Examining Financial Reporting Objectives and Principles at Hammerson Plc

The UK’s top-notch assignment writing service, Native Assignment Help, specialises in providing unparalleled quality and outstanding customer satisfaction through our human-written case study. Our dedicated team can readily assist you with challenging essays or intricate research papers. Choose Native Assignment Help today and experience firsthand what a reliable and committed partner can achieve for you.

1: Financial Reporting: General Purpose Objectives

Financial reporting is considered an important and critical aspect of the accounting process for an organisation to establish strong financial credibility in the associated industries as well as the markets. As per narrations and illustrations of Wang et al. (2020), the key general-purpose objective linked with financial reporting is considered to be mainly influenced by how organisational resources are utilised to achieve better monetary prospects. Moreover, the general-purpose objective of financial reporting applicable for the selected company, Hammerson Plc. is also linked with establishment of managerial propositions being employed to facilitate a regulated accounting procedure on a daily basis. Financial reporting applicable for determination of financial objectives and targets for Hammerson Plc. can also be administered on the basis of following aspects related with financial information which are being presented on an annual basis:.

a) Income Statement

Income Statement is considered to be the primary factor associated with determination of financial reporting purpose and objectives which mainly ascertains the profitability proportion of an organisation during a specific accounting period (Acrete et al. 2019). The profitability figure achieved is considered to be the difference between sales revenues generated along with associated costs and expenses. Income Statement for Hammerson Plc. is also considered to be a highly important proforma to establish the credibility of operational and manufacturing activity streams that are being employed to generate a bulk profitability share.

b) Balance Sheet

Balance Sheet is considered to be the second important component or determination associated with the establishment of financial reporting goals and objectives for an organisation where main emphasis is laid on identifying financial positioning of assets and liabilities. The balance sheet can alternatively be termed as the “statement of financial position” applicable for Hammerson Plc to establish its accurate financial positioning during an accounting period. Assets and liabilities under balance sheet are further segregated on the basis of non-current as well as current assets, while liabilities are segregated as current as well as non-current liabilities (Pizzi et al. 2022).

c) Cash Flow Statement

Cash flow statement is considered to be the third important factor involved under the determination of financial reporting goals and objectives where annual cash positioning is determined for an organisation. In order to determine the annual cash positioning for an organisation, further emphasis is being offered for considering three main activities including operating, investing as well as financing activities (Roje and Redmayne, 2021). All three activities are considered to be relevant for Hammerson Plc. to ensure positioning of working capital, investments in capital assets as well as investor orientation prospects.

d) Statement of Changes in Equity

Statement of changes in equity is considered to be the fourth important parameter and factor of financial reporting and its purpose and objectives where final equity value for Hammerson Plc. is being determined. Emphasis on equity share capital valuation, additional capital, net profit, retained earnings, surplus and deficit is also prioritised under equity statement changes.

e) Notes to the Financial Statements

Notes to financial statements applicable for Hammerson Plc is considered to portray the additional information required to be presented for preparation of financial statements. These mainly include details of depreciation, valuation of goodwill as well as valuation of inventory.

The additional emphasis of financial reporting can be further witnessed for Hammerson Plc by obtaining numerical figures for accounts receivables. Accounts receivables is categorised under current assets and further segregation is also complemented to arrive at the figure of total accounts receivables. These include trade receivables values of GBP 27.5 million in 2021, prepayments of GBP 4.5 million, VAT receivable value for 2021 as GBP 15.7 million and other receivables value of GBP 17.9 million.

2: Recognition and Connection

Recognition and connection applicable for the company concerned Hammerson Plc is considered to be related with IFRS-15 revenue recognition as well as establishing a link between IAS and IFRS.

a) IFRS-15 Revenue Recognition

The IFRS-15 revenue recognition for Hammerson Plc is considered to be related with revenue recognised and realised from customer contracts. The IFRS 15 principles further stipulate that revenue is needed to be recognised and segregated based on service income, property fees income and joint venture and associate management fees. The recognition of revenue from car parking further suggests that revenue needs to be recorded at a time when a car parking slot is being used by a customer. Third party emphasis and obligation are further needed to be offered for realising revenue for property fees income and joint venture fees. Following is a detailed demarcation of segmental revenue analysis applicable for Hammerson Plc.

