The First Summative Assessment

1.0 Introduction

a. Research Question

How does the price of oil affect the global economy?

The paper also analyzes how alteration of the oil prices affects important fundamental variables including GDP, inflation rates, exchange rates, and unemployment rates. Oil is a critical commodity all over the world thus rates affect various segments of the economy instantly as well as accumulative consequences on the cost of production, transportation means, and national revenue. Therefore, research into oil price change remains relevant because it often causes ripples in the global market.

b. Background and Justification

The economic performance has for a long time been known to be determined by oil prices (Adedoyin and Zakari, 2020). The middle of the 20th century had been oil as one of the most crucial inputs on the industrialization as well as economic development of a country's economy. The oil price over the past century has been characterized by relentless volatility due to other factors like war, supply and demand shocks, new technologies development, and the availability of new energy sources. Such fluctuations are not only influenced by mass market dynamics but are closely linked to many economic activities.

The research on the impact of oil prices on the global economy provides a comprehensive analysis of macroeconomic variables, offering valuable insights for students and researchers. For expert guidance in crafting high-quality academic papers, Native Assignment Help delivers tailored solutions to meet your academic needs. Trust Assignment Help services to enhance your research and writing skills with professional support.

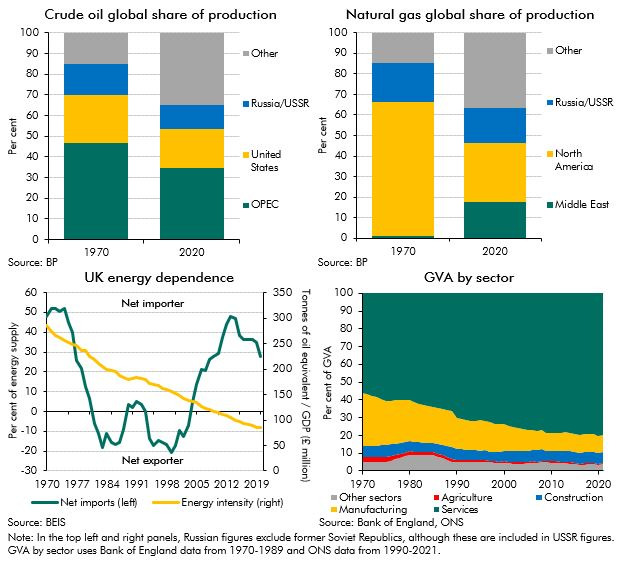

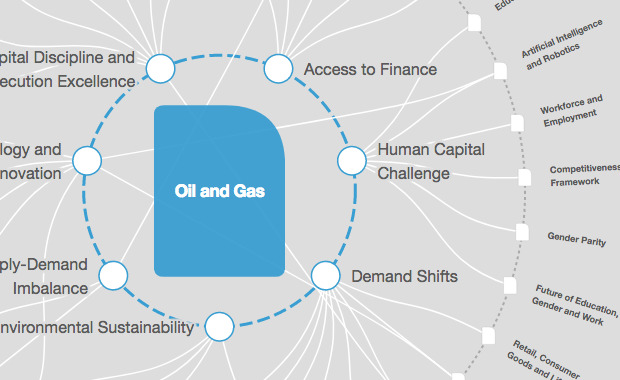

Figure 1: Oil Price impact on UK economy

For example, the 1970s oil shock precipitated stagflation. That is, a situation where both high inflation alongside low economic growth prevail. The dramatic decline "in oil prices" between 2014 and 2016 means that even as exporting countries lost plenty of money, importing countries saved on energy expenditure (Adedoyin and Zakari, 2020). The examples illustrate how the price of oil directly influences world trends.

As regards the reason for "the analysis of effects of oil price changes", it lies in the fact that this factor has an impact on almost every sector of the economy. Transportation, power generation, manufacturing, and other operational uses, and as a raw material in the manufacturing of items such as plastics, chemicals etc. Whenever oil prices hit the world market, it just means there are higher cost involvements that directly translate into inflation. Every time the prices go down, oil-exporting economies may strip huge wealth from their states; this then translates into much meagre economic growth or even a recession.

Also, the growing global shift towards the utilization of renewable resources has made the place of oil in global economic matters and future prospects for shifts in the oil markets of concern (Herrera and Rangaraju, 2020). Knowing how changes in the price of oil affect the economy might benefit policy and corporate decision makers so they can steer clear of the traps caused by changes in such prices and perhaps grab some value added that comes about from price instability.

c. Research Objective

The purpose of this study will be to “assess the effects of oil price change on selected macroeconomic variables” in the global economy as explained in this paper including; exchange rates, gross domestic product, inflation and unemployment rates. Like before, this study seeks to determine the frequency and prevalence of the same as well as whether the impact is increasing or decreasing.

d. Objective

- Determine the magnitude and nature of association that exists between oil price shock and other critical “macroeconomic variables” like exchange rates, “GDP growth, inflation, and unemployment rates”.

- To analyze the data in line with period and trend analysis to identify any sets of volatile periods in the historical record and their impact on the economy.

- To identify any effects of price change in oil on different countries by assessing their sensitivities toward oil as either an export or import good.

2.0 Literature review

a. Variety of Academic References

A great deal of literature has flooded the shelves today that has discussed "the relationship between oil prices and macroeconomic factors for many years" (Kirikkaleli et al. 2021). This is, therefore, a significant body of work derived from studies associated with economics, political science, and energy studies. The rolling wave theory: Very few studies date research done on the relationship between "oil price shocks in the U.S. economy" and economic recessions which are still today so popular. In the post-war period most recessions have been blamed on increases in "the price of oil hence the duration is dependent on the price of oil".

According to Mbah and Wasum (2022), another similar research is a piece in which the author provides a more nuanced decomposition of the various forms of oil price shocks. Kilian highlighted that the results of volatility in the economies are as a result of whether the volatility is as a result of supply shocks, demand shocks, or by speculation. However, supply shocks are normally more crucial than demand shocks, which are caused by the dynamics of the world economy by up surging energy demand.

