Active vs Passive PMS (Portfolio Management Services) in India and the UK

ABSTRACT

The comparison of active and passive management of portfolios management strategies are discuss in this study based on the conditions in India and United Kingdom in terms of market condition, volatility and regulation. In the less efficient and volatile market of India, active management that involves fund managers carrying out the buying and selling of securities is more appropriate. On the other hand, passive management or the tracking of market indices is the best option in stable and efficient market like that of the UK. The evidence based on analyzing the data, correlation analysis, and statistical hypothesis testing reveals the factors that play an important role in the investment decisions: efficiency, cost, risk factor and regulatory agencies. According to the research, it is recommend that one should make their investment decisions depending on the prevailing market and or their sensitivity to risks. This study will of better importance to investors, fund manager, and policymakers as it accredited recognizes market behavior, which is an essential strength to be consider. It is thus recommend for further research to establish long-term trends in performance as well as research the other investment vehicles. The research will help to advance knowledge about which management portfolio is efficient in various forms of the market.

Chapter 1: Introduction

1.1 Introduction

Active investment management and passive investment management are two types of investment management strategies that are quite different from one another in terms of their approaches and goals (Petry et al. 2021). Active management is employed with the view with buying and selling securities using fundamental evaluation superior to that of the “market index” ascertained by purchasing stock with slight variance from an index. Therefore, the comparison between the effectiveness of the “investment strategies” in two different markets of Indian “emerging market” and UK markets helps to identify the relevance of these two investment strategies in these two markets.

1.2 Background

The investment strategies can be categorised into two categories: 1) Passive investing and 2) Active investing, by which the execution strategies, philosophical behavior, and the underlying assumption of market behavior can be analyzed (Hasnaoui et al. 2021). Both these two types of strategies followed market efficiency and targeted to gain the returns from performance of the financial markets. However, the time commitment and risk are different for these two different strategies.

Definition of strategies for active investment and passive investment

Active investment refers to the selling and buying of investments based on the “average market returns”, performance on a short-term basis. Under the Active investing strategies, the investors or the fund managers have the right to take relevant business decisions for selling, holding and buying assets (Gjeç et al. 2023). It is also identified that the “Active investors” often depend upon market analysis and market forecasting. Therefore, “Active investment” incurs some higher costs for transaction expenses and fee management.

Similarly, Passive investment represents the holding and buying of investments level with some minimal amount of portfolio turnover. This type of strategy involves diversifying portfolio investment that reflects some market compositions like “S&P 500”. Under this “Passive investment strategy”, the investor tried to match the target with market performance. For example, index funds and “Exchange-Traded Funds (ETFs)” are some examples of “Passive investing”.

Explanation of relevance of this comparison to the UK and India

Discussion on the comparison of “passive investment” and the “active investment” holds some relevant position based on distinct characteristics of the markets in different countries like UK and India (Gavrilakis and Floros, 2023). Distinct regulatory features and economic characteristics, with different investor behaviors, are responsible for the fluctuating success of the investment strategies.

The financial markets of “developing countries” like India have a growing tendency towards ETFS, mutual funds with a higher volatile nature. The promising growth is observed in overall equity markets of India over the last few years, which is less efficient than some mature markets of the UK (Mobius and Ali, 2021). The increased interest in “institutional investors”, mutual funds and government policies such as encouraging the participation of a large number of retail investors might make active investments yield a better result unlike in “efficient market”. Still, the growth of passive investing especially through ETF is credited to change of mindset among investors to low cost products.

In addition, the “UK market” is rather developed and efficient thus there is already a well-established legal framework governing the market, and participants are made up of institutional investors. The publicly traded fund industry of the UK is less risky and emphasizes on the “index-tracking investments” from strategies of passive investment levels (Lakštutienė et al. 2025). The main challenge, however, is that most active managers in the UK have been able to use the opportunity of their skills to outperform the market though this is in the sector-specific funds or in periods of turbulence in the market. This in turn makes the UK as a country to be good ground for comparing the two strategies so as to determine their effectiveness when practiced in a well-developed efficient market.

1.3 Problem Statement

Concerning the “active and passive investment strategies” there is no common knowledge in which of the two can perform well in markets. While passive investment strategy was effective in developed countries like the UK and so on, active investment may possess more benefits in “emerging markets” such as India, where the “efficient market hypothesis” does not hold all the time (Clark and Dixon, 2024). Therefore, evaluation of the different practice of “active vs passive investment strategies” helps to understand the different types of conditions of markets with different economic and investors characteristics.

1.4 Research Aim and Objective

The present research study aims to identify the comparison of effectiveness and performance of the “passive investment vs active investment strategies” in two different markets of the UK and the India. Therefore, this research study emphasized the understanding of the market conditions of two distinct markets with its effect on the identification of the success of the investment strategies.

Literature Objective

- To explain the key concepts of the “active vs passive investment strategies” applied in two distinct markets of the UK and the India.

- To explore some theoretical frameworks for supporting the “active vs passive strategies”.

- To compare which strategy is better to apply for investments in the Indian market that remains in the process of its emergence and the “UK market”, which is characterized by higher efficiency and stability.

- To assess the performance of different companies based on “active and passive management systems” and analyze the relevance of this problem to the stock markets around the world.

1.5 Research Question

Main Research Question

- What is the role of the “active and passive investment strategies” applied in the UK and Indian market context based on different data performance levels of different companies?

Sub Research Question

- What is at the core of the main concept of an “active and passive investment style” and affected the efficiency performance in two financial markets of India and the UK?

- What are the main performance differences of “active vs passive funds” based on theoretical concepts and “multifactor models (value, size)” adopted in the UK and Indian markets?

- What is the role of some company-specific type of factors like industry and market capitalization that influence “active vs passive investment strategies” of the UK and Indian market?

- What is the impact of different market conditions of economic factors, volatility for determination of the success rate of passive vs active “investment strategies” in the UK and Indian market?

1.6 Research Rational

The justification of this research is to compare “active and passive investment strategies” with reference to the performance in emerging and developed markets namely India and the “United Kingdom”. The growing financial market of India continuously faced government regulations and limited efficiency. At the same time, the UK market performed a stable financial performance that also affected the performance of different companies in these two markets (Vidal et al. 2024). Therefore, multifactor analysis such as fund values and market sizes in two markets helps to identify the effectiveness of “passive vs active performance” in the UK and the Indian market. At the same time the present global trend emphasized on low-cost options such as index funds, ETFs which creates questions about future investments of the “emerging markets”. Comparison of country performance helps to find out investment strategies for the future in these two different markets.

Chapter 2: Literature Review

2.1 Discussion of the key theories to support the strategies

“Efficient Market Hypothesis (EMH)” with passive investment

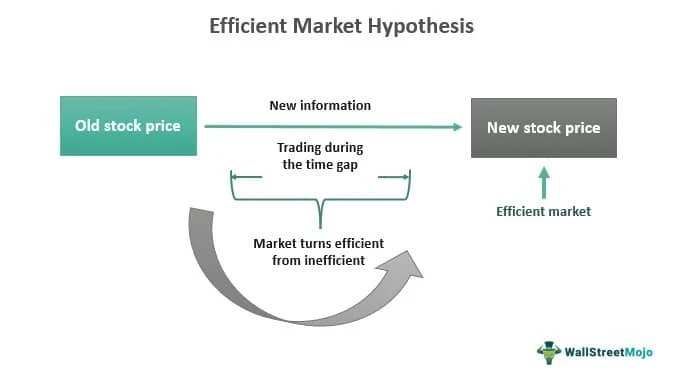

Specifically, the “Efficient Market Hypothesis (EMH)” by Eugene Fama in the 1960s states that financial markets are “informationally efficient”. As postulated by EMH, any information that is available in the market is already in the price of these securities and therefore it is not possible to outperform the market consistently using available information (Nyakurukwa and Seetharam, 2023). This leads to the conclusion of efficient markets as the idea of stock picking or timing the market will not produce better results than a passive investment strategy in the long-run.

Figure 1: EMH theory

(Source: https://www.wallstreetmojo.com/efficient-market-hypothesis/)

The passive investment strategies as recommended by EMH are “ETFs or index funds” because it mimic an index such as the “S&P500 index” cheaply. Analyzing the facts through passive investors’ lens, it is assumed that it will be positively impacted by the long-term market performance without the need for searching for specific stocks to invest in.

