Advanced Financial Advice Coursework Sample

An in-depth financial planning case study analysing retirement, investments, pensions, taxation, and estate strategies.

Ph.D. Experts For Best Assistance

Plagiarism Free Content

AI Free Content

Client Suitability Report For Lucy Cotton

1. Introduction

This suitability letter shall endeavor to present to Lucy Cotton a comprehensive financial management plan in accordance with her current status, the goal that she has in the near future, and her tolerance to risks. The recommendations are on the retirement income plan, taxation, estates, and budgets.

The two main aspects of financial planning that apply to Lucy are related to retirement planning and pension decision making, as well as estate planning with the purpose to minimize IHT cost. She also needs help on ethical investment and effective techniques in making gifts that will attract fewer taxes. Through her evaluation of both her strengths and weaknesses financially, her resources and consumptions, one is able to provide her with recommendations that are suited to her circumstances.

The first area of this report is Lucy’s liquid financial position and management plan that discusses her stocks; the second section is the management plan for her house; the third aspect is the management plan for other investments; and the last section is the summary of the management plan to improve Lucy’s financial condition. The recommendations are based on her risk comfort and long-term investment goals and aims at addressing some of the issues which include shortage of funds, tax implications, and investment returns.

2. Financial Overview & Current Situation

2.1 Income & Expenditure

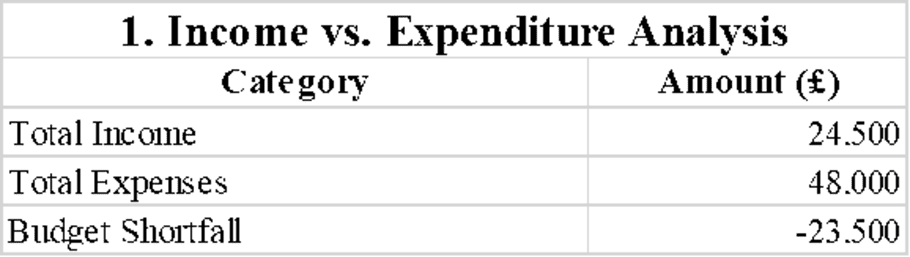

Figure 1: Income vs Expenditure analysis

(Source: Self-Created)

Thus, Lucy receives her state pension in the amount of £6,500 per year and private pension of £18,000, which makes her total income during the year £24,500. Nevertheless, her annual expenditure equals £48,000; thus, she has an annual deficit of £23,500. The deficit shown means that Lucy would have to look for more income or cut on her expenses to be able to finance her needs for expansion (Abdullah et al. 2024).

The outcomes of this evaluation reveal that she spends a considerable amount on petty expenses that include the likes of outings and holidays. Some of these expenses are part of her life; however, much better are the opportunities that can be realized through investment incomes, proper spending, and pension drawdowns. If the right decisions are not taken concerning the money she is saved and invested, it might run out over some period of time thus noting her financial security in the future.

2.2 Assets & Investments

Lucy has total value of personal property, cash, unit trust and an investment bond amounting to £2,128,000. Despite her having considerable assets, however, her liquid security is not large in amount. She has £60,000 in her current/checking time, while she has £100,000 in her saving/general time. This is due to the fact that the interest rate of her savings account is low hence it is not suitable for wealth creation. Additionally she has 40,000 Pounds in unit trust and 30,000 Pounds in investment bonds. Such investments need to be rebalanced concerning both the level of risk and the need to generate higher revenues (Advani et al. 2024).

This investment bond comes with a market value reduction (MVR) penalty and, therefore, should not be withdrawn without doing due diligence. Optically, Lucy needs to look for other forms of investment products that he or she is willing to bear risks for better returns. In addition, she has not used an ISA, which is an effective manner of गई maximizing the increase in investments.

2.3 Pension & Protection Policies

Specifically, Lucy has an uncrystallized personal pension with its value amounting to £400,000. The problem arises from here given that she has a very limited budget to work with, she is now in a dilemma on whether to opt for the flexi–access drawdown or take an annuity in a bid to make sure that she is able to receive a fixed income. Her pension withdrawal strategy will affect her incomings and outgoings in the future and also her tax contribution (Arpon et al. 2024).