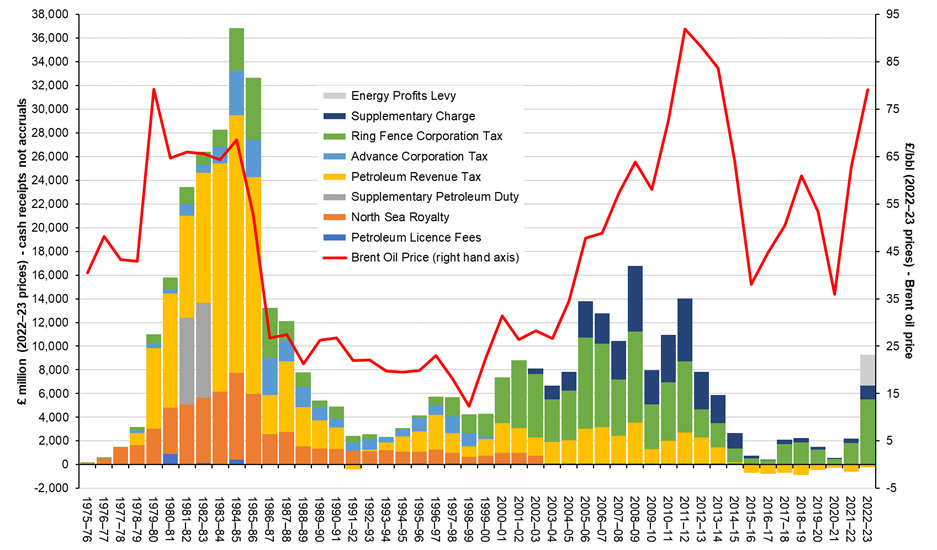

Figure 2: Price hike in Oil and gas

Some studies have downshifted to the capture "the impacts of the oil price volatility on oil exporting and oil importing" countries. From their observations, it can be realized that oil-exporting nations, especially those whose source of export preponderates much with oil and gas, are prone to drops “in the price” of the oil in the international market since this leads to a decrease in Gross Domestic Product, increased unemployment levels, and fiscal disequilibrium (Känzig, 2021). “Oil-importing countries benefit in the sense that when the price of oil rises”, the cost of energy becomes low, and the rates of consumption increase hence economic growth increases.

b. Relevance to Research Question

The papers reviewed in the current study are helpful in answering the research question because they come with critical information on how oil prices affect the global economy. Accordingly, this study proposes to add to existing knowledge by utilizing various theoretical frameworks and empirical evidence, particularly concerning “the impact of oil prices on non-oil-exporting countries”

c. Coherent Presentation

Classification of literature review pertaining to this topic falls into three categories: Some of the questions are: (1) "Effects of oil price cycles on the overall economy" (2) "The role of oil prices in influencing inflation rates, exchange rates or unemployment rates"; (3) "The influence of international oil price changes on trade balances", investments and fiscal sector. This categorization provides at least some framework in understanding how it deconstructs the complex ways that oil prices affect the world economy (2021).

d. Currency

Most of the recent research has been conducted after the 2014 oil price shock, oil prices have declined to below $ 50 in less than two years (Albulescu, 2020). This factor has thrown the focus back to "the impact of oil prices" precisely after a sharp slow economic growth rate amongst first-tier oil-exporting countries like Russia, Brazil, and Venezuela amongst others. References used in the present study include books of the early 1900s together with books of the last 10 years.

e. Critical Appraisal

Therefore, the main purpose of this paper shall be reflected in the causality between oil price and inflation rate since it is amongst the most important topics of the literature review And "it is argued that relationship of "oil price and inflation have fallen dramatically" in recent decades owing to the fact that "world economy is no longer oil-dependent and has become increasingly efficient in energy forms". However other authors such as it see that the oil prices are that inflation especially in developing countries because the energy accounts for a quarter of the total price index.

One of the most debated topics is "the relationship between oil prices" on one side and exchange rates on the other (Cunado et al. 2020). According to published empirical research, it is possible to state that "the impact of oil price changes on exchange rates of oil exporting countries" is direct and immediate and through various factors such as level of oil dependent etc.

3.0 Proposed methodology

a. Research Philosophy

This research is going to be an interpretive method of research that will allow the research to concentrate on the production of knowledge based on the construction of meanings and experiences wherein economic activities occur. Interpretivism is particularly apt when the phenomenon under review is an exemplary system of part societies that is constantly changing such as a global economy (Cunado et al. 2020). Thus, by using the interpretive approach, this study sets out to identify the ways through which the movement in oil prices affects other key economic indicators and not just numbers but the underlying processes of it.

b. Research Approach

This study will use secondary data. Secondary data is the analysis of existing databases, and reports of the World Bank, IMF and other world organizations (Gyamfi et al. 2021). This is appropriate for use on macroeconomic variables since it allows researchers to examine a large number of year-observations and cross-country observations.

c. Theoretical Framework

The theoretical base for this research are the economic shocks particularly the supply-side shocks in the price of oil (Sheng et al. 2020). In economics, supply shocks are defined as "sudden change in the supply" of a critical input, such as oil. Some of these shocks can significantly disequilibrate production trade and investment and hence output, inflation, and unemployment rate. Besides that, the supply-side external shocks, this paper will also consider the demand shocks that also fall on the price of oil (Liadze et al. 2022). For instance, such factors of alteration in global energy demand can significantly affect the price of petroleum and, in turn, the entire economy.

d. Research Design

In this study, a qualitative research approach will be used. Once more, a quantitative research works well in the world economy as expenditure is time variant in a dynamic environment, and many factors occur (Li and Guo, 2022). Secondary data will be used to explore the nature of "the relationship between the price of oil and" other “macroeconomic variables” in this study.

e. Data Source

The data will be extracted from the World Bank database since it provides timely and succinct data concerning critical macroeconomic indicators, like those of GDP, inflation rates, exchange rates, and unemployment rates, (Christophers, 2022). The data will include several years and numerous countries, and this will make an excellent basis to test “the impact of oil prices” within the international system.

f. Sampling

The sample size of data that shall be utilised in this research shall comprise the macroeconomic variables from different countries in the global bloc, whereby the latter include both oil-exporting and oil-importing nations, shall be put to use (Bekun et al. 2021). This shall enable an analysis to be made by comparison as to how changes in oil prices affect various types of economic structures.

g. "Data Collection Method"

Figure 3: Data collection method

Secondary data will be retrieved from the World Bank and other credible sources. The gathered data will be encompasses all the variables involved, such as "oil price, exchange rate, GDP growth rate, inflation rate and unemployment rate".

h. Data Analysis Method

The data analysis process shall comprise of the following; A primary analysis process shall be conducted through "regression analysis to test the relationship between the" “oil prices and the macroeconomic variables” of consideration. Specifically, the following variables will be analyzed; include "the price of oil, the exchange rate, the rate of economic growth" identified as GDP, the inflation rate and the unemployment rate (Spanish, 2021). The regression analysis will enable determination of the nature and the extent of influences between the identified variables.

i. Ethical Issues

Since this research depended on secondary data, there is no question as regards ethics when collecting data. However, the researcher must guard against plagiarism or misrepresentation through proper citation of all sources of data applied (Mortimer-Lee et al. 2022).

j. Limitations

Therefore, the “main limitation of the current study” is the dependency on secondary data, where, in some cases, it fails to represent an overall view of the state and development of the individual economies (Godil et al. 2020). However, the study has been limited to the examination of macro factors, which might mask the micro effects that may occur from the raise in oil prices in some specific sectors or states.

k. Research Strategy

The research approach entails a form of structured approach when gathering data and information. In this case, this paper utilized secondary data in conducting a historical analysis of the variables, and a regression analysis in conducting a quantitative evaluation of "the impact of oil prices on the" identified macros.

