Reducing Carbon Emissions: Impact of Car Tax and Public Transport Subsidy

Native Assignment Help provides assignment help to assist students in research, writing and proofreading process.

Introduction: Lowering Carbon Emissions Through Transportation Policy Analysis

Air pollution is considered as one of the most dangerous factors that is affecting nature and the environment. Many issues are being created on the basis of air pollution. One of the main causes of air pollution is the high rate of carbon emission. The reduction of the carbon emission in nature is the most appropriate factor for reducing many aspects such as “reduce the amount of energy you use, eat fewer animal products, shop locally, travel smart, and reduce waste”. The study is going to analyse the policies that are generated by the government for reducing carbon emission. The study is going to be significant as the study is going to analyse the policies closely and going to describe the impact of the policies on the processes of reducing the carbon emission of the environment. The study will further proceed with discussing the two polices and their impact on reducing the carbon emission in the environment.

Thesis Statement: A tax on the sales of cars and subsidy on the public bus fare are the two policies that are capable of reducing carbon emission.

Discussion

The government has discussed many policies for reducing the carbon emission and through the records is clear to the government that maximum amount of carbon emission is produced from the automobile industry for the analysis. The maximum amount of carbon that is being emitted is from the automobile industry and it is highly effective for the environment. Thus the government has started from the various policies like the several factors for involving the nature for the analysis. The automobile industry is increasing the percentage of greenhouse gasses in the environment. Thus the factors are very impressive for the several analytical aspects for the company evaluation. The two policies that are being addressed by the government are “a tax on the sales of the car” and “a subsidy on the bus fares”. These are the two policies that are introduced by the government for reducing carbon emission. The government has the idea of reducing the factors through the several factors for the development of the issues. The government predicted that these will reduce the use of the vehicles and the carbon emission will reduce at a high rate, which is very effective for protecting the environment.

Impact of then policy a tax on the sales of the car

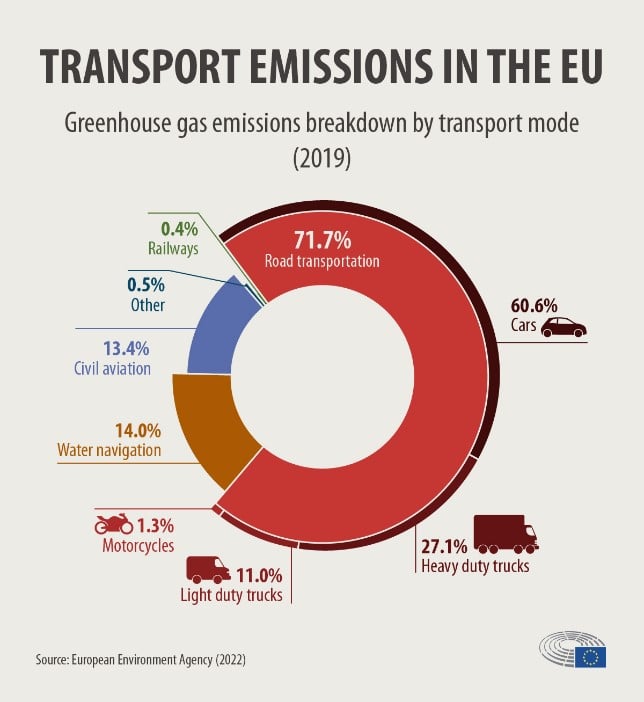

Transport emission is very impressive for the analysis of the several aspects of the cars in terms of the Carbon-di-oxide emissions. The emission of the green houses games needs to be reduced at a high rate which is the most appropriate factor for the analysis of the nature. The analysis is resulting in improper factors for several aspects of reducing carbon emission. The increment or inclusion of the tax in sales of the car will reduce the number of sales of the cars. It will be very impressive for reducing the percentage of carbon emission. The factors are very impressive for the analysis of the several aspects of the company. The taxation policies across Europe are very useful as the use of cars that emit less amount of carbon is reduced and it is a huge factor for the analysis of the market (Mostafaeipour et al., 2022). This process will help in the use of the low emissions of the carbon and it is a huge effective factor for reducing the carbon emission and the national vehicles fleet is also impacted through the reduction of the emissions.