Lucy also has other forms of insurance such as whole of life policy and private medical Insurance policy. The expenses of these policies are high, it may be necessary to reconsider these policies matching the present requirements and budget priorities of a woman.

3. Retirement Planning

3.1 Flexi-Access Drawdown vs. Annuity

The situation calls for the pension flexibility, in which Lucy shall select between flexi-access drawdown and purchase an annuity. Hence, if she chooses the flexi-access drawdown, she can take benefits in lump sum and the rest can remain invested. This option offers her much flexibility, which let them change withdrawals concerning their needs at the moment (Banda and Kawimbe 2024).

For flexibility and sustainability, the withdrawal rate suggested for flexi-access drawdown strategy is about 4% each year. This rate means that Lucy could earn approximated £ 1 200 per month or £14,400 in a year from the pension and keep the rest for the improvement of the investment portfolio.

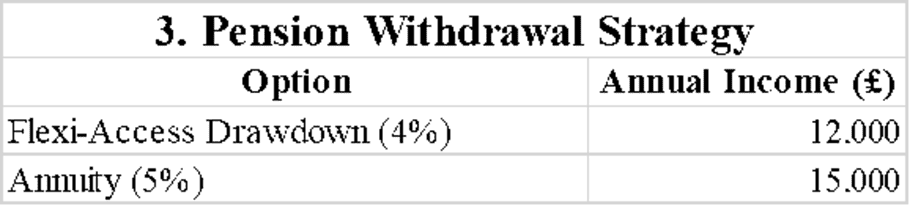

Figure 2: Pension Withdrawal Strategy

(Source: Self-Created)

In this case, Lucy may decide to invest in an annuity that will offer her a certain amount of money for a specified term or for her entire remaining lifespan. If she decides to annuitize it at 5% compounded annually, a cash value would be provided for £15,000 a year to her. The main benefit of the annuity is that no aspect of risk associated with investments would affect Lucy in as far as her pension is concerned. Nevertheless, this is not the case with an annuity as it is quite rigid when it comes to its payment plans (Daraei and Sendova 2024). Once she invests her money into an annuity, she could not change her periodic withdrawals which meant that her capital was committed to the annuity investment.

Therefore, the most appropriate recommendations based on Lucy’s need to have financial security and her desire of steady cash flow are to adopt a middle ground and go for the outlined combinations of the two alternatives. Thus, taking out a portion of pension and using the balance to contribute to the purchase of the annuity that provides the right balance of security and flexibility, Lucy will be able to achieve her goal (Downs 2025). This would provide her with the assured income from annuity while at the same time providing her with the option to take further injections in terms of the drawdown fund.

3.2 Sustainable Withdrawal Strategy

Lucy needs to develop a withdrawal plan that should make her financially secure while at the same time helping her pension investments to compound over time. To do this, she follows flexible drawdown plans that allow her to vary her withdrawal as per Goedmans’ performance and her requirements. In order to ensure that the fund lasts for long she should take out a percentage that is compatible with the kind of investments that she has made.

3.3 Investment Adjustments

The chosen Japan Smaller Companies pension fund is regarded as high-risk in terms of the market in which its funds are invested. Considering her risk-taking abilities as low to medium, it is advisable for her to rebalance her portfolio by allocating her investments to several classes of assets (Dzupire and Mutepuwa 2024). Equities could be diversified by bonds and fixed-income securities which will also help to minimize loss making investment especially during downturns in the market. For growth, there is an exposure to equities while for income and fixed income type investments there is a possibility of getting exposure to bonds. This type of diversification will make sure that the pension assets owned by Lucy will continue to generate an adequate level of returns while at the same time minimizing the risks occasioned by fluctuations in the market.

4. Investment & Savings Strategy

4.1 Reallocating Investments for Growth & Stability

Figure 3: Investment Growth Projection

(Source: Self-Created)

In this regard, Lucy’s investment currently calls for some modifications for her or his investment portfolio aimed at increasing her or his returns while at the same time avoiding the risks that might compromise the sustainability of his or her income. Since she is retired, her objective should be to keep as much money as possible as she also has no need for more capital, accumulate income from investments and reduce the risk exposure to investments. As such the best approach is diversification (Forsyth 2025). Having diversified her investments in this manner, Lucy can avoid losses caused by the fluctuations in the stock market while still increasing her worth steadily.