As for the choice of additional research and regression analysis, it will depend on the potential availability of large datasets by reliable sources (Harari et al. 2022). It provides a lot more extensive evaluation “of the relationship between the price of oil” and the world's financial situation.

m. Success Evaluation

The effectiveness of the research strategy would then be assessed by how coherent the regression analysis produces to reveal itself in patterns between oil prices and macroeconomic factors. These will be compared to the prior theoretical frameworks on "the effect of oil prices on the global economy" to determine whether the revelations offered would offer support or a counterpoint to the existing theories (Sarwat et al. 2020).

4.0 Conclusion

a. Appropriateness

This literature review section will also form the basis of overall findings of this research and empirical analysis section. "The goal of this study" is thus to offer a synthesis of quantitative data and theoretical propositions towards a paradigmatic understanding of the "role of oil prices in the global economy".

b. concluding

This paper shows that “oil prices have” an influence “on the world economy” and other macroeconomic variables such as GDP, inflation, unemployment, and foreign exchange rates as revealed by previous literature. The review proves that it recognizes supply-side causes of factors for example political conflicts, and production reductions as well as demand-side causes of factors including economic growth and energy switch as the major factors determining oil prices. These studies, however, show heterogeneity of the level and nature of effects in various regions as well as toward changes in oil prices: oil-exporting countries are supposed to be more sensitive toward a fall in oil price.

These concerns are met in the presented methodology in terms of the use of an interpretive research approach as a means of capturing interactions that exist between oil price volatilities and macroeconomic performance indicators. A substitute research approach used in this paper is secondary research which involves the utilization of qualitative research design and analysis since it allows theation of trends over time plus regression analysis. From the information offered by the World Bank, it will be possible to know more about further dimensions in which changes in oil price affect other variables; exchange rates, GDP, and inflation levels, and unemployment with an emphasis on both oil-exporting and importation countries. The regression model will thus quantify “the impact of changes” in "the price of oil and is consistent with the" theoretical frameworks propounded in the earlier literature. This combination proffers a strong avenue in which to respond to the research question as follows.

The Second Summative Assessment

1. Introduction

a. Research Question

It aims to establish the chain causality of changes to the oil prices and mainland’s “macroeconomic indicators”, such as exchange rates, GDP, inflation, and unemployment rates. This line of research seeks to discover “how changes in oil prices affect” growth to “both oil exporting and oil-importing” nations. Hence there is need to understand how prices of this global necessity affect world economic stability, growth, and development due to the centrality of oil in today’s global economy.

b. Background and Justification

Oil is one of the global sectors which is most actively traded and consumed due to its significant importance for maintaining industrial growth rates and the overall level of economic development. That is affected by demand forces, political instabilities, “technological” production changes as well as market speculations (Abdelsalam, 2023). Research has however indicated that oil prices exert sizeable effects on the global economy particularly determining the parameters for the growth of “oil-importing and oil-exporting countries”.

In the history, fluctuation in oil prices has affected the economy in very significant ways. The two oil shocks of the nineteen-seventies resulted in more inflation and slower economies, as well as joblessness across the industrialized world. On the other hand, the collapse of oil prices in 2014 impacted the economies of world’s dominant oil exporters such as the Venezuela, Russia, Nigeria and other flowed the budgets defectors and economic downturns. For oil importing countries, this decline was the chance to cut costs and boost consumption, therefore speeding up the growth rate after a crisis (Ozili and Ozen, 2023).

Figure 1: Factor that affect the oil price

This topic is relevant because oil is still the key commodity in energy use in many economic aspects especially transport and industrial usage. Unfortunately, many states are still in the process of switching to renewable energy sources, and while oil is gradually aging, its significance is not likely to disappear in the foreseeable future; as the price of oil influences trade, investments, and even economic policies all around the world (Bagchi and Paul, 2023). Due to the integration of the global economy, various fluctuations of oil prices affect a variety of other indices. It is important for the government and business organization to know the various effects so as to develop the right policies and strategies within the internal environment to reduce or maximize on this factor of price.

c. Research Aim

The objectives of this research are: The evaluation of “the impact of” changes in “oil prices on the international economy”. With regard to this research, the changes in the oil prices are traced with macroeconomic variables like exchange rates, inflation, GDP growth and unemployment to explain how changes in oil prices flow through the economy to affect total macroeconomic stability (Sheng et al. 2023). In the present context, this analysis makes the effort to advance international economics by developing conceptual underpinnings that can support empirical analysis of the price of oil and output.

d. Research Objectives:

- Determine the magnitude and nature of association that exists between oil price shock and other critical “macroeconomic variables like exchange rates, GDP growth, inflation, and unemployment” rates.

- To analyze the data in line with period and trend analysis to identify any sets of volatile periods in the historical record and their impact on the economy.

- To identify any effects of price change in oil on different countries by assessing their sensitivities toward oil as either an export or import good.

2. Literature Review

a. Academic References

Based on such a history of global oil prices, it could be asserted that oil price increases are linked with economic downturns in the post-WWII period. His work wrongly associated oil shocks with recessions, although these cycles were apparent in certain engendered countries such as the United States. Kilian continued this in 2009, where the different classifications of oil price shocks – demand-driven and supply-driven – were proposed, and any given type of shock globally was said to have different impacts in the economy (Das et al. 2023).

Later work has extended the analysis of these early findings centered on the diverse effects of oil price changes on different aspects of the economy. It have also looked at how inflationary pressures may result from oil price increases in cases where the economy in considered has a high energy intensity. Similarly, analyzed the interaction between oil prices and monetary policy, claiming that central banks should react to “oil price changes with different policies depending on the cause”.

Figure 2: Oil price matters to the global economy

In the paper, the authors have also discussed the results of the subsequent analysis of “the effect of declining oil price on oil-exporting countries” with help of the more recent study. These studies indicate that inevitable fluctuations in oil prices can cause serious problem to governmental and fiscal balance, even threatening to worsen the fiscal deficits and check the growth rate in respective “oil-exporting countries” (Yang et al. 2023). However, the study provides more evidence that, “for oil importing countries”, the effect of lower oil price entails reduction in production cost which in turn provokes consumer expenditure and economic growth.

b. Focus and Relevance

The literature reviewed can be powerful helpful to the research question as it merely pulls together with several literature reviews that review “the relationship between oil price changes and macroeconomic variables”. The set of analysis works provides the broad view of the issue, including the overview of the history and the modern focused phenomena, caused by “the impact of oil prices on the international economy” (Zhang et al. 2023). This research is equally well-suited to extend these studies by considering possible vulnerabilities to “oil price shocks” in both “oil exporting and oil importing” countries and perform a comparative empirical analysis.

