- FNN 5200 - Sustainable Financial Transformation: Microsoft's ESG Approach.

- Introduction: FNN 5200 - Sustainable Financial Transformation: Microsoft's ESG Approach.

- 1. The new norm of integrating sustainable finance from Microsoft into corporate finance processes.

- 1.1 Change of corporate objectives in terms of the traditional paradigm to the new ESG paradigm.

- 1.2 Differences between the stakeholder model and the shareholder model.

- 2. The role of finance in the pursuit of sustainability.

- 2.1 Difference from long-term value creation potentiality with a net present value approach.

- 2.2 Differentiation of maximised integrated value with maximised financial value in decision-making.

- 2.3 Description and state the usability of extra financial in financial reporting.

- 3. Explain the reasons behind the importance of transforming finance to achieve a sustainable future.

- 3.1 Reasons behind traditional stock compensation for a sustainable future.

- 3.2 Financial and sustainability targets of ESG.

- 3.3 Change the target from the stock option to sustainability to motivate the corporation for a sustainable future.

- 4. The role of the finance team in business development for a more sustainable future.

- 4.1 Differences between the efficient market hypothesis and the adaptive market hypothesis.

- 4.2 Demonstration of the M&A appraisal process.

- 4.3 Process of a corporate change from a traditional to a new ESG paradigm.

FNN 5200 - Sustainable Financial Transformation: Microsoft's ESG Approach.

Are you in need of online assignment help in the UK with AI-free case study? Look no further than Native Assignment Help. We have a dedicated team of professionals who are committed to delivering customised support for your academic needs and ensuring that you get excellent marks on all your assignments.

Introduction: FNN 5200 - Sustainable Financial Transformation: Microsoft's ESG Approach.

This report is going to demonstrate the sustainable financial opportunity for Microsoft. It has been going to involve corporate change within the organisation, from the traditional paradigm to the new ESG paradigm. Sustainable corporate finance transformation is going to be explained by using ESG Framework targets and objectives for the company. An explanation of the ESG paradigm and the traditional paradigm is going to be described by involving the new norms of the integrated sustainable financing situation at Microsoft.

1. The new norm of integrating sustainable finance from Microsoft into corporate finance processes.

1.1 Change of corporate objectives in terms of the traditional paradigm to the new ESG paradigm.

It has been mentioned that there are purpose-driven proportions in aspects of the maximum profit determination of the company. It involves corporate governance utilisation and serves stakeholder interests on a long-term basis. This new paradigm for corporate finance expresses the consideration of the environment, societal, and governance aspects to introduce a meaningful business philosophy to the company. However, it shares the concept of 3 p’s, people, profit, and the planet. The new ESG paradigm expresses that businesses should take into consideration the interests of people, which include stakeholders and shareholders of the company, as well as societal interests. The term profit in the three p’s concept explains segmentations regarding the profit allocation scope of the business (Tien et al. 2020). Lastly, Planet provides sustainable business development through modulation within the organisational system. Organisations and objectives for corporate finance have been changed to maintain all three segments of the new paradigm. This new paradigm concept for the sustainable corporate finance situation is completely different from the traditional objective paradigm. The traditional paradigm of Microsoft has not considered the people, planet, and profit concept; it only focuses on the profit maximisation aspects. However, the new ESG paradigm for Microsoft provides these three segments of consideration regarding corporate financial business maintenance objectives to improve the integrated sustainable finance system within the organisation.

1.2 Differences between the stakeholder model and the shareholder model.

The shareholder model has been explained that it might not be required in the long-term basis for achieving the company’s success. However, the stockholder model indicated that stakeholders in the company might take action based on the criteria for the company’s success. Shareholders have ownership of the company as it has purchased its stock. On the other hand, the stakeholder model explains that there are no requirements for ownership, and the stakeholder might not have ownership of the company (Vernimmen et al., 2022). The shareholder model expresses that the company's day-to-day decisions might not affect the shareholders. However, the aspect of the stakeholder model indicated that the company's day-to-day decisions impacted the movement of stakeholders of the company. The stakeholder and shareholder are competing regarding their interest in the business and relationship with the organisation. In terms of decision-making aspects, shareholders' point of view is being impacted by the business decision of the company. However, stakeholders' point of view is not impacted directly by the business decision, but in terms of CSR governance, companies should take into consideration the interests of the stakeholders. In business, ethical maintenance explains that both shareholders and stakeholders' interests are being taken into consideration by the organisation.

