Principles Of International Marketing: Nike Inc Case Study

Unveiling International Marketing Principles Through the Lens of Nike Inc.

Ph.D. Experts For Best Assistance

Plagiarism Free Content

AI Free Content

Principles Of International Marketing: Nike Inc

Introduction: Principles Of International Marketing: Nike Inc

Native Assignment Help provides assignment help to assist students in the research, writing, and proofreading process.

Getting entry into an international market is not an easy task and companies need to adopt various adaptation and standardisation tactics to make it a win-win situation. Keeping in mind this context, one of the main notions behind conducting this study is to focus on one selected company that is Nike which has get entry in the British market. The study will dos secondary study collection to study their marketing tactics which they adopt to run their operation in British market. The study will specially focus on the strategies they adopted and if they are different which is deployed in the other global business market and reason behind it.

About the company

The company that has been selected to do the research is America’s one of the top MNC who engaged in producing and designing of shoes named as Nike. The organization is settled close to Beaverton, Oregon, in the Portland metropolitan area. It is the world's biggest provider of athletic shoes and clothing and a significant producer of athletic gear, with income in overabundance of US$37.4 billion in its monetary year 2020. As of May 31, 2022, Nike worked a total of 1,046 retail locations all throughout the whole world, which is only two stores, less than the past monetary year.

(a) Their adaptation and/or standardisation strategies in the British market.

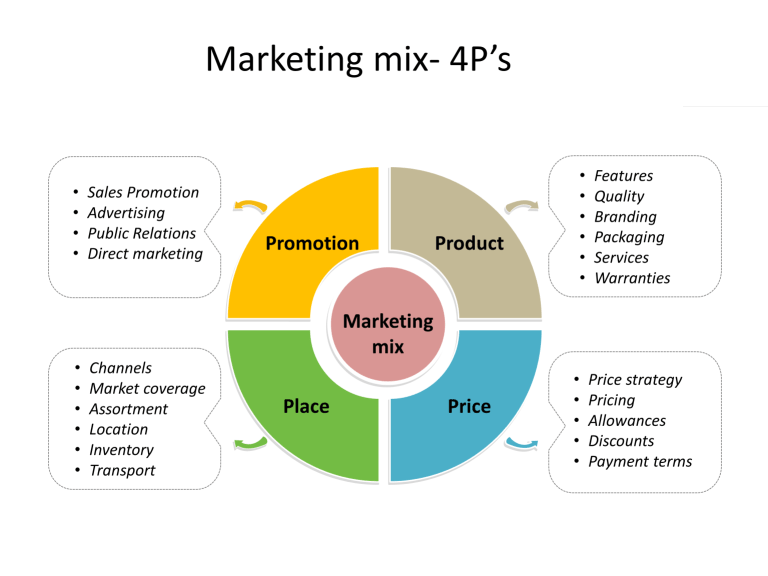

When entering a foreign market, among the most crucial things to keep in mind is the so-called conflict between uniformity and adaptability (Rao-Nicholson & Khan, 2017). Using the same Marketing Mix uniformly across all nations is referred to as standardisation (Kotabe & Helsen, 2022). While on the other hand, every nation or market has its own Marketing Mix as a result of adaptation (Gillespie & Swan, 2021).

The customer market in the United Kingdom is substantial. The present population of the nation is more than 68 million (WORLDOMETER, 2022). As birth rates continue to exceed mortality rates, the population is predicted to reach more than 70 million by the year 2039.

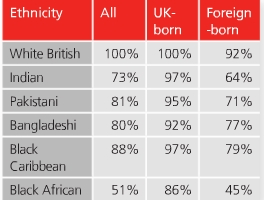

Figure 1: Diversified population of the United Kingdom

The concept of socioeconomic classes has historically had an influence on the United Kingdom, despite the fact that its population is heterogeneous. Consequently, over time, business entities have had to develop a broad variety of new products to satisfy the needs of diverse ethnic and religious groups. Business entities still have a lot of options to explore, though. While on the other hand, globalization has created a norm for adopting standardization as global standards for marketing strategies have been set for business entities while entering a new market as well (Timmermans & Epstein, 2010).

In this context, the standardization strategies of Nike in the British market will be discussed below through the 4Ps of Marketing.