At the moment Lucy has a portfolio containing financial securities, which consist of unit trusts and investment bonds. These principally should be measured according to their efficiency, cost of portfolio management, and taxation. Therefore, a review of her position will help her to identify the various assets that she holds and whether they are the most suitable for her long-term needs. Despite the fact that she has accumulated a considerable sum of cash she does not contribute to ISA and therefore she should invest a part of her savings in ISA. It provides tax free growth and she is in a position to get the maximum returns on her investments without paying extra taxes. Depending on the type and class of the stocks for her ISA allowance, Lucy can gradually diversify her capital with more tax advantageous structure (Genschel et al. 2024).

Another weakness relates to the high leverage as they trigger a high number of risky investment opportunities in which Lucy involves herself. A large part of her personal pension is with Japan Smaller Companies fund which is a highly risky investment. This level of concentration brings in a high level of risk, which is quite unsuitable with her risk aversion preference on financial regularity. Avoiding high risk security investment by incorporating an equity mix of composition stocks, bonds and yield funds among other investment instruments will provide more security. Such a diversification strategy will enable her avoid over-concentration in the stock market and cover all her expenses in retirement.

Fixed income through government and corporate bonds must be funded for income, blue chip dividend stocks for regular returns while inflation can be hedged through a REIT among others. This mix will secure her capital as well as have room for some appreciation in future. She should also consider the performance of her existing investment bond especially on the penalties incidence of early encashment of bond (Imparato 2024). In case that the bond is underperforming or is charged with high fees, a move to the more suitable investment asset class is advisable.

4.2 Socially Responsible Investing (SRI)

As such, Lucy has shown particular interest towards the SRI where she mentioned the ESG funds. Such an investment strategy is ethical to her and at the same time give her chances to improve her financial situation. With the current awareness of ESG funds, there is now a myriad of good equity funds that have embraced sustainability, ethical, and good governance in their investment portfolios (Kusuma and Panuntun 2024).

This means that there is a need for a shift towards ESG based investments to enable Lucy make socially responsible decisions when investing in the stocks but at the same time, she will achieve optimal results in terms of investment returns. It has also been evident that most ESG funds have performed well in terms of returns, as compared to the regular investment funds. Others include the long-term investment options such as sustainable index, funds, green bonds as well as ethical mutual funds.

There are several ESG scoring systems, and not all the funds labeled as ‘sustainable’ align with pure ethical investing standards (Park et al. 2024). These involve the complexity of understanding which funds are good ESG performers so consulting a financial advisor will be of great help to Lucy and get her to the right funds that can fit her risk and future goals.

5. Inheritance Tax (IHT) Mitigation

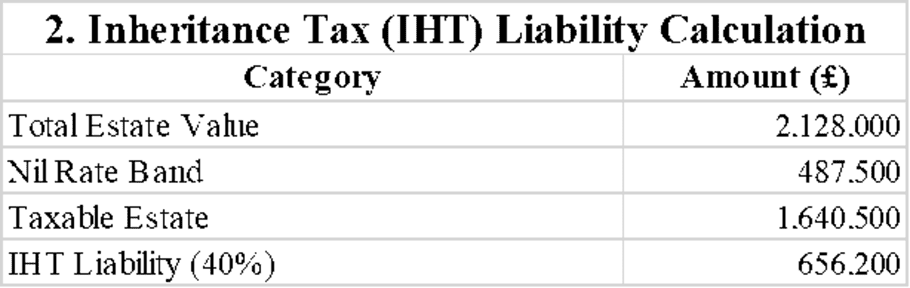

Figure 4: Inheritance tax liability

(Source: Self-Created)

The current level of assets in Lucy’s property surpass the nil rate band for IHT hence raising the possibility of high taxes to be paid by the inheritors. In particular, her beneficiaries may be faced by enormous costs in case of proper estate planning. Hence for Lucy to minimize this kind of a risk, several measures where she must employ include; lifetime gifting, trust and insurance.