Figure 1: Transport emission of carbon

There are many examples where the tax-benefit is providing a huge impact on the reduction of the carbon emission on the environment. The environment is affected through the analysis processes and the processes are needed to be impacted for the several aspects of the market. For example, in the market of Germany the use of cars enmities a high percentage of carbon is reduced. It is a huge factor for the market assumption and the impact of the market is based on how the processes are being affected. In the opinion of Sun et al., (2020), Germany is successful in reducing 50 g CO2/km reduction and it is a huge factor for the country. On the other hand, the United Kingdom is able to reduce the 95 g CO2/km in the country and it is a huge factor for reducing carbon emission in the market development plan. On the other hand, the Netherlands produced the most appropriate advantage in the tax payment variations and reducing the amount of carbon reduction of the carbon emissions (Zhang et al., 2021). These are the nations which have benefited from the policies at a high rate.

Impact of subsidy on public bus fares

The transportation sector is considered to be one of the key contributors to worldwide carbon emissions. However, many governments are taking key decisions, in this regard, to reduce carbon emissions. Subsidising fares of public transportation is such a way incorporated by governments to reduce carbon emissions. Subsidies are considered the mone of the principal techniques for governments to increase awareness among the general public to ride public transport as well as promote clean fuels. Several research studies have shown that investments in public transportation such as railways result in lower carbon emissions. According to Zhang et al. (2020), subsidies on fares of public transportation systems can persuade the general public to opt for utilising this system instead of the private transportation system. Public transport is considered a crucial factor to tackle the challenge of rising carbon emissions. The implementation of proper subsiding schemes should be followed by governments as it can cause a burden of deficits in fiscal policy. Sarrakh et al. (2020) argues that if the subsidies fail to enhance the quality of the service, they can lose their effectiveness. Most importantly, the government should opt for implementing targeted subsidies to increase access to public transport for people, especially for disadvantaged communities.

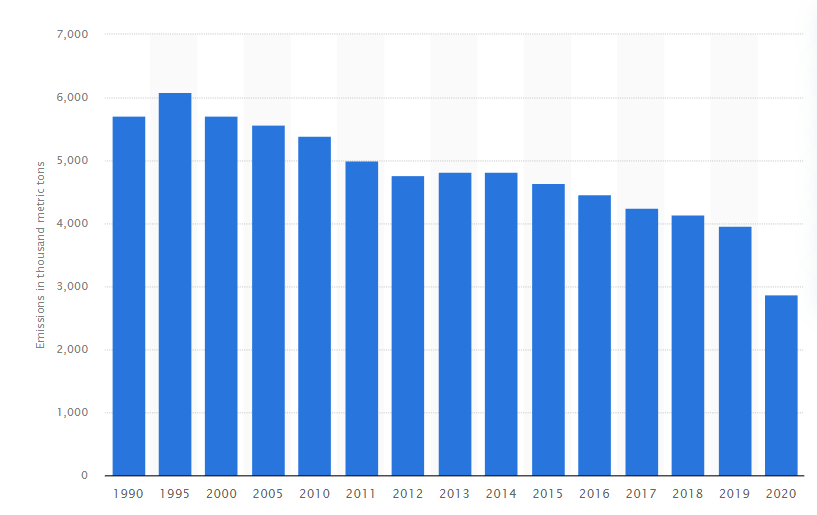

However, on the other hand, the public transportation system also contributes to carbon emissions. For instance, the United Kingdom’s urban public transportation system generated nearly 2.9 million metric tons of CO2 in the year 2020 (Statista, 2022). It implies that subsidising the public transportation system would not result in much relief for the governments to tackle the challenges of carbon emissions. Most importantly, the public transportation system has been witnessing a steady decline in the generation of carbon emissions since the year of 1995. The public transportation system of the UK generated a record high of over 6 million metric tons of CO2 in 1995. The public transportation system such as trains and buses can release one-third of the total emissions of the private transportation system. In contrast, Zhang et al. (2018) states that private transportation systems generate way more carbon emissions as compared to public transportation systems. However, several research studies have argued against the effectiveness of subsidies on fares of public transport in tackling the challenge of carbon emissions. Most importantly, subsidising fares on public transport can lead to increasing pressure on the fiscal policies of governments. It particularly impacts the fiscal policies of developing countries.