Figure 2: 4ps of the marketing mix

Product

Nike sells a wide range of products, including sports footwear, apparel, gear, and accessories. It creates and markets products for all young and middle aged consumers. Nike's marketing plan calls for growing the business through adjustments to the product mix based on the British market. The manufacturer markets these products under a variety of its brands, including Converse and Air Jordan (Childs & Jin, 2018). Nike broadens its product portfolio to better align with competitive landscape and suit the expectations of consumers and British market segments that rely on such marketing elements.

Place

Retail stores are the primary venues where Nike products are sold since they are strategically located and easy to get to all across the United Kingdom. These vendors include both large corporations like Walmart and small small local merchants. This also shows how consumers may purchase athletic items from Nike's web store. Furthermore, Nike operates its Niketown London store and Nike Factory stores throughout the United Kingdom, where it has oversight over retail sales practises and market analytics (Scott, 2018).

Price

Nike develops a value-based pricing strategy while taking into account consumer views of the cost of its items. The Inperceived value influences the high prices that consumers pay for the business entity's items (Brohi et al., 2016). In contrast, the premium pricing strategy of Nike uses high prices to promote its items as being of superior quality and value than those of competing firms. Given that its products are of great quality, it charges a higher price (PANDEY, 2017). However, other crucial determinants, such as its popularity as a label and the devoted following of its consumers, help to explain its high price (Dawes, 2009).

Promotion

Nike markets their products through both offline and online media. Additionally, Nike advertises its products by supporting sports stars and athletic events (Alsaffar, 2020). Personal selling through sales employees at Niketown retail shops is another promotion tactic of Nike. Furthermore, consumers in the British market who become members get access to some of the business entity's trendiest and most cutting-edge items before they are available anywhere else (Nike.com, 2022). The company also makes extensive use of digital video marketing to advertise its goods, which are mostly aimed at the sports community in the British market.

(b) Whether these strategies are different to the ones used in other international markets. Why and/or why not?

Due to some specific reasons which are applicable to the British market, these strategies would be different to the ones used in other international markets. The reasons behind these range from the increasing Awareness of the British population towards healthy food habits and a fit and active lifestyle to the increase in the growing number of Sporting events that would significantly contribute to the growth of the British sports industry that will further be supported by the booming economy of the nation.

From the year of 2023 to 2027, the British sportswear market is predicted to rise at an outstanding CAGR (Techsciresearch, 2022). The population's increasing desire for stylish, perfectly fitted athletic apparel will be the primary driver of market expansion. The demand for activewear is expected to increase in the future 5 years due to the growing number of people who are actively involved in regular exercise and are very worried about their health.

The public is very worried about their fitness due to rising rates of diabetes, obesity, and other diseases. Even among children, physical activities like yoga and swimming are growing in popularity, which will help the British sportswear industry expand over the next 5 yearsIn this backdrop, a surge in health issues among the nation's adolescents and adults will cause the British sportswear industry to grow over the course of the next 5 years. Because of the population's increased sedentary lifestyles, overweight, diabetic, and high blood cholesterol are on the rise. Over 4 million people in the nation will have diabetes by this year, compared to 850,000 who will either go undiagnosed or uncounted (Gregory, 2022). In the nation, 63% of people were overweight as of 2021, and 50% of people have been given an obesity diagnosis. Growing public concerns about healthy living and the risks of chronic illnesses like cardiovascular diseases encourage people to engage in physical activity and exercise, which will help the British sportswear industry expand over the next 5 years (Siddique, 2019).

In addition to that, after the global crisis which was caused by the pandemic of the Covid 19 virus, the Global population have become more health conscious and has been putting serious concerns about much more conscious of the negative effects of sedentary lifestyles, junk food intake, alcohol usage, and other factors that have caused people to prioritise money above their health (Saah et al., 2021).