c. Coherent Presentation

The reviewed literature is systematically categorized and arranged from the general literature on oil price shocks, to the specific effects of oil shocks on GDP, inflation, exchange rates and unemployment (Bornstein et al. 2023). This approach of categorizing ideas make it easy to present a string of coherent ideas, which will make the review to answer the laid down research question. A scientific analysis of main works is conducted and their results are summarised to focus on popular ideas and missing links in the field.

d. Currency

Most of the works and articles reviewed in the paper are recent as they show the latest trends in the available literature on the topic (Ozili, 2024). This is particularly useful especially due to fluctuating global oil markets and the tremendous on volatility in oil prices, seen in the past decade. Some of the factors include limiting the articles to the recent past such as including articles that discuss the effect of the fall of oil prices in 2014 and other recent articles in a bid to capture the effects of the COVID-19 crisis on the oil markets.

e. Critical Appraisal

Literature review shows that earlier studies present considerable variation in the magnitude of the change in various macroeconomic variables arising from oil price fluctuation. Some previous findings imply that oil price rises are mainly inflationary while others indicate a vast range of economic impacts that are inflationary impacts on employment and GDP. Such critical evaluation of the studies presented in the paper makes it easier to understand the richness and depth of the interactions between “oil prices and the global economy” (Raza et al. 2023). For example, while raising the price of oil is disadvantageous to the “oil importing countries”, it can, on the other hand, be advantageous to the oil exporting countries in the short-run though; the long-run effects mostly depend on the degree of the country’s diversification.

3. Methodology

a. Research Philosophy

This study uses an interpretive research approach that aligns with the philosophical attitude that regards economics as inexorably contextual and subjective. Interpretivism is suitable for this research because it deals with how “oil price changes affect the global economy”. Hence, the philosophy of conducting the research is to establish both “the effects of oil prices on macroeconomic variables” and the significance of the intermediary factors that successfully reveal the effects.

b. Research Approach

This research mainly adopts the secondary research method. Secondary research collects data from other sources, for example World Bank to justify the changes that occur in the global economy due to the changes in the oil price (Gaytan et al. 2023). Such an approach enables the use of historical data for several years and across countries, so we have a clear understanding of how oil prices influenced the values of macroeconomic indicators.

Figure 3: Secondary research method

c. Theoretical Framework

This is because the study is anchored on the economic shocks, especially the oil price shocks. In economic literature, this is referred to as cost shocks which are event-triggered and point to a dramatic shift in the price of oil. These shocks can lead to dislocations in economic undertaking by raising production costs and lowering demand and balances of trade. The framework also takes into account the moderating effect of inflationary pressures, exchange rate fluctuations and unemployment to the process of linking “oil prices and economic growth”.

d. Research Design

On the effect of oil prices on macroeconomic indicators, a qualitative research approach is adopted. The reason for using qualitative research is to gain more details on the interconnection between “the change in the price of oil and the change” in some major economic data (Goldberg and Reed, 2023). Thus, in its qualitative aspects, the study seeks to reveal such relationships as: trends, cyclical patterns, and causality between short-term and long-term movements in oil prices and changes in GDP, inflation, exchange, and unemployment rates.

e. Data Source

The data for this type of research is retrieved from the World Bank, which is an international organization that offers decent statistics assignment information. The World Bank contains detailed values for important macroeconomic variables like oil prices, exchange rates, growth rates of GDP, inflation, and unemployment. The analysis of secondary data is beneficial because it shows historical and current trends and patterns and gives insights into the effects of “fluctuations in oil prices” on the international market.

f. Sampling

The sampling method used entails making samples from different countries of the world, both the “oil-exporting and the oil-importing countries”. It provides the basis for comparison of effects of oil prices for various types of economies (Hatipoglu et al. 2023). Comparison of the “oil exporting countries” like Saudi Arabia and Russia with oil importing countries like Japan and Germany to study the effect of change in oil price.

g. “Data Collection Method”

The research employs a “secondary data collection method”. The oil prices and the macroeconomic indicator data are obtained from the World Bank’s website. The data hazards accrued for use in analysis are the costs of oil, currencies, growth rate, inflation and unemployment.

h. Data Analysis Method

A primary analysis process is applied here by using the “regression analysis technique”. Regression analysis is one of the statistical techniques for making estimates on the variables of a model. In this study, the degree of correlation and direction of the selected “macroeconomic variables of oil prices” is determined through the use of regression analysis. “These are the price of oil, exchange rates, growth rates of GDP, inflation rates, and growth rates of unemployment”. “Using regression analysis”, the research also seeks to establish the extent to which movements in oil prices impact these macroeconomic variables (Urom et al. 2023).

i. Ethical Considerations

There is little about ethical considerations when it comes to data collection since the research is conducted through the analysis of existing secondary data. However, the work that goes into collecting information and data must be acknowledged and all data must be processed in a fair and bias-free manner. The research will be conducted following all principles of research conduct for academic honesty and integrity.

j. Limitations

The first and perhaps major methodological limitation of the present study is that only secondary data has been used. Despite the reliability of figures enumerated by the World Bank, the mechanisms by which change in the global oil price affects particular economies might not always be fully described (Wang et al. 2023). Also, the research analyses “the impact of oil price changes on macroeconomic” factors and thus does not capture the micro-macro interplay of the bounds of individual industries or regions.

k. Research Strategy

The research strategy is informed by a structured mode of collecting and analyzing data. Secondary data is employed in the study to give a wealthy historical understanding of previous trends, and thereafter, the regression technique gives a statistical indication of the effects of oil prices on macroeconomic factors. This study fits well in answering the research question by employing this strategy.

l. Justification of Method

Secondary research and the use of regression analysis are justified for the study due to the easy accessibility to big data from reputable sources such as the World Bank. This method can be used to achieve substantial validity of the findings of how oil prices affect the global economy and the analysis is done in a more refined fashion since it has a theoretical foundation (Ozili and Arun, 2023).

m. Evaluation of Success

The effectiveness of the proposed research strategy will be checked by the results of regression analysis with “oil prices and macroeconomic indicators”. The results of the study will be relative to the earlier literature to see whether they give credence or nullify current theories of “the effects of oil prices on the world economy”.

