- Part 1

- 1) Ex-dividend share price

- 2) Capital gearing ratio using the market value.

- 3) Market value on the basis of “weighted average cost of capital”

- Part 2

- The financial results effect on future decision-making of the ABC Company

- Question 1

- a. The initial investment in the machine

- b. Calculation of terminal cash in flow

- c. Treatment of the value of working capital

- d. Calculation of Net Present Value

- E. Debt Financing

Part 1

1) Ex-dividend share price

Ex-dividend share means, when an organization or a company's higher authorities decided to declare the company's dividend then the board of directors of the company declare the record of the following dates of the company dividend. On this date, the person's must be on the record books of the company. If the company's record date is already decided then according to the company rules the ex-dividend date also be decided on the exchange of company stocks and the particular stock which is traded. The stock trades of the ex-dividend must be after the rate of the ex-dividend. Somehow, the company traders of the company are purchasing their stock after the date of ex-dividend date then the trader of the company cannot get any type of payment regarding the purpose of the dividend. The dividend buyers of the company are not required to the payment of the next dividend on a particular date.

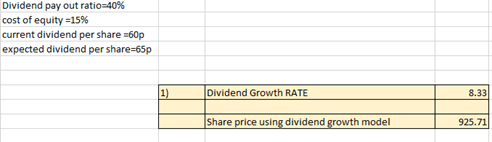

Figure 1: Calculating Ex-dividend share price

The above figure evaluates the ex-dividend share price using the dividend growth model. The ABC Company has a payout ratio regarding their company has 40 percent. The company always maintained its payout ratio for several years.

The current dividend of the company per share is 60p and the company's financial experts expected that the next year the current dividend per share will be 65p. The dividend growth rate of the company is 8.33 per cent. Using the dividend growth model when calculating the price of the share then the share price of the ABC company is 925p.

2) Capital gearing ratio using the market value.

The capital gearing ratio shows the portion which is high in the “debt to equity” and also the low gearing ratio shows the opposite factor of the “debt to equity”. When the company and the organizations collect their money from the creditors of the company this is basically the risk factor of the company. The investors of the company always reviewed the company ratios to identify the company's financial health. The capital gearing ratio reflects the risks of the company which is the takeover by the company. If the company has lots of debt equity then it is an unfavorable condition for the company. The investors are not wanted or are interested to invest their money in a company which had lots of debts, in case the company cannot find a good investor. Increase in the investors’ money for the company’s growth makes a favorable situation for the company.

The financing debt or the types of leverage usage also needs proper care by the financial experts of the company. The debts are helping the company to spread its business. Companies' new products and better services are helping to increase the companies’ profits. If a company never wanted to borrow then the company never had an opportunity to grow or spread its business.

Comparison of the various companies' capital gearing ratios on the basis of a similar industry is helping the higher authorities to recognize the company assets and make a proper decision on how the company can make more profit. The financial experts also find the issues of the firm operations of the company.

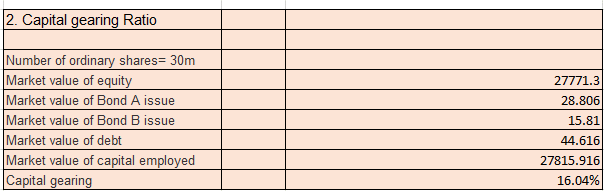

Figure 2: Calculating capital gearing ratio

The ABC Company has 30 million ordinary shares and the market value of the ABC Company’s equity is 277771.3. The above figure calculates the Capital Gearing Ratio of the ABC Company. The ABC Company has two bonds, bonds A and bonds B. Bonds A nominal value is the basis of 10 years. Bonds A pays the interest on an annual basis and the rate of the interest is 10 per cent. The total cost of debt on the ABC company bond is 11.5 per cent per year. In the current market, the ex-interest price of Bond A is 11.5 per cent per year. However, the current price of Bond A is £96.02. Another bond of the ABC Company is Bond B and Bond B redeemed the value of the bond on the basis of four years. Bond B pays the bond annual interest on per year is 7 per cent. However, the ex-market value on the current market is £105.04. The capital gearing ratio for the ABC Company is 16.04 per cent.

3) Market value on the basis of “weighted average cost of capital”

A company's “weighted average cost of capital” means the cost values of the company are blended on the company purpose of the finance pay system of the company's assets. The “weighted average cost of capital” is mixed of the various company debts and the cost carry debts of the company including the value of equity cost of the company.

If the ratio of the “weighted average cost of capital” is high its means the company has higher risks on the purpose of the company operations on the company firm. The company pays for their capital more in comparing the investors invest their money in the company. The risk is about the companies’ increases in their investments and the high demands of the investors.

On the other way the “weighted average cost of capital” is low then which means the company did not pay the needed money for the company equity and also the money is not enough for the company debt for all over growth of the company business.