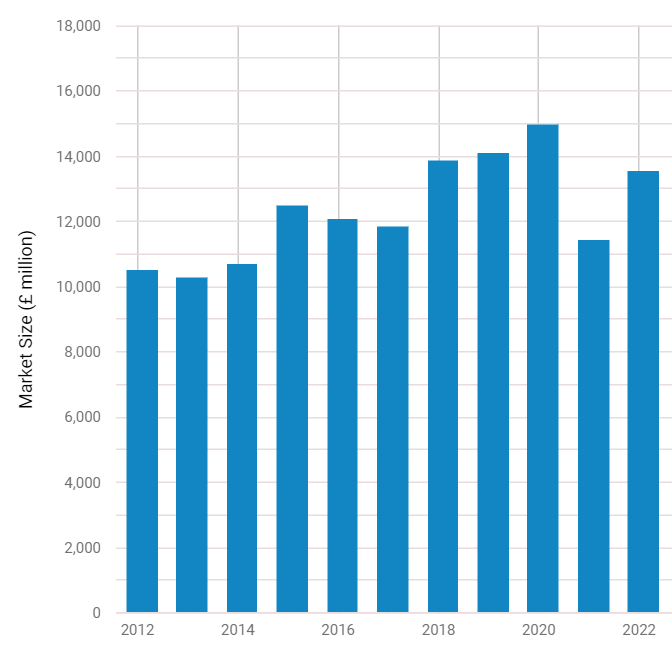

In addition to that, The country's growing number of sporting events will also contribute to the UK sportswear market's expansion during the next 5 years. In terms of income, the Sports sector will have a market worth more than 13 billion pounds in the year of 2022 (Ibisworld, 2022). In addition, it is anticipated that the Sports industry's market size would grow by more than 18% in the year of 2022 (Ibisworld, 2022).

Figure 3: Market size of the British sports industry

A booming economy ensures that more money will be available to the general public. The rise of British sports over the next 5 years is made possible by rising monthly income and a population that is becoming more inclined to invest in goods like sportswear (Clark, 2022). Athletic footwear is the most frequently purchased category of sporting goods in the British market, according to recent studies, with around 60% of customers have purchased it in the previous year (Tighe, 2022). Comparatively, just over half of the British consumers surveyed had purchased sportswear in the previous two years. The expansion of the British sportswear market over the next 5 years will be supported by the rise in demand for sports fitness, expanding home gym equipment adaptations, and rising demand for sports apparel.

Because of the above-mentioned reasons, the standardisation strategies would differ to some extent from the ones that are used in other international markets. Therefore, sportswear brands such as Nike would require to take adaptation strategies in accordance with the specific factors regarding the British market in two considerations while developing and implementing marketing strategies.

(c)The challenges of adaptation and/or standardisation strategies used in the British market compared to other international markets.

The current instability in local currency and bond markets has added to 6 years of extraordinary disruptions for businesses entering the British market, beginning with Brexit and continuing through the crisis which was caused by the pandemic of the Covid 19 virus and the effects of Russia's conflict in Ukraine. Executives claim that the current market upheaval has further eroded already shaky corporate confidence, endangering future investment and undermining economic development in the 5th largest economy in the globe (MacDonald, 2022). Additionally, the government recently stunned investors by announcing a significant tax reduction, propelling the British currency momentarily reaching a record low versus the dollar while driving up government debt rates. Since then, the currency has largely recovered, but the higher rates pose a danger to borrowing costs for both customers and business entities.

The United Kingdom's Gross Domestic Product fell by about 11% in 2020, the most among the Nations of the Group of Seven, as a result of the combined effects of the crisis which was caused by the pandemic of the Covid 19 virus and Brexit on the economy (The Economic Times, 2022). Immediate and monetary help, together with a prompt vaccination delivery, enabled it bounce back, with a Gross Domestic Product that is today greater than it was before the epidemic. However, disruptions brought on by Brexit, a lack of supplies, rising costs, and Russia's invasion of Ukrainians have all impeded the nation's economic recovery. London, which is among the most costly cities across the globe, is becoming, even more, costlier to conduct business in as a result of increased inflation (annualised rate of 9.1%) (Oxford Analytica, 2022).

Apart from these reasons, any business entity using digital marketing methods will be significantly impacted by the General Data Protection Regulation, a significant revision to the data protection laws of the European Union. For business entities looking to enter and conduct business in the British market, the General Data Protection Regulation is crucial to take into account as the United Kingdom continues to adhere to it after Brexit. This is necessary since breaking it might result in a punishment of up to 20 million pounds, or 4% of annual sales (Barrett, 2019).

(d) Critically discuss the similarities and differences between the standardization and/or adaptation strategies used by your chosen brand or company in the British market and by its major competitor

