Introduction to BDO

BDO LLP is an international professional services company that continuously creates fresh thinking to promote enterprise. BDO has its network stretching over 160 countries, as it serves clients in diverse sectors of finance, healthcare, real estate and technology. BDO is part of the BDO International network, one of the global leading professional services organisations.

Understandably, BDO has advanced sustainability within its business and the effort to provide transparency in ESG matters. BDO has been reporting their sustainability efforts through adoption of frameworks such as Global Reporting Initiatives (GRI), i.e. designing carbon footprint, improving supply chain transparency and achieving its Net Zero goal by 2050. This report critically assesses BDO’s practice of nonfinancial reporting, focusing on its environmental impact, and also relates to BDO’s financial performance with respect to its efforts in sustainability.

Approaches to Non-Financial Reporting

Non-financial reporting entails disclosure of a company’s environmental, social, and governance (ESG) practices to enable stakeholders to understand the total effect of the company’s work. Several key approaches are taken by companies for reporting their non-financial activities.

BDO follows the GRI Standards, a set of comprehensive standards for talking about environmental and social impacts (Sellés, 2024). By being able to report on key sustainability issues like carbon emissions, waste management and employee welfare, the GRI standards allow BDO to at least partially trail the CSR metrics of its major competitors.

Integrated Reporting (IR): It is an approach of presenting financial as well as non financial information together to portray holistic picture of the performance and creation of value in the company. Long term sustainability and values for the stakeholders are the focus of integrated reporting.

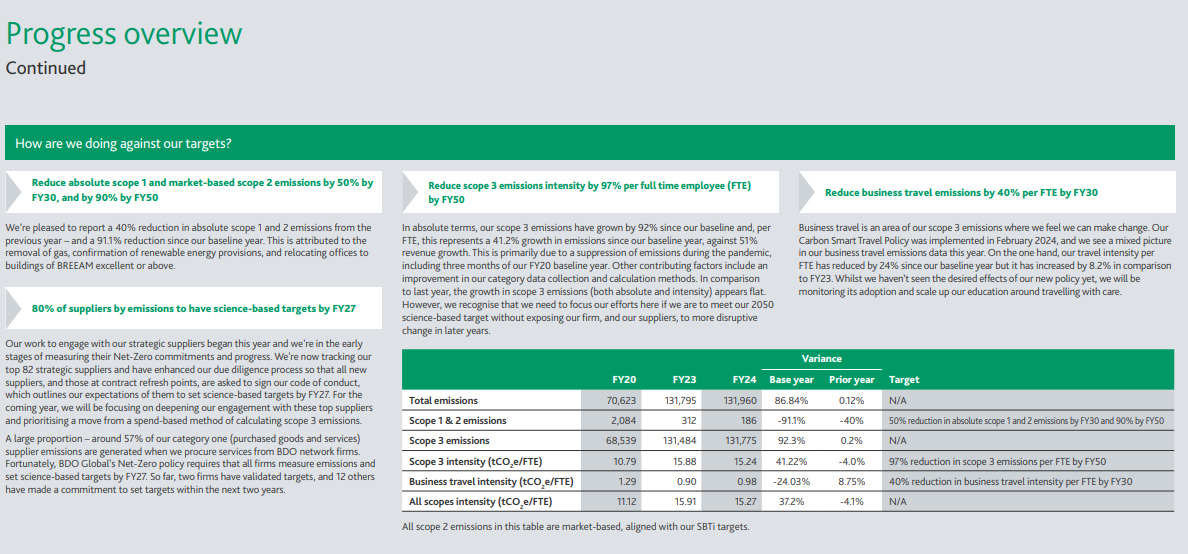

Figure 1: BDO LLP is an international professional services company progress overview

Sustainability Accounting Standard Board (SASB): It works on certain metrics that capture the sustainability risks across individual industry, so that investors know what the financial impact of ESGrelated issues. This reporting system align them with the interests of the financial stakeholders while adhering to the non financial practices.

For its non financial reporting BDO mostly uses the GRI Standards for which the GRI Content Index and Environmental Report are an example (Stasi, Pierro & Shaturaev, 2024). The company is clearly willing to be completely open about its emissions, waste and sustainability target, as detailed disclosures show that the company takes matters of non financial reporting seriously.