Theories of active listening of “Adaptive Market Hypothesis (AMH)”

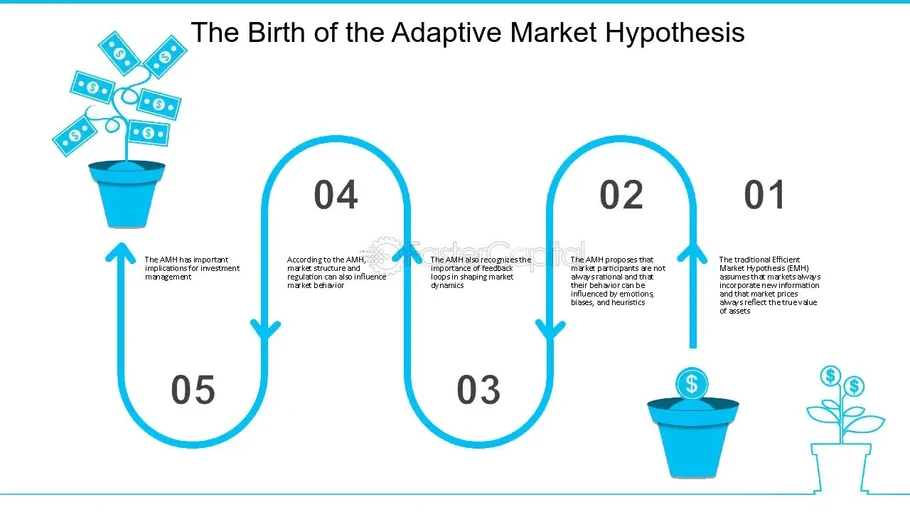

The “Adaptive Market Hypothesis (AMH)” presented by “Andrew Lo” in 2004 gives different views. The AMH as a theory proposes that efficiency cannot be constant since it undergoes changes over certain periods and in different contexts of the given market (Rönkkö et al. 2024). Unlike the EMH, the AMH postulates that investors learn and adjust to the conditions of the environment, in which stock market inefficiencies may occur in the absence of immediate or simultaneous adjustment.

Figure 2: AMH theory with active investing

(Source: https://fastercapital.com/content/Adaptive-Market-Hypothesis--A-New-Perspective-on-Efficient-Markets.html)

That is why active investing which involves trying to beat the market through the use of research, selecting of stocks or the appropriate timing mechanism perfectly suits the “AMH model”. In theory, the AMH will give a rationale for active management of funds, especially in the developing markets where they are likely to be existent.

“Behavioral Finance Theories” which challenge EMH

Behavioral finance also provides information that differs from the “Efficient Market Hypothesis”. It involves “psychology and behavioral finance” regarding the investor as irrational. For instance, the investor can be overconfident, frightened, or imitate other investors, which can lead to such effects as herd behavior or trends (Kumar, 2025). Such behavior patterns could lead to market frictions that an active investor might find profitable to take advantage of. Therefore, “behavioral finance” is evidence that the active strategies can operate and especially during the incidences where the investors’ attitude invades the sentiments and distort the market outcomes with value.

These theories provide the background to the current discussion on which strategy is more appropriate in particular markets between “active vs passive investment strategies”.

2.2 Global perspectives of “Passive vs Active Strategies”

Overview of the “Passive and active strategies”

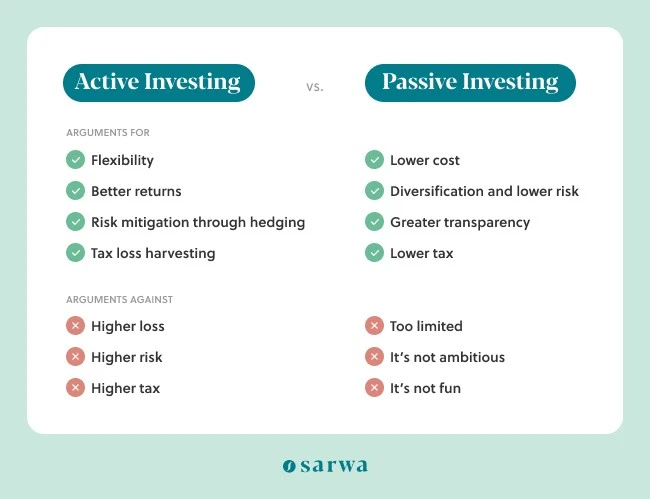

There has emerged a disagreement about the approach to investment, whether it should be passive or active across the globe, through both have merits and demerits. Active investment means there is an effort to beat the market returns by choosing specific securities, industries or at certain date of investing (Haddad et al. 2025). This strategy involves such factors as research, analysis, and may be associated with higher costs that are mainly shown as management fees.

Figure 3: Overview of “Active vs passive investing strategies”.

(Source: https://www.sarwa.co/blog/active-and-passive-investment)

Indeed, active management refers to the process of trying to beat the market through investing in individual securities, whereas passive investment is wherein one benchmarks their investment to a chosen market index or sector and purchase index funds or ETFs (Haddad et al. 2025). Passive strategies are usually converting to provide the investors with earnings in line with market returns not outperforming the same. The first one is that passive investing is cheap, and second, it does not expose an investor to the risk of a poor-performing manager.

Review of the academic papers comparing the effectiveness

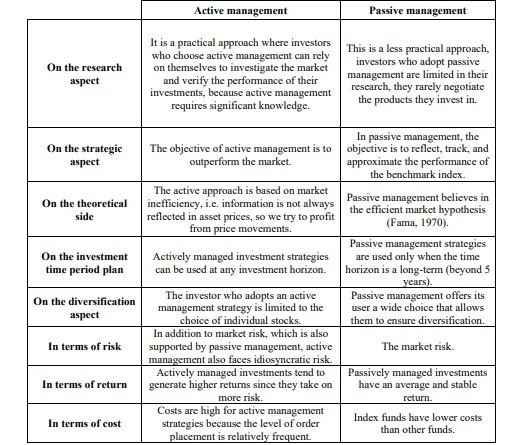

According AZOUAGH and DAOUI, (2023) the author emphasized on analyzing the comparative analysis between the “passive and active portfolio management” based on the theoretical approaches. The author highlighted “portfolio management” as the strategic investment from where the maximized return can be achieved (AZOUAGH and DAOUI, 2023). In the first section, the author identified the key concept of discussion on “active portfolio management”. In the case of this active portfolio situation, the managers always search for investment opportunities to get maximum returns. The author also highlighted the contrast of these approaches with “passive portfolio management opportunities”.

Figure 4: Comparison of the “active vs passive management”

(Source: AZOUAGH and DAOUI, 2023)

It also highlights the main comparison of both of these two approaches by using a concept of fundamental analysis. The author mentioned that this type of “active portfolio management” emphasized on bond selection and the stock selection process instead of analyzing the market index. The author also discussed that “passive management” highly depends upon the “Efficient Market Hypothesis (EMH)” using market indices and long-term strategic approaches. The author also highlighted the historical management decision of this “Passive portfolio” (AZOUAGH and DAOUI, 2023). The author also highlighted that the management method of the “Passive portfolio’ involves the “S & P 500 Index” for the US and the “FTSE 100 index” for the UK. Therefore, the author highlighted the overall comprehensive overview between these two types of investment approaches.

2.3 “Passive vs active strategies” in India

Historical development of the ETFs and “mutual funds” in India

The introduction of “mutual funds” in India started with the setting up of “Unit Trust of India” in 1964 but “passive investment” in India began only in the year 2000’s. The concept of ETFs has started in India in early 2000 as a result of which Indian investors were offered low-cost diversified investment instruments (Gupta, 2022). “Mutual funds and ETFs” had an equal growth rate over the last decade as awareness, government schemes such as the PMJDY, and the affluence of the middle class population intensified.

Market Efficiency in India with impact for strategic selection

However, the financial market of India is less efficient compared to the developed financial market of UK and US due to higher “variability, illiquidity and incomplete information”. The cut-off point may well be the result of the inefficiency, which also confirms that active managers could beat the market (Handoyo et al. 2023). Nevertheless, eventually, after the increase in complexity of the Indian market and its integration with global markets, passive investing is likely to become popular. This is evident by the fact that there is an increase in the use of “exchange traded funds (ETFs)” and “index funds” among the investors in India.

