk management approach for mitigating the impact of Black Swan events.

1.4 Research problem and Questions

The challenge that organisations experience in managing risks related to black swan events is the research issue that this dissertation seeks to solve. Rare, unpredictably occurring black swan occurrences can significantly affect businesses and the economy as a whole. There is a need for new techniques to lessen the impact of black swan events because traditional risk management practises are frequently unsuccessful in coping with such catastrophes. (as cited by Barry, 2021).

The research aims to address the following questions:

- What are the characteristics of black swan events, and how do they differ from other types of risks?

- What are the challenges that organizations face in managing risks associated with black swan events, and why are traditional risk management practices often ineffective?

- What alternative risk management strategies can organizations use to mitigate the impact of black swan events, and how effective are these strategies?

- What are the key factors that contribute to the success of organizations in managing black swan events, and how can these factors be replicated in other organizations?

- What are the implications of the research findings for risk management practices in the context of black swan events, and what areas require further research?

1.5 Structure of the study

This study attempts to provide a thorough understanding of the opportunities and challenges involved with risk management during black swan events by addressing these topics. (Bahmani, , 2023, p.161). To help readers comprehend the what, why, when, and how of the study, the following table highlights the key themes and issues that will be discussed throughout the dissertation.

| Chapter1: Introduction | The introduction provides an overview of the research problem, research objectives, and the scope of the study. It also highlights the significance of the study and the research methodology. Theoretical framework will be provided under a separate sub-heading within this chapter. |

| Chapter 2: Literature Review | In this chapter, past literature on black swan events and risk management practices will be reviewed and critiqued. The chapter covers the definitions and characteristics of black swan events, the impact of such events on organizations, and the limitations of traditional risk management practices in dealing with such events. The chapter also covers alternative risk management strategies that organizations can use to mitigate the impact of black swan events. |

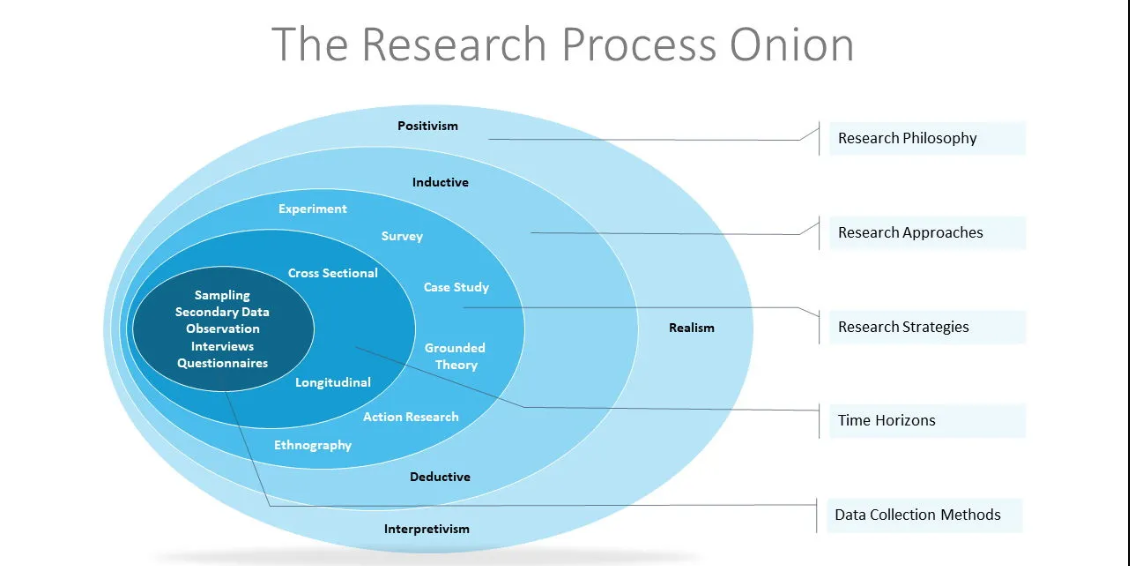

| Chapter 3: Research Methodology | This chapter outline the research design, data collection methods, and data analysis techniques used in the study with the help of Saunders Onion Ring. It also discusses the limitations and ethical considerations of the research. |

| Chapter 4: Data Analysis | In this chapter, major research findings will be presented and analyzed. It provides insights into the challenges that organizations face in managing risks associated with black swan events and identifies best practices for risk management in such scenarios. |

| Chapter 5: Research and findings | This chapter provides findings of the study highlighting impacts on organizations that have successfully managed black swan events. It analyzes the key factors that contributed to their success and provides recommendations for other organizations. |

| Chapter 6: Discussion | This chapter discusses the implications of the research findings for risk management practices in the context of black swan events. It also highlights the limitations of the study and suggests areas for further research. |

| Conclusion | This chapter concludes the overall important facts of the research by analyzing each and every topic. |

Chapter 2: Literature Review

2.1 Introduction

First, pertinent information is gathered for the literature review to perform an analytical study of risk management during black swan events from reputable academic sources such as books, journal articles, and research papers. (Adams, 2019, p.585). The sources discuss risk management, black swan events, and their effects on businesses across many industries. The literature review uses a variety of databases, including Google Scholar, JSTOR, and other academic search engines, to locate the most pertinent and recent publications on the subject.

The sources are scrutinised to guarantee their veracity, dependability, and applicability to the subject of the study. The goal of the literature review is to create a clear justification for the research issue. This would entail responding to inquiries about how the research fills a particular gap in the body of existing literature, what novel research methodology was used to investigate the subject, whether it resolves an open issue, whether it addresses a ground-breaking idea or theory, and whether it advances and reinforces existing knowledge in the field of study.

2.2 Background of the study

Black swan events are rare and unexpected occurrences that have significant consequences and are difficult to predict. These events are characterized by their extreme impact, their retrospective predictability, and their attribution to the wrong causes. Black swan events are not only limited to natural disasters, such as earthquakes or hurricanes, but can also include geopolitical events, technological disruptions, and economic crises. The impact of black swan events on risk management practices varies across different industries. In the financial industry, for example, the global financial crisis of 2008 was a black swan event that had a significant impact on risk management practices.

The crisis highlighted the need for more robust risk management frameworks that consider tail risks, stress testing, and scenario analysis. Similarly, in the healthcare industry, the COVID-19 pandemic was a black swan event that highlighted the importance of risk management practices in the face of global pandemics (Lewchuk, 2017, p. 404). The pandemic exposed weaknesses in healthcare supply chains, the need for better pandemic preparedness planning, and the importance of data-driven decision-making.

In the technology industry, black swan events can take the form of cyber-attacks, such as the 2017 WannaCry ransomware attack.