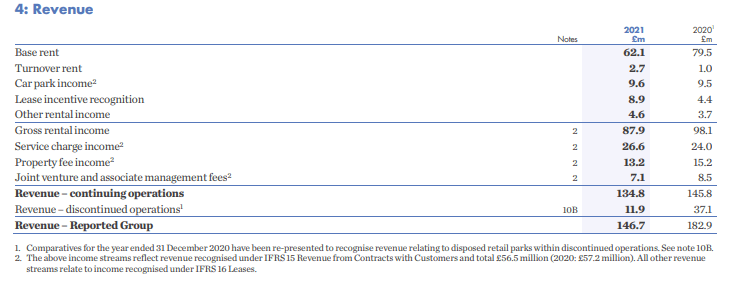

Figure 1: Revenue Segmental Analysis

As per the above revenue segmental analysis for Hammerson Plc in the financial year 2021, it can be administered that base rent and turnover rent incurred includes figures of GBP 62.1 and 2.7 million respectively. The total revenue from continuing operations is calculated as GBP 134.8 million, while revenue from the reported group is considered to be GBP 146.7 million.

b) IFRS 10

The application of IFRS 10 is considered to be relevant for Hammerson Plc, for ascertaining the overall annual positioning of consolidated financial statements. This is further established on the basis of considering preparation of income statement, balance sheet and cash flow positioning where overall financial accolades are being determined.

c) IFRS 3

IFRS 3 is mainly deemed to be an important standard prescribed by IFRS which emphasises accounting procedures needed to be followed in case of mergers and acquisitions. This can be further administered for Hammerson by ascertaining preparation of group accounts where parent company and subsidiary company financial details are presented individually and in a combined manner.

d) IFRS 16

IFRS 16 is further considered to be an important aspect of financial regulatory that highly emphasises conduct of organisations with regards to treatment of fixed assets. This is further noticed for Hammerson Plc by ascertaining depreciation value charged on an annual basis for non-current assets.

e) IAS 1

The implementation of IAS 1 is considered to be an integral part of the accounting norms needed to be contemplated by organisations where preparation of financial statements is concerned. This is further applicable for Hammerson Plc by primarily preparing income statement, followed by balance sheet and cash flow statement.

f) IAS 7

The implementation of IAS 7 standards and norms is further deemed to be an important aspect of corporate reporting where preparation of cash flow statements is being outlined. This can be further applied for Hammerson Plc. by ascertaining cash flow generated from three key activities including operating, investing and financing.

g) Connection between IAS and IFRS

The application of IFRS and IAS by the company concerned Hammerson Group is being applied mainly on legal terms where a binding is being imposed for following specific set of accounting principles and guidelines. This is being applied to ensure that detailed accounting measurements and presentation is being harmonised in order to attract a better investor perspective and influence in future. The connection between IAS and IFRS established for the company concerned Hammerson Plc can be primarily detected based on standards applicable for IAS 16. The IAS 16 further details the relevance of non-current assets or PPE which is needed to be recorded at book value by Hammerson Plc. The IFRS principles further prioritise the charging of depreciation for IAS 16 and the method that is needed to be applied for calculating depreciation. As stated and idealised by Assad and Alshurideh (2020), the main available methods of depreciation that could be charged on non-current assets include the straight line as well as the diminishing balance method.

3: Measurement

The measurement propositions of financial statements are further considered to be important indicators for Hammerson Plc. Lassoued and Khanchel (2021), viewed and observed that measurement of financial statements can be further contemplated by employing methods including historical value, fair value, and settlement value. Measurement as per IFRS is mainly considered to be related with ascertaining the final positioning of assets, liabilities, expenses and incomes for an organisation with respect to overall activity streams achieved during a financial year. This is also applicable for subsidiaries associated with Hammerson Plc which involves Grantchester Holdings Ltd and Hammerson Holding France SAS.

