- Unit 42: Planning for Growth Assignment Sample

- INTRODUCTION: Planning for Growth Assignment

- PART 1: INVESTING IN THE FUTURE

- LO1 Analysis of Competitive Advantage

- LO1 Evaluation of SME growth opportunities

- PART 2: OPTIONS FOR GROWTH

- LO1 Ansoff’s growth matrix

- Porter’s generic model

- Small and medium enterprises growth with risk

- LO2 Sources of Funding

- Selection of the best source of funding

- PART 3: DEVELOPING AN EXIT PLAN

- LO3 A business plan

- LO4 Different ways of exiting the small businesses

- Guidance for SMEs while exiting the company

Unit 42: Planning for Growth Assignment Sample

INTRODUCTION: Planning for Growth Assignment

Uncover the advantages of choosing our assignment help services for a seamless learning experience.

Small and medium enterprises (SMEs) are defined as those types of businesses that have limited or under a specific level of workforce, assets, and capital according to the government guidelines of a country (El Madani, 2018). Each country has a different definition of SMEs in view of the country's business environment. Small and medium-sized businesses play the main role in boosting the country's GDP and the value of the currency on the global level. SMEs provide services to the end users as well as to the big firms and represent themselves as multitasking companies in the country. Small and medium-size enterprises have a great opportunity for the development and growth of a business in their country(Al Asheq, and Hossain, 2019).

This file is divided into three parts of the assignment which include three different topics. In Part 1, the report discusses the growth opportunities of small and medium enterprises through the use of three models. To support the report, Allplants Company is considered a case company. The study also includes an analysis of the competitive advantage of an SME company and the analysis is done by two types of models. In part one of the report, the growth of an SME along with the consideration of different risks are discussed. The first part also highlighted the methods of funding and the best funding source selection by small and medium-sized enterprises. In the second part of the report, a focus area is the execution of a business plan for an SME company. The last part highlights the exit strategies of the SMES and discusses the suggestions and directions in order to attain the objectives of the report.

Figure 1: allplants logo

PART 1: INVESTING IN THE FUTURE

LO1 Analysis of Competitive Advantage

The competitive advantage analysis helps an organization to study its core competitors that influence the company's operational activities in the market. This analysis turns a phase of a case company towards finding a solution of better marketing, finer product expansion, and placing a good image in the industry (Cantele, and Zardini, 2018). For the case company's competitive advantage analysis, Porter's five forces model, and SWOT analysis are undertaken.

SWOT analysis

The acronym of SWOT is strengths, weaknesses, opportunities, and threats. The SWOT analysis is used by the company only when it wants to explore its inner and outer possibility of performing well in the market(Benzaghta, et. al. 2021). The case company gets more access to its growth opportunities by analyzing the following factors of SWOT analysis.

Strengths: providing healthier and high-quality products is one of the strengths of the case company which attracts a high range of customers (Abid, and Jie, 2021). Along with this, better service to the customer, and various types of vegan food items are also countable in Allplant's strengths.

Weakness: the cost of making fresh and healthy products is high which leads to a higher price of the products of a case company than the other suppliers (Longhurst, et. al. 2020). The case company is preparing fresh products so it is difficult to control everyday inventory management in the company.

Opportunity: After the coronavirus pandemic, everybody switched their eating habits from junk foods to healthy and vegan foods, which led to a great opportunity for a case company (Aldawod, 2022). Also, a broad range of marketing and advertisement opportunities conducted by external parties like YouTube channels, Blogs, etc. enhance the case company's sales.

Threats: This factor includes a high range of competitors in the market as the other supermarkets, and stores also provide this type of product (Kowalska-Pyzalska, et. al. 2020). There is no stable price in the industry for vegan foods, so there is always a price war which leads to a greater threat for Allplants.