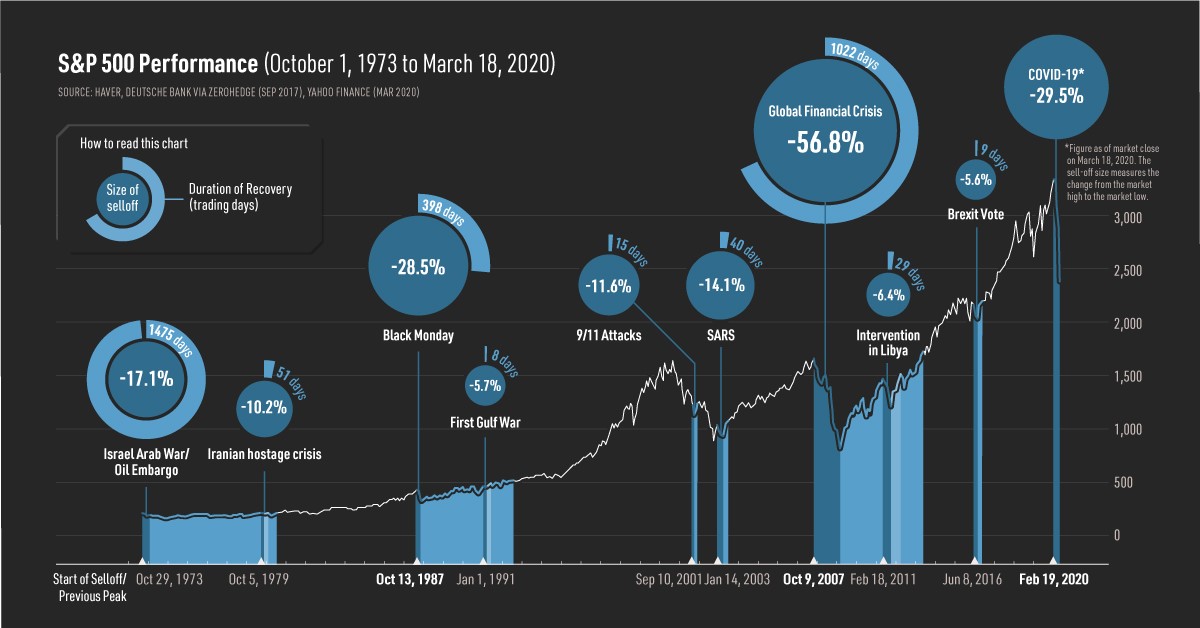

Figure 2: Black Swan Events: Short-term Crisis, Long-term Opportunity

This event highlighted the need for better cyber security practices, such as regular software updates and patching, strong authentication protocols, and employee training. Overall, the impact of black swan events on risk management practices highlights the need for organizations to be proactive in identifying and managing risks. Organizations should adopt a risk management framework that includes risk identification, assessment, mitigation, and monitoring (LeCavalier, 2016). This framework should be tailored to the specific needs of the organization and should consider both known and unknown risks, as well as the potential impact of black swan events.

2.3 Case study 1: Wal-Mart

A black swan event is a unusual and random event that has a significant impact on an organization, industry, or society as a whole. In the case of Walmart, the COVID-19 pandemic was a black swan event that had a profound impact on the retail industry and Walmart's operations. The pandemic forced Walmart to quickly adapt to new health and safety protocols, including increased sanitation measures and limitations on the number of customers in stores. Additionally, Walmart had to rapidly expand its online ordering and delivery services to meet the increased demand from customers who were staying at home. Despite these challenges, Walmart was able to successfully navigate the pandemic and even saw an increase in sales as a result of its proactive and adaptive approach to risk management (Martel & Klibi, 2016, p. 22).

The COVID-19 pandemic is an example of a black swan event that has posed significant challenges for organizations worldwide. The sudden and unprecedented nature of the pandemic has made it difficult for organizations to anticipate and prepare for its impact. The following are some of the challenges that organizations have faced in managing risks associated with the COVID-19 pandemic:

- Uncertainty and unpredictability: Black swan events are by nature unpredictable and difficult to anticipate. The sudden onset of the pandemic has left organizations scrambling to respond and adapt to the situation (Bolling, 2019, p. 5).

- Disruption of operations: The pandemic has disrupted supply chains and forced businesses to close or operate with reduced capacity, causing significant financial losses.

- Employee safety and well-being: Organizations have had to implement new measures to ensure the safety and well-being of their employees, such as providing personal protective equipment, implementing social distancing measures, and transitioning to remote work.

- Financial and economic impact: The pandemic has caused significant economic disruption, with many businesses struggling to stay afloat. Organizations have had to make difficult decisions, such as furloughing or laying off employees, to mitigate the financial impact.

Despite these challenges, organizations can adopt best practices for risk management to effectively mitigate the impact of black swan events. In the case of Walmart, the following risk management strategies were effective in managing the risks associated with the COVID-19 pandemic:

- Flexibility and agility: Walmart was able to quickly adapt to the changing situation by implementing new course to warrant the safety of its employees and customers. This flexibility allowed Walmart to continue operating during the pandemic while minimizing the risk of transmission.

- Robust supply chain management: Walmart's strong supply chain management allowed it to respond quickly to disruptions in the supply chain caused by the pandemic. Walmart was able to keep its shelves stocked and ensure that customers had access to essential goods (Filho, et.al 2016 68-79).

- Employee support: Walmart recognised the importance of supporting its employees during the pandemic and implemented measures such as hazard pay and bonuses to recognize their efforts. This support helped to maintain employee morale and loyalty during a difficult time.

- Communication and transparency: Walmart was transparent with its employees and customers about the measures it was taking to alleviate the risks associated with the pandemic. This communication helped to build trust and confidence in Walmart's response to the crisis.

The organizations can face significant challenges in managing risks associated with black swan events such as the COVID-19 pandemic. However, by adopting best practices for risk management, organizations can effectively mitigate the impact of these events and emerge stronger from the crisis.

2.4 Case study 2: Cirque du Soleil

In the case of Cirque du Soleil, the black swan event was the COVID-19 pandemic that caused the shutdown of the live entertainment industry. The pandemic led to the cancellation of all shows worldwide, resulting in significant financial losses for Cirque du Soleil. The company was not prepared for such a drastic and sudden disruption to its business operations, and its failure to adapt to the situation and implement effective risk management strategies ultimately led to its downfall. The pandemic was a classic example of a black swan event, which had a severe impact on Cirque du Soleil's business operations and financial performance, as it was an unexpected and unprecedented event that was difficult to predict and manage. The case study of Cirque du Soleil highlights the challenges that organizations face in managing risks associated with black swan events. Some of the challenges faced by Cirque du Soleil are (Lavers, & Leroux, 2018):

- Lack of preparedness: The COVID-19 pandemic was an unprecedented event that caught many organisations off guard, including Cirque du Soleil. The company did not have a contingency plan in place to deal with such an event.

- Dependence on live events: Cirque du Soleil's business model was based on live events, which became impossible during the pandemic. The company did not have a diversified revenue stream, which left it vulnerable to the impact of the pandemic.

- Financial pressure: The cancellation of shows worldwide resulted in significant financial losses for the company. Cirque du Soleil was already struggling financially before the pandemic, and the impact of the pandemic worsened the situation.