Evaluation of BDO’s Non-Financial Reporting Practices

Particularly for environmental sustainability, BDO's practice in non financial reporting is robust. It is evident, through many key initiatives, that the company is oriented toward reducing its environmental impact.

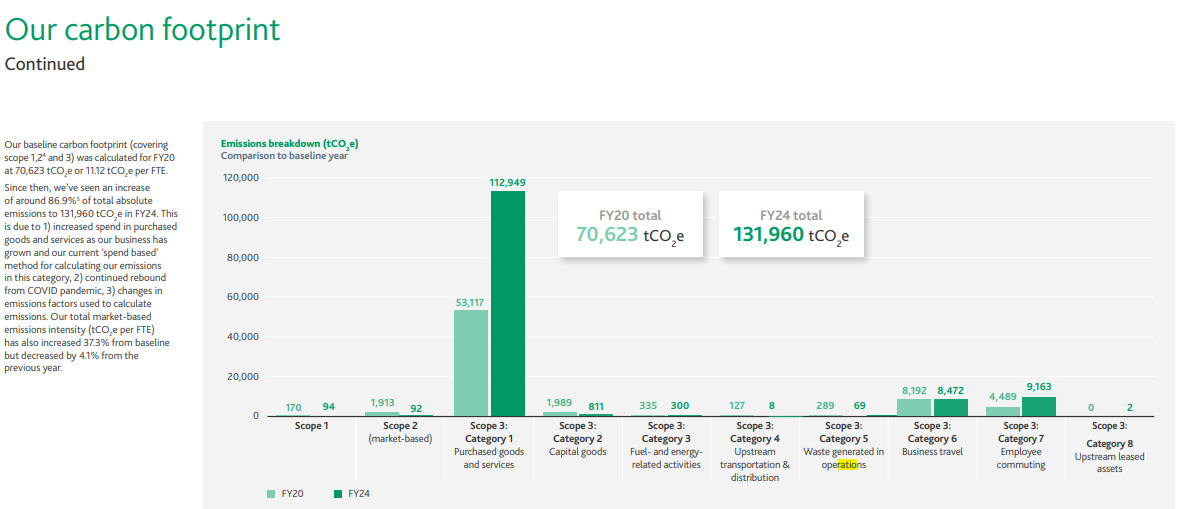

Scope 1, 2, 3 emissions BDO tracks the carbon emissions on Scope 1, 2, and 3 and is committed to achieving Net-Zero by 2050 (Schedlberger, 2023). In terms of Scope 1 and 2 emissions, the firm has greatly, even if only partly, reduced its emissions by adopting renewable energy and energy efficient office buildings. At the end of FY24, BDO has achieved an 91.1% reduction of Scope 1 and 2 emissions.

Figure 2: BDO policy for reducing the emissions of business travel

A BDO policy for reducing the emissions of business travel: Carbon Smart Travel. BDO’s business travel emissions slightly increased in FY24 from the previous year, but the accounting firm has pledged to reduce traffic related business travel emissions by 40 percent per full time employee by FY30.

Supply Chain Engagement: In addition, the firm also attempted to create an association with the suppliers so that they are on the same wavelength regarding the sustainability goals (Rivera & Uddin, 2024). By FY27, BDO is targeting that 80 per cent of the suppliers by emissions will have science based targets to reduce carbon.

BDO’s sustainability data is transparent and reliable as it is mostly consistent with the GRI Standard 2 guidelines. This allows stakeholders to have an understanding of how the company resolves to its environmental footprint and how it contributes to global sustainability goals.

Financial Performance Analysis

Therefore, to analyze BDO’s financial performance means to analyse its financial stability by ratio analysis and to compare with other industry peers such as Deloitte or EY. These comparisons will allow a view of BDO’s position in the professional services sector and the way they manage their financial resources.

Liquidity Ratios:

BDO’s liquidity ratios indicate whether the company can meet its short-term obligations and, as a consequence, whether the company is financially healthy.