Of all the ways of minimizing IHT exposure, probably one of the most suitable is gifting during one's lifetime. In the UK, people are allowed to give tax-free gifts to others, to the extent of the annual exemptions where the value of the gift reduces the amount of an entity’s assessable estate in gradual steps. Therefore, it will be possible for Lucy to minimize the size of her estate while at the same time effectively transferring her wealth through gifting her daughter and granddaughter over time (Patharkar et al. 2025). In the same regard, charitable gifts that were given seven years prior to the death of the transferor are not usually chargeable to IHT, and so the early planning is crucial.

Lucy has already given indication as to her desire to set up a trust for her granddaughter and laid down that the amount should remain locked up until the lady is 25 years of age. A discretionary trust would be appropriate for this purpose since it will permit some control as well as avoid entailing the assets with unnecessary taxation. This trust structure also gives protection due to events such as divorce or mismanagement of the assets by the beneficiaries.

One more measure of preventing excessive IHT is the use of a whole-of-life insurance policy strategy. This can be done to fund the future IHT liability to ensure that the heirs do not have to sell off the bequest acquired through inheritance to settle tax obligations (Walid 2024). For this situation, the policy should be structured where the payout will not be included in her taxable estate, by writing the policy in trust.

Finally, Lucy should also turn her attention to other estate planning techniques, products like business relief investments or charitable giving that may also bring further decrease in the size of her taxable estate. It would be rewarding for her to invest in the qualifying assets as these investments yield financial gains and tax deductions at the same time, contributing to causes she supports.

6. Addressing Budget Shortfall

Among the financial difficulties that Lucy is going to face, the most compelling one is the lack of sufficient funds to cover her annual expenditures. To this date, she has an annual income of £ 24,500, which means she lacks funds to cater for her annual expenditures that are estimated at £ 48,000, consequently, she incurs a budget deficit of £ 23,500. Unless this trend is changed, Lucy will be dependent on her savings and other investment instruments which may dry up in future. For long-term financial reliability, Lucy needs to work in two capacities; the first is to seek ways in which she can make additional investment for increased income coupled with the second way is to review and manage expenses (Okeke 2024).

6.1 Enhancing Investment Income

One way out of the financial dilemma of Lucy is by expanding her sources of passive income streams which include investments. At the moment, total investment on unit trust and investment bond is £ 700, 000 and these should be repositioned to generate steady income. Through reinvestment of this portion of the pension into high paying dividend stock, corporate bonds and fixed income securities; Lucy would be in a position to have additional steady cash income.

She should also take time to invest in Real Estate Investment Trusts (REITs) which pay their users divine which arises from rental income on built-property. REITs are inclined to offer returns of about 4% to 6% on an every year basis, and thus suitable for retired persons. Moreover, some of the savings should be shifted to tax-free ISAs which would increase her tax optimization and there would be interest earnings that she would need to withdraw now and then (Putri and Indriany 2024).

6.2 Reviewing Discretionary Expenses

However, besides increasing the income from investment, there is the need to change the spending pattern of Lucy . Entertainment, holiday, and general spending constitute part of her budget since they are not essential and most often are a luxury. Therefore, it implies she can work on shaving working capital expenses and expenses which are not necessary with an aim of cutting down on the monthly expenses yet still be able to comfortably live a lavish lifestyle.

For instance, it is as follows: she decreased entertainment expenses by £120 per month (20%) and holiday expenses by £112 per month (15%), which implies that she saves about £2,700 per a year. Such savings, along with the rest of the money from investment income, would assist in decreasing her reliance on current capital. Insurance costs in total £800 monthly and Lucy needs to make sure whether her insurances are the most effective at the current moment. Even more money will automatically be saved if she tried to obtain cheaper private medical insurance or modify the terms of her whole-of-life policy (Lativah 2025).

7. Final Recommendations & Action Plan

7.1 Optimizing Pension Withdrawals

Due to the fact that Lucy needs to secure and effectively draw down her personal pension worth £400,000 with enough longevity in a way that would provide her adequate income, the following plan is suggested, She should take a flexi-access drawdown which means that she at one and the same time has the option of the following benefits; a flexible amount of income; and an annuity benefit which means, she is assured of a stipulated amount of income irrespective of the amounts she withdraws.

