AC4052QA Financial Accounting Assignment

Sample financial accounting assignment analysing Tesco performance with ratio analysis, budgets, and financial statement preparation.

Ph.D. Experts For Best Assistance

Plagiarism Free Content

AI Free Content

A) Introduction

In this paper, the basic calculation and preparation of the statements for Tesco Plc, Mr. Ben and Ben Ltd were prepared in order to determine their performances and positions. These statements provide important information to deem the organizational performance based on suitability analysis including profitability, liquidity and financial structure.

B) Discussion

1.0 Analysis and Evaluation of Tesco plc (2017-2020)

Hence, it becomes easier to analyze Tesco Plc performance from the year 2017 to 2020 by the help of different financial ratios. These ratios offer an outlook of the financial performance, financial solvency and efficiency of its operations.

1.1 Performance Evaluation and Liquidity and Financial Structure

1.1.1 Performance Evaluation

There was an increase in Tesco’s profitability from 2017 to 2019 as depicted by the ROCE which was 0.55% in 2017 and 5.07% in 2018. This affirms that Tesco’s competency increased in business profit from the capital it funded (Majeed and Zainab, 2021). But going to 2020, the ROCE declined to a level of 3.83% could be due to outside factors such as the pandemic occasioned by the coronavirus.

This area saw an increase in the margin over the years, just as the other aspects of this organization. In 2017, it was reported to be 0.20% while the figure rose to 2.62% in the year 2019.

1.1.2 Structure of Finance and Liquidity

Another gearing ratios of the Tesco, namely the current ratio explained that the company faced some challenges in meeting his short term liabilities in both 2017 and 2019 (Feinberg and Zanardi, 2022). In these years, the current ratio was below 1.0, suggesting the company could have some problems with liquidity. However, it improved slightly in 2020.

The gearing ratio which determines Tesco’s use of debt was also high in 2017 at 454.71% (Folger et al. 2022). This declined to 101.20% in the year 2019, and this explains that Tesco was cutting on its rates of borrowing money.

1.2 Limitations of Ratios

Even though accounting ratios provide valuable information to assist in the management and decision-making processes of organizations, the following limitations exist with them.

1.2.1 Limitations of Ratios

The ratios do not incorporate the factors that exist outside the organization such as the market conditions and management decisions.

1.2.2 Historical aspect

The use of ratios is usually based on historical information and has little bearing on the current situation.

1.2.3 Different Accounting Methods

These methods of accounting can bring differences in the ratios between similar companies or at different time periods.

1.2.4 Non-Financial Factors

Ratios eclipse other vital factors that are not financial in nature, such as customer attitude, which is very crucial in any business.

1.2.5 Short-Term Focus

In terms of their disadvantage, Ratios are mostly based on the short-term picture and may not represent the long-term picture of the business.