Figure 2: CO2 emissions from public transport in the UK

Among the public transportation systems, the passenger car segment generated nearly 52 million metric tons of CO2 in the year 2020. It denotes that the private transportation system produces more CO2 than the public transportation system in the UK. Thus, subsidising the fares on public transportation systems such as Busses would help the government in reducing carbon emissions to a larger extent. Therefore, the benefits of subsiding fares on public transport outweigh the drawbacks of public transport such as annual carbon emissions. There are 2 principal ways to implement the subsidy on fares of public transport. Firstly, the government can opt to subside fares within a certain rate as it can be effective in eliminating the extra burden on fiscal policy as well as persuading people to opt for public transport (Zhang et al., 2020). Apart from this, the government should charge other passengers who opt for private transport. Therefore, it can be argued that subsidising fares on public transport would not result in much relief in addressing the challenge of carbon emissions. It is due to the carbon emission produced by public transport and low amounts of subsidies that fail to attract the attention of the general public.

Conclusion

Rising carbon emission is a key concern for all governments and people across the world. Transportation is one of the largest contributors to worldwide carbon emissions. Governments are implementing several measures to tackle the challenge of rising carbon emissions. Taxes on the sales of cars and subsiding on fares of public transport are two such policies through which the government intends to address the challenge of carbon emissions. Taxes on the sales of cars have benefited many countries in reducing carbon emissions. The public transport system also generates significant amounts of carbon emissions, however, it is much lower as compared to the private transportation system. However, public transport has been successful in reducing its carbon emissions steadily over the past few decades. Government should also opt to implement subsidy schemes effectively to reduce the burden on fiscal policies and enhance the quality of the service for the general public. Therefore, it can be concluded that both these policies can help in reducing carbon emissions.

Reference list

Hu, Y., Ren, S., Wang, Y. and Chen, X., 2020. Can carbon emission trading scheme achieve energy conservation and emission reduction? Evidence from the industrial sector in China. Energy Economics, 85, p.104590.

Mostafaeipour, A., Bidokhti, A., Fakhrzad, M.B., Sadegheih, A. and Mehrjerdi, Y.Z., 2022. A new model for the use of renewable electricity to reduce carbon dioxide emissions. Energy, 238, p.121602.

Sarrakh, R., Renukappa, S., Suresh, S. and Mushatat, S., 2020. Impact of subsidy reform on the kingdom of Saudi Arabia's economy and carbon emissions. Energy Strategy Reviews, 28, p.100465.

Statista, 2022. Carbon dioxide emissions from urban public transport in the United Kingdom (UK) from 1990 to 2020. [Online]

Sun, L., Cao, X., Alharthi, M., Zhang, J., Taghizadeh-Hesary, F. and Mohsin, M., 2020. Carbon emission transfer strategies in supply chain with lag time of emission reduction technologies and low-carbon preference of consumers. Journal of Cleaner Production, 264, p.121664.

Zhang, L., Long, R., Chen, H. and Yang, T., 2018. Analysis of an optimal public transport structure under a carbon emission constraint: a case study in Shanghai, China. Environmental Science and Pollution Research, 25(4), pp.3348-3359.

Zhang, L., Long, R., Huang, Z., Li, W. and Wei, J., 2020. Evolutionary game analysis on the implementation of subsidy policy for sustainable transportation development. Journal of Cleaner Production, 267, p.122159.

Zhang, L., Long, R., Li, W. and Wei, J., 2020. Potential for reducing carbon emissions from urban traffic based on the carbon emission satisfaction: Case study in Shanghai. Journal of Transport Geography, 85, p.102733.

Zhang, W., Hong, M., Li, J. and Li, F., 2021. An examination of green credit promoting carbon dioxide emissions reduction: a provincial panel analysis of China. Sustainability, 13(13), p.7148.