The company's operations increased shareholders' profit but it might negatively affect the stakeholder's proportion. Shareholder models explain that shareholders of the company have the power to impact and control management decisions and influence strategic policies within the organisation. Additionally, the stakeholder model identifies that stakeholders do not have the power to impact and control the managerial decisions of the organisation, but they might take part in the company’s success factors (Quiry et al., 2022). The CEO of Microsoft, Satya Nadella, is a shareholder of the company and shares the managerial control of the company. On the other hand, employees of Microsoft are the stakeholders of the company, who have been affected by the declining profit allocation of the company along with any business decisions.

2. The role of finance in the pursuit of sustainability.

2.1 Difference from long-term value creation potentiality with a net present value approach.

The net present valuation approach is the most efficient investment appraisal approach for evaluating investment return. However, this approach provides the investors with the potential to get potential returns from the investment in the future. The net present valuation approach provides an evaluation of the present value of the project's cash flow in the form of negative and positive values (Salzmann, 2013). A negative present valuation denotes that investors do not invest in the project as it is going to provide the financial future. Additionally, a positive net present valuation indicates a good investment, as it is going to provide a potential investment return to the investors. Long-term value creation provides the optimisation of financial, environmental, and societal value determination on a long-run basis. This value-creation method focused on increasing business sustainability and provides evidence regarding potential investment generation options. It has contributed to more economic growth as compared to peer companies and helps to meet long-term business objectives (Bogataj and Bogataj, 20). Both the value creation approaches are going to provide a long-term valuation for Microsoft, but NPV methodology is going to provide the decision-making regarding potential investment aspects. Hence, it has been mentioned that net present valuation is better than the long-term value creation potential approach for Microsoft’s future business development aspects.

2.2 Differentiation of maximised integrated value with maximised financial value in decision-making.

The integration of value involves balancing and managing the company's societal, ecological, and financial value dimensions. The maximised integrated value sets a time horizon for the anticipated value creation of the project. As has been mentioned, the integrated value shows the typical value, the promised value, and the expected maximised value. This level of maximised integration value has been demonstrated within the pre-deal period of the project. On the other hand, maximising financial value in decision-making provides ideas regarding financial risk association in aspects of a company's cash flow determination (Hoang and Nguyen, 2021). The maximum financial value is also reflected in the profit-earning situation of the company. The increased financial value of the company technically shows the increased market capitalization of the company, which provides a better financial situation indication for future aspects. In decision-making prospects, Microsoft needs to maximise financial value consideration for better decision-making aspects.

2.3 Description and state the usability of extra financial in financial reporting.

The additional financial information is going to help the company track the operating results, and it also describes the reason behind the change in the financial statement in the year's basic financial comparison discussion (Sun, Louche, and Pérez, 2011). Additional information in the financial reporting of Microsoft is going to increase the potentiality and accuracy of the company’s financial reporting. It has been going to help create a better competitive discussion and point out financial gaps to recover it efficiently for future aspects.

3. Explain the reasons behind the importance of transforming finance to achieve a sustainable future.

3.1 Reasons behind traditional stock compensation for a sustainable future.

Traditional stock compensation has been restricted to stock units, and there are dilutes in the ownership of the existing shareholders of the company. This method has not been effective in recruiting or retaining employees if the organisation's shares are declining in the recent market. It has increased the number of shares outstanding of the company. It has not provided benefits regarding stock diversification and liquidity aspects. Additionally, do not provide information regarding dividend payments or better investment return ideas. The concept of Sustainable Finance provides the process of taking the objective of the ESG framework in terms of making the investment decision in the financial factor (Pislaru et al. 2019). This traditional method of stock compensation has not provided long-term sustainable investment opportunity aspects or economic activity preferences. To involve sustainable finance opportunities within the organisational system of Microsoft, it is required to include sustainable funds, microfinance, credits for sustainable projects, green bonds, and others. Traditional stock compensation is not considered all these components of a sustainable financial system of the company.

3.2 Financial and sustainability targets of ESG.

The sustainable finance of the company requires taking into consideration environmental, societal, and governance factors in investment decision-making. However, the objectives of ESG factors are leading towards long-term investments in sustainable economic activity. The performance indicators of sustainable reporting provide the criteria that help the company improve its future financial performance. ESG strategy includes three main principles: ESG integration, impact investing and active ownership, exclusionary screening, and positive screening. The target of this ESG framework is to attract investors and help build customer loyalty. Due to that, it has improved financial performances and sustainably created business operations (Okafor et al., 2021). This framework has been creating value regarding topline growth, cost reduction, employee productivity of uplift, investment, asset optimisation, and reduced regulatory and legal interventions of the organisation. Microsoft has invested in cutting-edge climate technologies, accounting for one billion dollars for climate solutions. The company has been accelerating the innovation fund for climate change and carbon reduction aspects. It has been provided to the company to assess the sustainable financial situation within the organizational business process.