Figure 2: SWOT analysis chart

Porter’s Five Forces model

This model contains five forces that help the company to analyze its competition in the industry as well as in the market (Bruijl, and Gerard, 2018). In the context of All plants, Porter's five forces are discussed below:

Power of suppliers: the suppliers of a case company's industry are concentrated on the product's quality, terms, and prices. Therefore Allplants needs to develop better relations with different suppliers for the betterment of the company's operations.

Power of buyers: this factor includes the bargaining power of the buyers. For the case company, bargaining by the buyers is considered low. As fresh and healthy products are provided by the company and customers do not think too much about the prices when they buy healthy products.

Opposition counts in the industry: in the case company's industry, there is low competition but the competitors are increasing day by day after the COVID pandemic. Allplants is already doing great in the consumer market, but the company should adopt unique strategies to survive in the competitive market.

Product substitution threat of a company: this factor of Porter's five forces represents a high threat of product substitution for a case company. The substitutes for Allplant’s products include junk foods, packed foods, etc.

Possibility of new entrance: the new entrance force in the healthy food industry has now become high. As the demand for healthy and fresh foods is increasing day by day, people are highly investing in the vegan foods businesses.

LO1 Evaluation of SME growth opportunities

The UK has a large market for small and medium enterprises that are uplifting and promoting a healthy environment of the market within the UK economy(Miocevic, and Morgan, 2018). The UK government promotes small and medium-sized enterprises (SMEs) through various schemes such as startup loans up to £25000, applying for government contracts, and getting support for a tech business, etc (Calabrese, et. al. 2022). Talking about the case company which is Allplants Limited, which is a UK-based small and medium size company. The case company was established on the 18th of May 2016, as a private limited company. The case company’s name was changed on 25th May 2016 from Allplants Kitchen Limited to Allplants Limited. The company offers sustainable and healthy meals prepared from fresh fruits, vegetables, grains, seeds, and nuts to customers and people in rush(Allplants, 2022). All plants use insulation packaging to cover their meals. The packaging used by the case company is made up of upcycled materials, renewable materials, or recycled contents materials.

The case company is now looking for the growth areas of a business in which it can diversify its operation of a company. Different types of models and methods are used to identify the case company's strengths, weaknesses, and competitive position in the consumer market. The considerations of various models lead a company to grow without any loss. This part considers the pestle analysis, the Ansoff matrix, and the Porter generic models.

Pestle analysis

The pestle analysis contains political, economic, social, technological, legal, and environmental factors that are already represented by the pestle analysis name itself(Eierle, et. al. 2022). This analysis effectively shows the company's external environment in which the company wants to find various growth opportunities. The pestle analysis of a case company is explained below:

Political factor: This factor directs the company to pay attention to the political parties and government interference that affect SMEs the most. The factor contains government interventions such as foreign trade policy, regulation/de-regulation, grant funding to small businesses, tax policy, level of bureaucracy, etc. on an organization. The case company is highly supported by the UK government in the context of funding and different business ideas for healthy food services provided to the general public.

Economic factor: every company is affected by its country's economic condition in the world. Issues of economics that affect the company include business cycles, unemployment trends, economic growth, stock market performance, inflation and interest rates, etc. The UK has effective and favorable economic conditions for the SME growth perspective. The case company generated employment opportunities which created a boost in economic conditions.

Social factor: cultural and social factors play a major role in examining the external environment of the business. This factor considers consumers' buying habits, lifestyles, age differences, religion, education level, type of consumers, population growth, etc. After the COVID-19 pandemic, people became more conscious about their health and this led the company to attract more new customers by providing healthy dishes to them.

Technological factor: the continued improvements of various techniques in every business, factor increase the performance level of the company in the market. This factor contains automation, technology lifecycle, incentives, activity of research and development, and technological change rate in the market. The UK is a developed country that has the latest technology ever, and each company situated in the UK is using high technology. All plants also use the latest technology like online orders, home delivery, etc. to survive in the market.