To manage the risks associated with black swan events, organisations can adopt the following best practices:

- Develop a contingency plan: Organizations should develop a contingency plan that outlines the steps to be taken in the event of a black swan event. The plan should be regularly reviewed and updated to ensure its effectiveness.

- Diversify revenue streams: Organizations should have a diversified revenue stream that is not dependent on a single product or service. This can assist to mitigate the impact of a black swan event on the organisation's finances.

- Monitor risks: Organizations should have a robust risk management framework that monitors risks and identifies potential black swan events. This can help organizations to be better prepared to deal with such events.

- Invest in technology: Organizations can invest in technology to improve their agility and responsiveness to black swan events. For example, Cirque du Soleil could have explored digital platforms to offer its shows online.

The black swan events are rare but have a significant impact on organisations. It is essential for organizations to adopt best practices for risk management to mitigate the impact of such events. Black Swan events are unpredictable and have significant consequences for organizations. The ability to adapt and effectively manage risks is crucial for organizations to survive and thrive in the face of such events. Based on the provided case studies, some characteristics of Black Swan events and their impact on organizations are:

- Unpredictability: Black Swan events are rare and unpredictable, making it challenging for organizations to anticipate and plan for their impact.

- Amplified impact: Black Swan events have a significant impact on organizations and can guide to brutal consequences, including financial losses, reputational harm, and even bankruptcy.

- Need for adaptability: Organizations that are adaptable and can quickly respond to Black Swan events are more likely to survive and even thrive. Walmart's quick adaptation to the COVID-19 pandemic helped the company increase its sales and maintain its position as a retail giant, while Cirque du Soleil's failure to adapt ultimately led to its downfall (Bao, et.al 2021).

- Importance of risk management: Effective risk management is crucial for organizations to mitigate the impact of Black Swan events. Walmart's successful risk management strategies helped the company navigate the pandemic, while Cirque du Soleil's lack of effective risk management ultimately led to its bankruptcy (Gateau, & Simon, 2016), p.20).

2.5 The key factors that contribute to the success of organizations in managing black swan events

To replicate these factors in other organisations, it is important to prioritise flexibility and agility, develop robust risk management practices, encourage innovation and creativity, promote strong leadership, and establish effective communication channels (Saif-Alyousfi & Saha, 2021). Organisations can also learn from case studies and best practices from other companies that have successfully managed black swan events. There are several key factors that contribute to the success of organisations in managing black swan events:

- Flexibility and agility: Organisations that are able to quickly adapt and respond to changing circumstances are better equipped to handle black swan events. This requires a culture of flexibility and agility, where employees are empowered to make decisions and take action as needed.

- Robust risk management practices: While traditional risk management practices may be ineffective in managing black swan events, it is still important for organisations to have robust risk management practices in place. This include identify and assess risks, developing contingency plans, and regularly reviewing and updating these plans.

- Innovation and creativity: Black swan events often require organizations to think outside the box and come up with innovative solutions to unexpected problems. Companies that encourage creativity and innovation are more likely to be successful in managing these types of events (as cited by Saif-Alyousfi & Saha, 2021).

- Strong leadership: Effective leadership is critical in managing black swan events. Leaders who are able to remain calm and focused during times of crisis, communicate effectively with employees and stakeholders, and make tough decisions quickly and decisively are more likely to successfully navigate these events.

- Robust communication channels: Communication is key during a black swan event, both internally within the organization and externally with stakeholders. Organizations that have robust communication channels in place, including contingency plans for communicating during a crisis, are better equipped to manage these events.

2.6 The existing risk assessment methodologies used for managing Black Swan events

Based on the literature review, it appears that several risk assessment methodologies and techniques are available for managing Black Swan events (Askitas et al., 2021, p.12). These include Failure Modes and Effects Analysis (FMEA), Bayes Probabilistic Assessment, Monte Carlo Simulation, and Root Cause Analysis.

- FMEA can help identify potential failures before they occur and prioritise risks based on their severity, but it relies on expert judgement, which can be subjective and prone to errors. It also requires significant time and resources to conduct.

- Bayes Probabilistic Assessment can provide an objective assessment of the probability of an event occurring and can analyse both known and unknown risks. However, it relies on historical data, which may not be available for newly emerging risks, and may be limited by the quality and quantity of available data.

- Monte Carlo Simulation can model complex systems with multiple variables, allowing organisations to identify potential risks that may not be apparent through other methods. It can provide a probabilistic estimate of the likelihood and consequences of different outcomes. However, it requires significant computational power, making it time-consuming and expensive, and requires significant knowledge and expertise in simulation modelling and statistics.

- Root Cause Analysis identifies the fundamental cause of failures, allowing organisations to address the root causes rather than just the symptoms of the problem. It can improve the reliability and safety of products and services. However, it requires significant time and resources to conduct and may not identify all potential causes of failures as it relies on available data and knowledge (Kjoersvik & Bate, 2022, p. 419).

2.7 The challenges that organisations face in managing risks

Organisations face several challenges in managing the risks associated with black swan events, which are rare, unpredictable, and have significant impacts. Some of these challenges include:

- Lack of historical data: Black swan events are rare and unprecedented, making it challenging to predict their occurrence and impacts. Traditional risk management practices rely on historical data to estimate risks and impacts, which is not possible in the case of black swan events.

- Complexity and interconnectedness: Black swan events often have complex and interconnected causes and effects, making it difficult to identify and manage risks effectively. In some cases, risks can propagate through complex systems, leading to significant impacts that are challenging to manage.

- Limited control: Organizations have limited control over black swan events, as they are often caused by external factors beyond their control, such as natural disasters, pandemics, or geopolitical events.

- High impact and uncertainty: Black swan events often have high impacts and lead to significant uncertainty, making it challenging for organisations to plan and manage risks effectively (Walter, 2020, p. 174).

Traditional risk management practices are often ineffective in managing black swan events for several reasons. Firstly, traditional risk management practices rely on historical data and statistical models to predict risks and impacts, which is not possible in the case of black swan events. Secondly, traditional risk management practices tend to focus on known risks, ignoring the unknown or unexpected risks that are characteristic of black swan events. Finally, traditional risk management practices may not be agile enough to respond quickly to rapidly evolving situations, which is critical in managing black swan events (Grey & Alles, 2021, p. 195).

2.8 The risk management strategies used by organisations

The case studies provide insights into how two organisations, Walmart and Cirque du Soleil, coped with the Black Swan event of the COVID-19 pandemic.

Walmart, a retail giant, implemented various risk management strategies to cope with the pandemic. The company quickly adapted to the situation by increasing sanitation protocols, limiting the number of customers in stores, and expanding online ordering and delivery services. This helped Walmart to continue operations while ensuring the safety of its customers and employees. The company's decision to increase online ordering and delivery services was particularly effective in meeting the changing customer needs during the pandemic. Walmart's proactive approach to risk management allowed it to not only survive but also thrive during the pandemic. The company's sales increased during the pandemic, and it even offered bonuses and raises to its employees as cited by Mishra, (2020).