2.0 Statement of Income Preparation and Statement of Position of Finance Preparation for Mr. Ben

2.1 Income Statement for the Year Ended 30 April 2022

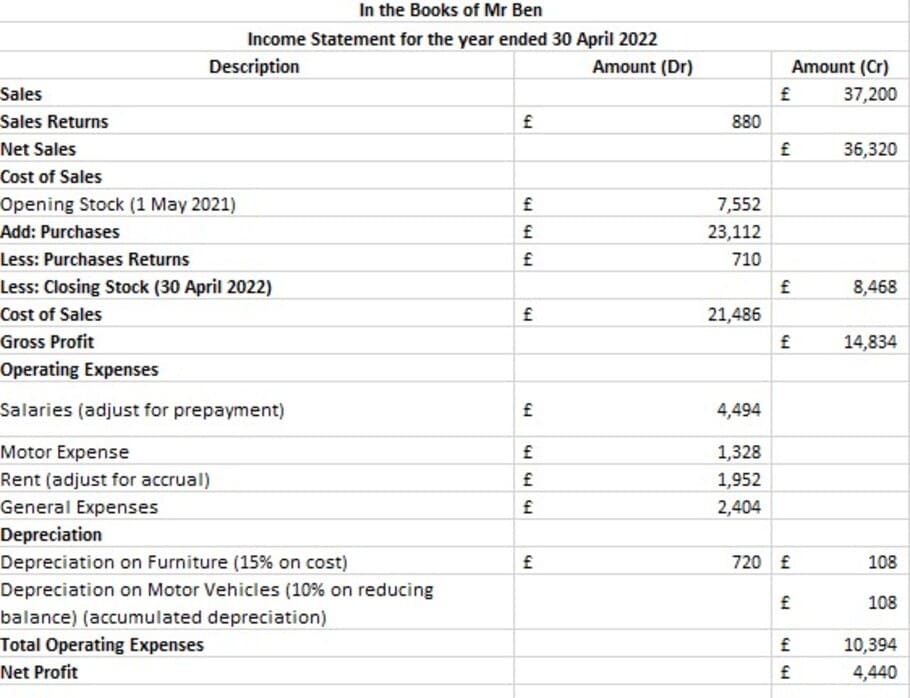

Figure 1: Income Statement

(Source: Self-created in MS Excel)

The Income Statement presents overall revenue and expenses of Mr. Ben for the business year ended 30th April 2022. The Net Sales totaled £36,320 after adjusting for the sales returns, while the Cost of Sales which was obtained by adding the opening stock of £7,552, the amount of purchase for the period £23,112 and less the purchase returns of £710 and the closing stock of £8,468 was £21,486. This was after having a Gross Profit of £14,834.

2.2 Statement of Financial Position as at 30 April 2022

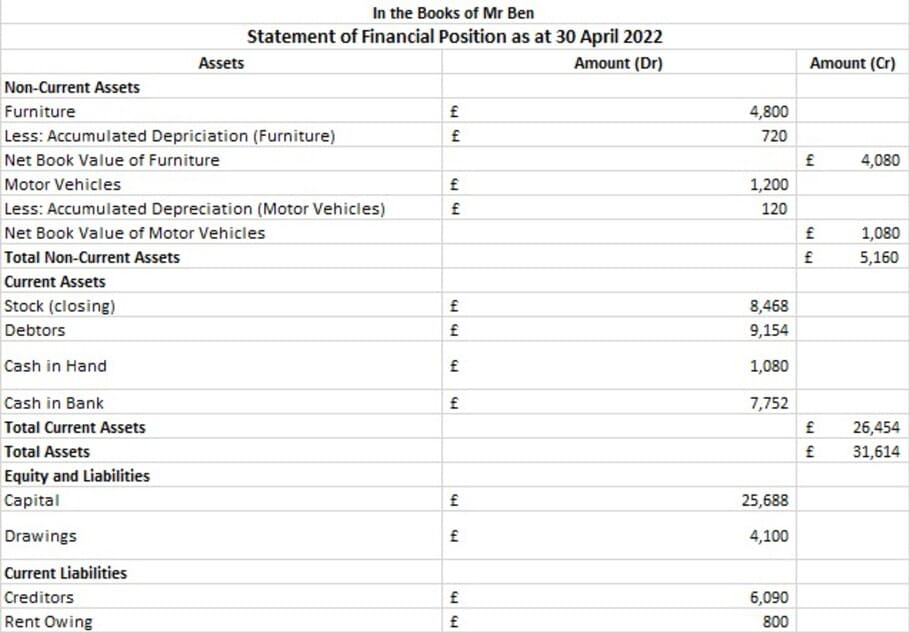

Figure 2: Statement of Financial Position

(Source: Self-created in MS Excel)

The statement of the financial position indicates the financial strength of Mr. Ben at the end of the year. On the Asset side of the balance sheet, the non-current Asset was £5,160, which comprised a furniture and motor vehicles’ total after deducing depreciation (Huang et al. 2022). The Current Assets amount up to £26,454 comprises closing stock, debtors, cash at hand and in the bank. The total assets are £31,614.