7.2 Investment Restructuring

In relation to the investment, it is recommended that Lucy has to spread her investments to get both steady and regular income. Speculative funds invested in the Japan Smaller Companies pension fund should be cut in order to invest in more stable income-generating assets (Sinervo and Laihonen 2024). Investing a portion of her investments in bonds, dividend funds, and REITs will increase her cash flow and eliminate the exact budget problem.

7.3 Trust Establishment for Granddaughter

Thus, Lucy has also mentioned that she will set aside £50,000 in a discretionary trust for her granddaughter. Such trust agreements are crucial in the right arrangement so as to avoid taxes touching on the money as well as to ensure the granddaughter will be financially sorted once she attains the age of 25 years.

7.4 Regular Financial Reviews

A financial plan is a dynamic plan; after it is formulated it is supposed to undergo changes from time to time to cater for economic conditions or circumstances change (Sinervo et al. 2024). Based on her current and future goals Lucy should make regular appointments for yearly review of pension, investment business and inheritance tax affairs. She could be able to stay adjusted for the long term financial gains while applying the various tax efficient solutions that are available.

8. Conclusion

To ensure that Lucy achieves this goal of financial security she needs to come up with a well-structured plan that will address the pension issue, the portfolio rebalancing and also the issue of inheritance taxes. Thus, the investment income should be increased, the discretionary spending should be decreased, and through application of the tax-efficient strategies she should be able to cover the £23,500 annual gap without endangering her cash and reserve fund.

Moreover, pension flexibly and the annuity income arm will also be able to provide some level of flexibility besides meeting the client’s retirement needs. In order to protect her financial security, she should engage the services of a qualified estate planner for him/her to advice on the best way to go about planning her estates, and incorporation of trust and whole of life insurance policies to help her shun all possible tax burdens that may be faced by her heirs.

This client suitability report assignment sample provides a clear demonstration of applied financial planning concepts, professional structure, and evidence-based recommendations aligned with academic assessment criteria. If you need personalised support in accurate financial calculations, our assignment help online service is ready to assist you.

Reference List

Journals

Abdullah, A., Salleh, M.Z.M., Ismail, W.A.A.Z.W., Anuar, T.F.T.M., Simpong, D.B.B., Rahman, N.A., Salleh, H.M. and Rasdi, S.A.B.M., 2024. Retirement Financial Planning: Strategies and Challenges in Avoiding the Incidence of Poverty. In Artificial Intelligence (AI) and Customer Social Responsibility (CSR) (pp. 101-109). Cham: Springer Nature Switzerland.

Advani, A., Disslbacher, F., Forrester, J. and Summers, A., 2024. Inheritance Tax reliefs: Time for reform?.

Arpon, Y.F., Dunuan, J., Perico, J., Abante, M.V. and Vigonte, F., 2024. Employees' Job Grade as Predictor of Social Security System (SSS) Provident Fund Savings, Loans, and Withdrawal Behavior. Loans, and Withdrawal Behavior (September 15, 2024).

Banda, B. and Kawimbe, S., 2024. Qualitative Analysis of Early Pension Withdrawal in Defined Benefit Schemes: A Case National Pension Scheme Authority (NAPSA) in Zambia. Journal of Business and Economics in 4IR, 1(1), pp.1-11.

Daraei, D. and Sendova, K., 2024. Determining safe withdrawal rates for post-retirement via a ruin-theory approach. Risks, 12(4), p.70.

Downs, R., 2025. What does the Autumn Budget mean for you?. In Practice, 47(1), pp.40-42.

Dzupire, N. and Mutepuwa, J., 2024. An optimal investment consumption model for retirees with no health insurance. Heliyon, 10(8).

Forsyth, P.A. and Li, Y., 2025. Risk Measures for DC Pension Plan Decumulation. arXiv preprint arXiv:2502.16364.

Genschel, P., Limberg, J. and Seelkopf, L., 2024. Revenue, redistribution, and the rise and fall of inheritance taxation. Comparative Political Studies, 57(9), pp.1475-1505.

Imparato, D., 2024. UN Tax Pillars to Address Capital Concentration (through Inheritance Levies) and Wealth Flight (through Exit Taxes)-Implications for the EU.