In contrast, Cirque du Soleil, a live entertainment company, failed to cope with the pandemic. The company had to cancel its shows worldwide, resulting in significant financial losses and ultimately leading to the company filing for bankruptcy. Cirque du Soleil's failure to adapt to the situation and implement effective risk management strategies led to its downfall. The Cirque du Soleil's response to the COVID-19 pandemic highlights the importance of effective risk management strategies for organizations. According to Krausmann & Necci, 2021 while some companies, such as Netflix and Amazon, were able to adapt quickly and mitigate their losses, Cirque du Soleil failed to do so and ultimately file for bankruptcy. One possible explanation for this difference in outcomes could be attributed to the effectiveness of their risk management strategies. Companies that were able to quickly adapt to the pandemic likely had robust risk management plans in place that allowed them to identify and respond to potential risks. In contrast, Cirque du Soleil's failure to adapt may suggest that they did not have effective risk management strategies in place, which ultimately led to their downfall.

This highlights the importance of evaluating the risk management strategies used by organizations, particularly in times of crisis. A thorough analysis of the effectiveness of risk management strategies can help identify areas of improvement and inform future decision-making. Organizations that are able to quickly adapt to changing situations and implement effective risk management strategies are more likely to survive and even thrive during Black Swan events. In the case of Walmart, the company's decision to increase online ordering and delivery services was particularly effective in meeting the changing customer needs during the pandemic. This highlights the importance of identifying and responding to changing customer needs during Black Swan events (Catalano, et.al 2018, p. 585).

2.9 The alternative risk management strategies organisations can use

Organizations can use several alternative risk management strategies to mitigate the impact of black swan events. These strategies can be effective in mitigating the impact of black swan events. However, their effectiveness depends on the specific context and circumstances of the organization. According to Devarajan, 2021 it's important for organizations to evaluate their unique situation and determine which strategies are most appropriate for them. Some of these strategies are:

- Scenario planning: This strategy involves developing different scenarios that could potentially happen and planning responses to each scenario. This allows organizations to be better prepared for unexpected events.

- Building resilience: Organisations can build resilience by diversifying their operations, having multiple suppliers, and having backup plans in place. This makes them more flexible and adaptable to unexpected events.

- Embracing innovation: Innovation can help organisations find new ways of doing things and can also help them find new opportunities. This can help them adapt to unexpected events and potentially thrive in the aftermath.

- Having a strong risk culture: Organisations can develop a strong risk culture by encouraging employees to identify and report risks, creating a risk-aware culture, and promoting risk management as an essential part of the organization's operations.

2.10 The implications of the research findings for risk management practices in the context of black swan events

The research findings highlight the importance of recognising the potential for black swan events and developing appropriate risk management strategies to mitigate their impact. Traditional risk management practices, such as relying on historical data and assuming a normal distribution of events, are often ineffective in dealing with black swan events, which are characterised by their unpredictability, rarity, and high impact. Alternative risk management strategies, such as scenario planning, stress testing, and agile risk management, can help organizations prepare for and respond to black swan events. Scenario planning involves developing multiple possible scenarios and creating action plans for each scenario. Stress testing involves simulating extreme scenarios to identify potential vulnerabilities and assess the organization's ability to withstand them. Agile risk management involves continuously monitoring and adjusting risk management strategies in response to changing circumstances (Masys, & Lin, 2017).

The key factors that contribute to the success of organizations in managing black swan events include leadership, adaptability, collaboration, and a culture of risk awareness. Leaders must be willing to take bold actions and make difficult decisions to protect their organization. Organizations must be adaptable and agile in responding to changing circumstances. Collaboration and communication between different stakeholders are critical for developing effective risk management strategies. Finally, a culture of risk awareness, where employees are encouraged to report risks and share their knowledge, can help organizations identify and mitigate risks more effectively (Wang, et.al 2022 p. 108147). Further research is needed to explore the effectiveness of alternative risk management strategies in different industries and contexts, as well as to identify new strategies for managing black swan events. Additionally, research is needed to explore the role of technology, such as artificial intelligence and machine learning, in improving risk management practices in the context of black swan events.

2.11 Recommendation for an effective risk management approach

Based on the analysis of existing literature and case studies, it is recommended that organisations adopt a proactive and holistic risk management approach for mitigating the impact of Black Swan events. , The proactive and holistic approach to risk management that involves identifying potential risks, developing a comprehensive risk management plan, implementing risk management strategies, continuously monitoring and reassessing risks, and fostering a risk-aware culture is the most effective way for organisations to mitigate the impact of Black Swan events (Wang, et al. 2018, p.34). This approach should involve the following key steps:

- Identify and assess potential risks: Organisations should conduct a comprehensive risk assessment to identify potential Black Swan events and their potential impact on their operations. This should involve analysing both internal and external factors that could lead to the occurrence of such events.

- Develop a risk management plan: Once potential risks have been identified and assessed, organisations should develop a risk management plan that outlines strategies for mitigating the impact of Black Swan events. This plan should include specific action steps, timelines, and responsibilities.

- Implement risk management strategies: Organisations should implement the risk management strategies outlined in their plan. This may involve developing contingency plans, investing in technology and infrastructure to enhance resilience, and regularly monitoring and assessing risks.

- Continuously monitor and reassess risks: Risk management is an ongoing process, and organisations should continuously monitor and reassess potential risks to ensure that their risk management plan remains effective and up-to-date (Kwag, et al. 2018, P. 380).

- Foster a risk-aware culture: Finally, organisations should foster a culture of risk-awareness and preparedness among employees at all levels. This can be achieved through training and education programmes, regular communication about potential risks, and encouraging a culture of transparency and openness.

2.12 Summary of the Literature review

The research on "Analytical Study of Risk Management in Course of Black Swan Events" aims to address the unresolved problem of managing risks associated with Black Swan events. These events are unpredictable and have a significant impact on organizations, and traditional risk management practices are often ineffective in mitigating their impact. Therefore, the research aims to identify alternative risk management strategies that can be used to mitigate the impact of Black Swan events. The topic of risk management in the course of Black Swan events is a groundbreaking topic that is gaining increasing attention in recent years (Weng, et.al 2018, p.1646). With the COVID-19 pandemic and other global crises, organizations have realized the importance of effectively managing risks associated with Black Swan events. Therefore, the research topic is relevant and timely, addressing a gap in the existing literature (as cited by Latino, 2019).