The measurement prospects applicable for Hammerson Plc are further considered to be relatable especially by considering the fair value approach. The fair value approach is considered to be a part of the IFRS 13 standards where assets and liabilities are being recorded at their current market and book values respectively.

4: Financial Statements and Disclosure

The financial statements and disclosure section of this assignment shall consider results of Hammerson Plc for the financial years 2021 and 2020 respectively. Further emphasis shall be offered for determining the disclosure of financial performances based on financial statements that are being prepared by Hammerson Plc.

a) Results of the Organisation

Income Statement

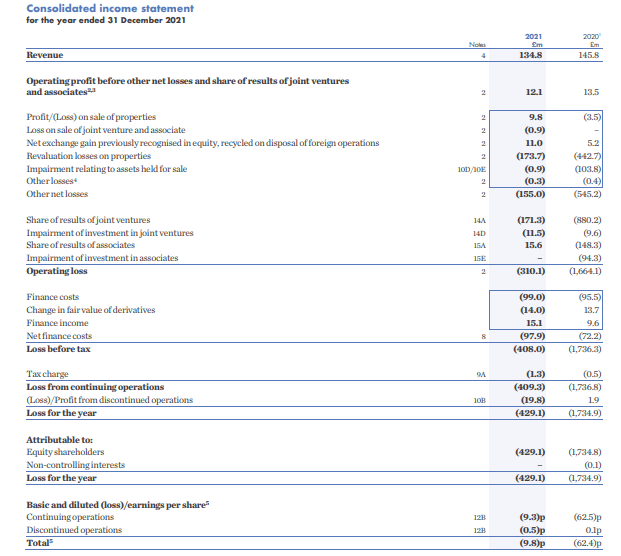

As per the income statement for Hammerson Plc, it can be determined that the performance of Hammerson Plc in 2021 and 2020 can be judged on the basis of discovering net profit or net loss. The net loss for 2021 and 2020 has been calculated as GBP -429.1 and GBP -1734.9 respectively. The overall profitability position is considered to be in an adverse state for Hammerson Plc. An adverse profitability position further implicates low business credentials for ensuring sustainability in the industry (Krasodomska et al. 2021).

Figure 2: Income Statement

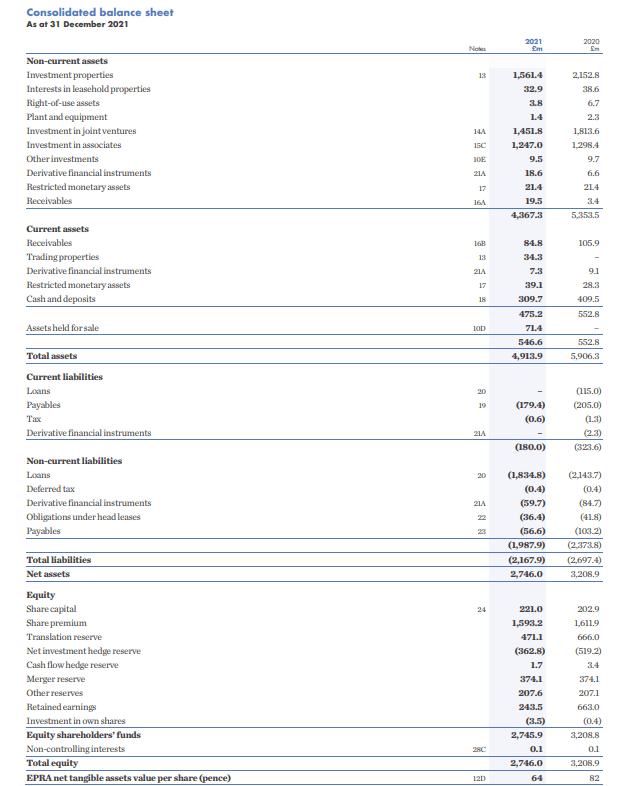

Balance Sheet

Balance Sheet for Hammerson Plc. further stipulates the value of total assets and total liabilities including equity obtained for the financial year 2021 and 2020 respectively. Total assets as well as total liabilities and equity for 2021 and 2020 have been calculated as GBP 4913.9 and GBP 5906.3 respectively. Hence, it can be administered that financial positioning for the financial year 2021 has decreased significantly which further jeopardises its credible financial metrics.