Legal factor: this factor includes different rules and regulations provided by the industry in which the company is operating. The laws related to health and safety laws, employment law, discrimination law, intellectual property law, product labeling regulations, anti-trust laws, health care laws, etc. The UK government has very strict rules for the food industry, so the case company has to operate according to the government policy to get continue growth.

Environmental factor: small businesses are highly impacted by this factor which contains climate change, geographical location, pollution, weather, waste management, climate, etc (Shtal, et. al. 2018). The case company offers eco-friendly products and it is sustainably operating. But if the company wants to grow then it needs to lower the impact of climate change on its operations.

PART 2: OPTIONS FOR GROWTH

LO1 Ansoff’s growth matrix

This matrix contains four blocks that lie on the X and Y axes. In the matrix, X-axis represents products and Y-axis represents markets, both axes include two points that are new and existing (Zanjani, et. al. 2020). The Ansoff matrix will help the case company outline its growth strategies after researching existing and upcoming new products and markets in the industry.

Market development: the market development strategy directs the case company to enhance its existing products in the new markets (Mukangai, and Murigi, 2021). This strategy leads a company to grow or enter a new market without any heavy cost.

Market penetration: this strategy will lead a case company to increase the sales of its existing products in the existing market (Auma, and Waithaka, 2020). The market penetration strategy guides a company to grow in the current market in which the company is operating.

Diversification: according to the diversification strategy, the case company should focus on making new products to enter the new market (Omosa, et. al. 2022). All plants will grow through the use of this strategy, as the company does not need high costs to develop new products.

Product development: this strategy influences every company to make new products and sell them in new markets (Prasetyo, and Rahman, 2018). The diversification of the product line in the case company will lead to large market coverage and more new customers for Allplants.

Porter’s generic model

Porter's generic model helps the company to identify its core competencies in the company's existing and currently operating market (Julita Julita, 2019). This model leads a case company to gain a competitive advantage after satisfying the competition trends of the markets on the company. The analysis has four strategies that are discussed below:

Differentiation focus: In this strategy, the case company has to focus on the narrow target competition to differentiate its products and activities from the competitors in the market.

Cost focus: this strategy says that a company should analyze its competitor's way of working by applying lower costs in the low target competitive scope of the market. The cost focus strategy will help the case company to achieve a competitive advantage by applying low cost.

Differentiation leadership: the differentiation leadership strategy helps the case company to analyze the competitive market by targeting a broad line of competitors (Brett, 2018). By analyzing the broad target of competitive scope Allplants will differentiate its activities from competitors and gain a competitive advantage.

Cost leadership: this strategy will allow the case company to grow in the market by investing at a lower cost and overviewing the broad target competitive scope of the competitors in the industry. The case company gains a competitive advantage by leading effective cost on the research of competitors.

Small and medium enterprises growth with risk

The performance of a case company determines the strategic decision power of a company. Before concluding any decision, the case company should deeply study its inner and outer business environment to avoid any risk in advance (Asgary, et. al. 2020). Every strategic planning has some part of the risk in it, and to replace the risk a case company has to line up all the risks related to the planning. All plants should focus on balancing their external and internal domain of business. As the competition is increasing in the case company's industry line should focus on better strategic planning to beat competition risk. A distinct strategy has distinct risks generated for the company. If Allplants use a market development strategy then the company has to face the risk of new market trends and competition. And if the company focuses on a strategy of differentiation focus then it will create a risk of introducing new products in the consumer market. By concluding the risk factor, the case company should opt effective strategy of differentiation leadership and product development strategies.

LO2 Sources of Funding

More funds are required when the company wants to expand its business. To direct the company's operations towards success and growth, the main role is played by capital investment in a business. There are various sources of funding in a company, and this case company has to find out the best source of funding for its business development and growth.