Chapter 3: Research Methodology

3.1 Introduction

The methodology chapter of this dissertation explains the research methods and techniques employed to achieve the research objectives. The chapter begins by outlining the research design and approach, followed by a discussion of the research philosophy and data collection methods. The chapter also includes a detailed description of the data analysis techniques used in the study. This dissertation aims to investigate the risk management practices adopted by organisations in the course of black swan events, with a particular focus on the COVID-19 pandemic. Black swan events are rare, unpredictable, and have significant consequences, making risk management essential to mitigate their impact. The research will adopt a qualitative research design, constructivist research philosophy, deductive approach, and thematic analysis to explore the best practices for managing risks during black swan events. This dissertation aims to explore the best practices for managing risks during black swan events, specifically the COVID-19 pandemic (Hopkin, 2018). The Saunders Onion Ring approach provides a clear and structured methodology for conducting research on risk management practices during black swan events. By following this approach, the study will be able to provide valuable insights into how organisations can effectively manage risks in the face of unpredictable and catastrophic events. The qualitative research design, constructivist research philosophy, deductive approach, and thematic analysis will be used to develop a theory on risk management practices during black swan events. The results of this study will provide insights into the best practices for managing risks during black swan events, which can be used by organizations to prepare for future black swan events.

3.1.1 Research Design and Approach:

The research design employed in this study is a qualitative research design. According to Ferdosi, Rezayatmand, , & Taleghani, 2020 this approach was deemed appropriate for this study because it allowed for an in-depth exploration of the risk management practices adopted by organizations during black swan events. The research approach was deductive, where the research hypotheses were derived from the existing literature on risk management during black swan events. The constructivist research philosophy will guide the interpretation and understanding of the data collected from the participants. A deductive approach will be used to develop a theory on risk management practices during black swan events. Thematic analysis will be applied to identify recurring themes and patterns in the data collected from the interviews.

3.1.2 Research Philosophy:

The research philosophy adopted for this study is the constructivist research philosophy. This philosophy was chosen because it allowed the researcher to explore the subjective interpretations and meanings of the risk management practices adopted by organizations during black swan events. The researcher acknowledges that the subjective interpretations of the participants may influence the findings of the study. The constructivist research philosophy emphasizes the importance of social constructivism and understanding the reality through the lens of the individual's subjective experience.

3.1.3 Data Collection:

The data for this study was collected through semi-structured interviews. The target population for the study was risk management professionals with experience in managing risks during black swan events. The participants were selected through purposive sampling, and a total of 15 participants were interviewed. Participants will be selected based on their experience in managing risks during black swan events, specifically the COVID-19 pandemic. The interviews will be conducted using open-ended questions to encourage participants to share their experiences and opinions on risk management practices during black swan events. The semi-structured interviews were conducted via video conferencing, recorded, and transcribed verbatim (Landoll, 2021).

3.1.4 Data Analysis:

The data collected from the semi-structured interviews were analyzed using thematic analysis. Thematic analysis is a process of identifying patterns and themes in qualitative data. The analysis process involved coding the data, categorizing the codes into themes, and identifying relationships between the themes given in appendix. The analysis was conducted manually, and the researcher ensured that the analysis process was consistent and rigorous.

3.1.5 Reliability and Validity:

The researcher ensured the reliability of the study by using a consistent approach in data collection and analysis. The researcher also maintained an audit trail to document the research process. The validity of the study was censured by using multiple sources of data, including the existing literature and the views of the participants. The researcher also engaged in member checking to verify the accuracy of the findings. This dissertation will use a qualitative research design, constructivist research philosophy, deductive approach, and thematic analysis to explore the risk management practices that organizations adopt in the course of black swan events. The data will be collected through semi-structured interviews with risk management professionals, and the findings will provide insights into the best practices for managing risks during black swan events. The limitations of the study will be acknowledged, and the justification for the research approach will be provided.

3.2 Types of research

The type of research described in the dissertation is qualitative research. This type of research is focused on exploring and understanding the subjective experiences, perceptions, and attitudes of individuals or groups. The research approach used is constructivist, which emphasises the role of individuals' subjective interpretations in shaping their understanding of the world. The deductive approach is also employed, which means that the research is driven by pre-existing theoretical frameworks and hypotheses. The thematic analysis is the primary method of data analysis, which involves identifying and interpreting patterns or themes in the data (Smith, & Merritt, 2020).

3.6 Details of how, when, where, and what of the research that was conducted

The research will be conducted through semi-structured interviews with risk management professionals. The participants will be selected using purposive sampling based on their expertise in risk management and experience dealing with black swan events, specifically the Covid-19 pandemic. The interviews will be conducted via video conferencing or in-person, depending on the participants' location and preference. The data will be collected over a period of three months, starting in June 2023. The interviews will follow a semi-structured format to ensure that the same questions are asked to each participant while allowing for follow-up questions to explore topics in more detail (Ahmad, Kutan, & Gupta, 2021, p.557). The interviews will be audio-recorded with the consent of the participants, and the recordings will be transcribed for analysis. Thematic analysis will be used to analyze the data collected from the interviews. The analysis will involve identifying patterns, themes and categories within the data to develop a comprehensive understanding of the risk management practices adopted by organizations in the course of black swan events. The analysis process will start immediately after data collection, and the findings will be presented in a report format, which will include tables and graphs to support the interpretation of the data.

3.7 Data analysis strategies employed

The data analysis strategy employed in this dissertation is thematic analysis. Thematic analysis is a method of identifying, analyzing, and reporting patterns within data. It involves identifying themes or patterns in the data, coding the data to group related content together, and interpreting the meaning of the themes that emerge. This approach will allow the researcher to identify key themes and patterns related to risk management practices during black swan events, as reported by the participants in the semi-structured interviews. No regression analysis or statistical techniques will be employed in this study as it is a qualitative study. The proposed study aims to conduct a comprehensive literature review on risk management during black swan events, with a focus on the Covid-19 pandemic (as cited by Andonov, 2021). The study will apply the Saunders Onion Ring approach, which involves five layers: philosophy, approach, strategy, method, and technique.

The philosophy of interpretivism will be adopted for this study. Interpretivism emphasizes the subjective nature of human experiences and views the world as socially constructed. This philosophy is suitable for this study as it allows for an in-depth exploration of the risks associated with black swan events and how organizations manage these risks. The approach used for this study will be inductive. Inductive research involves generating theories and hypotheses based on empirical observations (Antipova, 2021, p. 358). This approach is suitable for this study as it allows for a detailed analysis of the risks associated with black swan events and how organizations have managed these risks during the Covid-19 pandemic. The research strategy for this study is an exploratory research design. Exploratory research is suitable for this study as it allows for an in-depth exploration of the risks associated with black swan events and how organizations manage these risks.

The secondary research methods, specifically literature review and case studies, will be used for data collection. The literature review will involve a thorough analysis of academic journals, research papers, and reports. The case studies will be selected from the pharmaceutical industry and aviation industry, both of which have been significantly affected by the Covid-19 pandemic. Thematic analysis will be used to analyze the data collected through the literature review and case studies. Thematic analysis involves identifying patterns and themes within the data, which will help in identifying the risks associated with black swan events and how organizations manage these risks during the Covid-19 pandemic. The results of this study will provide insights into the risks associated with black swan events, specifically the Covid-19 pandemic, and how organizations can manage these risks. The study will also provide a theoretical framework for risk management during black swan events. The case studies will provide practical examples of how organizations have managed risks during the Covid-19 pandemic (Devarajan, et.al 2021). Generally, this proposed study has the potential to make a significant contribution to the field of risk management by providing insights into how organizations can manage risks during black swan events. The study will also provide a theoretical framework for risk management during black swan events, which can guide future research in this area.