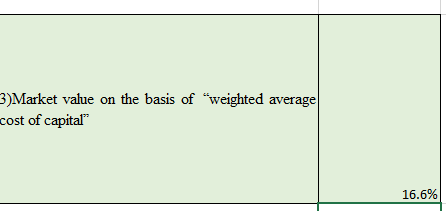

Figure 3: Calculating Market value on the basis of “weighted average cost of capital”

The above figure evaluates the market value on the basis of the “weighted average cost of capital” for the ABC Company. The market value on the basis of the “weighted average cost of capital” is 16.6 per cent. In the calculation of the market value on the basis of the “weighted average cost of capital” first market value of Bond A multiply the value of the cost of debt for the ABC Company.

Why struggle alone when success is a click away? With our professional online assignment help, you’ll receive tailored guidance from subject-matter experts to ensure top-quality submissions every time.

Part 2

The financial results effect on future decision-making of the ABC Company

The assessment has consisted of several calculations on basis of some scenarios. The ABC Company has issued shares and bonds, the data was provided in the assessment. The results come out of the calculations rare signifying some of the possibilities about the company ABC. The result has come out signifying some of the future estimations that will help in the decision-making in the future.

The calculations of Ex-dividend share price, using the dividend growth model have been established. The Ex-dividend defines a stock that is trading in the stock market without the value of the next dividend payment. The missed out date is called an Ex-date, and it is the day started on that day when the stocks start trading without the value of the next dividend payout. The buyer who purchased that stock before the Ex-dividend date is entitled to the next dividend payment, however, those who purchased the stock on the ex-dividend date or after are non-liable to pay the dividend. The answer provided above has been calculated using the dividend growth model and the share of the price comes to around 925.71.

The dividends serve as an important tool that announces the company’s success and they act as a source of investment income. Dividends are generally paid in cash however they can also be used as an additional share of the stock. When the dividend payments have been announced the impact on the share price can be noticed. The announcements create demand for that stock until the ex-dividend date is mentioned. When the date comes the share price makes a correction and goes back to the pre-dividend levels. The demand for the stock is generally low after the announcements of the Ex-dividend date. Investors can make a profit in the future by holding the stock that has announced the Ex-dividend date for their share. The ex-dividend price of the share is indicating the share is in a good health and it making revenue generation which made the stock demand. The future decision of the stock is in a good position, the share has to come out with a strong fundamental so that the demand increases again among the investor.

Another calculation of the Capital gearing of the ABC firm has been calculated using the market value of the share. Capital gearing ratio signifies the capital structure of a company, it is calculated as equity to total debt ratio. The ratio provides insight to the investors on the company's position and how the companies are geared. The company may be highly geared or low geared basically depending upon the stocks that are composed in a firm. The company is said to be low-geared when the firm is composed of more common stocks than interest or dividend-bearing funds. However, a company is in high gear when the company provides an inertest bearing stock than providing the common stock. High gear signifies the high risk whereas low gear signifies the lower risk in the firm. The capital gearing of the ABC firm using the market value is 16.04%.

The capital gearing ratio is said to be the financial leverage, it is a good thing for a firm that needs to expand its reach. It is said that the company has a gearing ratio of more than 50% and is considered highly levered or geared. The company can be a great threat to financial risk, as during the time of low profit and higher interest rates a bank may be loan default and bankruptcy. However, a company presenting a gearing ratio of less than 25% is said to be low-risked by both investors and lenders. The ABC firm has a lower gearing ratio signifies the company is out of financial risk. The future prospect of the company in the matter of lending money from banks or institutions is good. As the lender sees the gearing ratio before lending money to any firm So, in the future, the firm will not face any hardship in lending money.

The next part of the assessment asked to provide the market value-weighted average cost of capital. A company's weighted average cost of capital is the overall cost required to pay the finance of its assets. It is the combination of the cost to carry out the debt plus the cost of equity. A high WACC indicates a higher risk associated with the firm’s operation, which means paying more for the capital that investors have put into the company. Alternatively, a lower WACC represents the company not paying as much as the required equity and debt for the company. Companies with a lower WACC are often more established, larger, and safer to invest in. The calculation of WACC resulted in a value of 16.6% for the ABC Company.

The lower weighted average cost for the ABC company is signifying that the company is at low risk, making investors and lenders profitable for lending money to the ABC firm. The ABC Company has a higher potential to add value for its stakeholders. The WACC shows the hurdle rate for a firm to achieve, or generate a minimum rate of return to sustain the creditors and shareholders of the company. The ABC Company is in a good position for investment purposes. The WACC can be used to value a firm, in this regard the low WACC is pointing out the good position of the firm with respect to the free cash flow growth and the calculated weighted average cost of the firm. The future scope of the firm is great, as we can see the WACC for the company is low making the company suitable for investing in a different project. The weighted average cost can be calculated to measure the acceptance of a project in the firm. The Internal rate of return is compared with the firm's cost of capital to give judgment on a project's acceptability or not.