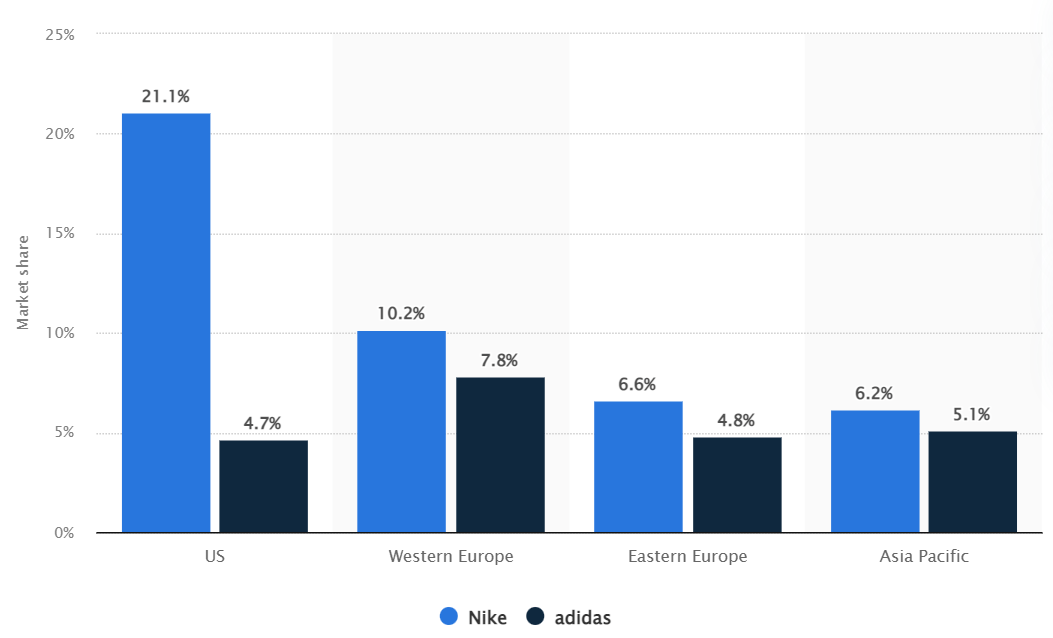

One of the biggest competitors of Nike in the British market has been Adidas which also operates within the sportswear industry. Both business entities have constantly captured a significant amount of sportswear market share in the British market over the years.

Figure 4: Nike vs Adidas sportswear market share

In this context, the various marketing mix factors and the similarities and differences between the standardisation strategies of both business entities have been critically discussed below.

Product

In the British market, Nike offers a huge selection of items. In the British market, Nike's primary product portfolio is the Sportswear range, which consists of sports footwear, t-shirts, sweatpants, underwear, and sock. Sports bags, protective gloves, and other accessories are included in the area of sports kits. Nike consistently aims at producing goods in such a manner that it may decrease damage, and its products are highly distinctive in terms of both product quality and features.

While on the other hand, Nike and Adidas both produce similar goods. In addition to sports sportswear, and other sports accessories such as protective gloves, watches, eyewear, and other sporting items, Adidas' line of products is available in the British market. Adidas is mostly concerned with producing items of the greatest grade.

Place

Almost all of Nike's products are distributed in the United Kingdom. As of 2022, there are 40 retail outlets of Nike in the British market (ScrapeHero, 2022). With 30 retail sites or almost 75% of all Nike retail locations in the British market, England is the nation with the most Nike outlets in the United Kingdom (ScrapeHero, 2022). Niketown, the brand's own shop, is located in London (Nike.com, 2022). Nike also has a website-based shop. In addition to this, Nike maintains its own distribution facility in the United Kingdom to guarantee that its products are available there.

While on the other hand, Adidas guarantees product availability in the British market in three different methods. The business entity sells its goods directly through a single, designated store. It also uses distributors to make its items available in showrooms across the British market with several brands. In addition to that, their merchandise may also be found at other online retailers like Amazon and other regional online shops.

Price

Nike bases its pricing decisions on value instead of cost in the British market. In the British market, Nike often charges higher pricing for their products. Nike's premium pricing is justified by the fact that the British consumer has become devoted to the brand (Mahdi et al., 2015). Consumers are therefore prepared to pay more for brand identity.

Adidas, on the other hand, in the British market, charges both reasonable rates and premium prices for select specific brands. As a result, Adidas charges competitive pricing for their goods in the British market. Because of this reason, Adidas items cost less than Nike Sportswear in the British market. This indicates that Adidas' price strategy in the British market is the skimming pricing strategy (Mahdi et al., 2015).

Promotion

Both business entities in the British market employ promotional tactics to promote their goods, including the use of magazine advertising and celebrity endorsements. Nike's marketing strategy in the British market includes sponsoring well-known players and teams as one of its essential components. Adidas acknowledges the value of sponsorship, but it is not as active in its pursuit of partnerships as Nike is. Nike has always prioritised supporting the most well-known athletes and teams as sponsors. For instance, the success of athletes like Cristiano Ronaldo, Rodger Federer, and Rafael Nadal, and internationally renowned clubs like Manchester United helped Nike's sales increase in the British market (Batmunkh, 2021). Adidas, on the other hand, frequently supports important organisations and events. For instance, it is the official sponsor of the Summer Olympics, the UEFA Champions League, and FIFA (Holtbrügge & Schuster, 2017).