Venture capital funds: this source of funding is provided by the venture capitalists to a company to get investment interest and some part of the business share. Venture capital investment surpassed $15bn for the first time, in advance of $14.8bn upraised in the year 2019. If the fund provider thinks that the company has strong development and growth possibility in the future then only the funding company invests in the business (Pinkow, and Iversen, 2020). The venture capital fund is the most suitable source of funds for small and medium-sized enterprises. For the case company, this method of funding is satisfactory as the company has high growth capability so it can easily get funds from any venture capital firm.

Bank loans: Any company can get easy funds from this source of funding. The business loan from a bank can be accessed up to £50,000 and interest-free for up to 56 days. Bank provides loans to a company with a signed agreement in which the company will pay the principal amount along with the chargeable interest to the bank on a future date (Temelkov, and GogovaSamonikov, 2018). The case company can prefer this method while undertaking the rate of interest disadvantages of a bank loan.

Peer-to-peer lending: the funds offered only to that organization that requires funds other than this method is the same as a bank loan. Funds are provided only in the structure of money in peer-to-peer lending and also this is the fastest and easiest source of funding (Reza‐Gharehbagh, et. al. 2020). The case company can apply to this funding source as this is more suitable funding for a business in comparison with others.

Friends and family: this source of funding works sometimes but not all the time. The company can get some funds from their friends and relatives but there is a huge gap between expected and actual funds provided by the relatives. This method of funding should be avoided by Allplants Limited to maintain its image in the market and get expected funds from one place.

Government funding: this method of funding consumes lots of time for the companies, as it requires numerous legal formalities to get approved funds from the government of the country. Any company that wants to start its business as an SME can apply for a government-backed Start-up loan from the range of £500 to £25,000 to start and grow the business. By the way, all country's government has different funding schemes to provide growth opportunities for SMEs in a country (Brown, and Lee, 2019). The case company can opt for funds from any government growth scheme but this leads to slow growth of a business in a market.

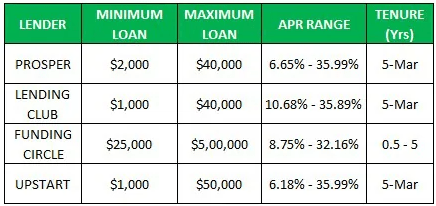

Selection of the best source of funding

The case company growth and expansion strategies need a huge amount to be invested to get a clear pathway and strong vision. The proper method of funding will lead the company in the right direction to achieve more opportunities on time. For the case company, it is recommended that a suitable source of funding is peer-to-peer lending or venture capital or it can also apply for a bank loan. Within the United States, the peer-to-peer lending model is to be gaining supremacy over traditional funding by providing consumer loans of more than $48 billion between 2006 to the year 2018. It is predicted to grow to an estimated $150 billion in 2025. Here's a list of P2P websites that provide information on loans that SMEs can access for better evaluation.

Figure 3: loans that SMEs can access through peer-to-peer lending

Peer-to-peer lending is a fast and easily available source of funding that consumes less time for the case company and brings that available time to effective planning. Venture capital is also a satisfactory source of funding, as the support of growth planning and decision-making will also be gained by a case company by this method. The case company also gets funds from a bank loan which is an effective source of funding that helps a company to enhance its market reach.

PART 3: DEVELOPING AN EXIT PLAN

LO3 A business plan

Executive summary:

The executive summary represents the thumbnail of new business planning for Allplants Limited. The objectives, products and services, market segmentation strategies, company history, and summary, projected profit and loss, competitive edge, and sales strategy are examined in this study.

Strategic Objectives:

The main aim of the case company is to create more growth potential and generate high profits in the current business market. To achieve the objectives of a company it has come to notice that the variety of tastes in healthy products with their economic prices will lead high customer base for an organization. All Plants Limited has different goals in their new business plan, which are highlighted below:

- To enlarge sales by 20% in the upcoming years of a company.

- To widen consumer base and their satisfaction by 20% in the forthcoming years of a business.

- To establish 7 new company stores in distinct areas across the UK.

- To know the variety of products.