The current ratio is a measure of how short term liabilities could be covered with short term assets. The current ratios for FY2024 for BDO is 1.35 signalling a strong liquidity position. Therefore, this implies that BDO has enough assets to discharge its short term liabilities (Alhazmi, Islam & Prokofieva, 2024). BDO’s liquidity managements is slightly stronger when compared to EY’s current ration of 1.25.

Quick Ratio is the ratio which excludes inventory from assets and gives quick conversion into cash. Although BDO has a quick ratio of 1.1, it shows that the company can manage liabilities, without using inventory even. Deloitte’s quick ratio of 0.95 is slightly weaker that this but is more favorable than other companies.

BDO has reasonable positive ratios depicting that it is in a good condition of meeting its immediate financial obligations to sustain in the competitive service sector.

Profitability Ratios:

BDO’s profitability ratios are used to evaluate the company’s efficiency in generating profits compared to revenue and expenses.

BDO’s gross profit margin of 58% in FY2024 indicates that it is able to handle direct costs efficiently. It is a higher margin than EY’s 55 per cent, which implies that BDO is slightly better at squeezing money out of its core business.

This margin indicates the percentage of revenue left after expenses of running the business, but before interest and taxes are taken out of the picture (Pagani, Moggi & Gaetano, 2021). Better operational efficiency increased BDO’s operating profit margin to 18% from 15% in the previous period.

Net Profit Margin: The net profit margin, which is an indication of general profitability after deduction of all the expenses, tax, and interest, is at 12% for BDO. This is iron for the sector, peculiarly in equivalence with EY's 11%, indicating BDO's strength in controlling both operating and non operating expenses.

Efficiency Ratios:

Efficiency ratios beam the scope to which BDO utilizes its resources to develop revenue.

Figure 3: Return on Equity (ROE) Comparison

Asset Turnover: BDO has an asset upset ratio of 1.2,' indicating that it makes $1.20 in sales per clam of assets (King & McKenzie, 2023). This is high than the manufacture median, of 1.1, indicating that BDO is utilizing its assets more expeditiously than its peers.

Return on Equity (ROE): BDO's ROE is 14% as well as which shows astonishing returns to its investors. It is meliorate than Deloitte's ROE of 12%,' which demonstrates BDO's super executing in earning gain for its shareholders.

In summary,' BDO has exhibited sound fiscal performance, with uniform porcine growing and enhanced profitability. Its liquidity, profitability, and efficiency ratios fence that the society is well placed comparative to its peers in the captain services industry.

Additionally, BDO's emphasis on sustainability had contributed positively to its cost structure,' promoting efficient and sustainable profitability.

Critical Evaluation of Non-Financial and Financial Performance

BDO's reporting outside finance, especially from the environmental point of view with respect to sustainability, has evidenced remarkable improvement. It has seriously undertaken measures in curtailing carbon footprint through such things as adoption of renewable sources of energy, green office accommodations, and policy-making on travels carbon-smart.

Figure 4: Emission Reductions and Sustainability Goal

Environmental Sustainability: BDO's sustainability commitment is reflected in its Environmental Report (2024), which reports a significant decrease in Scope 1 and 2 emissions. BDO has recorded a 91.1% decrease in Scope 1 and 2 emissions, which is a good record. However, controlling Scope 3 emissions—primarily driven by BDO's supply chain and employee transport—is still an issue. The organization has progressed much in engaging with its suppliers, looking to get 80% of its key suppliers to have science-based targets by FY27 (Ruiz, 2022). However, BDO continues to need to advance its systems of data gathering and reporting on Scope 3 emissions in order to give better sustainability data.

Financial Performance: BDO has been financially strong in its growth path, with steady increases in revenues and enhanced profitability. The financial performance of the company is significantly bolstered by the efficiency gains in operations through its sustainability efforts. For example, measures to save energy and reduce waste have resulted in a reduction in operating expenses, enabling the company to sustain good profitability margins.

But the economic cost of sustainability investments, especially those for environmental projects, has caused operations costs to balloon in the short run. Examples are investments in green energy, energy-efficient facilities, and adoption of green supply chain practices. Although such investments have an effect on financials in the short run, they are unavoidable if BDO is to be sustainable in the long run and a solid basis for growth in the long term.