Kusuma, V.P.I. and Panuntun, B., 2024. Strategy to Increase Investment Portfolio at Retired Priority Banking Customers of PT Bank Rakyat Indonesia Yogyakarta Adisucipto Branch Office. Finance: International Journal of Management Finance, 1(3), pp.25-29.

Lativah, E., 2025. Financial Management Strategy Analysis in Facing Market Volatility: A Case Study of Manufacturing Companies in Indonesia. Journal of Financial Management and Strategy Analysis, 1(1), pp.1-6.

Okeke, N.I., Bakare, O.A. and Achumie, G.O., 2024. Forecasting financial stability in SMEs: A comprehensive analysis of strategic budgeting and revenue management. Open Access Research Journal of Multidisciplinary Studies, 8(1), pp.139-149.

Park, S., 2024. Optimal Consumption and Portfolio Strategy for Retirees with Inflation. forthcoming in Journal of Risk Management.

Patharkar, D., Negi, P., Bhende, R., Dhule, C., Agrawal, R. and Morris, N.C., 2025, January. Retirement Portfolio Allocation Optimization Using Machine Learning with XAI. In 2025 International Conference on Multi-Agent Systems for Collaborative Intelligence (ICMSCI) (pp. 852-858). IEEE.

Putri, R.Y. and Indriany, L., 2025. The Influence of Financial Literacy and Practical Budgeting on Financial Stability on Ecommerce Business Performance. Margin: Jurnal Lentera Managemen Keuangan, 3(01), pp.16-26.

Sinervo, L.M. and Laihonen, H., 2024. New development: Public managers between a rock and a hard place—social-financial sustainability in local government. Public Money & Management, 44(6), pp.559-564.

Sinervo, L.M., Bartocci, L., Lehtonen, P. and Ebdon, C., 2024. Toward sustainable governance with participatory budgeting. Journal of Public Budgeting, Accounting & Financial Management, 36(1), pp.1-19.

Walid, M.R.I.K.I. and Yusuf, M.M., 2024. Analysis of the Effect of Pre-Retirement Withdrawals: VBA Simulation. Malaysian Journal of Science Health & Technology, 10(2), pp.107-116.

Go Through the Best and FREE Samples Written by Our Academic Experts!

Native Assignment Help. (2026). Retrieved from:

https://www.nativeassignmenthelp.co.uk/advanced-financial-advice-coursework-sample-47558

Native Assignment Help, (2026),

https://www.nativeassignmenthelp.co.uk/advanced-financial-advice-coursework-sample-47558

Native Assignment Help (2026) [Online]. Retrieved from:

https://www.nativeassignmenthelp.co.uk/advanced-financial-advice-coursework-sample-47558

Native Assignment Help. (Native Assignment Help, 2026)

https://www.nativeassignmenthelp.co.uk/advanced-financial-advice-coursework-sample-47558

- FreeDownload - 40 TimesApplying Entrepreneurship in Global Context - GBM6AEN Assignment Example

Applying Entrepreneurship in a Global Context INTRODUCTION Entrepreneurship...View or download

- FreeDownload - 41 TimesConsultancy Report on Organisational Strategy Assignment Sample

Introduction - Consultancy Report on Organisational Strategy Hydro turbines...View or download

- FreeDownload - 39 TimesCustomer Due Diligence in AML Compliance Framework Assignment Sample

Question 1 Introduction:Customer Due Diligence - Key to Fighting Financial...View or download

- FreeDownload - 39 TimesDestination Planning and Development Assignment Sample

Destination Planning and Development Assignment We understand that university...View or download

- FreeDownload - 42 TimesProject FY002 Board Report

Strategic Marketing Analysis and Consumer Insights for LifeTime Smartwatch...View or download

- FreeDownload - 42 TimesUnit 2: The Marketing Concept Webinar Assignment

Unit 2: Marketing Processes and Planning Assignment Sample Introduction The...View or download

-

100% Confidential

Your personal details and order information are kept completely private with our strict confidentiality policy.

-

On-Time Delivery

Receive your assignment exactly within the promised deadline—no delays, ever.

-

Native British Writers

Get your work crafted by highly-skilled native UK writers with strong academic expertise.

-

A+ Quality Assignments

We deliver top-notch, well-researched, and perfectly structured assignments to help you secure the highest grades.