3.0 Cash Budget Preparation and Profit Budget Preparation for Ben Ltd for the Six Months

a) Cash Budget for Ben Ltd: Clothing for the period of January to June 2021

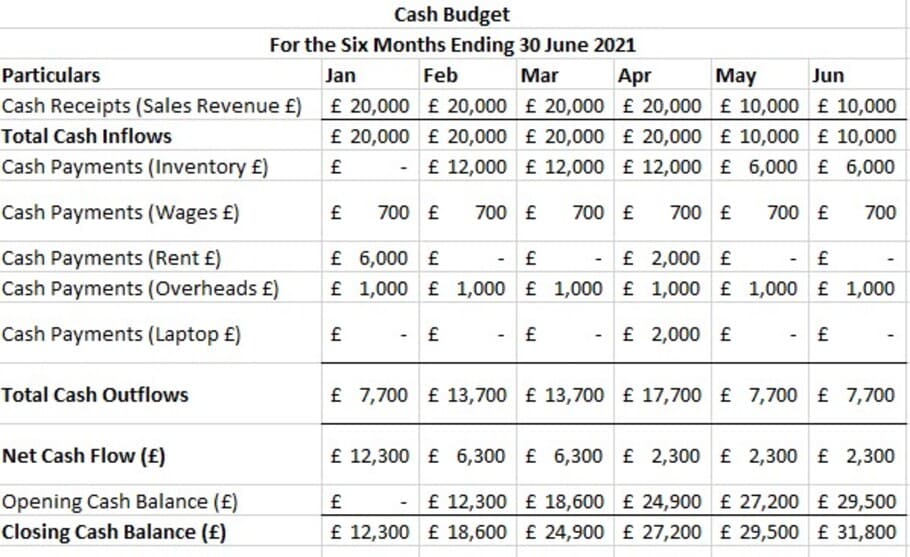

Figure 3: Cash Budget

(Source: Self-created in MS Excel)

Ben Ltd commenced business in January 2021, and it was assumed that it would generate cash from sales in each month of the year. The estimated target for sales of the sports shoes for January to April is 400 units per month with its corresponding value totaling £20, 000 (Baah et al. 2021). The sales in this period reduce to 200 units, and the total sale made in this period is £10,000.

b) Profit Budget for Ben Ltd (January to June 2021)

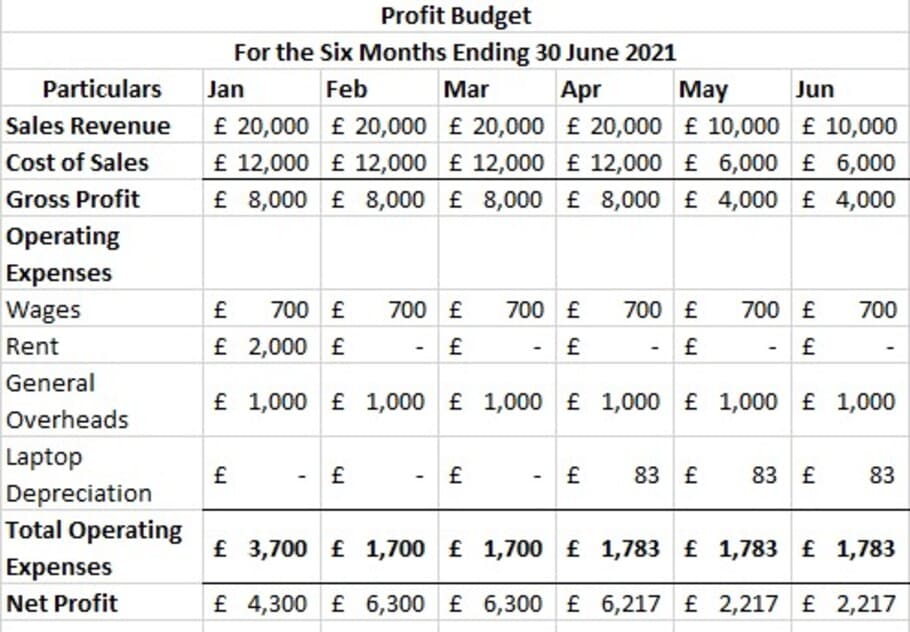

Figure 4: Profit Budget

(Source: Self-created in MS Excel)

The cost of sales for example for a given month is arrived at by multiplying the number of units sold by the cost per unit of £ 30. Hence operating expenses entails wages, rent, other overheads and depreciation on the laptops (Egorova et al. 2022). For instance, in January sales revenue are £20000 while cost of sales is £12000.