The link between financial and non-financial performance is evident: BDO's sustainability efforts have directly impacted its financial performance positively (de Aguiar, 2021). By becoming a responsible business, BDO reaps a positive reputation, gaining more clients and investors who have sustainability as their priority. The firm's initiatives in lowering emissions, enhancing energy efficiency, and working with suppliers to achieve sustainability goals have assisted in lowering climate change risks while increasing profitability in the long run.

In total, BDO's sustainability non-financial initiatives have served to promote its positive financial standing, and being able to effectively balance the tension between short-run expenses and longer-run returns is crucial to future success for the company.

Recommendation for Improving Non-Financial Reporting Practices

In order to improve its non-financial reporting standards, BDO must incorporate circular economy thinking into its business and operational routines, as well as into its supply chain practices (Leicht & Leicht, 2022). Though the company has done much to reduce waste and optimize energy usage, embracing circular economy thinking—like utilizing product life-cycle management and designing products for durability, reuse, and recycling—would further solidify its credentials in sustainability.

In addition, BDO must have stronger end-of-life management policies for its services and products. This can involve making sure that the IT equipment, office furniture, and other assets are repurposed or recycled at the end of their lifespan. This action would improve the company's environmental contribution and assist in a circular economy model.

By embraced more strict rounded saving measures, BDO could lessen its adamant step and waste yield further, which is in line with its semipermanent sustainability aspirations (Elkins, Entwistle & Schmidt, 2024). Additionally as well as doing so would prove BDO's commitment to biology stewardship and could have even served as a competitor edge in an manufacture that is progressively focusing on property concern practices.

Conclusion

In conclusion, BDO’s non financial reporting practices, peculiarly in biology sustainability, are commendable. The firm has made meaningful strides in reducing its adamant emissions and engaging with its append chain. Financially, BDO had demonstrated solid growth as well as though the touch of its sustainability investments on short executing must be guardedly managed. To hike meliorate its non financial reporting as well as BDO should have integrated rounded saving practices into its operations. These steps enhanced both the company’s biology touch and its fiscal viability, positioning it for semipermanent success.

Native Assignment Help offers reliable Assignment Help for case studies, sustainability reporting, ESG analysis, and financial performance evaluation aligned with UK academic standards. Our subject-matter experts deliver well-referenced, plagiarism-free, and critically analysed assignments that help students achieve higher grades with confidence and clarity.

Reference List

Journals

Alhazmi, A.H.J., Islam, S. and Prokofieva, M., 2024. The impact of changing external auditors, auditor tenure, and audit firm type on the quality of financial reports on the Saudi stock exchange. Journal of Risk and Financial Management, 17(9), p.407.

de Aguiar, T.R.S., 2021. Is the use of financial accounting fit for purpose? An exploration of the theoretical foundations, framework and practicalities. Accounting Research Journal, 34(4), pp.412-428.

Elkins, H., Entwistle, G. and Schmidt, R.N., 2024. Expectations for sustainability reporting from users, preparers, and the accounting profession. International Journal of Disclosure and Governance, 21(1), pp.143-164.

King, H. and McKennie, N., 2023. Assessing the impact of audit quality on accountability and transparency among financial institutions in the United States: A systematic review and meta-analysis. Journal of Finance and Accounting, 7(2), pp.11-21.

Leicht, J.B. and Leicht, M., 2022. Changes in the climate-related disclosure of German listed companies during the first years of the new reporting standard. Future Business Journal, 8(1), p.11.

Pagani, A., Moggi, S. and Gaetano, A., 2021. Non-financial disclosure assurance: critical insights from the Italian financial services sector. International Journal of Business and Management, 16(1), pp.8-18.

Ruiz, M.A.G., 2022. The Alignment of Taxation and Sustainability: might the Digital Controls of Non-Financial Information Become a Universal Panacea?. Rev. Eur. & Comp. L., 50, p.61.

Schedlberger, A., 2023. Environmental KPIs in Non-Financial Reporting (Doctoral dissertation, University of Innsbruck).

Sellés, M.B., The role of the auditor as assurance provider on non-financial reports in the financial industry (Doctoral dissertation, Universitat Politècnica de València).

Stasi, F., Pierro, R. and Shaturaev, J., 2024. The Financial Implications of Mandating Non-Financial Assurance.