Empirical Studies of fund performance in India

According Rathod and Thakrar (2024), the effectiveness of performance evaluation of the “Indian Mutual Fund”. The author mentioned the four primary components that determine the overall financial system of India. Elaborate concept of the development of “Mutual Fund” started in 1963

Figure 5: Development process of Mutual Fund of India

(Source: Rathod and Thakrar, 2024)

The author described that the 1st evaluation process of the Mutual fund started in 1964-87. The funds from the public sector entered in second phase of the “Mutual Fund” which begans in 1987 to 1993. During this phase, LIC was established in 1990 and was able to manage the overall assets performance of approximately 47,004 crores. The 3rd phase began in 1993 and during this stage, the “Franklin Templeton” merged with the Kothari Pinoeer. This is the growing phase of Indian “Mutual Fund” because during this stage most of the foreign funds started to invest on the Indian “mutual Funds” (Rathod and Thakrar, 2024). The 4th phase began after February 2023. The author elaborately describes the growth of the “Indian Mutual Fund” and mentions the regulatory reforms, growing performance of SIPs, etc. The author also mentioned the SEBI regulation with different types of planning of multiple schemes. Finally, the author identified the main factors like expense ratios, experience, and fund size that affected performance management of the “Indian Mutual Funds”. The author emphasized on risk tolerance, market conditions and strategic decisions on taking analysisof “Indian Mutual Funds”.

Economic factors and regulatory factors affected the passive and active investment

As it has been seen, due to SEBI regulation, the Indian regulatory environment is more open and friendly to both “active and passive fund management”. Many rules that were introduce in order to increase the level of transparency or to better protect the investors have positively impacted the retail clients by making easy for them to invest in the active or passive management products (Joshi and Dash, 2024). There are many factors, which have effects on the performance of both the active and the passive fund, some of which are inflation, interest rate and GDP growth. However, it has to be noted that the risk level in India, which is comparatively higher than others may offer more opportunity to generate alpha for the active managers.

2.4 “Passive vs Active Strategies” of the UK

Evolution of the Passive and Active investment in the UK

Investment has over the years been dynamic in the nature in the “United Kingdom”. Before the emergence of passive investing or index investments, which are based on the belief that market averages cannot be beaten, active investments used to be ruling the roost wherein managers choose securities with the aim to outperform the market (Sotiropoulos et al. 2025). However, starting from the beginning of the 2000s, passive investment tools, including “indexes and ETFs”, became rather popular. This shift is due to acknowledgement of the high costs and impossibility most of the times of outcompeting the market averages. There is a minimal need for active management meaning that it is cheap to embark on passive investment which gives wide market coverage such as the FTSE 100 index. Indeed, passive approaches play a large and growing part in the population of investments in the United Kingdom today.

Efficiency of the “UK market” rather than the Indian markets

It is assumed that the UK market is efficient, even in the short term, so the stock price is up to date with the availability of various information. In such an efficient market environment, active managers experience serious difficulties in beating the market indexes (Salim et al. 2021). This makes passive investing preferable in the UK as it enables one to earn the market’s returns but at very low costs of active fund manager fees. On the other hand, developing economies such as the Indian economy may offer more scope to the active managers as it has inefficiencies with spaces that are not fully disclosed and where markets may not be perfectly competitive.

Efficiency of empirical research on ETFs and UK-based funds

According to Bonizzi et al. (2023), the UK based pension funds in the context of the liquidity performance. In the article, this represents the UK pension funds tendency to make “liquidity management” as the primary objective, and forces selling during the crisis. As a

Figure 6: “UK’s pension fund leverage”

(Source: Bonizzi et al. 2023)

As a result of market orientation of financial system, these actions erase potential for pension funds to be long-term investors (Bonizzi et al. 2023). The 2022 gilt market instability was exemplary to such issues. The paper urges the need to provide institutional changes that would enable the pension funds to achieve the social objectives of meeting the pension needs as well as promoting long-term investment.

Discussion on institutional investors' tendencies and work

Several pension funds and insurance companies are involved in active and passive equity investments in the UK marketplace. Because they have long-time horizons and huge equity, they utilize passive approaches as cheap and effective means of diversification (Blahun et al. 2022). But, active management is also observed with several institutional investors in selected sectors or where they consider there are inefficiencies. This is explained by the fact that they are in a position to diversify between passive investment opportunities and the possible active strategy returns.

2.5 Comparative analysis in UK vs India

Difference of liquidity, market structure and efficiency

Figure 7: GARCH (1,1) for Volume

(Source: Khan et al. 2023)

According to Khan et al. (2023), this paper aims at investigating if the returns and trading volume of the ASX in different week days differs from that of other Asian Markets. There are three procedures they employed in this study; ordinary least square regression, Autoregressive Conditional Heteroscedasticity (GARCH) (1,1), and the Kruskal-Wallis test. Time series data of the period 2013:07 to 2019:03 has been used and analysis done by means of EViews and SPSS. These results suggest that stock returns increase and decrease in countries such as China, South Korea, Taiwan, Thailand, Indonesia, and Pakistan due to changes in the day. On the other hand, there is no specification in either India or Malaysia (Khan et al. 2023). It is also important to note that trading volume also differs from one day to the other of the week in most of these countries, the lowest trading volume was recorded on Monday in Malaysia. This means that no causality is established between fluctuations in stock returns and the trading volume which occurs on the one and the same day. This confirms the observation made in the study that the day-of-the-week effect is not universal in all markets. This implies that the stock prices and volume have a day of the week effect where organized and systematic and there is no such pattern that exists.

Regulations role, investor behaviour for shaping the strategic effectiveness

According to Becker et al. (2024), there was tremendous interest in the usage of artificial intelligence by news organizations and various media houses have come up with guidelines for this practice. In this analysis, 52 guidelines are considered, which belong to approximate countries most of which are in western Europe and North America. This explores the way that publishers regulate AI in its coverage of the news. This study identifies many similarities, which is quite usual because news organizations are dealing with uncertainty created by AI, especially after ChatGPT’s release in November 2022 (Becker et al. 2024). It is found that most publishers pay attention to factors such as transparency and supervision specifically on matters concerning use of AI for content creation. Nevertheless, specific variations can be observed depending on the country and the particular organization. The research also identifies some areas that require further discussion including overreliance of organisation’s on the technology, integrating the use of AI into organisations for longer term use, and fairness in application of Artificial Intelligence. Therefore, according to the findings of the study, it can be concluded that the publishers are setting similar rules; however, there are significant barriers that one needs to overcome in the future.

Challenges of passive and active investors of both markets

Figure 8: Growth in Global Passive on ETF Investment

(Source: Joshi and Dash, 2024)

According to Joshi and Dash (2024), ETFs let people invest in various markets at a low cost and where information is easily available to the public. ETNs have emerged as popular financial instruments in the USA due to the fact that about half of the investments made by investors are in ETFs. While a large number of articles and papers have been written on different aspects of ETFs, only a limited number of general overviews can be found. In this way, the article analyzes 2058 articles from the last fifty years to present a proper overview of the research on ETFs. Therefore the authors review the studies that are more relevant, the journals and the research topics that are more frequent. They note that there has been a great advancement in ETF research in particular in the year 2020, 2021 and up to 2022 (Joshi and Dash, 2024). Most of the presented works are originated from the USA and other developed countries; nevertheless, there is a vast potential for research in developing countries. It also outline some topics that include risk, return, and tracking errors of ETFs. The new trends include; Machine learning, Artificial intelligence and sustainable exchange traded funds. This study also enables policymakers, researchers and regulators to have an insight into ETFs as well as identify gaps for further research.

2.6 Gap of Research Implications and Literature

The literature gap helps to identify the future “research scope” area which is discussed as follows.

Identification of the areas for research lacking

AZOUAGH and DAOUI (2023) describe a detailed discussion on the limitations and the benefits of “passive vs active portfolio management. However, the author did not identify different investors and investment companies' profiles. The author also did not identify how this type of hybrid strategy can be adapted to different types of marketing situations like the Indian “emerging markets” or the UK markets, which creates one research gap for the future research area. Similarly, Rathod and Thakrar, (2024) elaborately describe the concept of the performance of “Indian Mutual Fund”. However, the author did not emphasise an analysis of the “factor-based model”, inverstor behaviour in different markets, which creates a research gap for the future research area. On the other hand, The article of Bonizzi et al. (2023) does not explicate even though the actions of pension funds are potentially capable of either enhancing or exacerbating systemic risk or what policy changes could help alleviate these short-term pressures.