- To focus on the psychological and demographic strategies

Company summary:

Allplants Limited is a small and medium-sized company (SME) in the UK. The company placed a good market position and powerful goodwill in the consumer market through unique product selling and advertisement strategy. The variety of healthy and fresh food products provided by the company to the consumers maintains the positioning of the company in consumers' minds.

Company history:

The company was founded in 2016 with a great plan to provide healthy foods to its customers. From the beginning, the company adopted different strategies for growth and development and kept working on them. Allplants introduced many stores of its company within the UK in different regions.

Products and services:

The company offers only vegetarian products to its customers. The products are made up of healthy plants and fruits by the company. Allplants offers a variety of dishes to its consumers to bring healthy habits to them. The case company is delivering its products within the UK only as it is a UK-based SME company.

Market segmentation:

The food industry has high competition all over the world and nowadays individuals are switching from junk food to healthy food habits. The market segmentation strategy is very useful for the case company to achieve continuous growth in the market(Dolnicar, et. al. 2018). The company should mainly focus on the psychological and demographic strategies that are discussed below:

Psychological segmentation: in this type of market segmentation strategy the focus of a company should be attracted to a healthy lifestyle, beliefs, personality traits, and values while providing its products to the consumers.

Demographic segmentation: this market segmentation strategy believes that the company should pay attention to the consumer's age, gender, and income while delivering its products to them(Gajanova, et. al. 2019). The little champs are more attracted to the taste of the product and young ones do not pay that much attention to the taste as they only want healthy foods.

Sales strategy:

The case company should focus on product development and market penetration strategy to raise its product sales in the market. Market penetration will lead the company to increase its sales in the existing market through various methods like discounts, promotional offers, vouchers, coupons, etc. to enlarge its sales by 20% in the next years. On the other hand, the product development strategy will lead the company to implement new variations in its products like new dishes, and similar dishes with different tastes, and introduce them into the new market.

Competition edge:

The case company is operating in a highly competitive industry as many other stores and shops are providing the same products in the market. All plant competitors are Fresh Fitness Food Ltd, Wiltshire Farm Foods, Oakhouse Foods Ltd, Kbk, etc.

Projected profit and loss:

After applying the new business plan, the overall revenue of the case company is to be evaluated to rise by £10 million in contrast to the last year. The Allplant’s profit is also assessed as it will be boosted by 20% in the upcoming year.

Financial information:

All plants and new businesses best choose venture capital and government funding which is more suitable for the company. The company also invests its capital through its current selling revenue. Other than this the company will go through with the government funding which is around £25,000 which is sufficient for the company to establish its new planning for the business in a market.

LO4 Different ways of exiting the small businesses

If the expected revenues are not achieved by the company then it will create a situation of winding up the business. This situation is faced by the company when the appropriate planning is not made and suitable strategies are not opted by a business. The company should have to plan itself to face an exit situation and make an exit strategy in advance to get rid of the huge loss. The case company has different types of business plan exit strategies that can be applied at the time of winding up a business.

Voluntary winding up: the voluntary winding up exiting strategy refers to a systematic way of winding up a company. In this strategy, the company is willingly winding down due to some reasons like bankruptcy, death of promoters, etc. The business sells its all assets and liabilities to bring out money from it, and this happened after applying a voluntary winding-up exit strategy.

Selling the business: The selling business exit strategy of a company is very useful when an organization becomes insolvent and the owner wants to keep some shares to gain part of the profit in the future(Krukowski, and DeTienne, 2022).

Merger and acquisition: A merger means voluntarily being an equal part of the newly established company together with another company. Whereas acquisition means to acquire or buy another company without concerning its board of directors(Segal, et. al. 2021). If the case company feels that the new business plan is not generating expected profits then the company has the option of being merged with another company or surrendering itself to another firm as an act of acquisition.