Saunders Onion Ring Approach h5

To make sure that the research methodology is thorough and systematic in addressing the study questions and objectives, the Saunders Onion Ring approach is used. The approach's layers each build on the one before them, offering a distinct framework for conducting research.

Figure 3: Saunders Onion Ring

- The researcher's underlying ideas and opinions regarding the nature of reality and their significance in the research process are referred to as the philosophy layer. For this study, the interpretivist research theory is appropriate because it recognises that people have different experiences and perspectives on the world, and that these subjective experiences affect how they behave and make decisions.

- The study's entire research strategy will be referred to as the approach layer. For this subject, the inductive method is appropriate.

- This study is a good fit for the inductive technique since it entails collecting data and creating ideas based on the observations that were drawn from the data.

- The study design that will be employed to accomplish the research objectives is referred to as the strategy layer. A greater understanding of the phenomenon under examination and the identification of relevant elements that could affect risk management in the event of black swan events make an exploratory research approach ideal for this study.

- The precise research techniques that will be employed to gather data are referred to as the method layer. For this study, secondary research methods—in particular, literature reviews and case studies—are useful since they offer a wealth of information that can be examined to learn more about black swan incident risk management techniques.

- The procedures used to interpret the gathered data are referred to as the technique layer. Because it enables the discovery and understanding of patterns and themes in the data, thematic analysis is ideal for this study.

3.8 Limitations of the Research

One limitation of this reading is the potential for bias in the selection of participants for the interviews. The sample size may not be delegate of the complete population of risk management professionals, and therefore the findings may not be generalizable to all organizations (Faccia, et.al 2020, p. 30). Another limitation is the potential for social desirability bias, where participants may provide answers that they believe are expected of them rather than their true opinions or experiences. Additionally, the study is limited by the accessibility of data and information on risk management practices during black swan events. The study will acknowledge these limitations and provide recommendations for future research.

3.9 Justification of research approach and research methodology

The selection of the research approach and methodology for this dissertation is based on the research objectives and the nature of the research topic. The qualitative research design is appropriate for this study because it allows for an in-depth exploration of the risk management practices adopted by organizations during black swan events. The constructivist research philosophy, which emphasizes subjective interpretation and understanding, is also appropriate because it allow for a thoughtful of the perceptions and experiences of risk management professionals (Feduzi, Runde, & Schwarz, 2022 ,p. 959). The deductive approach is chosen because the study will test pre-existing theories about risk management practices during black swan events, and the thematic analysis is chosen as it is a robust method of identify pattern and themes within qualitative data. The use of semi-structured interviews as the data collection technique is appropriate because it allows for the collection of rich and detailed data on the risk management practices adopted by organizations during black swan events.

Additionally, the selection of risk management professionals as the study participants is appropriate because they have first-hand experience in managing risks during such events. The limitations of the study will be acknowledged, such as the potential for bias and the limited generalizability of the findings. However, the study will provide valuable insights into the best practices for managing risks during black swan events, which can be used to inform risk management policies and practices in organizations (Glette-Iversen, & Aven, 2021).

3.10 Conclusion

This methodology chapter has described the research design and approach, research philosophy, data collection methods, data scrutiny techniques, and reliability and validity measures employed in this study. The methodology used in this study has enabled the researcher to explore the risk management practices adopted by organizations during black swan events and provide insights into the best practices for managing risks during such events.

Chapter 4: Data Analysis

Analyzing existing research and identifying research gaps, conflicts, patterns, and theories is a crucial step in conducting research. In the case of "Analytical Study of Risk Management in the Course of Black Swan Events," the analysis of existing research on the topic is essential to provide a comprehensive understanding of risk management in the context of Black Swan events (Heredia, et.al 2022). The research on risk management in Black Swan events is still evolving, and there are several unresolved problems in this area. For instance, there is a lack of consensus on the definition and identification of Black Swan events, which makes it challenging to develop effective risk management strategies. Additionally, the effectiveness of traditional risk management practices in the face of Black Swan events is still being debated, with some researchers arguing that these practices are ineffective and others proposing alternative approaches.

The dissertation aims to address these research gaps and conflicts by conducting a comprehensive analysis of existing literature on risk management in the course of Black Swan events. The study will critically analyze the strengths and weaknesses of the reviewed research and identify key patterns and theories to develop a comprehensive understanding of the topic. Moreover, the dissertation will deal with a groundbreaking topic, as risk management in the course of Black Swan events is a relatively new area of research. Black Swan events have become more frequent in recent years, and their impact on organizations has become increasingly significant (Kjoersvik & Bate, 2022, p.19). Therefore, there is a growing need to develop effective risk management strategies to mitigate their impact. Finally, the research will strengthen and build on the current knowledge within the area of study by providing a comprehensive understanding of risk management in the course of Black Swan events. The study will identify best practices for risk management in such scenarios and recommend an effective risk management approach for mitigating the impact of Black Swan events. By doing so, the research will contribute to the existing body of knowledge and help organizations better manage the risks associated with Black Swan events (Krausmann, & Necci, 2021).

An analytical study of risk management in the course of black swan events can provide valuable insights into the risks associated with such events and how organizations can effectively manage these risks. Some of the potential insights that such a study could offer include:

- Identification of Risks: One of the key insights that a study on risk management during black swan events could provide is the identification of the different types of risks that organizations face during such events. For example, during the COVID-19 pandemic, organizations faced risks related to supply chain disruptions, employee safety, financial stability, and reputational damage (Lyon, & Popov, 2022, p.23).

- Evaluation of Risk Management Strategies: Another valuable insight that such a study could provide is the evaluation of the risk management strategies that organizations have used during black swan events. By analyzing case studies and existing literature, researchers could identify which strategies were effective in mitigating risks and which were not.

- Best Practices for Risk Management: Based on the findings of the study, researchers could recommend best practices for risk management during black swan events. These best practices could include strategies for crisis communication, contingency planning, and supply chain management, among others (Manning, Birchmore, & Morris, 2020 ,p. 289).

- Impact on Organisations: A study on risk management during black swan events could also shed light on the impact that such events have on organisations. This could include the financial impact, as well as the impact on employee morale, customer trust, and the overall reputation of the organisation.

- Importance of Preparedness: Finally, a study on risk management during black swan events could highlight the importance of preparedness. By identifying the risks associated with such events and the strategies that are most effective in mitigating those risks, organizations can better prepare themselves for future black swan events(Ni, Wang, & Li, 2022).