They both sell their products via offline and online media. Adidas and Nike each have unique brand campaigns. If British shoppers prefer to wear lightweight sports shoes, the bulk of basketball shoes are made by Adidas distinct-looking, lightweight footwear (Turner, 2019). Additionally, they use alluring marketing campaigns to draw in British customers, like making their websites appealing to online shoppers.

References

Alsaffar, H. (2020). Marketing and Services Management Nike's Marketing Mix and PESTEL analysis in China Marketing and Services Management Nike's Marketing Mix and PEST EL analysis in China Hussain Alsaffar. August.

Barrett, C. (2019). Are the EU GDPR and the California CCPA becoming the de facto global standards for data privacy and protection?. Scitech Lawyer, 15(3), 24-29.

Batmunkh, E. (2021). Role of Football in International Business and Economy. Management Science and Business Decisions, 1(2), 39-56.

Brohi, H., Prithiani, J., Abbas, Z., Bhutto, A., & Chawla, S. (2016). Strategic Marketing Plan of Nike.

Childs, M., & Jin, B. (2018). Nike: An innovation journey. In Product innovation in the global fashion industry (pp. 79-111). Palgrave Pivot, New York.

Clark, D. (2022, November 15). UK Wage growth 2020. Statista. https://www.statista.com/statistics/933075/wage-growth-in-the-uk/

Dawes, J. (2009). Brand loyalty in the UK sportswear market. International Journal of Market Research, 51(4).

Economictimes.indiatimes. (2022, August 23). UK economy shrank record 11% in 2020, worst since 1709. The Economic Times.

Gillespie, K., & Swan, K. S. (2021). Global marketing. Routledge.

Gregory, A. (2022, November 1). “Alarming” rise in type 2 diabetes among UK under-40s. The Guardian. https://www.theguardian.com/society/2022/nov/01/alarming-rise-in-type-2-diabetes-among-uk-under-40s#:~:text=The%20number%20of%20people%20under%2040%20in%20the%20UK%20diagnosed

Holtbrügge, D., & Schuster, T. (2017). The Internationalization Strategy of Adidas. The Internationalization of Firms. Case Studies from the Nürnberg Metropolitan Region, 19.

Ibisworld. (2022, August 18). IBISWorld - Industry Market Research, Reports, and Statistics. Www.ibisworld.com. https://www.ibisworld.com/united-kingdom/market-size/sports-clubs/

Indiafreenotes. (2020, February 6). 4Ps of Marketing. Indiafreenotes. https://indiafreenotes.com/4ps-of-marketing/

Kotabe, M. M., & Helsen, K. (2022). Global marketing management. John Wiley & Sons.

Lse.ac.uk. (2011, April 14). The evidence shows that multiculturalism in the UK has succeeded in fostering a sense of belonging among minorities, but it has paid too little attention to how to sustain support among parts of the white population. British Politics and Policy at LSE. https://blogs.lse.ac.uk/politicsandpolicy/multiculturalism-immigration-support-white-population/

MacDonald, A. (2022, September 30). U.K. Market Turbulence Is Latest Challenge for British Businesses. WSJ. https://www.wsj.com/articles/u-k-market-turbulence-is-latest-challenge-for-british-businesses-11664554694

Mahdi, H. A. A., Abbas, M., Mazar, T. I., & George, S. (2015). A Comparative Analysis of Strategies and Business Models of Nike, Inc. and Adidas Group with special reference to Competitive Advantage in the context of a Dynamic and Competitive Environment. International Journal of Business Management and Economic Research, 6(3), 167-177.

Nike.com. (2022). NIKETOWN LONDON. Nike.com. https://www.nike.com/retail/s/niketown-london

Oxford Analytica. (2022). Stagflationary forces will plague the UK economy. Emerald Expert Briefings, (oxan-es).

PANDEY, B. C. (2017). Nike Inc-Complete Analysis: SWOT, PESTLE and Marketing strategy. BookRix.

Rao-Nicholson, R., & Khan, Z. (2017). Standardization versus adaptation of global marketing strategies in emerging market cross-border acquisitions. International Marketing Review.