3.3 Change the target from the stock option to sustainability to motivate the corporation for a sustainable future.

The sustainable future requires maintenance of the ESG matrix, that explains the three concepts of opportunities: people, planet, and profit. Target stock compensation has only provided extended stock options for the investment aspects and it impacted the prophetic maximisation prospects. A sustainable future provides the business with sustainable opportunities to work on diversified plans for societal development and environmental and corporate governance. These core valuation help the company easily achieve business target and goals at the end of the financial year and increase stakeholder engagement. A stock option does not cover all days of financial and non-financial proportions of the company in terms of providing the business development part (microsoft.com, 2023). Microsoft has been required to compose the further development prospects of sustainable financial policies to utilise the ESG framework modulation of the company in future aspects.

4. The role of the finance team in business development for a more sustainable future.

4.1 Differences between the efficient market hypothesis and the adaptive market hypothesis.

The Efficient market hypothesis provides ideas regarding new information of the company related to the market reflected in the stock valuation proportion. It is neither fundamental nor technical analysis to generate the excess return proportion for the company. There are three forms of Efficient market hypothesis, such as semi-strong, strong, and weak (Klok et al. 2022). These assumptions affect the company's stock prices and provide decision-making aspects to the shareholders of the company for investment aspects. The benefit of the efficient market hypothesis is that it explains the market setup for the valuation of the different stocks and it has been indicated as an impactful way for investors regarding portfolio return aspects (Abrate et al. 2019). It has described the additional risk performances regarding the current market situation. On the other hand, the adaptive market hypothesis explains the economic theory that provides a combination of principles and the controversial Efficient market hypothesis in Behavioural finance. This concept was introduced by MIT professor Andrew Lo in the financial year 2004. Efficient market hypothesis principles are not rational but behavioral finance principles concepts are rational (Carolina Rezende de Carvalho Ferreira et al., 2016). However, the adaptive market hypothesis has rational behavior finance principles along with efficient market principles. This theory has been explained as a potential hypothesis going to state that the best prediction can be made using the trial and error base (Ghazani and Ebrahimi, 2019). However, this adaptive market hypothesis has more potential for Microsoft than the Efficient market hypothesis for its recent financial situation aspects. The adaptive market hypothesis is going to provide the company with net income growth for the next year based on the financial data for 2022 (18.22%) (microsoft.com, 2023). Additionally, this method is going to provide the stock market growth aspects understanding for the company based on the financial factors available in recent years. This method is going to provide Microsoft with possible stock increased or decreased growth in the future based on the recent growth of 0.78% (289 USD) in 2023.

4.2 Demonstration of the M&A appraisal process.

The determination of the M&A appraisal process includes various stages to demonstrate valuation aspects to the company. There are five main stages of M&A appraisal: Negotiation letter of intent, assessment and preliminary review, due diligence, negotiations and closing, and post-closure implementation. These five-stage criteria of M&A appraisal explain the commercial value of the target business model along with providing financial conditions and any other legal risk (Sánchez-Granero et al. 2020). The concept of merger and acquisition appraisal has helped the company reduce financial risks. This strategy of merger and acquisition appraisal is going to help Microsoft expand its business in other markets for a better business operational proportion and utilise the business expansion opportunity.

4.3 Process of a corporate change from a traditional to a new ESG paradigm.

The traditional paradigm of corporate finance does not provide the opportunity to maintain societal and environmental aspects. However, the new paradigm considered three elements: people, planet, and profit. It has been shared not only with business development but also with a commitment towards social and environmental development. The traditional method is considered an anti-competitive analysis for the financial demonstration. Additionally, the ESG paradigm considers societal cost-benefit analysis to provide a balanced view to maintain the interest of societal and environmental benefits along with the business. The change from the traditional paradigm to the new ESG paradigm explains the development of business process opportunities and also helps to increase the profit-earning situation by maintaining all the societal and environmental impacts (microsoft.com, 2023). Microsoft has considered the ESG paradigm as it has shifted towards purpose-driven opportunities from profit maximisation opportunity. The shift from the traditional paradigm to the new ESG paradigm helped the company increase its net earnings proportion, as Microsoft’s Net earnings increased by 61271 million USD in the financial year 2021 to 72738 million USD in the financial year 2022.