2.7 Conclusion

The above section focuses on the efficacy of “active and passive strategies” in terms of theories about them and their application in the existing markets. The “Efficient Market Hypothesis” approves passive approach whereas the “Adaptive Market Hypothesis” and “Behavioral Finance” advocate for active approach especially in the less efficient market environment.

Summaries of key takeaways

But in fully developed markets such as of the “United Kingdom”, passive strategies have the tendency of performing better mainly due to cost advantage and market efficiency. Analyzing the active strategies in “emerging markets” such as India shows that there can be higher return on investment due to inefficiencies and risks that are likely to be associated with the markets. The measures of institutional investors, regulations and economic condition plays vital role in the success of these strategies.

Chapter 3: Methodology

3.1 Introduction

Concerning the methodology used in this study and the details of the active and passive investment strategies in India and the UK, this chapter presents the information. While Chapter 2 provided the theoretical perspective of the phenomenon, this chapter provides the empirical perspective. Statistics and figures are employed in the analysis to make an evaluation on the investment performance of these two countries.

3.2 Method Outline

Sources of data: Secondary data is used in this research study, and the method used to collect data is also quantitative (Ward et al. 2021). This means that unlike surveys or interviews, the research employs secondary data that is obtained from the firms’ financial statements, the stock Exchange and investment records. It follows that comparisons are made on the numerical values of active and passive investment.

3.3 Research Philosophy

The study adopts positivism as its paradigm, implying that quantities are employed to find out more about investment plans. There is an absence of annotations and only facts and figures that are measurable and quantifiable are used in the study (McCarthy et al. 2025). This procedure is useful in making explanations of the difference between active and passive investments.

3.4 Research Approach

This means that this study is a deductive one since it starts from hypothesis regarding investment strategies and tests them against empirical data (Plazen et al. 2023). Because this study deals with the analysis of relative performance of investments, such an approach assists in generating and experimenting with hypotheses with real numbers.

3.5 Research Design

According to this study, the research design adopted is descriptive and comparative in nature (Minta et al. 2023). Descriptive research useful in explaining how the active and passive investments are carried out while comparative research useful in identifying the differences in holding the active and passive investments in India and in the UK.

3.6 Research Strategy

Secondary data collection is employed as a method: This is due to the fact that this type of study relies on previously gathered financial data of companies, stock market data, and investment fund performance S&P, Dow Jones, and FTSE (Borlase et al. 2022). The provision of the guideline guarantees that the information gathered is credible and correct.

3.7 Research Method

Methods of data analysis in the study are quantitative. This means that figures and figures are used as a basis to compare one investment plan to the other (Sangalli et al. 2024). Based on the above methodology the theoretical framework, the following techniques are used in the study.

As for the method used to compare the two investment strategies, comparative evaluation is applied to see which of them has better results by examining qualitative ratios. This involves such aspects as the return performance of the active and passive funds in India and that of the in UK, risk, cost.

3.8 Data Collection Method

The following is the list of the secondary data sources used in the study: Stock market indices. The next two tables show mutual fund and ETF performance reports. Financial statements of investment funds are also used. Some of the sources of information may be derived from regulatory authorities such as the Financial Conduct Authority in the United Kingdom and SEBI of India. Academic journals and financial market studies are going to be used for collection of data. The use of these sources makes it possible to have the appropriate information that will be helpful in the comparison of the investment strategies.

Indices such as FTSE 100 and NIFTY 50 are used since they are general market indicators. That way the study can compare the performance of the active and passive investments under various economic conditions of the indices.

There is abundance of information available with mutual fund and ETF reports such as returns, risk level, management fees and others (Othonos et al. 2023). These reports enable one to compare the difference between actively-managed funds and that of passively-managed funds.

Balance sheets, profit and loss accounts of the investment funds demonstrate their profits, losses and the overall solvency. This enables the study to determine whether active funds outperform their benchmarks once the costs have been taken into consideration.

Such regulatory reports from FCA and SEBI make data credible and assures it complies with the market standards. They provide information on how severally the various regulations impact the investment undertakings.

Scholarly publications offer articles that contain research information that can be used to perform the analysis and explain the current trends in the market. The use of these sources assists to explain the way investments has been in the past and other variables that may affect them.

3.9 Data Analysis

For the analysis of data, SPSS software was used. In order to verify how various factors influence the investment return, regression analysis is used. Regression analysis used to determine the nature of the association of investment returns and conditions of the market. The use of comparative analysis is done for the passive, and active investment strategies comparison in the UK.

Market conditions or investment style or any other conditions are observed in regression analysis to measure impact on returns of funds. This allows determining in detail which factors are most influential concerning active and passive investments.

Literally, correlation means testing or knowing how two things co-vary for instance in relation to market fluctuations and their effects on returns on investment. The implication is that one of the factors could affect the other if the two are highly correlated. It is useful in a comparison of investment plans between one market and another.

3.10 Research Ethics

In light of the fact that the study relies on data collected from previous literature analysis, the most important aspects of ethical considerations are regarding the reliability of the information obtained and the citation of sources used. Thus, the study does not employ personal data and complies with all the ethical requirements by using only financial data available to the public domain.

As the study will be based only on the data available in other sources, another aspect which can be seen as ethical is being accurate and citing the sources. An important thing to note is that this study does not employ any personal data and adheres strictly to all the universally recognized ethical standards only using the financial data that is available to the public domain.

In order to ensure that the information is reliable and credible, data is going to be collected from reliable sources (Gromova et al. 2023). This is because when the data to be used in the study is wrong or manipulated, a wrong conclusion will be arrived at.

In order to minimize bias data and any form of manipulation the study has been written objectively. This means that ethical research has to declare how data is collected and analyzed so as to avoid coming up with result that are misleading.

The study complies with the obligations stipulated by the data protection laws and code of ethics of data analysis of financial data. However, the study does not involve personal data but the conduct of the research follows the relevant guidelines to avoid any form of ethical violation.

3.11 Research Limitations

The following are difficulties that were encountered in this research:

Limited access to information: The study is limited by the available financial statements which may be partly incomplete at times.

Market fluctuations: In the stock market especially, performance might be skewed by such events like the economic crisis, or inflation that may affect the validity of past data.

Analyzed findings: The findings have been analyzed with special reference to the UK and India but the facts may not remain the same in other countries.

The study cannot regulate for such random events such as a country’s financial crash or changes in the government policies. Such events are capable of affecting the investment portfolio and therefore affect the study.

As the study is limited to only two countries, the conclusion cannot be generalized to the extent of developed markets such as the United States Market or even to emerging markets such as China. However, as mentioned, this is particularly applicable in emerging and developed markets in the following ways:

Secondary source data may be difficult to come by and some reports maybe lacking in some parameters (Hossain et al. 2022). To overcome the above, data from various sources is employed to triangulation to enhance on the accuracy and complementarity.

The elements of market regulation or changes in the financial policies could affect the investment in different way in various years. Due to this, evidence gathered from earlier data may be irrelevant in estimating the current prices in the market.

Nevertheless, proper sourcing helps in dealing with any of the above challenges by making the study as accurate as possible.

3.12 Time Horizon

Figure 9: Time Horizon

(Source: Self-created in Project Libra)

3.13 Conclusion

This chapter provides information on the research approach that would be used for comparing active and passive investment management companies in India and the UK. The research employs a quantitative research design, relying of secondary data, with the assumed positivism philosophy and a deductive method. The data such as the financial reports, stock market indices, and investment performance records are then tested using regression and correlation and comparative analysis. This makes it easier to develop a research process that belongs to the academic realm, scholarly, valid and relevant towards making investment analysis.

Chapter 4: Finding and analysis

4.1 Introduction

The presented chapter discusses the results and conclusions regarding the comparison between active and passive investments in the UK and Indian Markets. In as much as it is required to come up with the best-performing strategies in the stock markets, this objective involves evaluating these strategies depending on factors such as the returns, risks, volatility in the markets, efficiency, and other related indices. By the analysis of the given data and performance indicators, this chapter attempts to review the strengths and weaknesses of each strategy in various markets. Discussions of the results in connection with the research questions the comparison of the two strategies and the differences between them will be explain to investors. This finding analysis chapter identifies the “Passive vs active PMS” in two markets of India and the UK, which is discussed in the following sections.