Guidance for SMEs while exiting the company

A suitable exit strategy will lead a company high price when the business is selling off and winding up. It is important for the case company to deeply analyze the advantages and disadvantages of each exit strategy to opt for the best strategy. In the case of Allplants, it has effective brand value and market position, therefore the company has to undertake that exit strategy from which the company's branding and positioning activity will not affect. If the case company's new business plan will be executed according to the planning then the exit plan for the business is not necessary. The merger and acquisition exit strategy is considered a good and effective strategy for the case company. Allplants will not suffer any huge losses related to goodwill and finances if the company will use the merger and acquisition exit strategy.

Recommendation and Conclusion

It is concluded from the above-mentioned report that the case company has the capability to implement the new business plan in the market. The company will be able to make a new business plan only if it analyzes both the internal and external business environment of an organization. The growth opportunity of a case company is to find out about the different analysis methods or tools. For the external business environment, the pestle analysis, Ansoff's matrix, and Porter's generic models are used. While determining the internal business environment, the SWOT analysis and Porter's five forces models are used. To achieve the goals of a case company it is recommended that the company should also pay attention to its competitors and customer's preference. It is concluded that the case company has various types of exit and invasion strategies. A satisfactory exit and entering strategy will lead a case company to achieve success and growth in the consumer as well as in the competitive market.

REFERENCES

Abid, A. and Jie, S., 2021. Impact of COVID‐19 on agricultural food: A Strengths, Weaknesses, Opportunities, and Threats (SWOT) analysis. Food Frontiers, 2(4), pp.396-406.

Al Asheq, A. and Hossain, M.U., 2019. SME performance: Impact of market, customer and brand orientation. Academy of Marketing Studies Journal, 23(1), pp.1-9.

Aldawod, A., 2022. A framework for the opportunity recognition process in UK entrepreneurial universities. Technological Forecasting and Social Change, 175, p.121386.

Allplants, 2022. FEED YOUR POWER (online).

Asgary, A., Ozdemir, A.I. and Özyürek, H., 2020. Small and medium enterprises and global risks: evidence from manufacturing SMEs in Turkey. International Journal of Disaster Risk Science, 11(1), pp.59-73.

Auma, S.N. and Waithaka, T., 2020. INFLUENCE OF MARKET PENETRATION STRATEGY ON ORGANISATIONAL PERFORMANCE OF PUBLIC UNIVERSITIES IN KENYA. International Research Journal of Business and Strategic Management, 1(1).

Benzaghta, M.A., Elwalda, A., Mousa, M.M., Erkan, I. and Rahman, M., 2021. SWOT analysis applications: An integrative literature review. Journal of Global Business Insights, 6(1), pp.55-73.

Brett, M.R., 2018. Cost leadership or differentiation? Applying Porter’s competitive strategies in ecotourism: A case study of Mkhuze Game Reserve. African Journal of Hospitality, Tourism and Leisure, 7(2), pp.1-27.

Brown, R. and Lee, N., 2019. Strapped for cash? Funding for UK high-growth SMEs since the global financial crisis. Journal of Business Research, 99, pp.37-45.

Bruijl, D. and Gerard, H.T., 2018. The relevance of Porter's five forces in today's innovative and changing business environment. Available at SSRN 3192207.

Businessindicator, 2021. SWOT Analysis (online).

Calabrese, R., Cowling, M. and Liu, W., 2022. Understanding the dynamics of UK Covid‐19 SME financing. British Journal of Management, 33(2), pp.657-677.

Cantele, S. and Zardini, A., 2018. Is sustainability a competitive advantage for small businesses? An empirical analysis of possible mediators in the sustainability–financial performance relationship. Journal of cleaner production, 182, pp.166-176.

Dolnicar, S., Grün, B. and Leisch, F., 2018. Market segmentation analysis: Understanding it, doing it, and making it useful (p. 324). Springer Nature.

Eierle, B., Hartlieb, S., Hay, D.C., Niemi, L. and Ojala, H., 2022. External Factors and the Pricing of Audit Services: A Systematic Review of the Archival Literature Using a PESTLE Analysis. Auditing: A Journal of Practice & Theory, 41(3), pp.95-119.