Figure 3: Balance Sheet

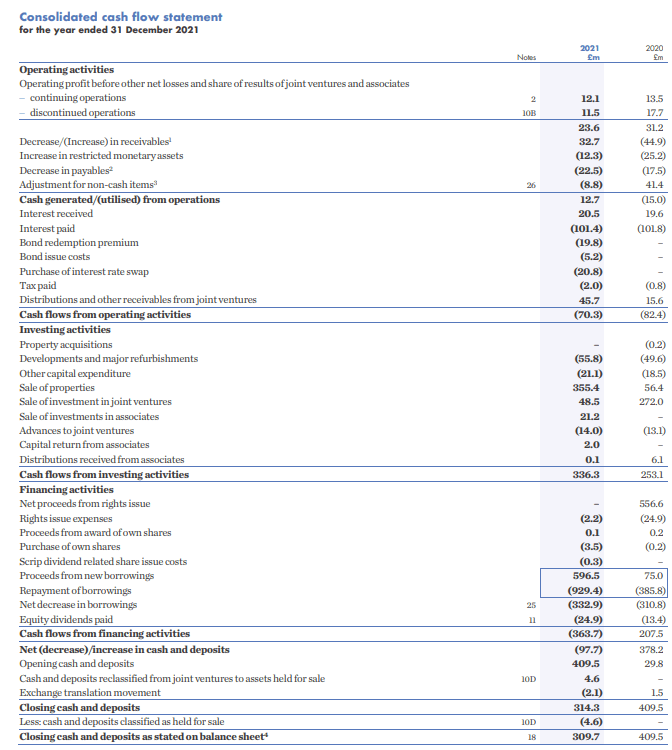

Cash Flow Statement

The cash flow statement stipulates the figures of cash flow from operating, investing as well as financing activities for Hammerson Plc in the year 2021 and 2020. As per cash flow statement, operating cash flow contains figures of GBP -70.3 and -82.4, while investing cash flows contains values of GBP 336.3 and 253.1. The financing cash flows contains values of GBP -363.7 and 207.5 and further suggests that main emphasis is being laid for selling properties while investor and operational orientation has been sacrificed. The high selling of properties is considered to be an unfavourable position for an organisation as fixed assets valuation would also be minimised (Biondi et al. 2021).

Figure 4: Cash Flow Statement

b) Disclosure

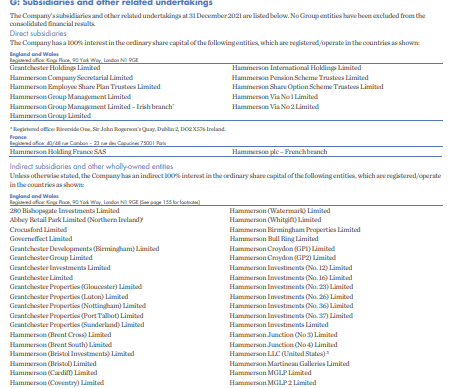

The disclosure of financial statements applicable for Hammerson Plc is considered to be related with practice of standards as per IAS 1. The following factors are further considered to be part of the disclosure metrics of Hammerson Plc. The applicability of disclosure is further deemed to be relevant for Hammerson Plc as well as its group structure and subsidiaries existing. The emphasis for subsidiaries associated under group structure of Hammerson Group is considered to be related with the parent company holding greater than 50% shareholding and voting rights for implementation of key decisions.