4.2 Data analysis

4.2.1 Stock Indices

Figure 10: Descriptive Statistics between FTSE 100 and NIFTY 50

(Source: Self-created in SPSS)

In the UK, the FTSE 100 index varied between 7,514.93 and 8,320.29 with an average of 7792.18 and a variation of 216.80 whereas the NIFTY 50 of India fluctuated between 17648.88 and 20069.75 with a mean of 19058.29 with the variation of 653.95. The active PMS Managers tend to change portfolios with the market movements while passive PMS tracks index movement. Since the range of fluctuations of NIFTY 50 is comparatively high, it pointed to the fact that there is a comparatively high level of activity in the markets, which may be beneficial for active management (Aithal et al.2023). The FTSE 100 is less volatile, and as a result, passive management would be a suitable passive investment strategy for long-term investment in the United Kingdom.

Figure 11: ARIMA Model

(Source: Self-created in SPSS)

The results based on ARIMA (0,0,0) on PMS indicate that Portfolio Management Services (PMS) has greatly developed in India and is also in a growing stage in the UK. The coefficient of determination is equal to R-squared = 0.975, consequently, the model reflects 97.5% of change in the data. Specifically, the value of RMSE is equal to 8.355 and of MAE 6.838 testifying to small prediction errors. The value of MaxAPE is equal to 4.2 percent and it represents the highest percentage error of prediction (Petry et al.2021). The value of the Ljung-Box test is equal to 1065.79 and significant at 0.000 therefore there are some problems with the accuracy of the model. It also allows the evaluation of such things as active and passive management strategies in the investment market.

Figure 12: Correlation between FTSE 100 and NIFTY 50

(Source: Self-created in SPSS)

The results of the correlation analysis performed on FTSE 100 and NIFTY 50 are as follows: Pearson correlation coefficient = 0.920. It is explicit from the aforementioned results that FTSE 100 and NIFTY 50 moving in the same direction because a high positive value of correlation coefficient suggests that two variables or two sets of data move in the same direction with FTSE 100 increase and NIFTY 50 also increases. Since the significance value is zero, it represents a very highly significant level of correlation at 0.01 level (Reis et al.2025). The observations for both indices are 180. The result shows that the stock market of the UK and India is contemporaneous which a great help for the portfolio management process is. Thus, both active and passive clients can generate value out of this information in managing their investments.

4.2.2 Mutual Funds and ETFs

Figure 13: Descriptive Statistics between 1-Year Returns and 5-Year Return Percentage

(Source: Self-created in SPSS)

The correlation table provides information about the relationship between FTSE 100 stocks and NIFTY 50 stocks and it is 0.920 for the Pearson coefficient of correlation. This implies that the indices have a strong positive correlation and changes in one similarly affect the other. The t-test results show that this research’s notion is statistically significant as the p-value is less than 0.05, which is 0.000 (Buller, and Braun 2021). There are 180 observations of this index presented in the data set for both indices. This is relatively good information to comprehend the nature of the stock exchange in India and in the United Kingdom. Active PMS seeks to achieve a better return than the benchmark index, while passive PMS will manage to reflect the benchmark index returns. This could point out that passive PMS may be effective for both regions since there is a high correlation between the movements.

Figure 14: ANOVA

(Source: Self-created in SPSS)

These active and passive portfolio management services (PMS) in India and the UK indicate the most different performance trends. FTSE 100 and NIFTY 50 have absolute coefficient of correlation equal to 0.920, which attests to a strong relation between the two indices. Between-group variation from the ANOVA test for 1-year and 5-year returns was 19.479 and 220.579 respectively, which indicates the existence of performance difference. That is more so given that the mean square is arrived at by computing the sum of squared differences from the mean, and in this case, the Risk (Standard Deviation) has a mean square value of 6.196, which captures variability (Jani et al.2019). The expense ratios vary with a between-group sum of squares equal to 1.595, the empty group statistics tell us that they missed some data. These conclusions point out the differences between active and passive PMS strategies on returns, risks, and costs of the two markets.

Figure 15: ANOVA and Model summary

(Source: Self-created in SPSS)

This regression aims at establishing the effect of risk (standard deviation) and expense ratio on 1-year return (%). In total, the model fits 99% of the difference and achieves a 0.990 coefficient in R². As indicated in the previous sections of this paper and in concurrence with the “ANOVA test” results, there is significance (“p < 0.001”). As for the F-value, the obtained statistic (242.604) reflects a high predictive ability while the residual variability is relatively low (0.199).

Figure 16: Coefficient analysis

(Source: Self-created in SPSS)

This paper gives the coefficients table for a regression model which aims at estimating 1-year return (%). It is -1.930 with p of 0.090 therefore it shows that the coefficient is statistically insignificant (Gavrilakis and Floros, 2023). The coefficients of the following variables, “expense ratio (%) = 0.020” “P-value = 0.968” show that the regression analysis of return has an insignificant relationship. However, there exists a highly significant positive relationship at a 1% level of significance between risk (standard deviation) and return with the measure of 0.663 coefficient of beta (0.989).

Figure 17: Graphical representation of Regression

(Source: Self-created in SPSS)

Figure 18: P-P plot for Regression standardized Residual

(Source: Self-created in SPSS)

This presents an autocorrelation check that is a plot of the partial residuals to check for the normality of residuals (Mobius et al. 2021). The distribution is still close to normal distribution since the mean is almost equal to zero (2.116E-15) and the standard deviation is 0.845 proofing the validity of the model.

Figure 19: Scatterplot

(Source: Self-created in SPSS)

The R-squared value is 0.990 which implies that the “1-year return” variation is determined by the risk and expense ratio to an extent of 99% (Ali et al. 2022). The F-test states an F-value of 242.604 with a probability value of <0.001, meaning that there is a good fit of the selected model. The coefficients for the risk are 0.663 (p < 0.001), therefore depicting a significant effect on returns, and for the expense ratios, the coefficients are 0.020, p = 0.968 indicating no effect. It is for this reason that Active PMS may well offer higher returns because it entails a higher cost hence higher risk while on the other hand, Passive PMS at its highest aim at the control of the cost with the least effects on returns.

Figure 20: Experiments of coefficient and ANOVA

(Source: Self-created in SPSS)

The comparison between active and passive PMS is done for the Indian as well as the UK market along with the effect of risk and expense ratio on the returns with varying holding periods (Clark and Dixon, 2024). Regularity and reliability of the regression analysis can also be estimated by the level of R-squared: 0.990 for one-year return and 0.973, for five-year return proves that the variance in return performance is explained to a great extent. Shirley risk is proven to effectively explain returns whereby beta has a high coefficient (for 1 year = 0.989 and for 5 years = 1.293) with higher significance level of 0.01. Still, the expense ratio is not determinant of returns (t-value =2.74; sig 0.2). The result of the performing ANOVA test also confirms the goodness of fit of the developed model because the p-value, in this case, is less than 0.001 (Esparcia et al. 2022). Such evidence implies that though risks enhance returns, the expense ratio significantly does not affect the performance of the PMS in both nations.

Figure 21: Descriptive analysis

(Source: Self-created in SPSS)

The fact is that the comparative analysis of the active and passive approaches to Portfolio Management Services (PMS) is provided with reference to such financial indicators as “Assets under Management (AUM)”, “Net Asset Value (NAV)”, and “Market Capitalization” in the cases of India and the UK. It is $958.89 million with the minimum figure standing at $413.37 million and the maximum at $1,492.26 million and a SD of $464.52 million which shows that the amount of portfolio was highly dispersed among the sample firms (Charania et al. 2021). The NAV is 108.78 on average with the value ranging between a basic value of 96.71 and a maximum of 118.90, mainly due to the varying performance of the funds. Market Capitalization is fairly high, meaning $4.69 billion with a minimum of $3.82 billion and a max of $5.88 billion point at the disparity of firms in the league. The variation in AUM and NAV indicates that the two groups among active and passive PMS are different while the former and the latter differentiate the market capitalization hence the scales of firms in these two financial markets.

Figure 22: Correlation

(Source: Self-created in SPSS)

The series data thus represent the connection of active and passive PMS financial variables in India & the UK. Specifically, AUM has a month correlation of -0.312 with Market capitalization and -0.034 Net Asset Value (NAV). On average, AUM’s has a relatively higher positive relationship with Turnover ratio 0.209and negative relationship with Dividend yield -0.099. Consequently, overall the findings of the paper can be summarized as the parameter of market capitalization has a moderate positive co-relation which is equal to 0.523 with NAV. These are relatively low coefficients which imply that AUM, NAV, and Market Capitalization do not have a very high relationship between them; it could be that passive and active PMS strategies differ in one or many aspects.