C) Conclusion

Upon evaluating Tesco’s performance and financial position from the year 2017 to 2020, the profitability, and the liquidly issues arise due to the external shocks. Thus, the necessary financial statements and budget in Mr. Ben and Ben Ltd will help to manage the financial profit, cash flow, and further financial prospects, and so it will be beneficial for the businesses.

Preparing accurate financial statements, ratio analysis, and budgets requires strong accounting knowledge and precision. This assignment sample demonstrates structured analysis and clear calculations, helping students understand academic expectations. If you’re struggling with similar accounting tasks, professional finance assignment help can ensure accuracy, clarity, and timely submission while boosting your subject understanding.

References

Journals

Baah, C., Opoku-Agyeman, D., Acquah, I.S.K., Agyabeng-Mensah, Y., Afum, E., Faibil, D. and Abdoulaye, F.A.M., 2021. Examining the correlations between stakeholder pressures, green production practices, firm reputation, environmental and financial performance: Evidence from manufacturing SMEs. Sustainable Production and Consumption, 27, pp.100-114.

Egorova, A.A., Grishunin, S.V. and Karminsky, A.M., 2022. The Impact of ESG factors on the performance of Information Technology Companies. Procedia Computer Science, 199, pp.339-345.

Feinberg, B. and Zanardi, M., 2022. Analysis of the Influence of Operational Costs on Increasing the Financial Performance of American Public Health Corporation. MEDALION JOURNAL: Medical Research, Nursing, Health and Midwife Participation, 3(2), pp.44-57.

Folger-Laronde, Z., Pashang, S., Feor, L. and ElAlfy, A., 2022. ESG ratings and financial performance of exchange-traded funds during the COVID-19 pandemic. Journal of Sustainable Finance & Investment, 12(2), pp.490-496.

Huang, Z.X., Savita, K.S. and Zhong-jie, J., 2022. The Business Intelligence impact on the financial performance of start-ups. Information Processing & Management, 59(1), p.102761.

Majeed, M.T. and Zainab, A., 2021. A comparative analysis of financial performance of Islamic banks vis-à-vis conventional banks: evidence from Pakistan. ISRA International Journal of Islamic Finance, 13(3), pp.331-346.

Go Through the Best and FREE Samples Written by Our Academic Experts!

Native Assignment Help. (2026). Retrieved from:

https://www.nativeassignmenthelp.co.uk/ac4052qa-financial-accounting-assignment-47238

Native Assignment Help, (2026),

https://www.nativeassignmenthelp.co.uk/ac4052qa-financial-accounting-assignment-47238

Native Assignment Help (2026) [Online]. Retrieved from:

https://www.nativeassignmenthelp.co.uk/ac4052qa-financial-accounting-assignment-47238

Native Assignment Help. (Native Assignment Help, 2026)

https://www.nativeassignmenthelp.co.uk/ac4052qa-financial-accounting-assignment-47238

- FreeDownload - 35 TimesUnit 4: Leadership and Management Assignment Sample

Introduction: Leadership and Management Assignment This report discovers the...View or download

- FreeDownload - 45 TimesAdvanced Measurement Systems And Data Analysis Assignment

Task 1 The solution of this problem aims at determining the straightness error...View or download

- FreeDownload - 41 TimesConsumer Behaviour Assignment Sample

Introduction- Consumer Behaviour Assignment The following report is based...View or download

- FreeDownload - 40 TimesBiomass Gasification for Sustainable Power Generation - Assignment Sample

Biomass Gasification For Sustainable Power Generation: Memorandum Of...View or download

- FreeDownload - 39 TimesStrategic Marketing Assignment Sample

Strategic Marketing Assignment 1. Introduction - Strategic Marketing...View or download

- FreeDownload - 43 TimesUNIT CMI 302 Managing a Team to Achieve Results

UNIT CMI 302: Assessment Booklet: Managing a Team to Achieve...View or download

-

100% Confidential

Your personal details and order information are kept completely private with our strict confidentiality policy.

-

On-Time Delivery

Receive your assignment exactly within the promised deadline—no delays, ever.

-

Native British Writers

Get your work crafted by highly-skilled native UK writers with strong academic expertise.

-

A+ Quality Assignments

We deliver top-notch, well-researched, and perfectly structured assignments to help you secure the highest grades.