Saah, F. I., Amu, H., Seidu, A. A., & Bain, L. E. (2021). Health knowledge and care seeking behaviour in resource-limited settings amidst the COVID-19 pandemic: A qualitative study in Ghana. PLoS One, 16(5), e0250940.

Scott, I. (2018, November 30). How Nike Makes Retail Work. Www.linkedin.com. https://www.linkedin.com/pulse/how-nike-makes-retail-work-ian-scott/

ScrapeHero. (2022, October 14). Number of Nike locations in the UK in 2022 | ScrapeHero. ScrapeHero.

Siddique, H. (2019, May 12). UK heart disease fatalities on the rise for first time in 50 years. The Guardian; The Guardian. https://www.theguardian.com/society/2019/may/13/heart-circulatory-disease-fatalities-on-rise-in-uk

Smith, P. (2017). Nike and adidas: market share by region | Statista. Statista; Statista. https://www.statista.com/statistics/895136/footwear-market-share-of-nike-and-adidas-by-region/

Techsciresearch. (2022). United Kingdom Sportswear Market Share, Trends | TechSci Research. Www.techsciresearch.com. https://www.techsciresearch.com/report/united-kingdom-sportswear-market/10682.html

Tighe, D. (2022, July 25). UK: most commonly purchased sporting goods 2021. Statista. https://www.statista.com/forecasts/1284517/consumers-that-bought-sporting-goods-by-product-type-uk

Timmermans, S. and Epstein, S., 2010. A world of standards but not a standard world: Toward a sociology of standards and standardization. Annual review of Sociology, 36(1), pp.69-89.

Timmermans, S., & Epstein, S. (2010). A world of standards but not a standard world: Toward a sociology of standards and standardization. Annual review of Sociology, 36(1), 69-89.

Turner, T. (2019). Adidas and the Creation of a Transnational Market for German Athletic Shoes, 1948–1978. In Consumer Engineering, 1920s–1970s (pp. 171-190). Palgrave Macmillan, Cham.

WORLDOMETER. (2022). U.K. Population (2019) - Worldometers. Worldometers; www.worldometers.info. https://www.worldometers.info/world-population/uk-population/

Go Through the Best and FREE Case Studies Written by Our Academic Experts!

Native Assignment Help. (2026). Retrieved from:

https://www.nativeassignmenthelp.co.uk/principles-of-international-marketing-nike-inc-case-study-20328

Native Assignment Help, (2026),

https://www.nativeassignmenthelp.co.uk/principles-of-international-marketing-nike-inc-case-study-20328

Native Assignment Help (2026) [Online]. Retrieved from:

https://www.nativeassignmenthelp.co.uk/principles-of-international-marketing-nike-inc-case-study-20328

Native Assignment Help. (Native Assignment Help, 2026)

https://www.nativeassignmenthelp.co.uk/principles-of-international-marketing-nike-inc-case-study-20328

- FreeDownload - 2169 TimesWider Professional Practice and Development in Education

Wider Professional Practice and Development in Education Get free samples...View or download

- FreeDownload - 1214 TimesUnilever CSR Analysis: Sustainability and Governance Insights Case Study

Evaluating Unilever’s CSR Policies and Stakeholder Engagement Part 1:...View or download

- FreeDownload - 1572 TimesGlobal Supply Chain Management of Tesco, Lidl, Aldi Comparative Analysis Case Study

Analyzing Global Supply Chain Strategies: Tesco, Lidl, and Aldi The UK’s...View or download

- FreeDownload - 850 TimesSTO306HK - Current Issues in Management Maxims Group

STO306HK - Current Issues in Management Maxims Group Case Study Current Issues...View or download

- FreeDownload - 414 TimesApplying Millers Four Pillars Model: Addressing Michael Needs in Care Case Study

Introduction: Applying Millers Four Pillars Model: Addressing Michael Needs in...View or download

- FreeDownload - 1319 TimesHikma Pharmaceuticals Business Strategy and Competitive Analysis Case Study

Strategic Position and Market Competitiveness of Hikma...View or download

-

100% Confidential

Your personal details and order information are kept completely private with our strict confidentiality policy.

-

On-Time Delivery

Receive your assignment exactly within the promised deadline—no delays, ever.

-

Native British Writers

Get your work crafted by highly-skilled native UK writers with strong academic expertise.

-

A+ Quality Assignments

We deliver top-notch, well-researched, and perfectly structured assignments to help you secure the highest grades.