Figure 5: Group Structure and Subsidiaries of Hammerson Group

Assets and Liabilities

Assets are classified on the basis of current and non-current assets where current assets imply assets which could be converted within cash in twelve months or less. A prime example of current assets includes accounts receivable and inventory. Non-Current assets are considered to be assets which have no immediate prospect of being converted into liquid cash. Examples of non-current assets include equipment, furniture and building. Liabilities can also be segregated on the basis of current and non-current prospects where current liabilities imply liabilities needed to be settled within a specific financial year. Non-Current liabilities imply liabilities that need to be settled after more than one financial year. Prime examples of non-current liabilities imply long-term borrowings and debentures, while current liabilities include creditors and trade payables.

Incomes and Expenses

Main incomes associated with Hammerson Plc are considered to be sales revenues, while expenses can be segregated on the basis of manufacturing and operating expenses. Manufacturing expenses include cost of goods sold, while operating expenses include administrative, marketing and finance expenses.

5: Reflection

In the context of financial reporting applicable for an organisation, I feel the importance of practicing and following applicable standards is deemed highly pivotal for encouraging fair and truthful communication of organisational excellence. This is being further demonstrated in this assignment based on considering the applicability of IFRS and IAS and how it stimulates to assessment of overall financial performance for Hammerson Group. My perspective of financial reporting has also discovered the role of financial statements including income statement, balance sheet as well as the cash flow statement is also important as it is deemed to be the primary gateway through which investors access information about an organisation. Hence, in real world circumstances the context of financial results obtained for Hammerson Group are conceived to be relevant to viably locate how financial results impact the overall industry positioning and dominance of an organisation.

Conclusion

International financial reporting is considered to be an important trait for Hammerson Plc where the application of Fair value as per IFRS 13 is being employed. Further emphasis on the financial performance of the company suggests that the overall income, cash position as well as financial position has been jeopardised which has led to low cash reserves, low fixed assets values as well as low profitability. The role of the annual report of Hammerson Plc is also deemed to be important for investors of Hammerson Plc to take vital investment related decisions based on assessment of financial performances achieved.

Reference List

Acerete, B., Gasca, M. and Llena, F., 2019. Analysis of environmental financial reporting in the Spanish toll roads sector. Spanish Journal of Finance and Accounting/Revista Española de Financiación y Contabilidad, 48(4), pp.430-463.

Assad, N.F. and Alshurideh, M.T., 2020. Financial reporting quality, audit quality, and investment efficiency: evidence from GCC economies. WAFFEN-UND Kostumkd. J, 11(3), pp.194-208.

Biondi, L., Grandis, F.G. and Mattei, G., 2021. Heritage assets in financial reporting: a critical analysis of the IPSASB's consultation paper. Journal of Public Budgeting, Accounting & Financial Management, 33(5), pp.533-551.

Krasodomska, J., Simnett, R. and Street, D.L., 2021. Extended external reporting assurance: Current practices and challenges. Journal of International Financial Management & Accounting, 32(1), pp.104-142.

Lassoued, N. and Khanchel, I., 2021. Impact of COVID-19 pandemic on earnings management: An evidence from financial reporting in European firms. Global Business Review, p.09721509211053491.

Pizzi, S., Del Baldo, M., Caputo, F. and Venturelli, A., 2022. Voluntary disclosure of Sustainable Development Goals in mandatory non‐financial reports: The moderating role of cultural dimension. Journal of International Financial Management & Accounting, 33(1), pp.83-106.

Roje, G. and Redmayne, N.B., 2021. On the management and financial reporting for state assets—a comparative analysis between Croatia and New Zealand. Public Money & Management, 41(2), pp.118-126.

Wang, W.K., Lu, W.M., Kweh, Q.L. and Siao, W.Y., 2020. Related‐party transactions and corporate performance following the adoption of International Financial Reporting Standards in Taiwan. Managerial and Decision Economics, 41(3), pp.371-379.