Overall perspective can be made by analyzing the above scenario that the ABC company is in a good position in terms of lending money from an investor and the future scope of the ABC company is good.

Question 1

a. The initial investment in the machine

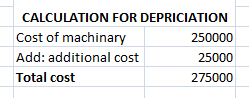

Figure 4: Calculations

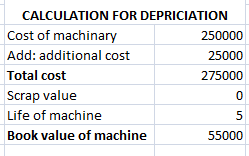

The machinery cost 250000. The installation cost behind the machine is 25000. The additional cost adds to the cost of the machine. However, this additional cost is included when an asset was purchased. When the depreciation of an asset is calculated, the installation charge also is considerable.

Figure 5: Calculations

The life of the machine is 5 years. The depreciation calculation is made on the straight-line method. The straight line method is based on the calculation, where the scrap value is minus the cost of the machine. After that, the value is divided by the self-life. Here the book value of the machine after 5 years is 55000. The scrap value of the machine is assumed zero.

b. Calculation of terminal cash in flow

Figure 6: Calculations

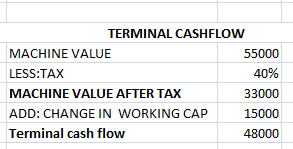

The terminal cash flow made at the year ended. The calculation is the process to know the liquidation value of a machine after the end of the machine's life. The terminal cash flow represents the value of the machine; the machine can be old or new. In this above calculation, the cash flow is made to know the value of the machine after 5 years. The scrap value of the machine is not mentioned in the study. Therefore it was assumed that the company has the machine scarp value of zero. The tax rate is 40 percent, which is deducted from the final machine value. The change in working capital indicates the company may include current assets in the business or a decade of its current liabilities in the market. However, the change in working capital is added to the machine value after the payment of tax. The terminal cash flow of the machine after 5 years is 48000.

c. Treatment of the value of working capital

The working capital of a company or business is basically a difference between the current assets and liabilities. However, if the working capital comes in positive it means the current asset of a company is higher than the current liabilities. In the current asset the cash, is not considerable. Whereas in the current liability, the debt does not take part in the calculation, therefore the positive working capital evaluates that the company has in a position, where it is totally able to pay its debt. However, a company that is in its best to liquidity its assets easily is considered as the best company. The company has a working capital of 15000. The amount is adjusted at the end of the 5th year. The company has a positive working capital, which means the company is able to liquefy its assets easily in the market. However, the increase in the working capital for the machine implies that the company must increase its current assets in the business. On the other hand, it can be said treat the company may decrease its current liabilities by repaying the debt of the company. Eventually, the higher working capital represents the company’s positive nature in business practice, and also indicates the activeness of business strategies.

d. Calculation of Net Present Value

|

Calculation of NPV |

|||

|

year |

cash flow |

discounting factor |

Present Value |

|

0 |

-250000 |

1 |

-250000 |

|

1 |

50000 |

0.85 |

42500 |

|

2 |

50000 |

0.7225 |

36125 |

|

3 |

50000 |

0.614125 |

30706.25 |

|

4 |

50000 |

0.52200625 |

26100.3125 |

|

5 |

50000 |

0.443705313 |

22185.26563 |

|

NPV= Sum of present value |

-92383.17188 |

Table 1: NPV

From the above computed NPV, it can be said that the purchase of the machine should not be made as the NPV is negative. It seems that if the company purchases the machine then it will be facing loss in the company. The value of the machine is 250000 and the net present value after five years compared with a discounting factor of 15% and it can be said that the amount computed has been negative resulting in the loss of the company. The depreciation amounts to 55000 and it has been calculated for 5 years. Here it is seen that the value of the discount in the 3rd year shows a value of 30706 which is comparatively low than the other year's values. It is also seen that the company needs to focus on the rate of return and to make it lower so that the company could able to purchase the machine.

NPV is therefore calculated to identify whether the value of the machine at the end of a certain is a positive value or a negative value. If the results come negative then the company should not purchase the machine.

E. Debt Financing

If a firm raises funds through debt financing they will be an increase in the value of finance in the balance sheet. Debt financing includes certain interest and amounts that are required to be paid to the lenders or the borrowers of the company. This creates a deduction in the value of the interest in the cash flow. This reduction in net income also represents a tax benefit through the lower taxable income. Increasing debt finance helps to increase the value of capital ratios of the company. In the event of a company's liquidation, debt holders are senior to equity holders. The value of the firm can also increase with the increase in the debt finance of the firm.

The company can increase the value of the NPV by taking loans from other financial bodies. It can be helpful for certain years and this can help the company to take necessary steps for the improvement of the NPV. With the increase in the value of debentures, the company can also be able to increase the NPV for 5 years which can amount to a positive value at the end. The value of the bonds is also to be required to increase so that the company can able to face the NPV at a positive rate and also can purchase the machine for the betterment of the company and to earn profit. The NPV needs to be increased by the company in order to help in the profit maximization of the company and to increase the sale value of the firm.