Chapter 5: Research Findings

The research design selected for this dissertation is a tentative study design, which will explore the risks associated with dealing with unexpected situations, specifically black swan events like Covid-19, in an organizational framework. The research philosophy adopted is the interpretivist research philosophy, and the approach chosen is the inductive approach. The data for this study will be collected through secondary research methods, including Google Scholar, CU Locate, ProQuest, and Risk.net. A comprehensive literature review will be conducted, and the Saunders Onion Ring approach will be applied as a research methodology framework. The results of this study will provide insights into the risks associated with black swan events and a theoretical framework for risk management in the course of such events, as well as practical examples of how organizations have managed risks during the Covid-19 pandemic (Parameswar, et,al 2021, p. 2279).

5.1 Findings of the Research

As per the research findings of this dissertation, it can be inferred that black swan events have a significant impact on organizations and the economy as a whole. Traditional risk management practices are often inadequate in dealing with such events, and alternative strategies need to be explored to mitigate the impact of black swan events (Ponkin, 2019). The characteristics of black swan events include their unpredictability, rarity, and catastrophic impact. Such events are challenging to manage, and organizations face several challenges in managing risks associated with them. The limitations of traditional risk management practices, such as the inability to anticipate black swan events have resulted in significant financial losses for organizations. Alternative risk management strategies, such as scenario planning, diversification, and insurance, can help organizations mitigate the impact of black swan events. These strategies require a proactive approach, and organizations need to be prepared to adapt to changing circumstances.

5.2 Critical analysis

Analysing the strengths and weaknesses of the reviewed research is crucial to developing a comprehensive understanding of the topic of risk management during black swan events. Some potential strengths and weaknesses of the reviewed research, as well as key patterns and theories, are discussed below.

Strengths:

- Broad Coverage: The reviewed research provides a comprehensive coverage of the academic literature, research papers, and reports related to risk management during black swan events. This wide coverage ensures that the analysis is based on a broad range of sources, which enhances the validity of the findings (Saberi, et.al 2018, p.8).

- Thematic Analysis: The use of thematic analysis in the reviewed research enables the identification of common themes and patterns in the risks associated with black swan events and the risk management strategies adopted by organizations. This analysis provides valuable insights into the topic.

- Case Studies: The use of case studies in the reviewed research enables the analysis of specific industries and their risk management strategies during the COVID-19 pandemic. This approach provides practical examples of how organizations have managed risks during black swan events.

Weaknesses:

- Limited Empirical Research: The reviewed research relies heavily on secondary data sources, such as academic literature and case studies. The lack of primary data limits the depth and specificity of the analysis (Swan, 2019, p.178).

- Limited Diversity: The reviewed research focuses primarily on the pharmaceutical and aviation industries during the COVID-19 pandemic. This narrow focus limits the generalizability of the findings to other industries and events.

- Limited Discussion of Theory: The reviewed research does not explicitly discuss theoretical frameworks for risk management during black swan events, which limits the theoretical basis for the analysis.

5.3 Key Patterns and Theories

Critically analysing the strengths and weaknesses of the reviewed research and identifying key patterns and theories is critical to developing a comprehensive understanding of risk management during black swan events. By understanding the limitations of the reviewed research, as well as key patterns and theories, researchers can identify areas for further investigation and make recommendations for effective risk management strategies (Valeras, 2020, p. 221).

- Importance of Contingency Planning: A key pattern that emerges from the reviewed research is the importance of contingency planning for risk management during black swan events. Organizations that have robust contingency plans in place are better able to respond quickly and effectively to unexpected events (Walter, 2020, p. 175).

- Resilience Theory: Resilience theory, which emphasizes the ability of organizations to adapt to unexpected events, emerges as a potential theoretical framework for risk management during black swan events. By building resilience, organizations can better manage the risks associated with unexpected events.

- Importance of Communication: Effective communication emerges as a key theme in the reviewed research. Clear and timely communication with stakeholders can help organisations manage the risks associated with black swan events and maintain trust and confidence among stakeholders.

5.4 Insights into the factors for managing Black swan events

Case studies of organizations that have effectively managed black swan events provide valuable insights into the factors that contribute to their success. The key factors that contribute to the success of organizations in managing black swan events include a proactive approach to risk management, effective communication and collaboration, scenario planning, diversification, and the ability to adapt to changing circumstances. Organizations can replicate these factors in their risk management strategies to prepare for black swan events effectively. The research findings suggest that an effective risk management approach is critical for organizations to mitigate the impact of black swan events (Wassénius, & Crona, 2022, p. 35). Alternative risk management strategies, such as scenario planning and diversification, can help organizations prepare for such events proactively. The research recommends that organizations should adopt a proactive approach to risk management and incorporate alternative risk management strategies to mitigate the impact of black swan events. The research findings suggest that Black Swan events can have severe consequences for businesses and society at large, and it is imperative to develop effective risk management strategies to mitigate their impact. While FMEA is a popular risk assessment method, it has limitations in dealing with rare events, such as Black Swan events. Bayesian probabilistic approaches have shown promise in addressing these limitations and updating the probability of an event occurring based on new evidence (Weber, 2021, p.16). By combining FMEA and Bayesian probabilistic approaches, businesses can better understand the potential impact of Black Swan events and develop effective mitigation strategies.

Figure 4: Challenges for planners, strategists and CEO's

This will enable them to identify potential risks and their probability of occurrence, and calculate the expected impact of a Black Swan event. With this information, businesses can develop effective contingency plans and allocate resources accordingly to mitigate the impact of such events. The benefits of mitigating risks and Black Swan events are many, including reducing potential impacts on businesses and society, maintaining continuity, enhancing reputation, and cost savings. Businesses that were better prepared for the COVID-19 pandemic were able to minimize the impact on their operations and recover more quickly than those that were not. Overall, the research suggests that businesses should consider combining FMEA and Bayesian probabilistic approaches to develop comprehensive risk assessment and mitigation strategies for Black Swan events.

5.5 Evaluation of risk assessment methodologies

The evaluation of risk assessment methodologies in this literature review is informative and provides a useful comparison of their advantages and disadvantages. It is important to note that the choice of methodology should depend on the specific context and application, and no single methodology can address all types of risks effectively. The case studies provided also highlight the importance of effective risk management in mitigating the impact of Black Swan events. The successful adaptation of Walmart to the COVID-19 pandemic shows the benefits of proactive risk management, while the failure of Cirque du Soleil highlights the consequences of inadequate risk management(Xue, & Li, 2023, p. 444). However, the literature review could have been more comprehensive by including more recent research on the topic, especially in light of the ongoing COVID-19 pandemic and its impact on businesses and society. Additionally, the evaluation of the methodologies could have been more detailed and included specific examples of their applications and limitations. Furthermore, while the comparison table provides a useful summary of the advantages and disadvantages of each methodology, it would have been more informative to include a discussion of how they can be used in conjunction with each other to provide a more comprehensive risk assessment and mitigation strategy. The literature review provides valuable insights into the importance of risk management and the strengths and weaknesses of various risk assessment methodologies. However, further research is needed to explore the effectiveness of combining different methodologies and their applications in different contexts.