Figure 23: Experiments of coefficient and ANOVA

(Source: Self-created in SPSS)

About the impact of the independent variables, namely AUM, NAV, and the dependent variable comprising of Turnover Ratio in PMS in India and the UK the following hypothesis is developed. The total value of R-square is 0.242, therefore only 24.2 percent of the variation in turnover can be predicted by the factors under analysis. Of more importance, the chi-square value is output is 32.480 with a p-value of 0.745 also signifying that the proposed model is not statistically significant. The AUM has very little impact (eta= 0.001) while NAV has even a little positive impact (eta = 0.498) and the Market Capitalization has a negative impact (eta = -10.217). All these imply that there are other factors that affect the turnover in active and passive PMS strategies other than those enshrined in this model.

Figure 24: MLRM analysis of dividend field

(Source: Self-created in SPSS)

The above figure depicted the summary and results from the “ANOVA” tables of the “multiple linear regression model” that had been used in determining the “Dividend Yield (%)”. The predictor variables used were “Market Capitalization (Billion $)”, “Assets under Management (AUM)” Million $, and “Net Asset Value (NAV)”. It is also placed the “R-squared” of .272, meaning that 27.2 % of the total variance of “Dividend Yield” can be measured by the employed predictors (Zhanbayev et al. 2023). It is important to note that the “ANOVA table” displays an overall model significance which indicates that the set of predicts has the overall statistical significant relationship with “Dividend Yield”. [Referred to Appendix: 1].

Figure 25: Scatter Plot of Dividend Yield

(Source: Self-created in SPSS)

The model relates the independent variables; “Assets under Management (AUM)”, “Net Asset Value (NAV)” and Market Capitalization to the “dependent variable” is “Dividend Yield” in “Portfolio Management Services (PMS)” with reference to India and the UK. Statistical significance of the factors is given by the “R-squared” value of 0.272, thus only 27. 2 percent of the movements in dividend yield are attributable to these variables. The “p-value” is equal to 0.703 which proves that the selected model of assessment is non-significant (Ahmad et al. 2022). NAV has a very insignificant positive on the result, which is 0.049 while AUM has a negative, yet very tiny effect on the result, which is -0.001. From such findings, therefore, one can deduce that there are other factors that affect dividend yield in both active and passive PMS strategies. [Referred to Appendix: 2].

Figure 26: Descriptive statistics on the regulatory data

(Source: Self-created in SPSS)

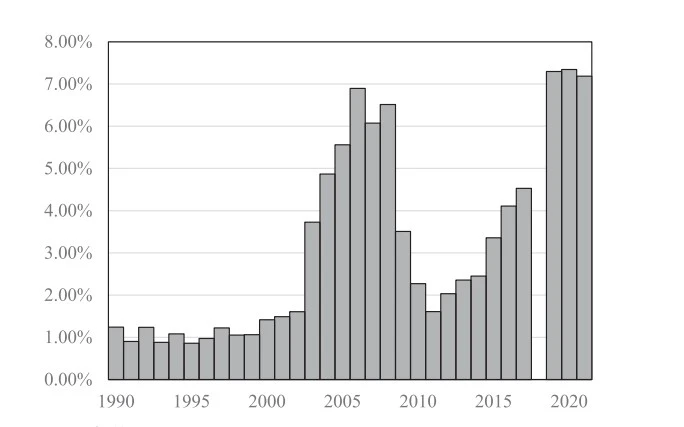

The above figure focuses on the “GDP growth rate”, “inflation rate” and the “interest rate” from the Indian economy and the UK economy that may affect “Portfolio Management Services”. The estimated “growth rate” of GDP per year is from 2.5 % to 6.8 % with the average of 4.65 %. Inflation is standing between 3.2 and 5.5 percent with mean of 4.35 percent (Kavadis and Thomsen, 2023). Interest rate is between 4.00% and 6.25% with an average of 5.13% based on the information regarding active and passive PMS strategies in both countries, indicating that the two economies are not similar. “Higher GDP, lower inflation rates” may favor the active management while stable interest rates may be suitable for long-term investment in the markets.

Figure 27: Correlation between some economic variables

(Source: Self-created in SPSS)

The model is built for the analysis of the links between the “GDP growth rate, inflation rate”, and the interest rate in India and the UK. The coefficient of skewness is high with a value of 0.983 and the correlation between all three factors is a value of 1.000 which indicates the variables are perfectly correlated or the variables move in the same direction (Sood et al. 2023). This implies that GDP leads to growth of inflation and “interest rates” in the economy. Such a strong relationship may affect the active and passive PMS on the enterprise. Active PMS may therefore work better in a growing economy since it is able to adapt to conditions within its environment. Thus, passive PMS could be more effective in stable economy. Thus, it denotes that these results require additional data to validate, in order to enhance the processes of investment.

Figure 28: ANOVA result of predicted variables “inflation rates”

(Source: Self-created in SPSS)

The changes in “interest rate” were found to have a perfect correlation with inflation changes since the value of R was equal to 1.000. This means that one percent increase in the interest rates translate to an increase in inflation level by 1.022 per cent. However, GDP as a variable was excluded whereby its effect was not considered by help of exclusion (Murthy et al. 2022). While in the active PMS, fund managers change the strategies with respect to economic changes in the market, but in passive PMS investments are made according to the market trends. For such generalization, more data is required; this particular model considers only two data points as of the inputs. There are various considerations that investors should make in order to make sound decisions in the two countries.

Figure 29: ANOVA result of predicted variables “interest rates”

(Source: Self-created in SPSS)

The above table identified a perfect positive relationship between “inflation rate and interest rate” since the coefficient of determination is equal to unity (R = 1.000), indicating that in the quest to analyses interest rate changes inflation is a perfect explanation. Using the above equation, every given percentage point increase in inflation increases the interest rates by 0.978 percentage points (Lin, 2022). The change in the moving average was not adjusted for, and thus it is also unclear how their change will affect “GDP growth rate”. In active PMS, the managers make some changes in the portfolio depending on the inflation and interest factors while other PMS follow the market patterns. The economic influence on both the Indian and the UK markets must be factored into the considerations by the investors.

4.3 Conclusion

Thus, after analyzing the FTSE 100 and NIFTY 50 it is easier to understand that the two indexes have essential differences. The FTSE 100 index is less volatile therefore passive management is ideal for long-term investment while active management will be appropriate for NIFTY 50 due to its high volatility. Moreover, as will be seen from the following figures, the relationship between the two indices is very high and positive hence implying that the market indices of the UK and India are synchronized thus conveying significant information for portfolio management. It can be very useful for both active and passive investors to use this information when investing to gain knowledge on how to manage the investments properly. Therefore, this chapter identified the different types of strategies of investment in two markets of the Indian markets and the UK market. It is identified that in the case of the Indian market, there is high volatility that effectively impacted the capturing of the market inefficiencies. At the same time, the UK market tends towards the passive investment levels followed by the consistent returns and the lower cost.

Chapter 5: Discussion

5.1 Introduction

The aim of the chapter is to provide the interpretation and discussion of the active and passive portfolio management studies in the UK and Indian markets. A proper comparison between these strategies is important since it enhances understanding of the performance of the strategies under varying market conditions. The UK market is developed and rather stable while the investors have to operate in the Indian market, which is characterize by higher volatility and frequent regulatory shifts. Discussing these findings will try to give the reader a deeper understanding of how the conditions within the market, along with certain economic factors and overall investors’ behavior, affect the results of active and passive approaches. In addition, it will look into the real-life consequences of the two different markets for investors as well as fund managers and it will give recommendations on how to enhance the portfolio profit-making decisions in the two different markets. Thus, the discussion aims to expose the practical application of the discussed concepts and ideas towards improving the processes of portfolio selection.

5.2 Market efficiency and investment strategies

5.2.1 Active vs Passive Management in different market conditions

The Gross and net PMS are two distinct ways of managing the fund in the stock market. Such disparate outcomes can explain by the differences of supply chain markets between India and the United Kingdom (Verma et al.2021). This paper, based on the research findings, makes a comparative analysis of the active and passive PMS in India and the UK.