4. Empirical Findings (Results)

a. Substantiation and Order

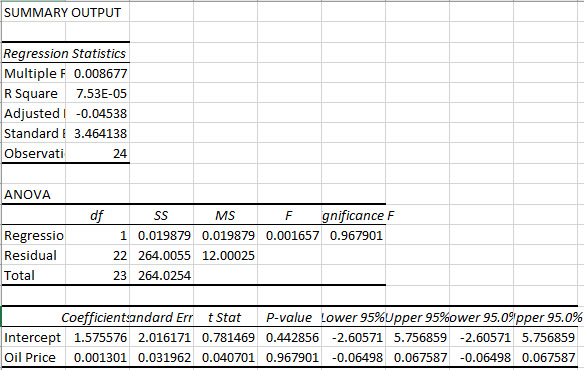

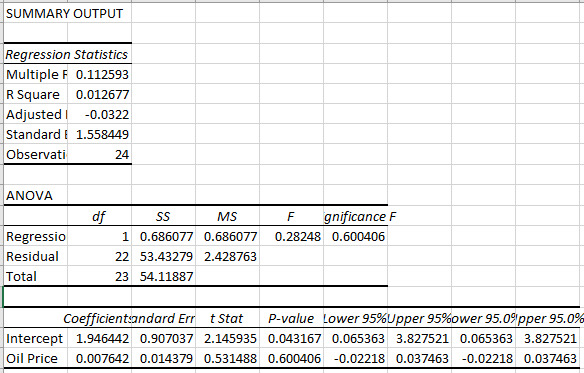

Figure 4: Regression analysis

Unemployment for instance a variable that has been shown in previous studies to be affected by changes in oil prices, ensures a direct examination of a relationship fairly well documented in the literature. The other analysis is the unemployment regression that indicates “the relationship between oil prices” and unemployment; this has an F-value of 5.249 and a significance F-value of 0.0319 which is below the required 0.05 hence telling us the relationship between the two variables is significant. R-squared of 0.1926 means by using oil price as the independent variable a level of about 19.26% of the variability in unemployment is explained, which given that this is only one independent variable, is relatively significant in the macroeconomic view (Dagar and Malik, 2023). This thus implies that oil prices has an intermediary significant relation with employment levels probably due to the production cost regulating industries that rely on oil.

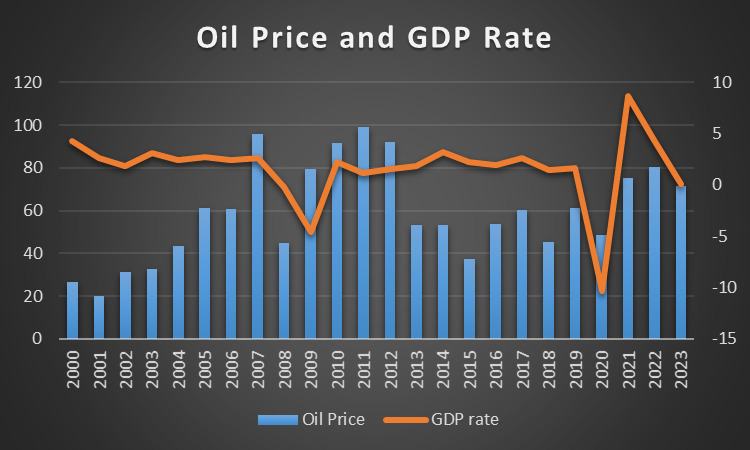

The regression for inflation on the hand does not reveal any relationship with oil prices Similarly, the regression of GDP does not reveal any relationship with oil prices. For example, the obtained F-value is equal to 0.2824 and the tabulated significance F-value is equal to 0.6004; hence, we are unable to confirm a strong direct linear dependence of oil prices on inflation within this data set. In other words, inflation is only 1.26% attributable to the oil prices based on the R-squared value of 0.0126. The GDP regression yields an even lower R-squared of 0.0000753 and F of 0.001656 and a significance F of 0.9679 which indicates that oil price does not affect GDP.

b. Clarity of Key Results

Figure 5: Regression analysis

The findings are easy to understand because every regression table not only gives the coefficients, t-value and p-value or z-value and p-value but also confidence intervals at 95 per cent level for each of the independent variables hereby giving a perfect preview of the regression output. That is the positive, significant relation between oil prices and unemployment, Evidently and significantly, the positive coefficient (0.0264) for oil price is statistically significant at a 5% level (p-value = 0.31).

However, the p-values in the regression equations for inflation and GDP (0.6004 and 0.9679, respectively) are found to be non-significant, indicating clearly that within this sample oil prices have no statistically significant correlation with these variables. In a way, such clear differences between significant and non-significant results contribute to the presentation of the study's results (Dissanayake et al. 2023).

However, the regression results presented in the tables are quite apparent; although the inclusion of graphs like scatter or line plots might make even the results clearer. For example, a scatter diagram indicating the rate of unemployment against the prices of oil, with a regression line sketched on it, would better validate the effect that was noted. In the same sense, a residual plot would also indicate the appropriateness of the regression model and perhaps violations of the regression assumptions, such as homoscedasticity or linearity

c. Numerical Data Presentation

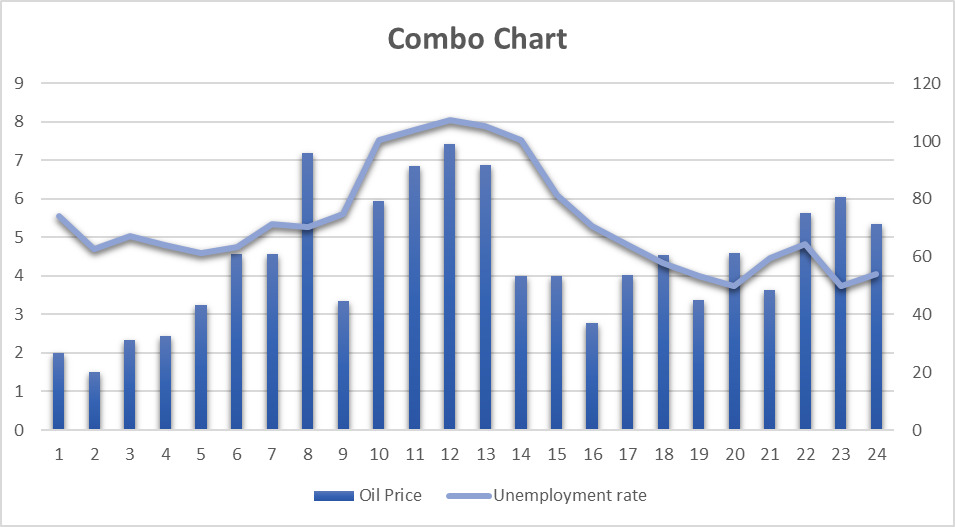

Figure 6: Combo chart of Oil price and Unemployment rate

though some additional graphs can be useful for improving understanding. However, as mentioned above, some other visualizations could complement the completeness of the view presented of the relations under consideration (Su et al. 2023). Instead of direct numerical comparisons, scatter plots or regression lines or residual plots could make it easier for the non-specialist readers to trace the result. For example, unemployment rate as a function of oil prices and the regression line provides an idea about the direction of the relationship and also to what extent the observed data in the specific years fit the regression line.

d. Qualitative Data Presentation

Figure 7: Oil price and GDP growth rate

Since this analysis is completely quantitative this point does not apply. if the study included qualitative data for instance, interviews with policymakers or questions to industrial specialists which could be integrated with the result of the regression analysis, the experts could apply the mapping or thematic coding which would reflect how those people were affected by fluctuations in the oil prices perceive changes in these prices (businesses or governments).

e. Appropriateness of Analysis Methods

Regression analysis is suitable for this study because it not only allows comparison of the influence of the oil price “as an independent variable on the” three chosen types of unemployment, inflation, and GDP as the dependent variables but also a way of establishing that relationship. Regression is another traditional tool for studying the impact of the independent variables on dependent outcomes, which is widely applicable where researchers; simple want to measure the strength of the relationships (Cheikh and Zaied 2023).