El Madani, A., 2018. SME policy: Comparative analysis of SME definitions. International Journal of Academic Research in Business and Social Sciences, 8(8), pp.103-14.

Gajanova, L., Nadanyiova, M. and Moravcikova, D., 2019. The use of demographic and psychographic segmentation to create a marketing strategy of brand loyalty. Scientific Annals of Economics and Business, 66(1), pp.65-84.

JulitaJulita, S.E., 2019. DEVELOPMENT OF PORTER GENERIC STRATEGY MODEL FOR SMALL AND MEDIUM ENTERPRISES (SMEs) IN DEALING WITH ASEAN ECONOMICS COMMUNITY (AEC). KUMPULAN JURNAL DOSEN UNIVERSITAS MUHAMMADIYAH SUMATERA UTARA, 8(9).

Kowalska-Pyzalska, A., Kott, J. and Kott, M., 2020. Why Polish market of alternative fuel vehicles (AFVs) is the smallest in Europe? SWOT analysis of opportunities and threats. Renewable and Sustainable Energy Reviews, 133, p.110076.

Krukowski, K.A. and DeTienne, D.R., 2022. Selling a business after the pandemic? How crisis and information asymmetry affect deal terms. Business Horizons, 65(5), pp.617-630.

Longhurst, G.J., Stone, D.M., Dulohery, K., Scully, D., Campbell, T. and Smith, C.F., 2020. Strength, weakness, opportunity, threat (SWOT) analysis of the adaptations to anatomical education in the United Kingdom and Republic of Ireland in response to the Covid‐19 pandemic. Anatomical sciences education, 13(3), pp.301-311.

Miocevic, D. and Morgan, R.E., 2018. Operational capabilities and entrepreneurial opportunities in emerging market firms: Explaining exporting SME growth. International Marketing Review.

Mukangai, W.I. and Murigi, E.M., 2021. The Effect of Market Development on Sales Performance of Agro-Based Dealers in Nairobi City County, Kenya. Journal of Marketing and Communication, 4(1).

Omosa, H.M., Muya, J., Omari, S. and Momanyi, C., 2022. Role of product diversification strategy on performance of selected tea factories in Kenya. International Academic Journal of Innovation, Leadership and Entrepreneurship, 2(2), pp.279-296.

Pinkow, F. and Iversen, J., 2020. Strategic objectives of corporate venture capital as a tool for open innovation. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), p.157.

Prasetyo, P.E. and Rahman, Y.A., 2018. Effectiveness of new product development on mat creative industry. KnE Social Sciences, pp.633-653.

Reza‐Gharehbagh, R., Hafezalkotob, A., Asian, S., Makui, A. and Zhang, A.N., 2020. Peer‐to‐peer financing choice of SME entrepreneurs in the re‐emergence of supply chain localization. International Transactions in Operational Research, 27(5), pp.2534-2558.

Segal, S., Guthrie, J. and Dumay, J., 2021. Stakeholder and merger and acquisition research: a structured literature review. Accounting & Finance, 61(2), pp.2935-2964.

Shtal, T.V., BURIAK, M.M., AMIRBEKULY, Y., UKUBASSOVA, G.S., KASKIN, T.T. and TOIBOLDINOVA, Z.G., 2018. Methods of analysis of the external environment of business activities. Revistaespacios, 39(12).

Temelkov, Z. and GogovaSamonikov, M., 2018. The need for fintech companies as non-bank financing alternatives for SMEs in developing economies. International Journal of Information, Business and Management, 10(3), pp.25-33.

Zanjani, S., Iranzadeh, S., Khadivi, A. and FeghhiFarahmand, N., 2020. Designing a Corporate Growth Strategy Based on Ansoff Matrix Using Fuzzy Inference System. Innovation Management in Defense Organizations, 3(2), pp.151-178.