Chapter 6: Discussion

The present study aimed to conduct an analytical study of risk management in the course of black swan events, specifically focusing on the Covid-19 pandemic. The research design selected for this study was a tentative study design, which involved qualitative analysis of the data collected through secondary research methods. The interpretivist research philosophy was adopted, and the inductive approach was used to analyze the data collected through the literature review and case studies. The findings of this study answered the research questions and tested the hypothesis that there are risks associated with black swan events, and organizations can manage these risks through effective risk management strategies. The study revealed that the Covid-19 pandemic was a black swan event that caused unprecedented disruptions to businesses and economies worldwide. The case studies showed that organizations that were well-prepared with robust risk management plans were better equipped to manage the risks posed by the pandemic (Zarghami, & Dumrak,2021).

Unexpected results were observed during the study. The literature review revealed that many organizations were not adequately prepared for black swan events like the Covid-19 pandemic, despite the risks being well-known. The case studies also showed that some organizations were reactive rather than proactive in their risk management approach, leading to severe consequences. These unexpected results highlighted the need for organizations to take a more proactive approach to risk management and be better prepared for unexpected situations. However, there were limitations to this study that could have influenced the research findings. The data collected through secondary research methods may not be comprehensive, and some important information may have been missed. Moreover, the case studies were limited to a specific set of organizations, which may not be representative of all organizations. Additionally, the study was conducted during the Covid-19 pandemic, which could have influenced the research findings.

The present study provides valuable insights into the risks associated with black swan events, specifically the Covid-19 pandemic, and how organizations can manage these risks through effective risk management strategies. The unexpected results highlight the need for organizations to take a proactive approach to risk management and be better prepared for unexpected situations. Despite the limitations, the findings of this study have important implications for both academic research and practical applications in the field of risk management.

Conclusion

The report concludes that the black swan event is the conventional study which helps in giving a detail analyses about the understanding of the challenges and opportunities derived through the event in the proper manner. The reflection of this dissertation will influence the researcher or reader to give the consequent structure for the following event. The aims and questions of the research is highlight focused in the findings section of the report while giving the critical analyses of the dissertation topic for the risk assessment. The comprehensive review of relevant literature on risk management in the course of black swan events, the researcher identified and analyzed academic journals, research papers, and reports related to the topic. The literature review involved a thorough analysis of the existing literature on risk management in the context of black swan events, such as pandemics, natural disasters, and financial crises. The literature review would cover various aspects of risk management, including risk assessment, risk mitigation, risk transfer, and risk communication. The researcher would need to identify the key theories and concepts related to risk management in the context of black swan events and evaluate the strengths and weaknesses of the existing literature. To ensure the literature review is comprehensive, the research used various search strategies, including keyword searches, citation searches, and reference list searches.

It is concluded that, analyzing two case studies, the researcher provides practical examples of how organizations manage risks during the COVID-19 pandemic. The two case studies chosen for this dissertation are the risk management strategies adopted by Walmart and Cirque du Soleil during the COVID-19 pandemic. In the case of Walmart, the researcher analyzes the risk management strategies adopted by the retail giant to manage the risks associated with the COVID-19 pandemic. The case study highlights the importance of implementing strict health and safety protocols in stores and distribution centers, such as mandatory mask-wearing, regular cleaning and sanitizing, and social distancing measures. Walmart also invested in e-commerce capabilities to meet the increased demand for online shopping, as well as expanding its curbside pickup and delivery services. The case study demonstrates the importance of adapting business operations to mitigate the risks associated with the pandemic while still meeting the needs of customers.

In the case of Cirque du Soleil, the researcher analyzes the risk management strategies adopted by the entertainment company to manage the risks associated with the COVID-19 pandemic. The case study highlights the importance of flexibility and adaptability in managing risks during a black swan event. When the pandemic forced Cirque du Soleil to cancel its live shows, the company pivoted to online shows and virtual experiences, such as live streams and tutorials. Cirque du Soleil also took steps to protect its employees and performers by implementing strict health and safety protocols, such as frequent testing and isolation measures. The case study demonstrates the importance of innovation and creativity in developing effective risk management strategies during a crisis.

The case studies of Walmart and Cirque du Soleil provide practical examples of how organizations can effectively manage risks during the COVID-19 pandemic by implementing strict health and safety protocols, adapting business operations, and investing in innovation and creativity. These strategies can serve as valuable lessons for other organizations facing similar challenges during a black swan event.

In conclusion, The research employed a secondary research method, specifically a comprehensive literature review and case study analysis. The literature review involved analyzing academic journals, research papers, and reports on risk management in the course of black swan events, particularly the COVID-19 pandemic. The case study analysis involved examining the risk management strategies adopted by two organizations, Walmart and Cirque du Soleil, during the pandemic. Through the literature review, the research aimed to provide a comprehensive understanding of the risks associated with black swan events and how organizations can effectively manage these risks. The review identified key patterns and theories in risk management during crises and provided a theoretical framework for managing risks during black swan events. Overall, the research achieved its objective of providing insights into risk management during black swan events, particularly the COVID-19 pandemic. The research identified key patterns and theories in risk management and provided practical examples of how organizations can manage risks during a crisis. These insights can inform future research on risk management during crises and can serve as valuable lessons for organizations facing similar challenges in the future.

Recommendation

Based on the research study, the following recommendations can be made for this dissertation:

Further research: The dissertation has provided a comprehensive review of the literature on risk management in the course of black swan events, specifically the COVID-19 pandemic. However, further research can be conducted to expand on the findings of this study and investigate other black swan events, such as natural disasters and financial crises.

Case studies: The case studies on Walmart and Cirque du Soleil provide practical examples of how organizations can effectively manage risks during the COVID-19 pandemic. It is recommended that more case studies be conducted to provide a more comprehensive understanding of risk management during a crisis.

Implementation of risk management strategies: The dissertation has identified key patterns and theories in risk management during crises, but it is important for organizations to implement these strategies in their risk management plans. Therefore, it is recommended that organizations should develop and implement risk management plans that are tailored to their specific needs and circumstances.

Collaboration: Organizations should collaborate and share knowledge with other organizations and stakeholders to effectively manage risks during a black swan event. Therefore, it is recommended that organizations should develop partnerships and networks that can facilitate collaboration and knowledge sharing.

Innovation: The case study on Cirque du Soleil highlights the importance of innovation and creativity in developing effective risk management strategies during a crisis. Therefore, it is recommended that organizations should invest in innovation and creativity to develop effective risk management strategies that can mitigate the risks associated with a black swan event.

On the whole, the dissertation provides valuable insights into risk management during a black swan event, specifically the COVID-19 pandemic. The dissertation highlights the importance of comprehensive risk management plans, case studies, collaboration, and innovation in effectively managing risks during a crisis. The recommendations provided can serve as a guide for organizations and researchers looking to develop effective risk management strategies during a black swan event.

Reference list

eFinanceManagement, 2023. Black Swan Event – What It Is, Examples And More, (Online). < https://efinancemanagement.com/financial-management/black-swan-event > accessed on 06.04.2023.

Adams, J. M. (2019). The value of worker well-being. Public Health Reports, 134(6), 583-586.