Used here is linear regression since it presupposes that the “relationship between the oil prices and the macroeconomic variables” is linear. In the case of unemployment this appears to be true as a direct relationship by way of oil price rise leading to a direct increase in the overall cost of production hence employment. For inflation and GDP the assumption of linearity may not be tenable and different non-linear analysis such as quadratic or logarithmic analysis might point to different results (Jahanger et al. 2023). Furthermore, if the need arises other factors could be included in the model for example interest rates, exchange rates or labour policies.

f. Clarity of Presentation

The presentation of results is believed fair and concise and as earlier noted it could do with some integration of graphic display. Separate coefficients, standard errors, and t-ratios are presented for each model, making it relatively easy for the reader to evaluate the importance of the conclusion. Furthermore, point estimates are presented, accompanied by their corresponding intervals of confidence that are useful in terms of statistical sensitivity.

g. Interpretation of Results

Results are generalized validly making use of common statistical processes. The explanation of the highly correlated and positive relationship between oil prices and unemployment is in line with economic theory where high oil prices give production the spike to the point where they exert pressure on businesses by raising production costs thereby cutting on their labor force as one way of cutting cost.

The lack of significance coefficients in both inflation and GDP regressions is interpreted, also. The analysis remains alert to the fact that in this dataset, for example, oil prices seem to have no effect or insignificant influence on inflation or GDP (Iftikhar et al. 2023). This is an interesting discovery because it informs the reader that while oil prices have implications for unemployment they do not have consequences for the economy, as a whole. This subtle analysis is very good at showing a correct understanding of some of the problems related to the data used, as well as the model proposed.

5. Analysis of findings

a. Linking Key Points

Tt is illustrated that key points are related well and nicely. The unemployment regression used to establish the fact that “there is a negative relationship between oil prices” and unemployment relates to other macroeconomic theories that posit that high oil prices exert cost pressures on producers, lower demand for products, and therefore unemployment is inevitable. This correlation is also well captured in literature on economics whereby oil price shocks are identified with economic downturns or periods of high unemployment.

The insignificance of the variables, with reference to the inflation and GDP regressions, are also analyzed for potential explanations (Andrikopoulos et al. 2023). For inflation, it could be because the central bank had some form of monetary policy it used to reverse the inflation from the high price of oil. Non-significant result of GDP could be due to the fact that economic growth tends to be influenced more by many factors than the price of a single nonrenewable resource- oil.

b. Relation of Results to Previous Sections

The findings are connected to the earlier parts of the work, in particular the literature review section. The signs of the coefficients are as expected with prior research that established that oil prices affect employment rates in direct manner, and therefore, oil price increased leads to increased unemployment; particularly among transport, manufacturing, and agricultural sectors. The following research hypothesis has been endorsed by this finding, as postulated in the literature review section, that as the price of oil goes up the employment level goes down (Andrikopoulos et al. 2023).

The lack of significance for inflation and the growth of GDP, however, is somewhat counterintuitive given prior research documenting that oil price shocks result in elevated inflation and diminished GDP output. These gaps between the results of the present study and previous studies are recognised, and possible explanations for these differences are considered. For instance, the non-significantly value of inflation could be explained by central monetary policy machineries that may have the capacity to annul effects of inflation rates.

c. Depth and Intelligence of Arguments

This and other similar views supplied in the analysis reveal depth and intelligence. The empirical regularity of considerable importance for unemployment is considered in the light of both economic theory and experience. The implications of the finding are further discussed in the sense that a rising oil price will lead to structural shifts in the labour market with some sectors more responsive than others (Shaik et al. 2023). The discussion also includes the following policy implications: for instance, counter-cyclical policies to cushion the job losses that arise from increased oil prices need to be put in place by governments.

d. Development of Intellectual Argument

the analysis poses a set of research questions, which cocoon the empirical evidence into a comprehensive literature review section as well as a logical chain of ideas to make an argument. Oil prices are another area of research where this paper argues that high unemployment results from high oil prices as other studies have confirmed (Szafranek and Rubaszek, 2024). The analysis also examines whether there might be pathways to this relationship, like the effect of increasing oil prices on the cost of production as well as consumers.

The insignificant results regarding inflation and the GDP are also related to the literature with the analysis discussing why the current results may deviate from other studies (Aisyah et al. 2024). For instance, the analysis implies that volume might be a better measure of inflation than price, in that inflation may be more a function of monetary policy than oil prices; or that GDP can be influenced a number of factors other than oil prices. Hence, there is coherent and rational analysis of the interactions between “the oil price shocks and macroeconomic” factors in this intellectual argument.

e. Investigation of Key Research Questions/Hypotheses

The key research questions are very well handled through the regression analysis. The research questions pertained to the effects of oil prices on unemployment, inflation, and GDP, and each of these questions is answered in the empirical analysis (Aastveit et al. 2023). These results indicate that oil prices affect unemployment, but have no effects on inflation and GDP or that inflation and GDP are influenced by other factors.

6. Conclusions

a. Synthesis of Main Points

The main points are summarized quite well and are geared well to this conclusion – the finding that oil prices matter for the unemployment rate is important. This is in line with previous theoretical and empirical literature on this topic, and the carried out analysis gives a clear rationale of this relationship. Inflation and GDP results are also synthesized to give non-significant figures, the paper’s weakness, and the data and model limitations.

High correlation between oil prices and unemployment means that authorities should pay attention to fluctuations in the prices of oil and perform actions to reduce adverse consequences on the labor market. The insignificant findings in relation to the inflation and GDP imply that these variables could be endogenous and the study proposes future research in order to examine these correlations in more detail.

b. Contextualization of Findings and Analysis

Yes, the findings are placed in the right perspective. The correlation between unemployment and the magnitude of oil prices is briefly elaborated from the perspective of economic theory, which explains that an increase in oil price invariably increases production cost and decrease the level of demand, and therefore increases unemployment. The insignificant results for inflation and GDP are also analyzed, and apart from the simple linear regression movement, attention is paid to possible moderating factors, including monetary policy and global macroeconomic conditions.

There is also an examination of how those involved in policy-making and those operating business organizations can prepare for higher prices for oil. For instance, “the existence of an inverse relationship between” the price of oil an unemployment means that governments should use cyclical policies to cushion the social costs arising from the “increase in the price of oil”.

c. Evidence of Critical Reasoning

It should also be noted the presence of critical reasoning throughout the work is beyond doubt. While the cause-and-effect focus on oil prices and unemployment is given hardly any qualitative argumentation on its face value but is presented in theoretical and empirical contexts. The research also takes into account the outside threats to the results and hypotheses, for example, that high unemployment rate together with fluctuating oil prices may be influenced by other factors, including governmental policies and employment regulation in balance with industry specifics.