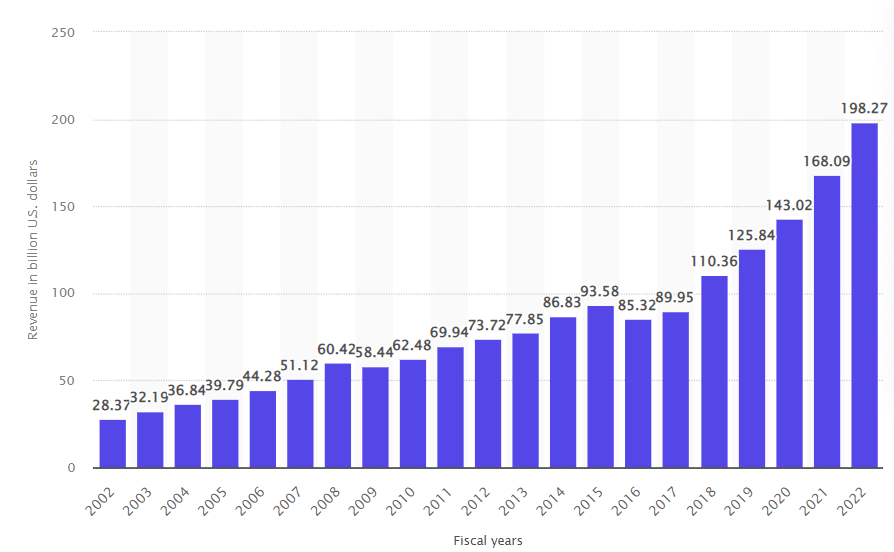

Figure 1: Revenue growth of Microsoft

Conclusion

This report has covered the sustainable corporate financing options for Microsoft. It has covered the role of sustainable financing in Traditional paradigm concepts to the new ESG paradigm. It has also provided the pursuit of sustainability in the role of Financing for Microsoft. The study explains transforming financing to achieve sustainable future Business Development aspects and ESG target for Microsoft. This report explains the efficient market hypothesis and adaptive hypothesis concepts for the sustainable future and changes from traditional paradigm to the new ESG paradigm in Microsoft.

References:

Abrate, G., Nicolau, J.L. and Viglia, G., 2019. The impact of dynamic price variability on revenue maximization.Tourism Management,74, pp.224-233.

Bogataj, D. and Bogataj, M., 2019. NPV approach to material requirements planning theory–a 50-year review of these research achievements.International journal of production research,57(15-16), pp.5137-5153.

Carolina Rezende de Carvalho Ferrei, M., Amorim Sobreiro, V., Kimura, H. and Luiz de Moraes Barboza, F. (2016). A systematic review of literature about finance and sustainability. Journal of Sustainable Finance & Investment, 6(2), pp.112–147. doi:https://doi.org/10.1080/20430795.2016.1177438.

Ghazani, M.M. and Ebrahimi, S.B., 2019. Testing the adaptive market hypothesis as an evolutionary perspective on market efficiency: Evidence from the crude oil prices.Finance Research Letters,30, pp.60-68.

Hoang, A.T. and Nguyen, X.P., 2021. Integrating renewable sources into the energy system for smart cities is a sagacious strategy toward a clean and sustainable process. Journal of Cleaner Production,305, p.127161.

Klok, Y., Kroon, D.P. and Khapova, S.N., 2022. The role of emotions during mergers and acquisitions: A review of the past and a glimpse into the future.International Journal of Management Reviews.

Okafor, A., Adeleye, B.N. and Adusei, M., 2021. Corporate social responsibility and financial performance: Evidence from US tech firms. Journal of Cleaner Production, 292, p.126078.

Pislaru, M., Herghiligiu, I.V. and Robu, I.B., 2019. Corporate sustainable performance assessment based on fuzzy logic.Journal of cleaner production,223, pp.998-1013.

Quiry, P., Le Fur, Y. and Vernimmen, P., 2022.Corporate finance: theory and practice. John Wiley & Sons.

Salzmann, A.J. (2013). The integration of sustainability into the theory and practice of finance: an overview of the state of the art and outline of future developments. Journal of Business Economics, 83(6), pp.555–576. doi:https://doi.org/10.1007/s11573-013-0667-3.

Sánchez-Granero, M.A., Balladares, K.A., Ramos-Requena, J.P. and Trinidad-Segovia, J.E., 2020. Testing the efficient market hypothesis in Latin American stock markets.Physica A: Statistical Mechanics and its Applications,540, p.123082.

Sun, W., Louche, C. and Pérez, R. (2011). Finance and Sustainability: Exploring the Reality we are Making. Critical Studies on Corporate Responsibility, Governance and Sustainability, pp.3–15. doi:https://doi.org/10.1108/s2043-9059(2011)0000002007.

Tien, N.H., Anh, D.B.H. and Ngoc, N.M., 2020. Corporate financial performance due to sustainable development in Vietnam.Corporate Social Responsibility and Environmental Management,27(2), pp.694-705.

Vernimmen, P., Quiry, P. and Le Fur, Y., 2022.Corporate finance: theory and practice. John Wiley & Sons.