Active investment is the fund manager changes the portfolio through purchase and selling of stocks and aims at getting performance than that of the indicated index. They use research and analysis when making decisions on issues to do with markets, the companies’ performance and the general economic conditions (Walker-Sperling et al.2022). However, passive investment entails investing in a set of stocks that would replicate a particular index, such as the FTSE 100 Index of the United Kingdom or the NIFTY 50 Index of India. This strategy involves limited activities of buying and selling and the major aim of fund management is to track the market’s performance.

5.2.2 Impact of Market Efficiency Hypothesis (EMH)

In the UK, the FTSE 100 index does not fluctuate much because its value is not hugely affected. For this reason, passive investment is preferable for such investors who will hold stock for many years. There is more fluctuation experienced in the NIFTY 50 index of India as compared to the more volatile one because it has more value fluctuation (Monga et al.2024). This influences active management and it makes it favorable as the fund managers can exploit these changes to get higher returns.

The analysis of the FTSE 100 index, which is 7,514.93—8,320.29 with an average value of 7,792.18. Its fluctuation is less as compared to NIFTY 50, which ranged between 17,648.88 to 20,069.75 with an average of 19,058.29. Integers show that there is more activity in the Indian market therefore it will be productive for active managers.

5.2.3 Predictive modeling and market condition

An ARIMA analysis was perform to predict the fluctuation of the market trends. The evaluation revealed that PMS is gradually adopted in India and in the UK. Out of 100 percent, it precisely accounted for 97.5 percent of the changes in the data hence minimizing the margin of error in the predictions (Khan et al.2021). However, there were some problems related to the accuracy of the model that has to be discuss further in the future.

Therefore, by conducting a correlation analysis of FTSE 100 and NIFTY 50, the correlation coefficient was found to be 0.920, which indicates a high positive relation; this suggests that when the FTSE 100 increases, NIFTY 50 also increases (Sing, and Singh 2024). This information is useful for investors who wish to introduce posted in their strategic portfolio in both markets.

5.3 Conclusion

This study outlines the major issues concerning active and passive portfolio management in India and the United Kingdom. Active management is more favorable in the Indian market because of high fluctuations and inefficiencies, while passive strategies are efficient in the UK market. This paper will consider the various internal and external factors in determining the investment decision, such as the conditions in the market, costs, risks, and regulations. This knowledge assists the investors, fund managers and policy makers to make suitable decisions for investment. In the end, it is crucial to understand that every investment approach has its advantages and disadvantages, which are determine by investor intentions, the threat hold of risk, and the conditions in the given market, Therefore, the decision in favor of one or another method of portfolio management in both regions should price by the researches.

Chapter 6: Conclusion and Recommendations

6.1 Introduction

This Chapter is based on active and passive portfolio management services (PMS) comparison in India and the United Kingdom. The reason for selecting two different markets was to compare the performance of both the investment strategies in two different kinds of markets; one being the emerging market, which India and the other was being a developed efficient, market; the UK.

The undertaken research focused on the performance of investment strategies and anomalies, the efficiency of the market along the effects of multifacilities including size of the firm and economic factors. The research method adopted in the current study is a quantitative research design because the researcher relied on secondary data and used statistical tests in the analysis conducted in the Statistical Package for Social Sciences (SPSS). In this chapter, the results of the research work are present following the formulated research objectives, and conclusions are made concerning the situation in the studied country for investors, and policymakers, along with the recommendations for formations and institutions. It also explains the limitations and offers a research agenda to support future studies on PMS effectiveness in different markets.

6.2 Linking with Objectives

This section relates the research outcomes to the objectives of the study regarding the main and sub-research questions. The facts that have provide offer an understanding of the distinguished and ineffective investment categories such as active and passive investment in India and the UK marketplace.

1. Understanding active and passive investment strategies

The first of the research objectives points to the identification of active and passive investment strategies in the United Kingdom and India. The research question that is corresponded to the study of the main concepts of these strategies and their effects concerning the influence on the market. According to the research findings, active investment attracts high risks and higher expenses from trading frequencies and management decisions while on the other hand passive investment is cheap and it aims to mimic the market indexes (Ismail et al.2024). Such observation is consistent with theories of market efficiency and investor behavior, which revealed that passive strategies would cause better returns in efficiently trained markets such as the UK while active strategies might prove useful in India’s relatively emergent financial market.

2. Comparing the performance of active vs passive funds

The second research objective dealt with the performance differences using other factors such as value-related, size-related, etc. The related research question examines whether active or passive funds deliver superior returns under certain market conditions. This paper’s implication, for instance, is that while passive funds in the UK perform better than active funds due to the efficient market, active managers in India consistently earn superior returns because of the inefficiency in the Indian stock market (Ehiedu, and Obi 2022). This means that passive strategies are most effective in mature markets as referred to in this paper while active strategies apply in emerging markets by trying to take advantage of the inefficiencies that may exist

3. Influence of company-specific factors on investment strategies

The research question was to establish the various ways through which organization-operational factors like industry, market capitalization, and others affect investment strategy success. This has been the focus or core of the related research question in both markets. The research showed that for small and mid-cap companies active management is lucrative while for large-cap, it is synched with passive management (Kalyani, and Murugan 2021). The UK’s trends vary for the sector cause, active funds may perform rather well in specific industries.

4. Impact of market conditions on investment strategy success

The last objective was to establish the impact of economic factors, volatility, and a market condition on strategy performance. The research question addressed to the study how various economic environments influence investment success do. The findings therefore established that market risk, regulatory changes, and shareholders’ sentiment have a significant impact on performance. In this regard, there is an opportunity for active managers in India because of more market fluctuations in comparison to economic stability in the UK, which lends itself to passive management (Pandey, and Jessica 2022). This study aligns these results with the research objectives making it easy to understand when and where each investment strategy is effective and thus important for investors, policymakers, and institutions.

6.3 Summary of Findings

Active vs passive PMS Performance

The comparing active and passive PMS in India and the UK, specific performance characteristics of the two services can establish. In the UK market, passive management was on average more effective than active management in the end thus the efficiency of the market. Other typology Passive funds proved to exhibit lower volatility, better relative Sharpe ratio, and transaction cost. However, due to higher risk and lack of liquidity, Indian markets were more appropriate for active fund management (Dias et al.2022). Experienced fund managers operating within the Indian market exploited these inefficient markets thus earning supernormal returns in some periods more so in the small-cap and mid-cap funds.

Market efficiency and investment strategy

Market efficiency had a significant impact on the overall performance of active and passive strategies. The results provided empirical evidence to the EMH in that markets such as the UK prove that passive strategies yield better returns because they cannot easily compressed (Shaik et al.2024). In the Indian market in which there are deficiencies, active managers can capitalize on such gaps and make higher returns therefore supporting the EMH, specifically the semi-strong form EMH.

Regulatory and economic influences

In both markets, it was determined that regulatory systems had a considerable impact on various investment plans. The legal and regulatory framework in the UK is highly developed to capture passives, especially index-tracking products such as ETFs (Abraham, 2021). This has made active funds more important in India due to institutional investors and government measures that have encouraged retail investors, although, this market polity sometimes poses some degree of constraint.

6.4 Recommendation

The future research on the active vs. passive approach for managing the investment portfolio should focus on the following aspects to fill the gap observed in this study (Saha et al.2021).

6.5 Conclusion

It has found that active and passive investment strategies work as per the efficiency of the market, rules, and regulations of a particular country, and the objectives that the investment makers want to achieve. This study offers a great informative lesson for investors, fund managers, and policymakers, as the decisions made should correspond to a market environment and investors’ goals. Even though active management can be effective in such countries as India, most benefits can derive from developing efficient countries such as the UK through passive management. For the future of PMS, in both markets, many strategies will have to slowly shift and employ elements of both scientific and art to suit the investors.

Writing a research paper requires clarity, critical insight, and alignment with research objectives. This dissertation effectively links market efficiency, regulatory influence, and investment outcomes across India and the UK. However, presenting such comparisons concisely while meeting academic expectations can be challenging. With British dissertation helpers, you can refine analysis, strengthen conclusions, and ensure your work is well-structured, coherent, and academically sound—helping you submit with confidence and achieve better results.