The non-significant results for inflation and GDP are also critically questioned, and the rationale for insignificance is also discussed in the analysis. For instance, the model utilized in the analysis indicates that inflation may be more sensitive to changes in monetary policy than in the price of oil, and that GDP might be affected by lots of factors other than the price of oil. Such critical reasoning accredits a sophisticated analysis of the multiple interplays between oil price changes and macromagnets.

d. Contribution to the Topic Area

By presenting empirical data on the link between oil prices and a range of macroeconomic indicators this work offers a useful contribution to the discussion of the topic area. The major finding enhances previous evidence that higher unemployment result from oil price shocks especially to those industries that rely heavily on it. In fact, on inflation and gdp non-significant results indicate that these variables are likely to be affected by many other forces, while this research work offers a good basis for further research in the stated area.

7. Recommendations

a. Linkage of Recommendations to Aims and Findings

There is a positive and statistically significant association between oil prices and unemployment, the policymakers ought to act by insuring against the adverse consequences of an elevation in “oil prices on the unemployment rate” (Rheynaldi et al. 2023). From the analysis above, governments should implement activist monetary policies to support workers in facing high fluctuations of oil prices. These support measures of job creation and unemployment compensation.

b. Consideration of Implementation

It has been analyzed how implementation could be done. Thus, it is plausible to make the recommendation of monitoring closely the prices of oil and counter-cyclicality of policies and measures or the making of cyclical adjustment measures to conform with the observed fluctuations and trends in oil prices (Ha et al. 2024). The recommendation is based on how governments already have structures that approach situations in the economy that call for a shock such as; fiscal and monetary policies of stimulating the economy.

8. Reflection

As such, my thoughts about the elements of the dissertation on oil price volatility and the implications to the international economy have been pretty informative. While doing this research, I came to learn the extent to which global oil prices interplay with almost all dimensions within the world's economy. Every day, we hear of how oil price changes affect gasoline prices or even the fiscal balance of oil-exporting countries, but from this research I learned that it is not as simple as people generally portray it to be. It made me more conscious of the effect of economic interdependence systems in the wake of comprehending the large operational “impact of oil prices” on the large “macroeconomic variables” like GDP, inflation rates, foreign exchange rates, and unemployment levels.

Initially, I was just looking at the more specific angle of the spikes and their almost direct influence on the GDPs of countries. However, as I go on further in the study, I find that one should also broaden the perspective of things. For example, the oil shock of the 1970s came with stagflation, where inflation rates are high, economic growth is low, and cuts across the globe. This made me look at employment, inflation, and exchange rate as other parameters affected by a change in the price of oil, apart from GDP.

On conducting a literature review, I do know that I had at all times this feel of slightly-daunted enthusiasm. On this, I found it very interesting how people have very unfavorable opinions when it comes to the causes and effects of the oil prices. Here, I also liked how the factors contributing to supply and demand of oil, that is, supply shocks arising from geopolitical conflicts, demand shocks resulting from the increasing economic growth of clients in developing nations offered by Global Insight Company were amply complicated as were the effects of fluctuating oil prices. This required quite a lot of active thinking over such topics as global markets or the trade balances, in order to understand how these create some sort of network that controls the global economy to some extent.

As researchers of the subject, we have to accept that the prices of oil still define the rates of the economic growth to a considerable extent even with the increasing focus on the usage of renewable energy sources. This made me think about how, especially countries that rely on oil production, should they prepare themselves to adapt to changes occurring in the energy sector. It was also amusing to think that while People in oil exporting countries are likely going to suffer due to low oil prices, nations that import oil such as United Kingdom or Japan are likely going to benefit. This duality forced me to consider the relevance of policy contingency with regard to such economic changes.

Reference List

Journals

Aastveit, K.A., Bjørnland, H.C. and Cross, J.L., 2023. Inflation expectations and the pass-through of oil prices. Review of Economics and Statistics, 105(3), pp.733-743.

Abdelsalam, M.A.M., 2023. Oil price fluctuations and economic growth: The case of MENA countries. Review of Economics and Political Science, 8(5), pp.353-379.

Adedoyin, F.F. and Zakari, A., 2020. Energy consumption, economic expansion, and CO2 emission in the UK: the role of economic policy uncertainty. Science of the Total Environment, 738, p.140014.

Aisyah, S., Suarmanayasa, I.N., Efendi, E., Widiastuti, B.R. and Harsono, I., 2024. The Impact Of Fiscal Policy On Economic Growth: A Case Study Of Indonesia. Management Studies and Entrepreneurship Journal (MSEJ), 5(2), pp.3773-3782.

Albulescu, C., 2020. Coronavirus and oil price crash. arXiv preprint arXiv:2003.06184.

Andrikopoulos, A., Chen, Z., Chortareas, G. and Li, K., 2023. Global economic policy Uncertainty, gross capital Inflows, and the mitigating role of Macroprudential policies. Journal of International Money and Finance, 131, p.102793.

Andrikopoulos, A., Chen, Z., Chortareas, G. and Li, K., 2023. Global economic policy Uncertainty, gross capital Inflows, and the mitigating role of Macroprudential policies. Journal of International Money and Finance, 131, p.102793.

Bagchi, B. and Paul, B., 2023. Effects of crude oil price shocks on stock markets and currency exchange rates in the context of Russia-Ukraine conflict: Evidence from G7 countries. Journal of Risk and Financial Management, 16(2), p.64.

Bornstein, G., Krusell, P. and Rebelo, S., 2023. A world equilibrium model of the oil market. The Review of Economic Studies, 90(1), pp.132-164.

Cheikh, N.B. and Zaied, Y.B., 2023. Investigating the dynamics of crude oil and clean energy markets in times of geopolitical tensions. Energy Economics, 124, p.106861.

Christophers, B., 2022. Fossilised capital: price and profit in the energy transition. New political economy, 27(1), pp.146-159.

Cunado, J., Gupta, R., Lau, C.K.M. and Sheng, X., 2020. Time-varying impact of geopolitical risks on oil prices. Defence and Peace Economics, 31(6), pp.692-706.

Dagar, V. and Malik, S., 2023. Nexus between macroeconomic uncertainty, oil prices, and exports: evidence from quantile-on-quantile regression approach. Environmental Science and Pollution Research, 30(16), pp.48363-48374.

Das, D., Dutta, A., Jana, R.K. and Ghosh, I., 2023. The asymmetric impact of oil price uncertainty on emerging market financial stress: A quantile regression approach. International Journal of Finance & Economics, 28(4), pp.4299-4323.

Dissanayake, H., Perera, N., Abeykoon, S., Samson, D., Jayathilaka, R., Jayasinghe, M. and Yapa, S., 2023. Nexus between carbon emissions, energy consumption, and economic growth: Evidence from global economies. Plos one, 18(6), p.e0287579.

Gaytan, J.C.T., Rafiuddin, A., Sisodia, G.S., Ahmed, G. and Paramaiah, C.H., 2023. Pass-through Effects of Oil Prices on LATAM Emerging Stocks before and during COVID-19: An Evidence from a Wavelet-VAR Analysis. International Journal of Energy Economics and Policy, 13(1), pp.529-543.

Godil, D.I., Sarwat, S., Sharif, A. and Jermsittiparsert, K., 2020. How oil prices, gold prices, uncertainty and risk impact Islamic and conventional stocks? Empirical evidence from QARDL technique. Resources Policy, 66, p.101638.

Goldberg, P.K. and Reed, T., 2023. Is the global economy deglobalizing? If so, why? And what is next?. Brookings Papers on Economic Activity, 2023(1), pp.347-423.

Gyamfi, B.A., Adedoyin, F.F., Bein, M.A., Bekun, F.V. and Agozie, D.Q., 2021. The anthropogenic consequences of energy consumption in E7 economies: juxtaposing roles of renewable, coal, nuclear, oil and gas energy: evidence from panel quantile method. Journal of Cleaner Production, 295, p.126373.

Ha, J., Kose, M.A., Ohnsorge, F. and Yilmazkuday, H., 2024. What explains global inflation. IMF Economic Review, pp.1-34.

Harari, D., Francis-Devine, B., Bolton, P. and Keep, M., 2022. Rising cost of living in the UK. House of Commons Library, 20.

Hatipoglu, E., Considine, J. and AlDayel, A., 2023. Unintended transnational effects of sanctions: A global vector autoregression simulation. Defence and Peace Economics, 34(7), pp.863-879.

Herrera, A.M. and Rangaraju, S.K., 2020. The effect of oil supply shocks on US economic activity: What have we learned?. Journal of Applied Econometrics, 35(2), pp.141-159.

Iftikhar, H., Zafar, A., Turpo-Chaparro, J.E., Canas Rodrigues, P. and López-Gonzales, J.L., 2023. Forecasting day-ahead brent crude oil prices using hybrid combinations of time series models. Mathematics, 11(16), p.3548.

Jahanger, A., Ali, M., Balsalobre-Lorente, D., Samour, A., Joof, F. and Tursoy, T., 2023. Testing the impact of renewable energy and oil price on carbon emission intensity in China’s transportation sector. Environmental Science and Pollution Research, 30(34), pp.82372-82386.

Känzig, D.R., 2021. The macroeconomic effects of oil supply news: Evidence from OPEC announcements. American Economic Review, 111(4), pp.1092-1125.

Kirikkaleli, D., Adedoyin, F.F. and Bekun, F.V., 2021. Nuclear energy consumption and economic growth in the UK: evidence from wavelet coherence approach. Journal of Public Affairs, 21(1), p.e2130.

Li, Y. and Guo, J., 2022. The asymmetric impacts of oil price and shocks on inflation in BRICS: a multiple threshold nonlinear ARDL model. Applied Economics, 54(12), pp.1377-1395.

Liadze, I., Macchiarelli, C., Mortimer-Lee, P. and Juanino, P.S., 2022. The economic costs of the Russia-Ukraine conflict.

Mbah, R.E. and Wasum, D.F., 2022. Russian-Ukraine 2022 War: A review of the economic impact of Russian-Ukraine crisis on the USA, UK, Canada, and Europe. Advances in Social Sciences Research Journal, 9(3), pp.144-153.

Ozili, P.K. and Arun, T., 2023. Spillover of COVID-19: impact on the Global Economy. In Managing inflation and supply chain disruptions in the global economy (pp. 41-61). IGI Global.

Ozili, P.K. and Ozen, E., 2023. Global energy crisis: impact on the global economy. The impact of climate change and sustainability standards on the insurance market, pp.439-454.

Ozili, P.K., 2024. Global economic consequences of Russian invasion of Ukraine. In Dealing With Regional Conflicts of Global Importance (pp. 195-223). IGI Global.

Raza, S.A., Masood, A., Benkraiem, R. and Urom, C., 2023. Forecasting the volatility of precious metals prices with global economic policy uncertainty in pre and during the COVID-19 period: Novel evidence from the GARCH-MIDAS approach. Energy Economics, 120, p.106591.

Rheynaldi, P.K., Endri, E., Minanari, M., Ferranti, P.A. and Karyatun, S., 2023. Energy Price and Stock Return: Evidence of Energy Sector Companies in Indonesia. International Journal of Energy Economics and Policy, 13(5), pp.31-36.

Shaik, M., Jamil, S.A., Hawaldar, I.T., Sahabuddin, M., Rabbani, M.R. and Atif, M., 2023. Impact of geo-political risk on stocks, oil, and gold returns during GFC, COVID-19, and the Russian–Ukrainian War. Cogent Economics & Finance, 11(1), p.2190213.

Sheng, X., Kim, W.J., Gupta, R. and Ji, Q., 2023. The impacts of oil price volatility on financial stress: Is the COVID-19 period different?. International Review of Economics & Finance, 85, pp.520-532.

Spash, C.L., 2021. ‘The economy’as if people mattered: revisiting critiques of economic growth in a time of crisis. Globalizations, 18(7), pp.1087-1104.

Su, C.W., Chen, Y., Hu, J., Chang, T. and Umar, M., 2023. Can the green bond market enter a new era under the fluctuation of oil price?. Economic research-Ekonomska istraživanja, 36(1), pp.536-561.

Szafranek, K. and Rubaszek, M., 2024. Have European natural gas prices decoupled from crude oil prices? Evidence from TVP-VAR analysis. Studies in Nonlinear Dynamics & Econometrics, 28(3), pp.507-530.

Urom, C., Guesmi, K., Abid, I. and Dagher, L., 2023. Dynamic integration and transmission channels among interest rates and oil price shocks. The Quarterly Review of Economics and Finance, 87, pp.296-317.

Wang, K.H., Su, C.W., Umar, M. and Lobonţ, O.R., 2023. Oil price shocks, economic policy uncertainty, and green finance: a case of China. Technological and Economic Development of Economy, 29(2), pp.500-517.

Wen, J., Zhao, X.X. and Chang, C.P., 2021. The impact of extreme events on energy price risk. Energy Economics, 99, p.105308.

Yang, T., Zhou, F., Du, M., Du, Q. and Zhou, S., 2023. Fluctuation in the global oil market, stock market volatility, and economic policy uncertainty: a study of the US and China. The quarterly review of economics and finance, 87, pp.377-387.

Zhang, Y., He, M., Wang, Y. and Liang, C., 2023. Global economic policy uncertainty aligned: An informative predictor for crude oil market volatility. International Journal of Forecasting, 39(3), pp.1318-1332.