Reference List

Journals

Abraham, M., 2021. AN EMPIRICAL STUDY ON INVESTMENT PERFORMANCE OF SELECT STOCKS: TESTING EFFICIENT MARKET HYPOTHESIS. Management (IJM), 12(2), pp.817-824.

Aithal, P.K., Geetha, M., Dinesh, U., Savitha, B. and Menon, P., 2023. Real-time portfolio management system utilizing machine learning techniques. IEEE access, 11, pp.32595-32608.

AZOUAGH, I. and DAOUI, D., 2023. Comparative analysis of active and passive portfolio management: A theoretical approach. International Journal of Accounting, Finance, Auditing, Management and Economics, 4(3-1), pp.504-517.

Becker, K.B., Simon, F.M. and Crum, C., 2024. Policies in parallel? A comparative study of journalistic AI policies in 52 global news organisation’s. Digital Journalism, pp.1-21.

Blahun, I.S., Dmytryshyn, L., Blahun, I.I. and Blahun, S., 2022. STOCK INDICES AS INDICATORS OF MARKET EFFICIENCY AND INTERACTION. Economic Studies, 31(8).

Bonizzi, B., Churchill, J. and Kaltenbrunner, A., 2023. UK pension funds’ patience and liquidity in the age of market-based finance. New Political Economy, 28(5), pp.780-798.

Borlase, A., Le Rutte, E.A., Castaño, S., Blok, D.J., Toor, J., Giardina, F., Davis, E.L., Aliee, M., Anderson, R.M., Ayabina, D. and Basáñez, M.G., 2022. Evaluating and mitigating the potential indirect effect of COVID-19 on control programmes for seven neglected tropical diseases: a modelling study. The Lancet Global Health, 10(11), pp.e1600-e1611.

Buller, A. and Braun, B., 2021. Under new management: share ownership and the growth of UK asset manager capitalism.

Clark, G.L. and Dixon, A.D., 2024. Legitimacy and the extraordinary growth of ESG measures and metrics in the global investment management industry. Environment and Planning A: Economy and Space, 56(2), pp.645-661.

Dias, R., Pereira, J.M. and Carvalho, L.C., 2022. Are African stock markets efficient? A comparative analysis between six African markets, the UK, Japan and the USA in the period of the pandemic. Naše gospodarstvo/Our economy, 68(1), pp.35-51.

Ehiedu, V.C. and Obi, K.C., 2022. Efficient market hypothesis (EMH) and the Nigerian stock exchange in the midst of global financial crises. International Journal of Academic Management Science Research (IJAMSR), 6(8), pp.263-273.

Gavrilakis, N. and Floros, C., 2023. ESG performance, herding behavior and stock market returns: evidence from Europe. Operational Research, 23(1), p.3.

Gjeçi, A., Marinč, M. and Rant, V., 2023. Non-performing loans and bank lending behaviour. Risk Management, 25(1), p.7.

Gromova, E.A. and Ferreira, D.B., 2023. Tools to Stimulate Blockchain: Application of Regulatory Sandboxes, Special Economic Zones, and Public Private Partnerships. Int'l JL Changing World, 2, p.17.

Gupta, M., 2022. An Overview of Mutual Funds in India. New Trends of Business, Management & Commerce Studies, p.120.

Haddad, V., Huebner, P. and Loualiche, E., 2025. How competitive is the stock market? theory, evidence from portfolios, and implications for the rise of passive investing. American Economic Review, 115(3), pp.975-1018.

Handoyo, S., Suharman, H., Ghani, E.K. and Soedarsono, S., 2023. A business strategy, operational efficiency, ownership structure, and manufacturing performance: The moderating role of market uncertainty and competition intensity and its implication on open innovation. Journal of Open Innovation: Technology, Market, and Complexity, 9(2), p.100039.

Hasnaoui, J.A., Rizvi, S.K.A., Reddy, K., Mirza, N. and Naqvi, B., 2021. Human capital efficiency, performance, market, and volatility timing of Asian equity funds during COVID-19 outbreak. Journal of Asset Management, 22(5), p.360.

Hossain, A.D., Jarolimova, J., Elnaiem, A., Huang, C.X., Richterman, A. and Ivers, L.C., 2022. Effectiveness of contact tracing in the control of infectious diseases: a systematic review. The Lancet Public Health, 7(3), pp.e259-e273.

Ismail, A., Choudhary, S., Chawla, R.N. and Khan, A.W., 2024. How Strong is the Evidence of the Weak Form of Efficient Market Hypothesis-EMH?.

Jani, G., Modani, A. and Gite, H., Nippon Life India Asset Management.

Joshi, G. and Dash, R.K., 2024. Exchange-traded funds and the future of passive investments: a bibliometric review and future research agenda. Future Business Journal, 10(1), p.17.

Joshi, G. and Dash, R.K., 2024. Exchange-traded funds and the future of passive investments: a bibliometric review and future research agenda. Future Business Journal, 10(1), p.17.

Kalyani, V. and Murugan, K.R., 2021. AN EMPIRICAL STUDY ON INVESTMENT PERFORMANCE OF SELECT STOCKS: TESTING EFFICIENT MARKET ANOVA AND HYPOTHESIS. International Journal of Management (IJM), 12(2).

Khan, A., Khan, M.Y., Khan, A.Q., Khan, M.J. and Rahman, Z.U., 2021. Testing the weak form of efficient market hypothesis for socially responsible and Shariah indexes in the USA. Journal of Islamic Accounting and Business Research, 12(5), pp.625-645.

Khan, B., Aqil, M., Alam Kazmi, S.H. and Zaman, S.I., 2023. Day‐of‐the‐week effect and market liquidity: A comparative study from emerging stock markets of Asia. International journal of finance & economics, 28(1), pp.544-561.

Kumar, A., 2025, January. Decoding Investor Behaviour in Financial Decision-Making: A Critical Evaluation of Standard Finance vs Behavioural Finance. In International Journal for Research Publication and Seminar (Vol. 16, No. 1, pp. 50-62).

Lakštutienė, A., Sutiene, K., Kabasinskas, A., Malakauskas, A. and Kopa, M., 2025. Sustaining in Uncertain Time: Investigating Pension Fund Performance during Market Stress. Engineering Economics, 36(1), pp.96-112.

McCarthy, K., Aalbers, R. and Kearney, C., 2025. Organising for innovation: alliance-to-acquisition transitions and patent production. The Journal of Technology Transfer, pp.1-30.

Minta, K.J., Sescu, D., Da Luz, D. and Kaliaperumal, C., 2023. Global Mentorship in Neurosurgery for Medical Students Study (the GloMNMS Study): a multinational multi-institutional cross-sectional audit. BMJ open, 13(8), p.e071696.

Mobius, M. and Ali, U., 2021. ESG in emerging markets: The value of fundamental research and constructive engagement in looking beyond ESG ratings. Journal of Applied Corporate Finance, 33(2), pp.112-120.

Monga, R., Aggrawal, D. and Singh, J., 2024. EMH or AMH? Evidence from the emerging Indian equity market. International Journal of System Assurance Engineering and Management, pp.1-17.

Nyakurukwa, K. and Seetharam, Y., 2023. Alternatives to the efficient market hypothesis: an overview. Journal of Capital Markets Studies, 7(2), pp.111-124.

Othonos, N., Pofi, R., Arvaniti, A., White, S., Bonaventura, I., Nikolaou, N., Moolla, A., Marjot, T., Stimson, R.H., van Beek, A.P. and van Faassen, M., 2023. 11β-HSD1 inhibition in men mitigates prednisolone-induced adverse effects in a proof-of-concept randomised double-blind placebo-controlled trial. Nature Communications, 14(1), p.1025.

Pandey, R. and Jessica, V.M., 2022. Evolution of the housing market under the framework of adaptive market hypothesis and martingale difference hypothesis: a case of India. Property Management, 40(1), pp.17-28.

Petry, J., Fichtner, J. and Heemskerk, E., 2021. Steering capital: The growing private authority of index providers in the age of passive asset management. Review of international political economy, 28(1), pp.152-176.

Petry, J., Fichtner, J. and Heemskerk, E., 2021. Steering capital: The growing private authority of index providers in the age of passive asset management. Review of international political economy, 28(1), pp.152-176.

Plazen, L., Rahbani, J.A., Brown, C.M. and Khadra, A., 2023. Polarity and mixed-mode oscillations may underlie different patterns of cellular migration. Scientific Reports, 13(1), p.4223.